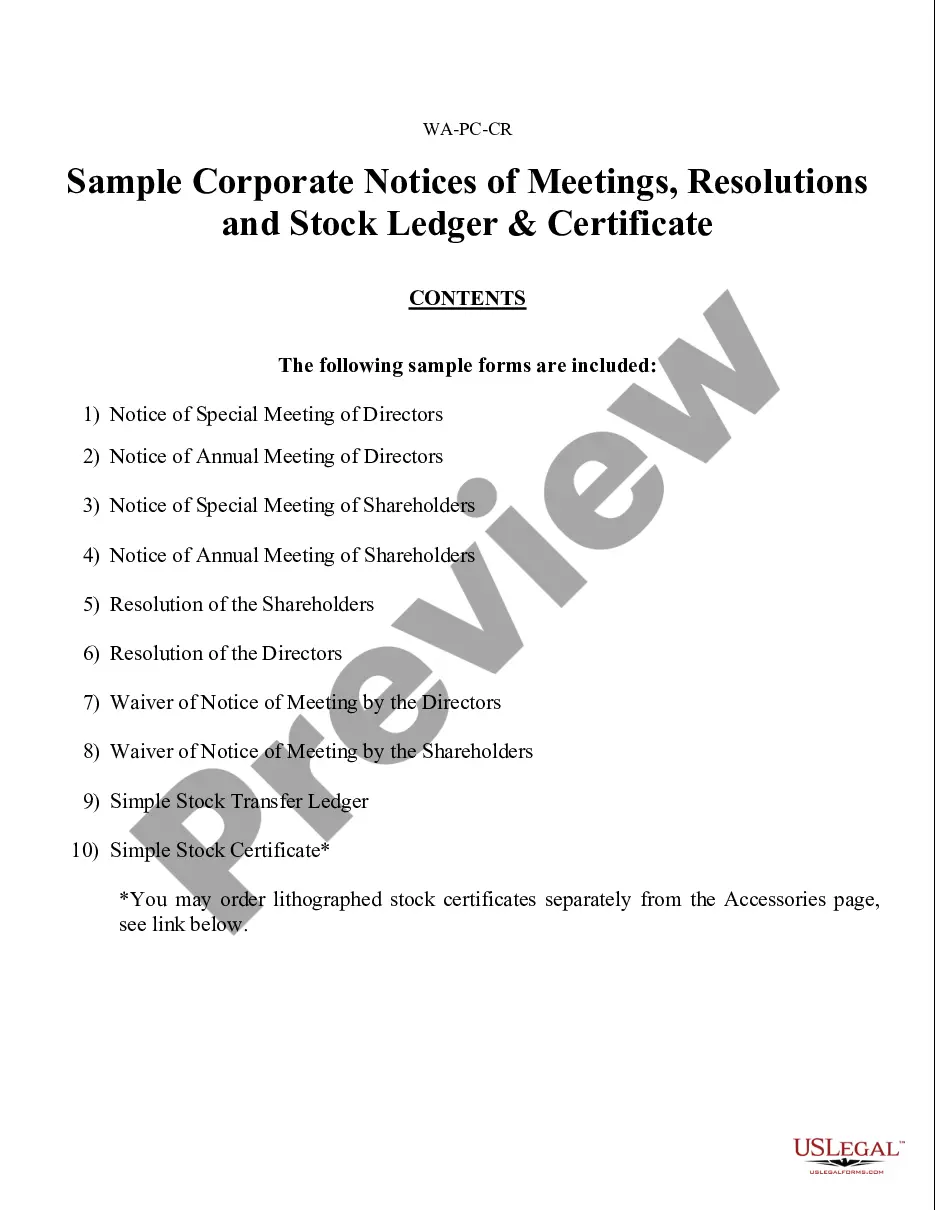

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

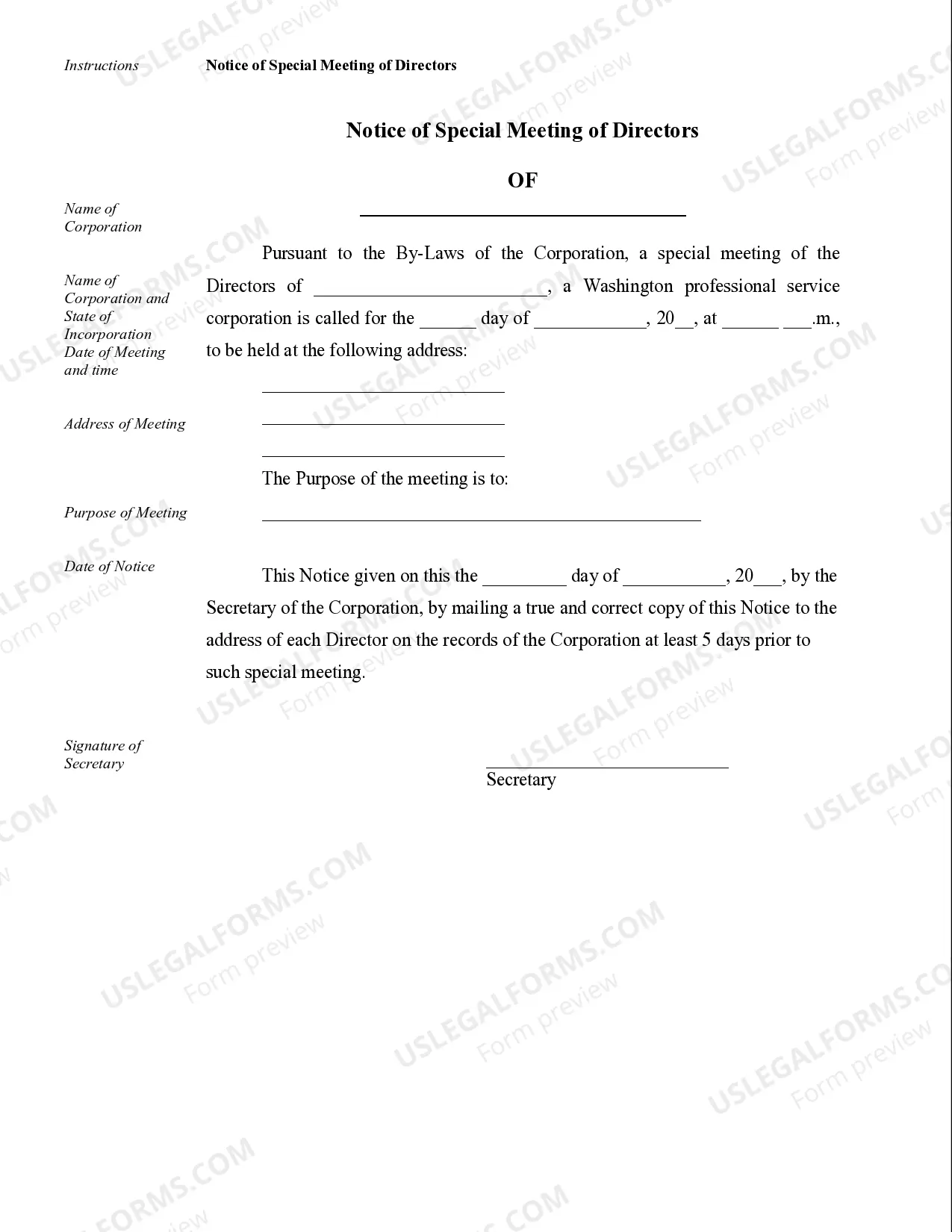

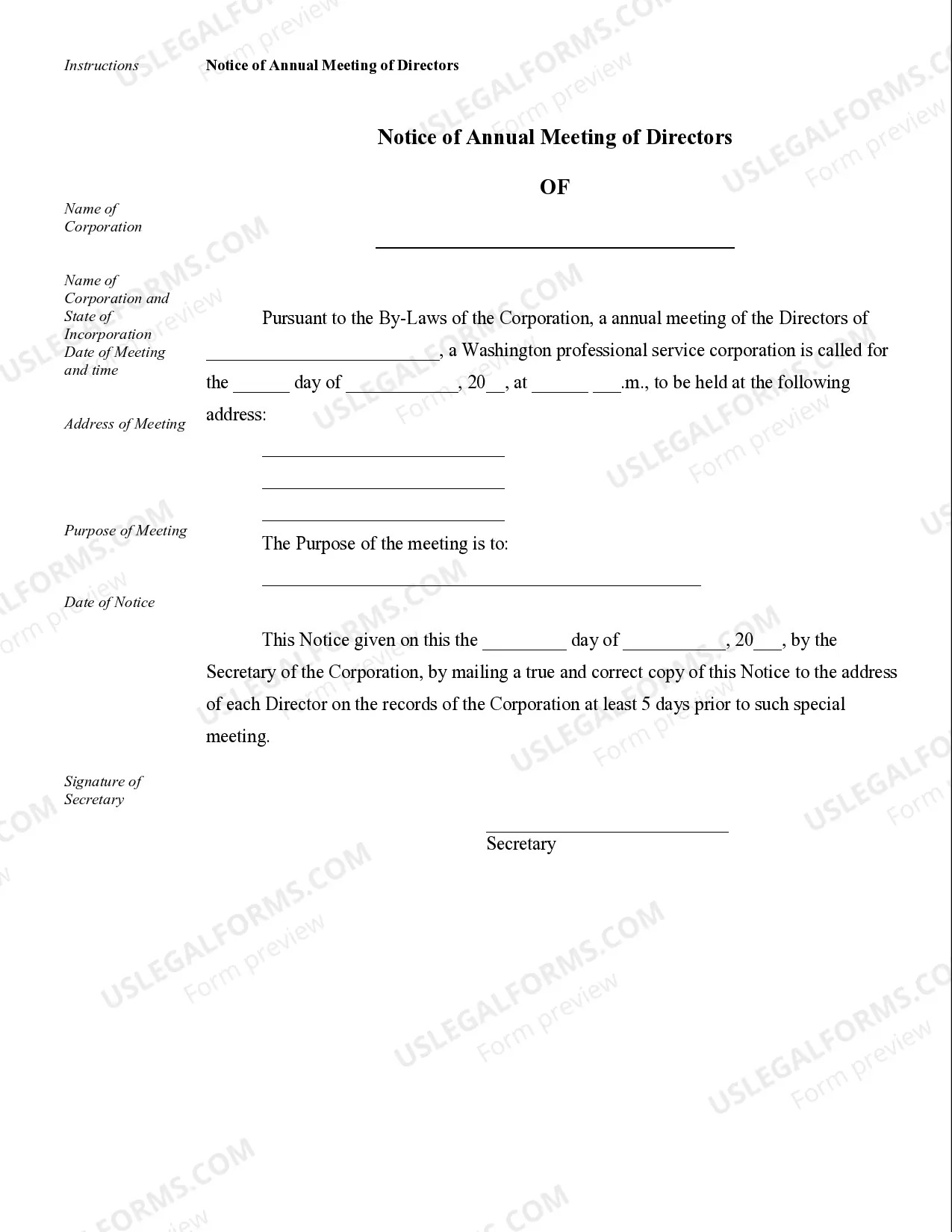

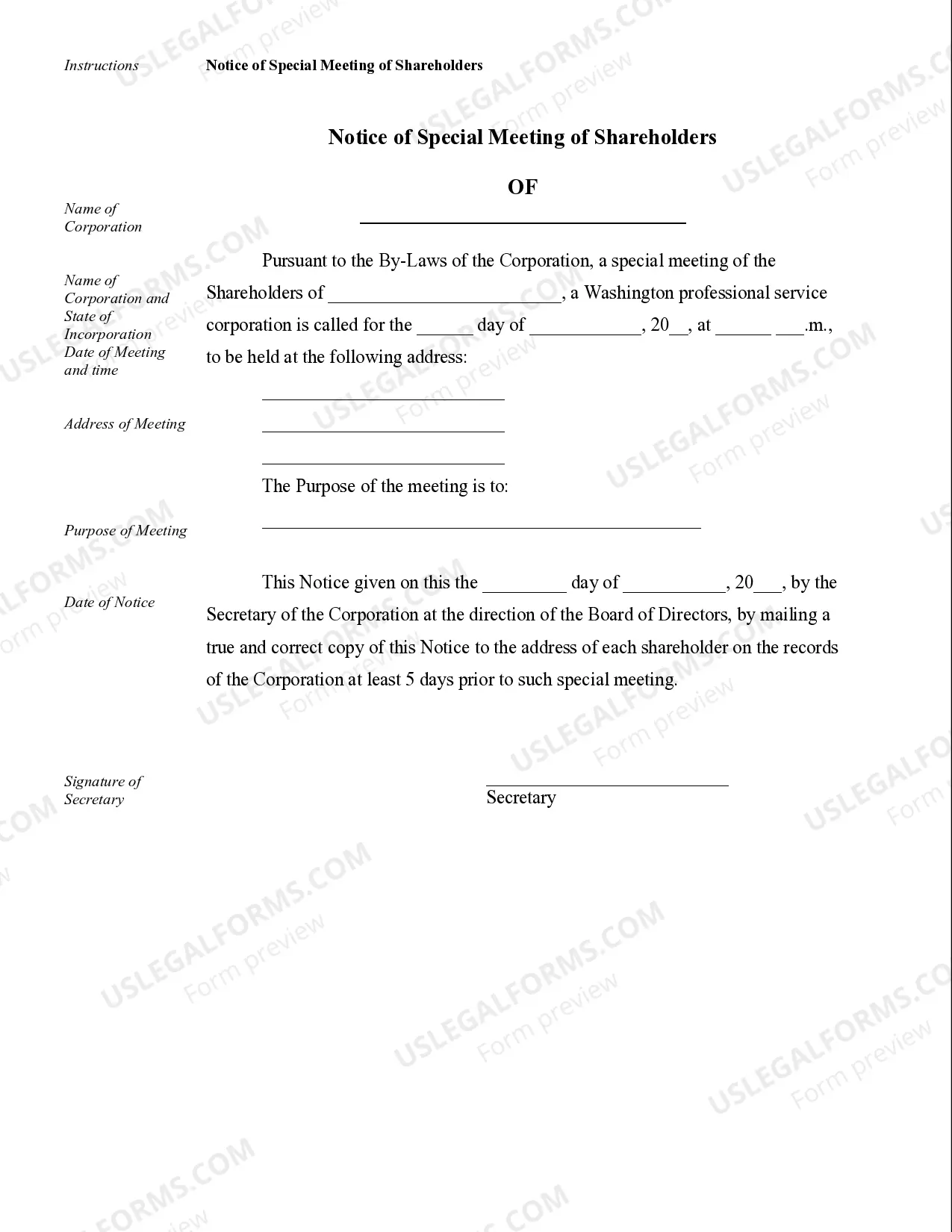

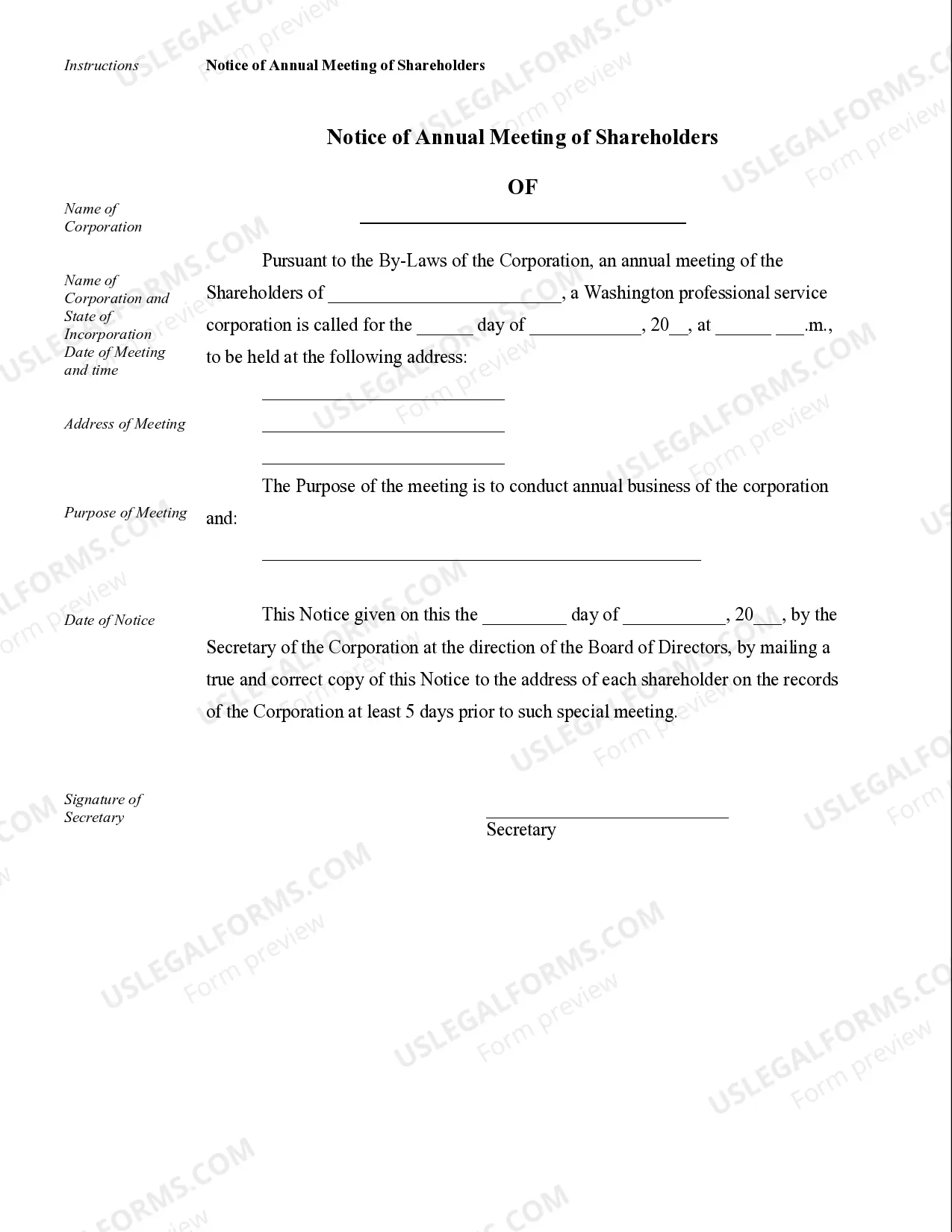

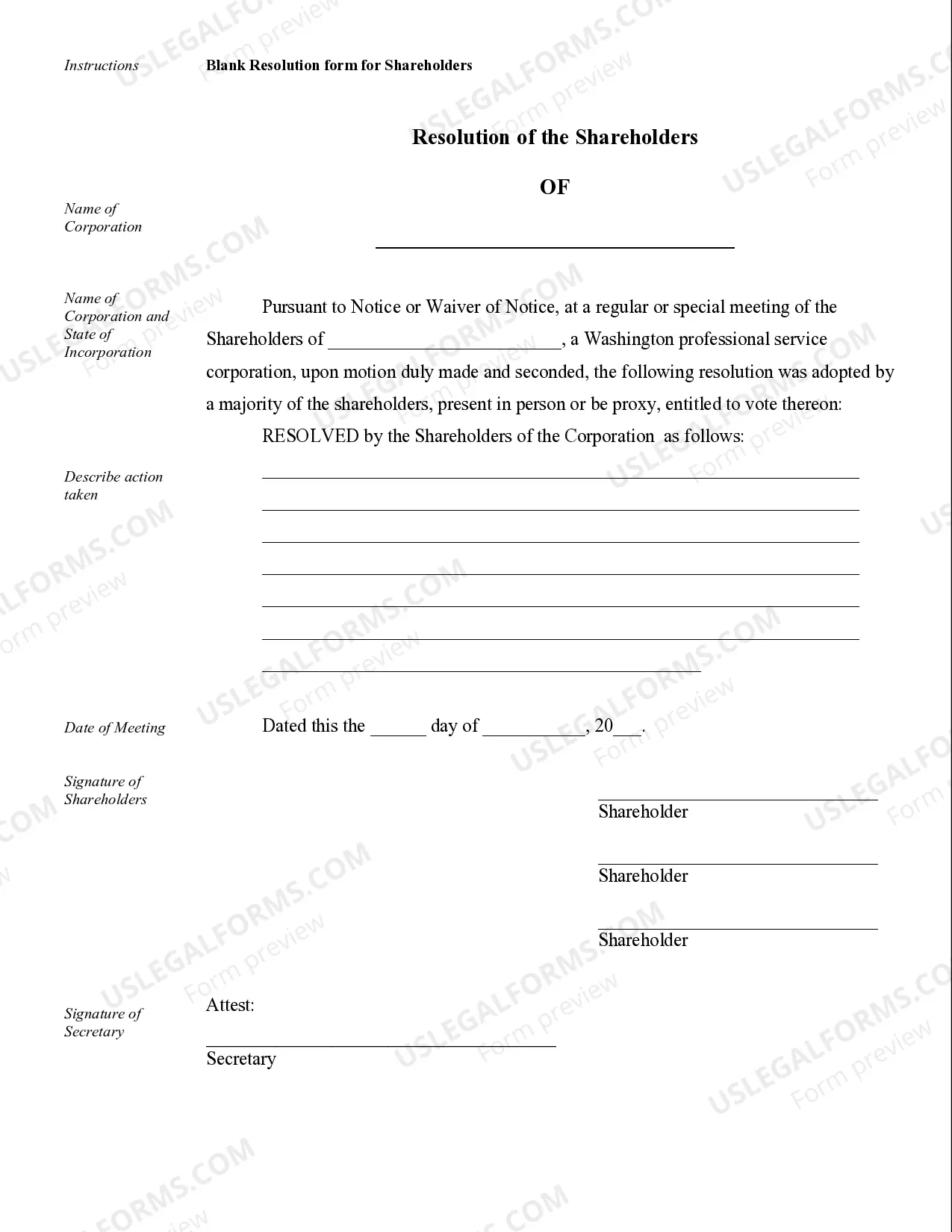

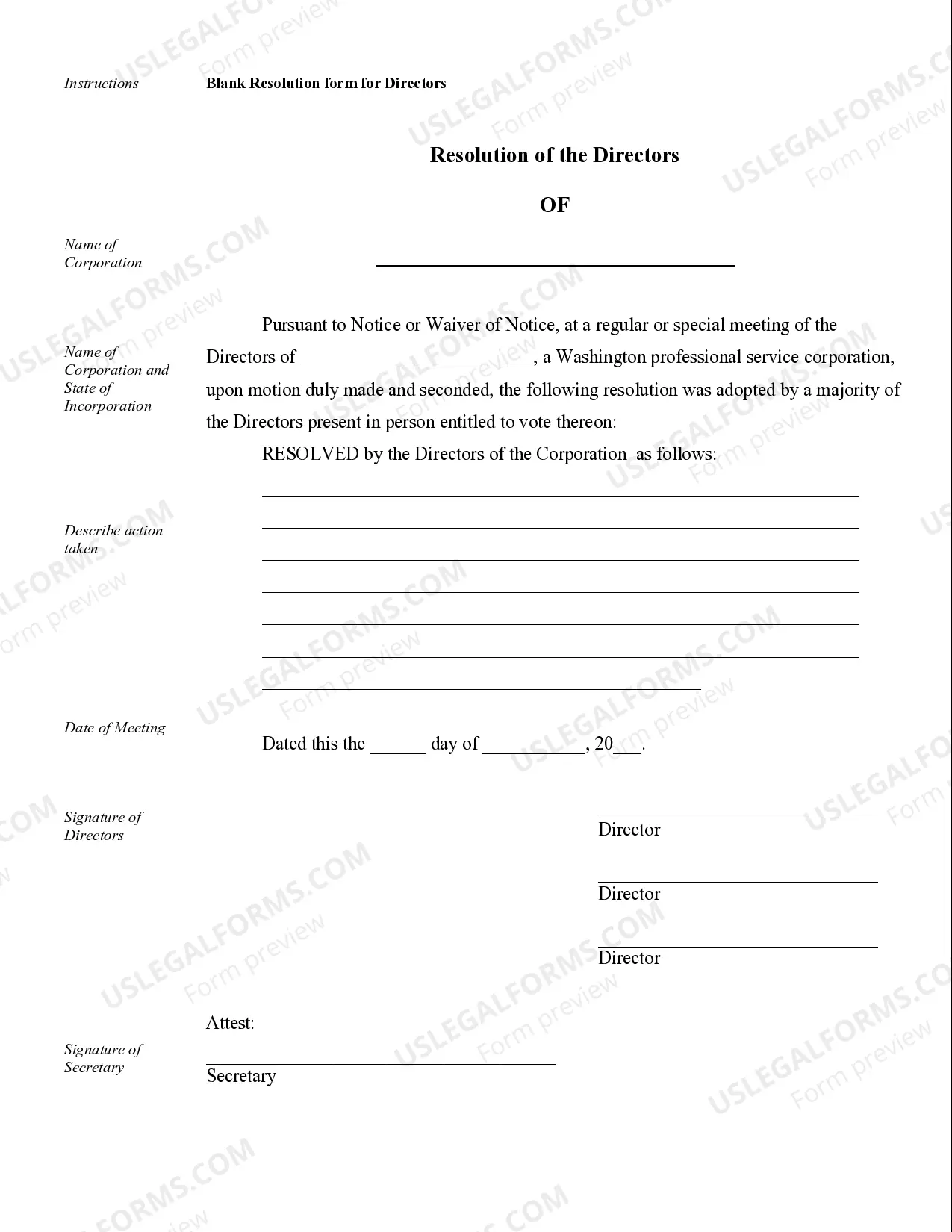

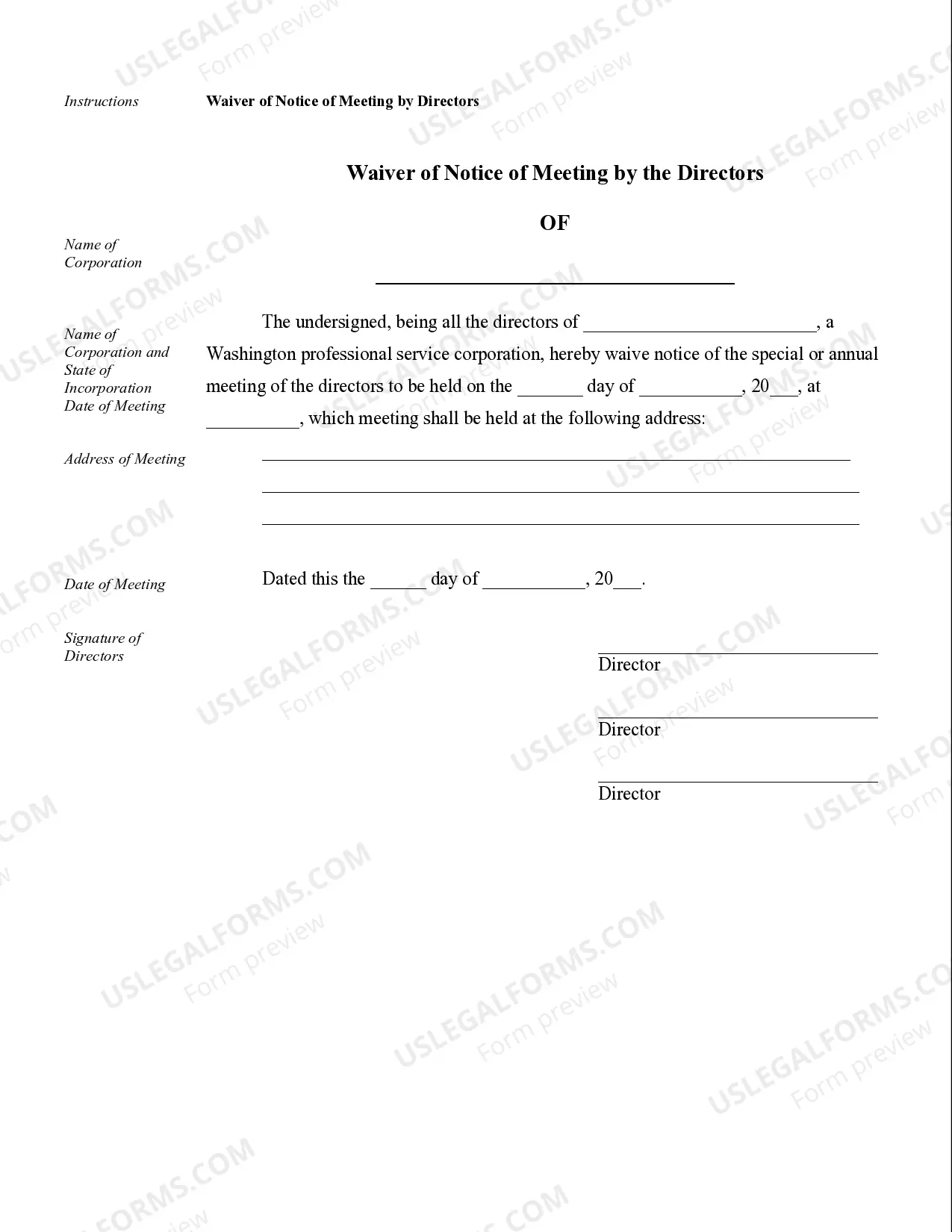

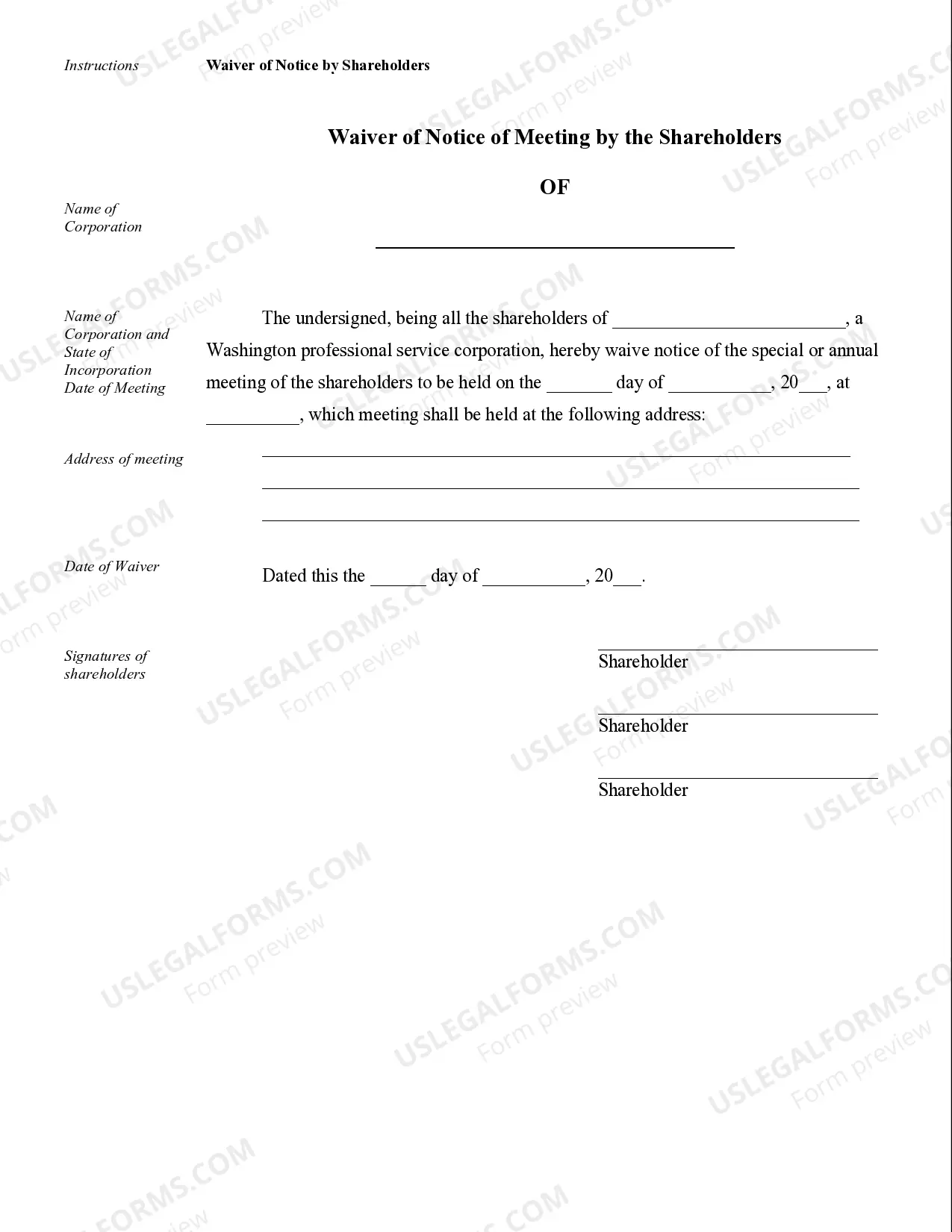

Bellevue Sample Corporate Records for a Washington Professional Corporation are essential legal documents that keep track of the company's activities, transactions, and decisions. These records are crucial for maintaining transparency, complying with legal requirements, and protecting the corporation's shareholders. The following are some different types of Bellevue Sample Corporate Records commonly maintained for a