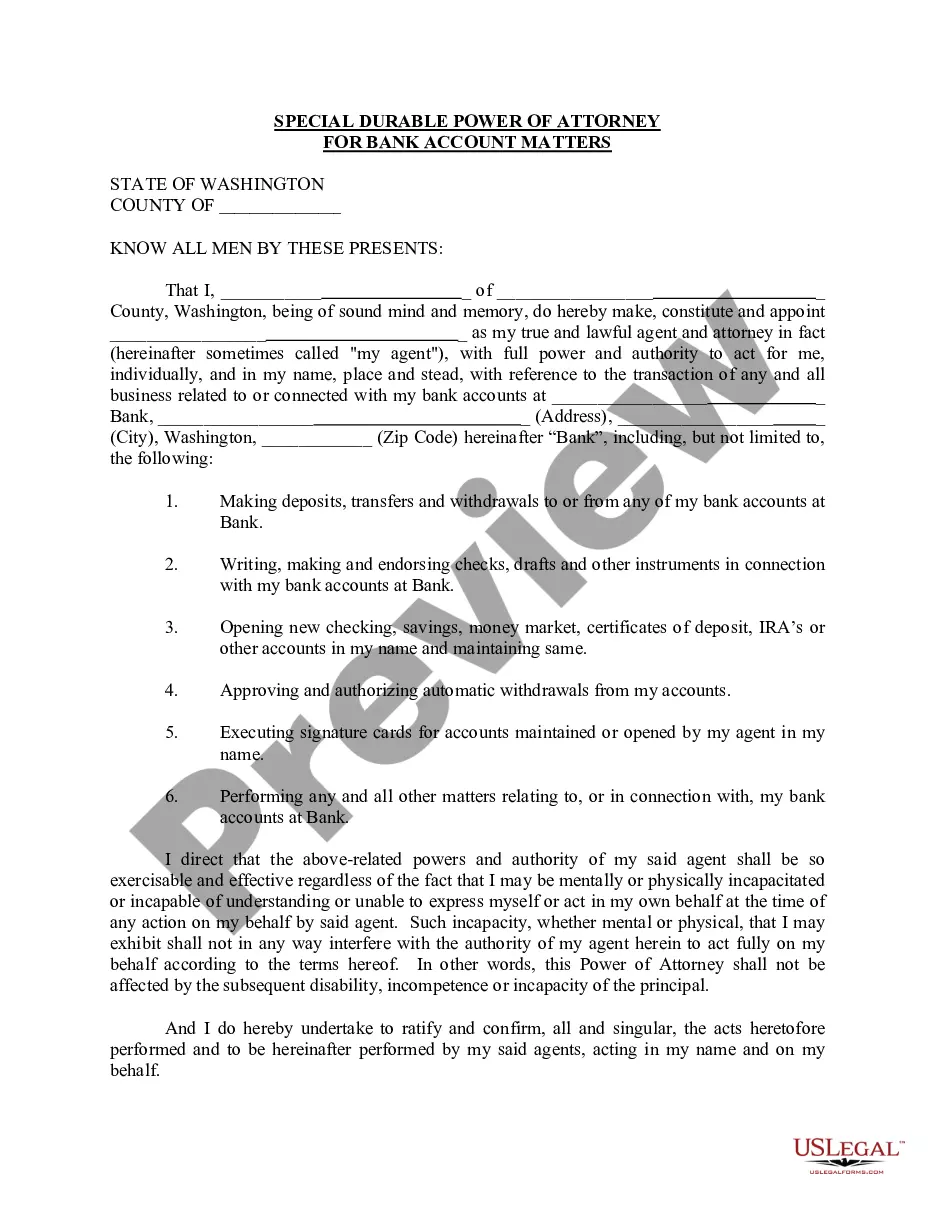

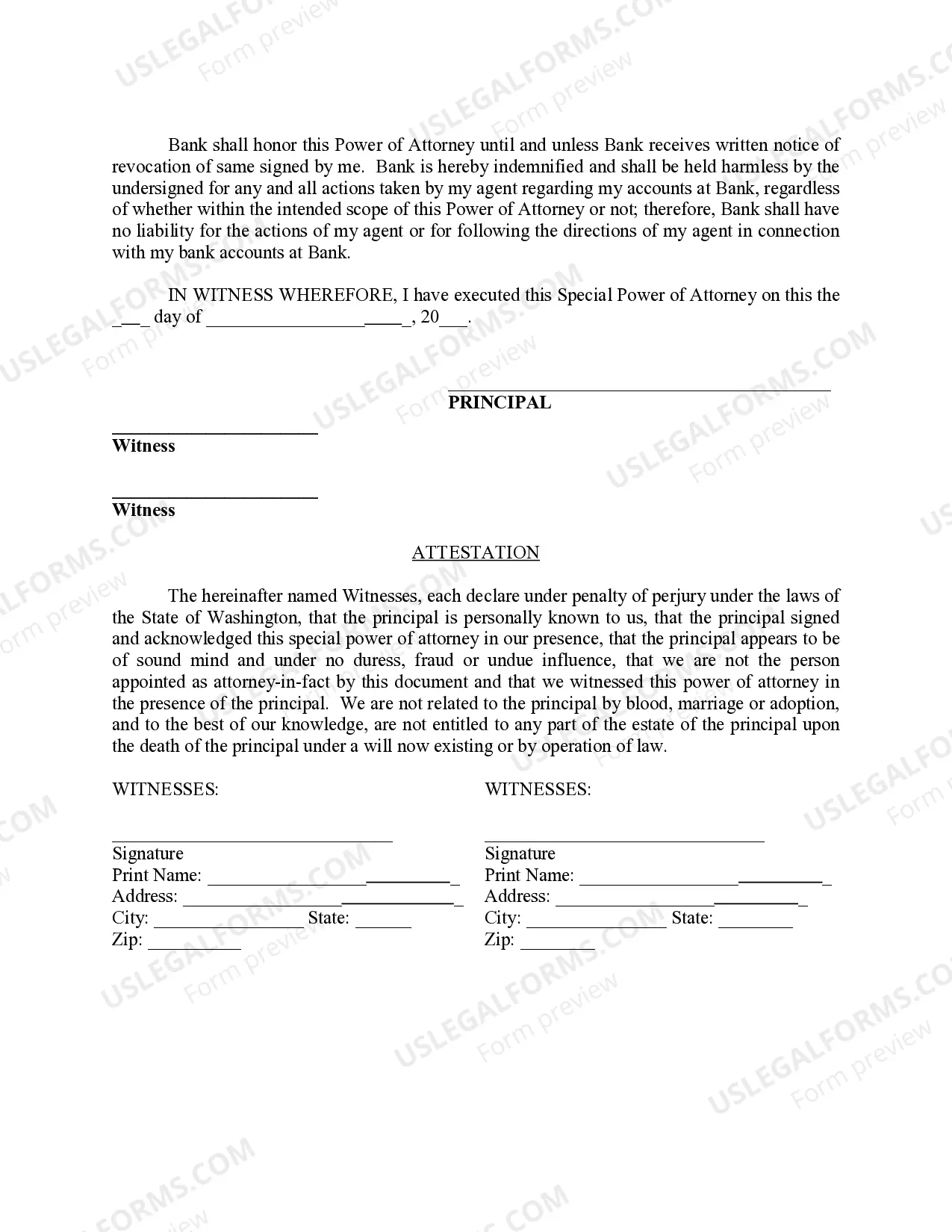

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

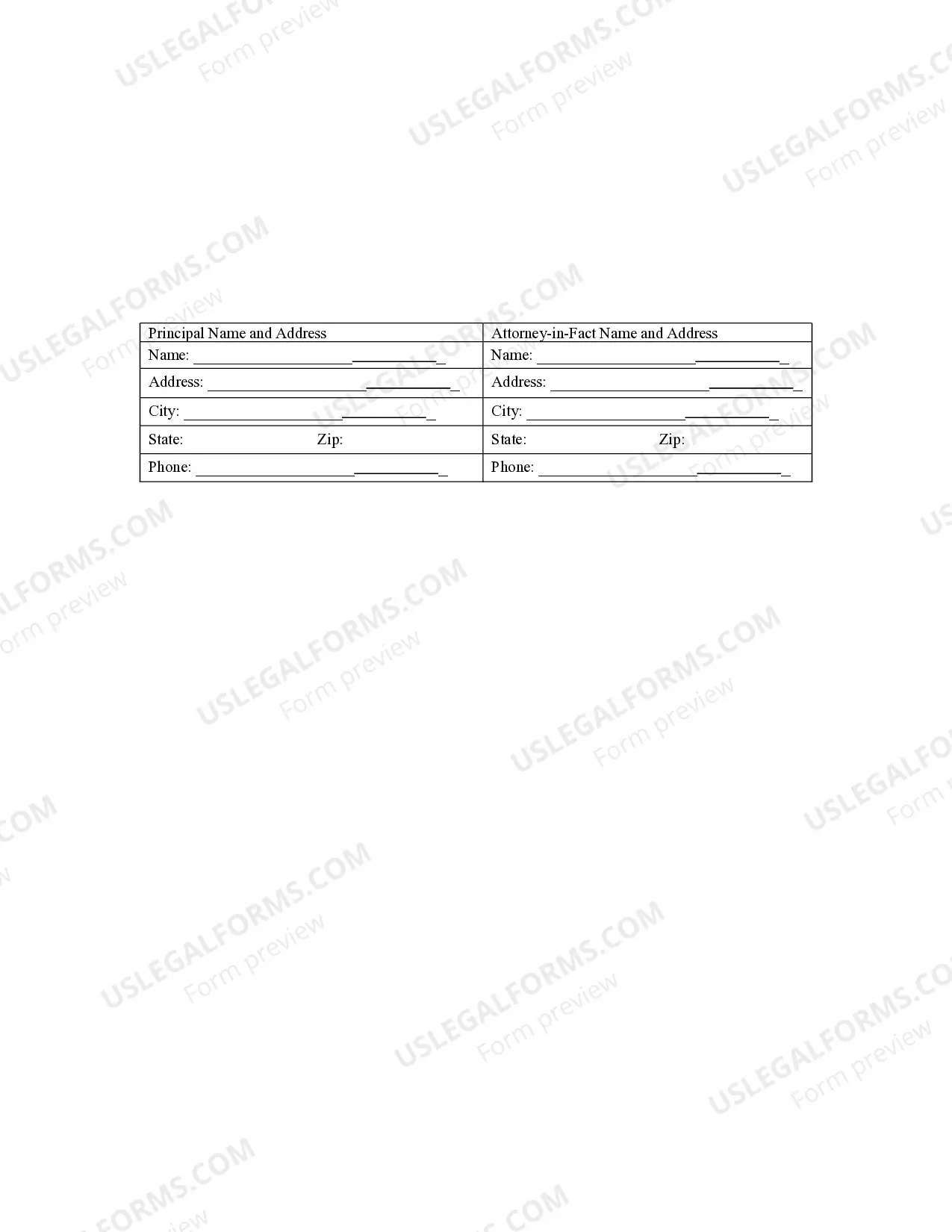

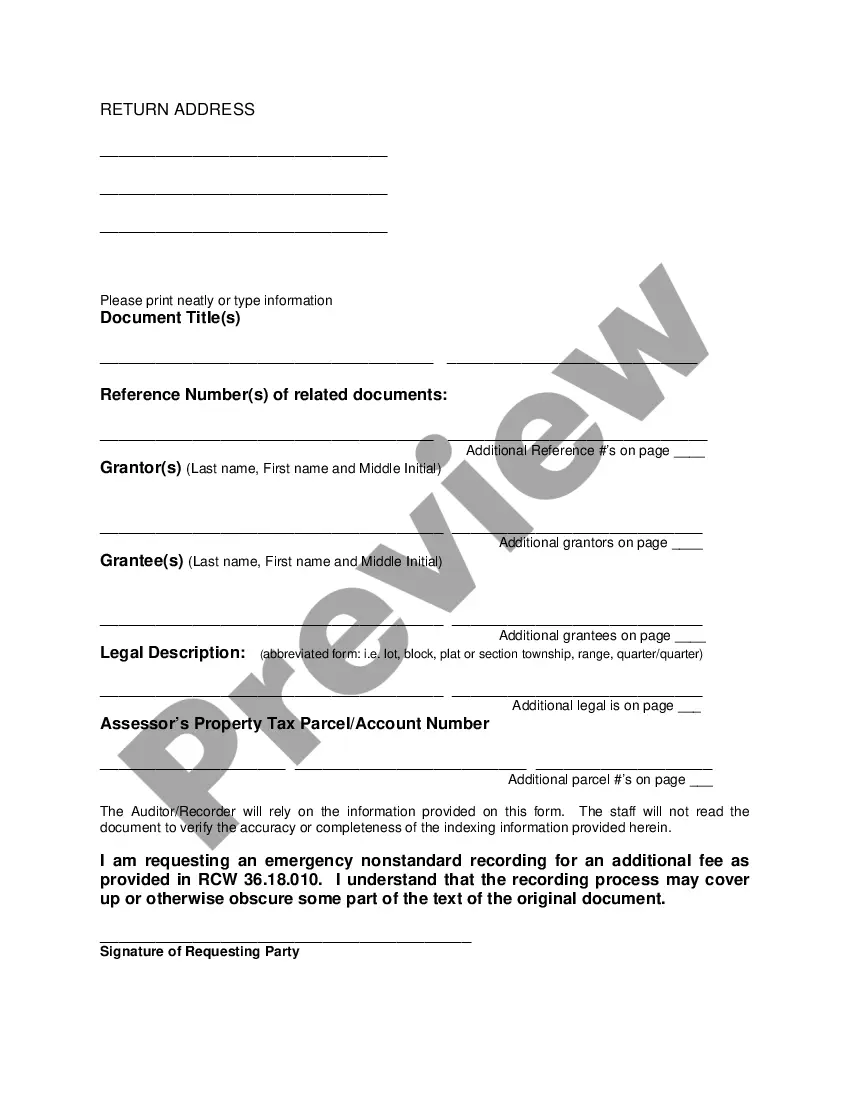

Vancouver Washington Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an individual, referred to as the "agent" or "attorney-in-fact," the authority to make financial decisions and handle specific banking matters on behalf of someone else, known as the "principal." This power of attorney ensures that the designated agent has the necessary authority to manage the principal's bank accounts when they are unable to do so themselves. This type of power of attorney is "special" because it only grants the agent powers specifically related to bank account matters, such as managing funds, making withdrawals or deposits, paying bills, and conducting other financial transactions. It is "durable" in nature, which means that it remains in effect even if the principal becomes incapacitated or mentally incapable of making financial decisions. In Vancouver, Washington, there might be variations or different types of Special Durable Power of Attorney for Bank Account Matters based on specific needs or preferences. Some of