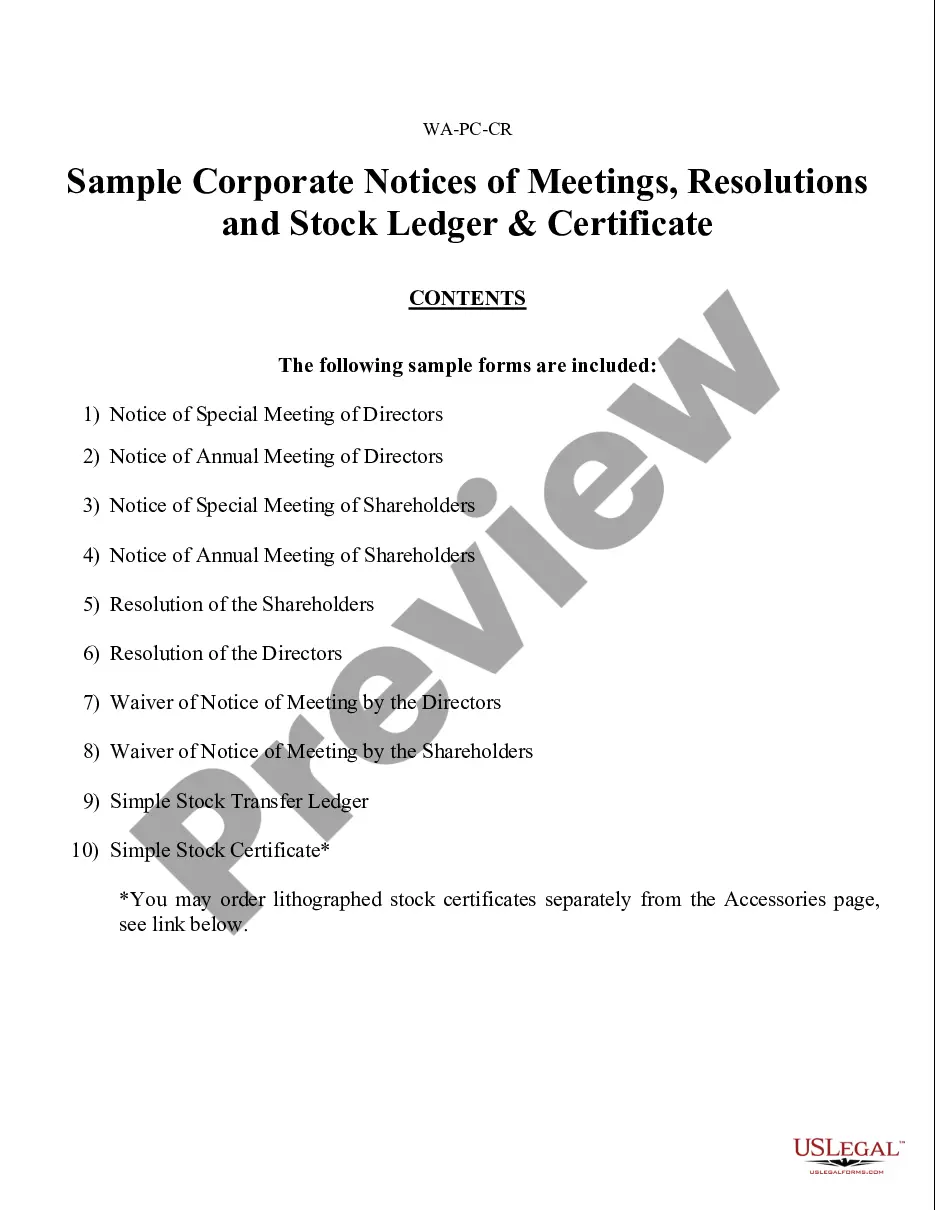

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

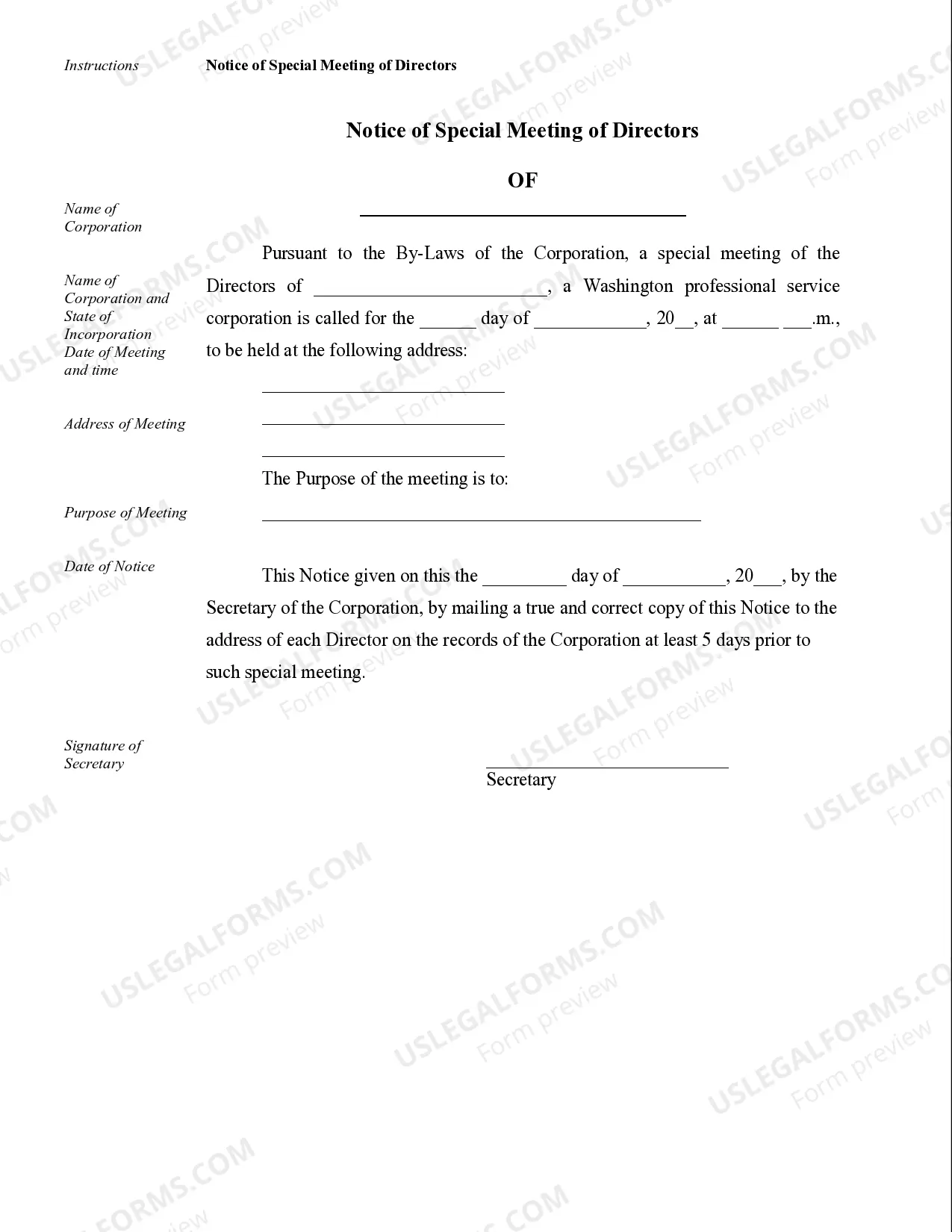

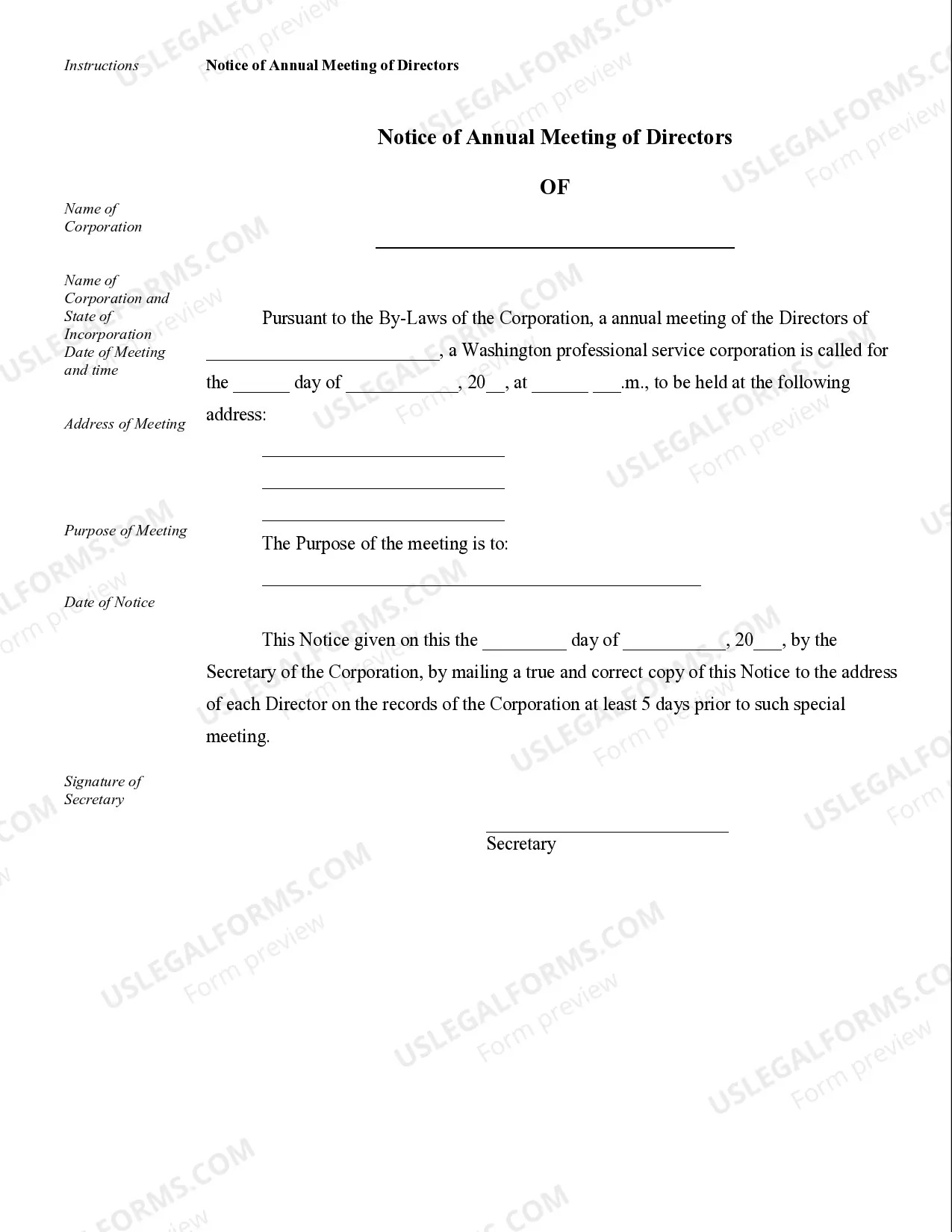

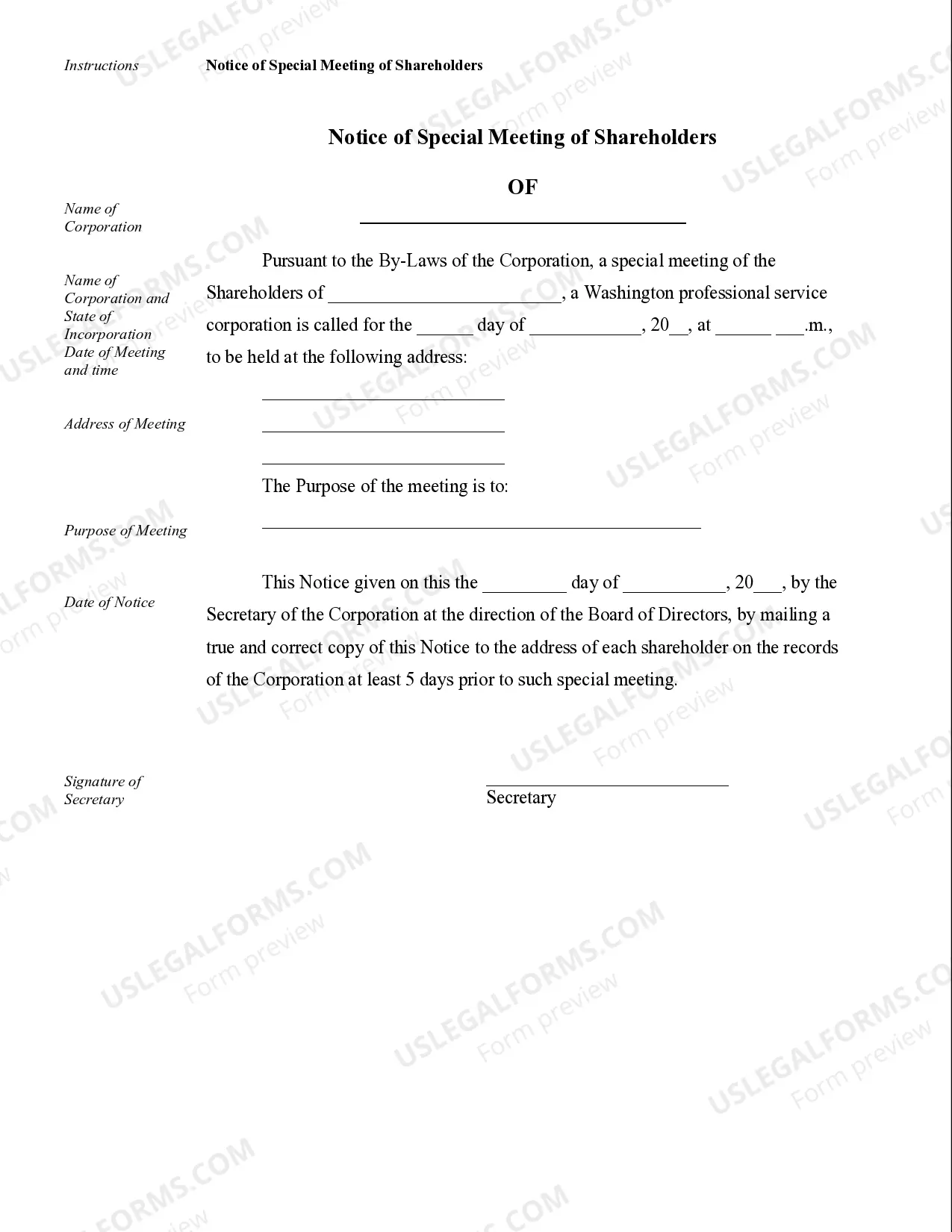

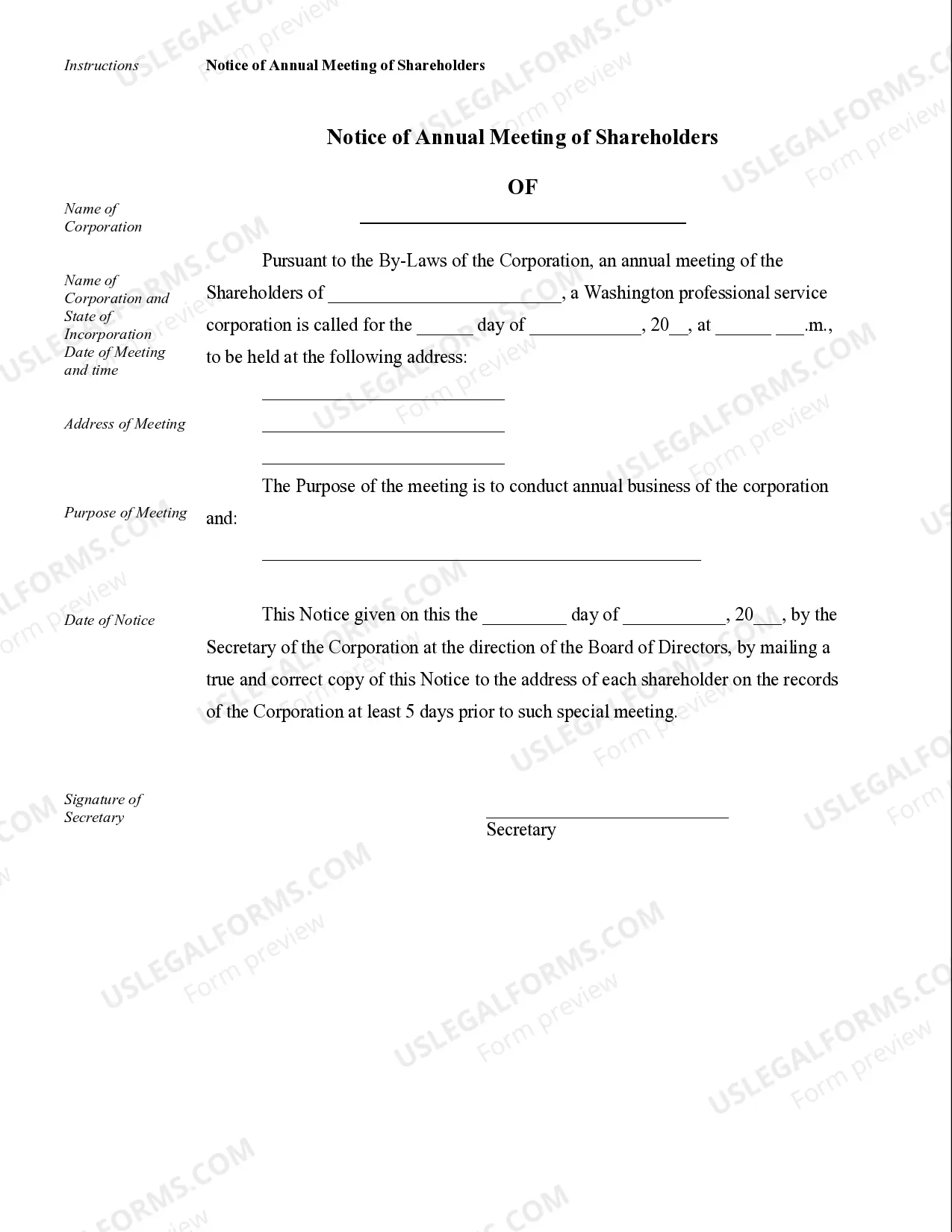

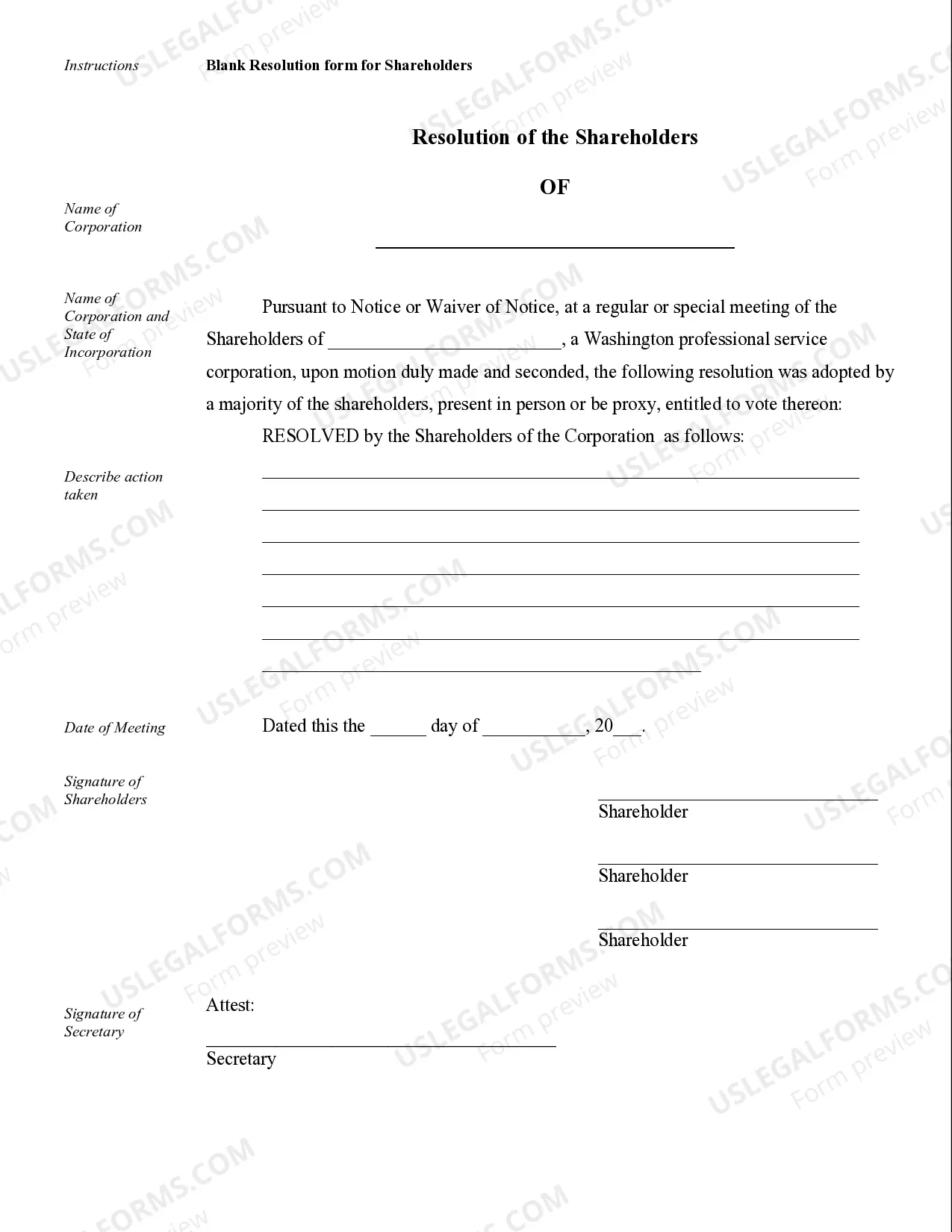

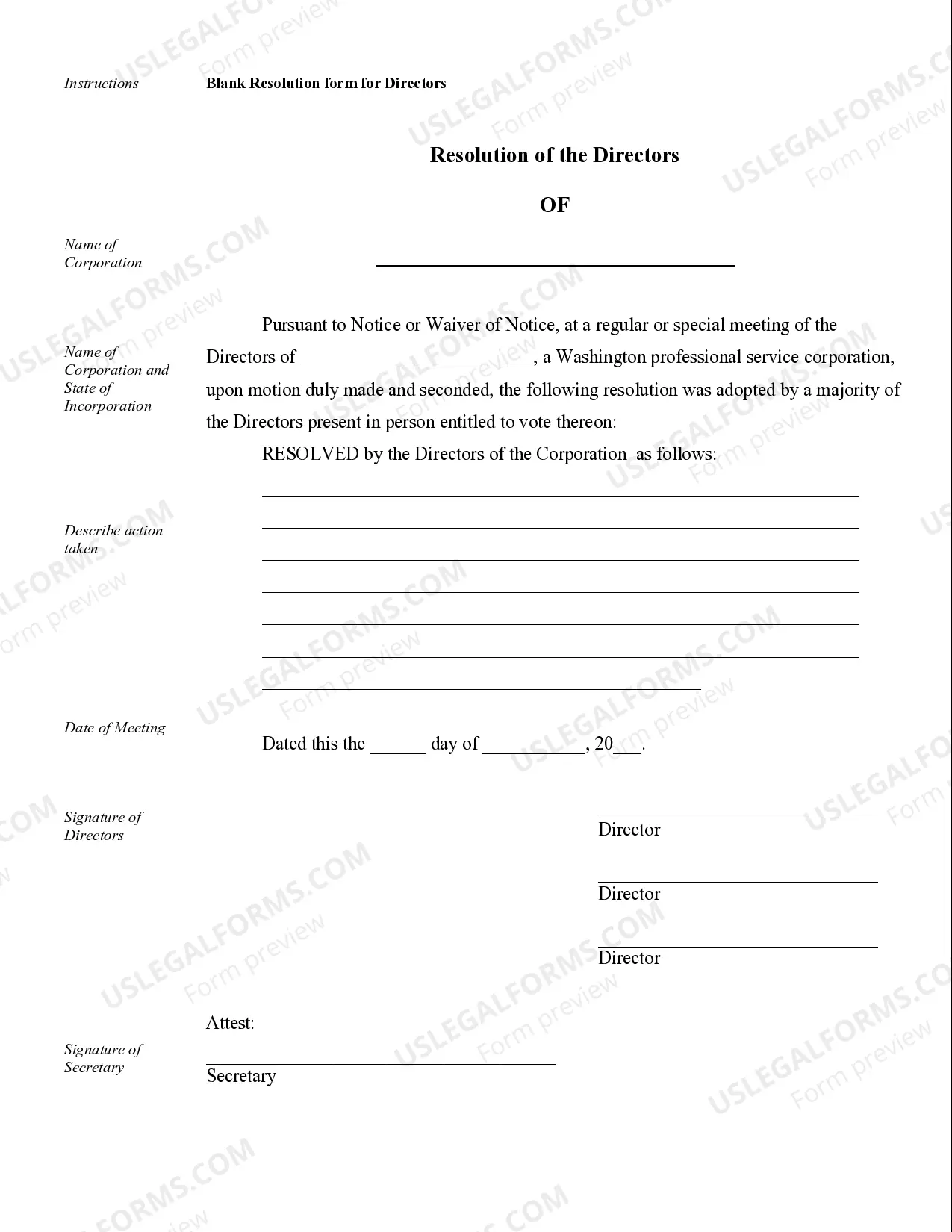

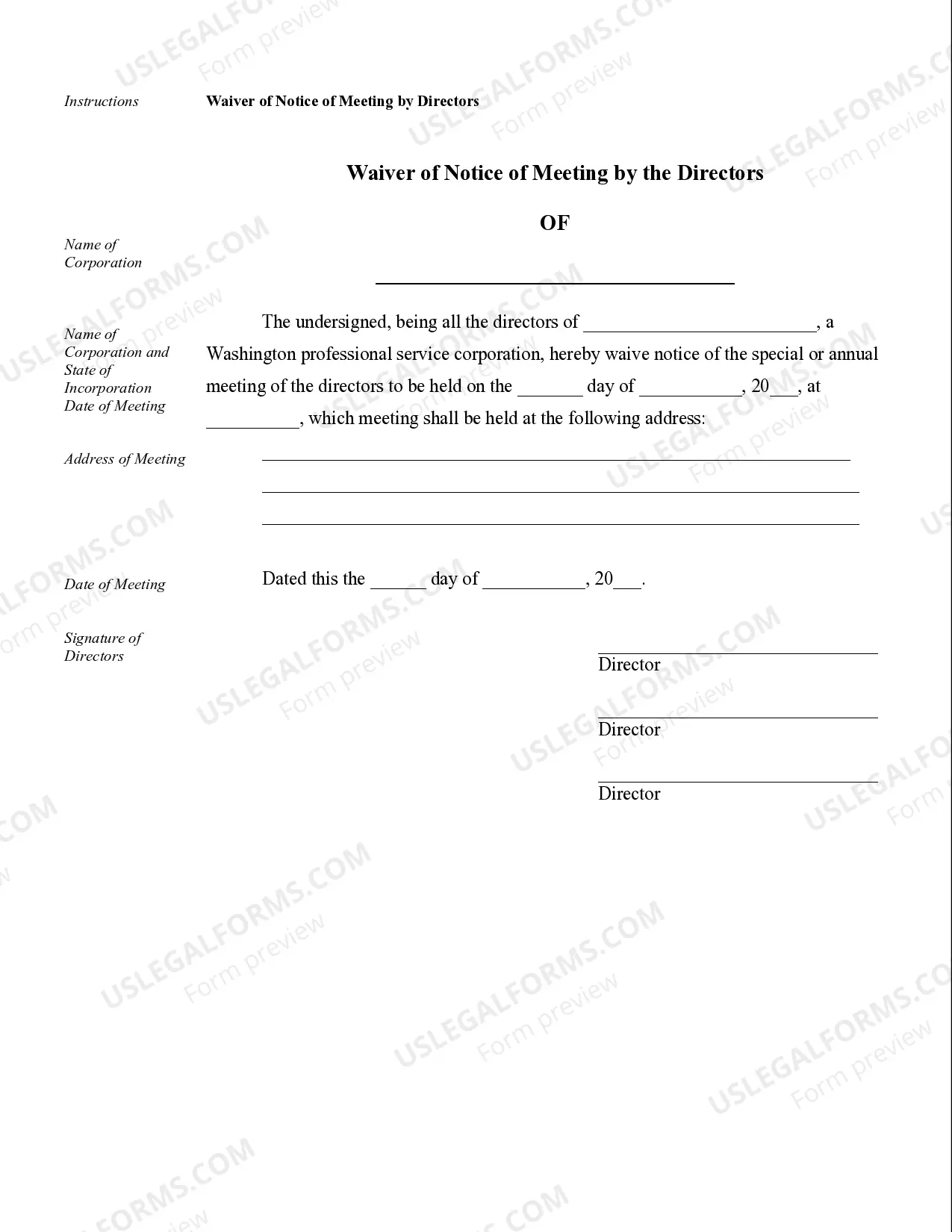

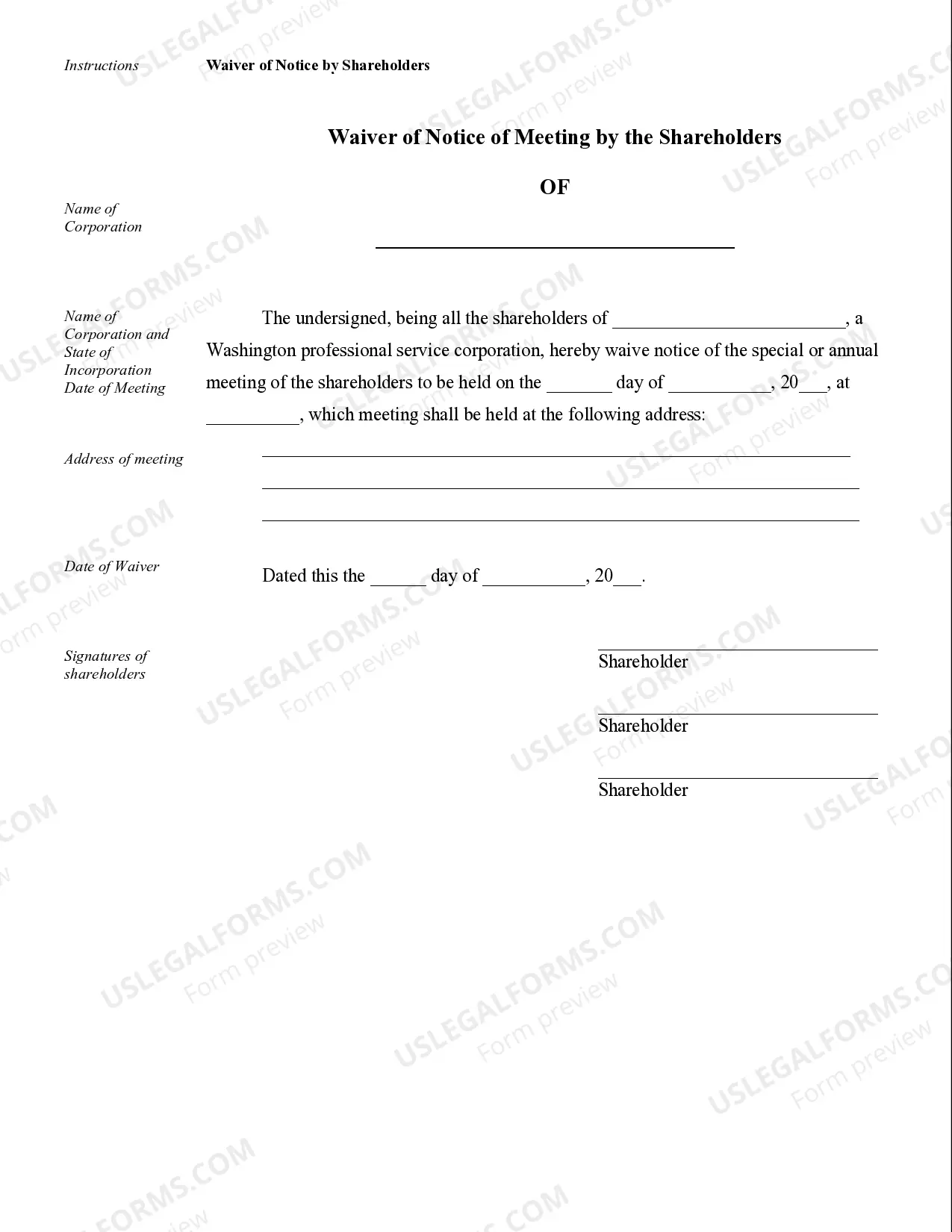

Seattle Sample Corporate Records for a Washington Professional Corporation: When starting or operating a professional corporation in Washington, it is crucial to maintain organized and accurate corporate records. These records serve as a comprehensive account of the corporation's