Washington Professional Corporation: 1. Articles of Incorporation: The Articles of Incorporation are one of the fundamental documents required to establish a Washington Professional Corporation. They outline the corporation's name, purpose, registered agent's name and address, and the number of authorized shares. 2. Bylaws: Bylaws serve as the internal operating rules for a corporation. They contain information about the corporation's structure, board of directors, meeting procedures, voting protocols, and various other governance matters. 3. Minutes of Meetings: These records detail the discussions and decisions made during board meetings and annual shareholder meetings. They include the date, time, location, attendees, and key topics discussed, such as election of officers, approval of financial statements, or major corporate transactions. 4. Shareholder Agreements: Shareholder agreements are contracts between the corporation and its shareholders, outlining their rights, responsibilities, and obligations. These agreements cover matters like stock ownership, transfer restrictions, dividend distribution, and dispute resolution mechanisms. 5. Stock Ledger: A stock ledger is a record of all authorized and issued shares of the corporation. It includes information about the shareholders, such as their names, addresses, and the number of shares held. It is crucial for maintaining accurate ownership records. 6. Financial Records: Bellevue Sample Corporate Records for a Washington Professional Corporation often include financial statements, balance sheets, income statements, and cash flow statements. These records provide a snapshot of the corporation's financial health, reporting revenue, expenses, assets, and liabilities. 