these variations include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type grants the agent only limited powers to handle specific banking matters, such as paying bills or managing a specific account. 2. General Special Durable Power of Attorney for Bank Account Matters: This grants the agent broader powers to handle various banking matters on behalf of the principal, providing more flexibility and authority. 3. Revocable Special Durable Power of Attorney for Bank Account Matters: This type allows the principal to revoke or terminate the power of attorney at any time, granting them the ability to regain control over their bank accounts. 4. Irrevocable Special Durable Power of Attorney for Bank Account Matters: In contrast to the revocable power of attorney, this type cannot be revoked or terminated unless certain conditions are met, providing more security and stability. It's crucial for individuals considering a Special Durable Power of Attorney for Bank Account Matters to consult with an attorney or legal professional who can guide them through the process and ensure that all relevant legalities and requirements are met. Creating a power of attorney is an important decision and must be carefully crafted to protect the principal's interests while granting the agent the necessary authority to manage their bank accounts effectively.Vancouver Washington Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an individual, referred to as the "agent" or "attorney-in-fact," the authority to make financial decisions and handle specific banking matters on behalf of someone else, known as the "principal." This power of attorney ensures that the designated agent has the necessary authority to manage the principal's bank accounts when they are unable to do so themselves. This type of power of attorney is "special" because it only grants the agent powers specifically related to bank account matters, such as managing funds, making withdrawals or deposits, paying bills, and conducting other financial transactions. It is "durable" in nature, which means that it remains in effect even if the principal becomes incapacitated or mentally incapable of making financial decisions. In Vancouver, Washington, there might be variations or different types of Special Durable Power of Attorney for Bank Account Matters based on specific needs or preferences. Some of these variations include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type grants the agent only limited powers to handle specific banking matters, such as paying bills or managing a specific account. 2. General Special Durable Power of Attorney for Bank Account Matters: This grants the agent broader powers to handle various banking matters on behalf of the principal, providing more flexibility and authority. 3. Revocable Special Durable Power of Attorney for Bank Account Matters: This type allows the principal to revoke or terminate the power of attorney at any time, granting them the ability to regain control over their bank accounts. 4. Irrevocable Special Durable Power of Attorney for Bank Account Matters: In contrast to the revocable power of attorney, this type cannot be revoked or terminated unless certain conditions are met, providing more security and stability. It's crucial for individuals considering a Special Durable Power of Attorney for Bank Account Matters to consult with an attorney or legal professional who can guide them through the process and ensure that all relevant legalities and requirements are met. Creating a power of attorney is an important decision and must be carefully crafted to protect the principal's interests while granting the agent the necessary authority to manage their bank accounts effectively.