activities, structure, and compliance with state regulations. Seattle provides various sample corporate records that are commonly used by Washington professional corporations. Let's take a closer look at some of these records: 1. Articles of Incorporation: This document is filed with the Washington Secretary of State and establishes the legal existence of the professional corporation. It includes information such as the corporation's name, purpose, registered agent, initial directors, and shares of stock, if applicable. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations, including procedures for meetings, director appointments, shareholder rights, and officer roles. Bylaws help ensure smooth functioning and compliance with state laws. 3. Minutes of Meetings: Minutes record the proceedings and decisions made during corporate meetings, such as board of director meetings and shareholder meetings. They document important matters, including approval of financial statements, election of officers or directors, and major corporate transactions. 4. Shareholder Ledger: This record lists the names, contact information, and share ownership details of the corporation's shareholders. It helps track and update ownership changes, dividend distributions, and voting rights. 5. Stock Certificates: If the professional corporation issues shares of stock, stock certificates are used to represent ownership interests. These certificates contain essential information, including the shareholder's name, the number of shares held, and the class and par value of the shares. 6. Financial Statements: Accurate and up-to-date financial statements, including income statements, balance sheets, and cash flow statements, provide a snapshot of the corporation's financial position. These records are essential for tax reporting, investor analysis, and maintaining transparency. 7. Annual Reports: Washington requires professional corporations to submit annual reports to the Secretary of State. These reports update the state on any changes to the corporation's information, such as registered agent, officers, or directors. It is important to note that these are just a few examples of the most