7. Contracts and Agreements: Copies of contracts and agreements entered into by the corporation, such as client contracts, vendor agreements, or partnership agreements, should be maintained as part of the corporate records. 8. Licenses and Permits: Copies of all licenses, permits, or any other regulatory approvals obtained by the corporation should be included to ensure compliance with local, state, and federal regulations. 9. Shareholder Resolutions: Shareholder resolutions document important decisions made by the shareholders, such as the approval of mergers or acquisitions, changes to the corporation's capital structure, or the appointment/removal of directors. 10. Tax Records: Bellevue Sample Corporate Records may also include tax-related documents such as tax returns, records of tax payments, and any correspondences with tax authorities. It's important to note that these records may vary depending on the specific requirements of the Washington Professional Corporation's industry, size, and specific circumstances.Bellevue Sample Corporate Records for a Washington Professional Corporation are essential legal documents that keep track of the company's activities, transactions, and decisions. These records are crucial for maintaining transparency, complying with legal requirements, and protecting the corporation's shareholders. The following are some different types of Bellevue Sample Corporate Records commonly maintained for a Washington Professional Corporation: 1. Articles of Incorporation: The Articles of Incorporation are one of the fundamental documents required to establish a Washington Professional Corporation. They outline the corporation's name, purpose, registered agent's name and address, and the number of authorized shares. 2. Bylaws: Bylaws serve as the internal operating rules for a corporation. They contain information about the corporation's structure, board of directors, meeting procedures, voting protocols, and various other governance matters. 3. Minutes of Meetings: These records detail the discussions and decisions made during board meetings and annual shareholder meetings. They include the date, time, location, attendees, and key topics discussed, such as election of officers, approval of financial statements, or major corporate transactions. 4. Shareholder Agreements: Shareholder agreements are contracts between the corporation and its shareholders, outlining their rights, responsibilities, and obligations. These agreements cover matters like stock ownership, transfer restrictions, dividend distribution, and dispute resolution mechanisms. 5. Stock Ledger: A stock ledger is a record of all authorized and issued shares of the corporation. It includes information about the shareholders, such as their names, addresses, and the number of shares held. It is crucial for maintaining accurate ownership records. 6. Financial Records: Bellevue Sample Corporate Records for a Washington Professional Corporation often include financial statements, balance sheets, income statements, and cash flow statements. These records provide a snapshot of the corporation's financial health, reporting revenue, expenses, assets, and liabilities. 7. Contracts and Agreements: Copies of contracts and agreements entered into by the corporation, such as client contracts, vendor agreements, or partnership agreements, should be maintained as part of the corporate records. 8. Licenses and Permits: Copies of all licenses, permits, or any other regulatory approvals obtained by the corporation should be included to ensure compliance with local, state, and federal regulations. 9. Shareholder Resolutions: Shareholder resolutions document important decisions made by the shareholders, such as the approval of mergers or acquisitions, changes to the corporation's capital structure, or the appointment/removal of directors. 10. Tax Records: Bellevue Sample Corporate Records may also include tax-related documents such as tax returns, records of tax payments, and any correspondences with tax authorities. It's important to note that these records may vary depending on the specific requirements of the Washington Professional Corporation's industry, size, and specific circumstances.