common Seattle sample corporate records for a Washington professional corporation. Depending on the nature of the business and specific requirements, additional records or reports may be necessary. Keeping well-organized corporate records is critical for legal compliance, tax purposes, and ensuring transparency for shareholders and investors. Professional corporations in Seattle, Washington can use these sample corporate records as a guide to maintain accurate and efficient corporate documentation.Seattle Sample Corporate Records for a Washington Professional Corporation: When starting or operating a professional corporation in Washington, it is crucial to maintain organized and accurate corporate records. These records serve as a comprehensive account of the corporation's activities, structure, and compliance with state regulations. Seattle provides various sample corporate records that are commonly used by Washington professional corporations. Let's take a closer look at some of these records: 1. Articles of Incorporation: This document is filed with the Washington Secretary of State and establishes the legal existence of the professional corporation. It includes information such as the corporation's name, purpose, registered agent, initial directors, and shares of stock, if applicable. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations, including procedures for meetings, director appointments, shareholder rights, and officer roles. Bylaws help ensure smooth functioning and compliance with state laws. 3. Minutes of Meetings: Minutes record the proceedings and decisions made during corporate meetings, such as board of director meetings and shareholder meetings. They document important matters, including approval of financial statements, election of officers or directors, and major corporate transactions. 4. Shareholder Ledger: This record lists the names, contact information, and share ownership details of the corporation's shareholders. It helps track and update ownership changes, dividend distributions, and voting rights. 5. Stock Certificates: If the professional corporation issues shares of stock, stock certificates are used to represent ownership interests. These certificates contain essential information, including the shareholder's name, the number of shares held, and the class and par value of the shares. 6. Financial Statements: Accurate and up-to-date financial statements, including income statements, balance sheets, and cash flow statements, provide a snapshot of the corporation's financial position. These records are essential for tax reporting, investor analysis, and maintaining transparency. 7. Annual Reports: Washington requires professional corporations to submit annual reports to the Secretary of State. These reports update the state on any changes to the corporation's information, such as registered agent, officers, or directors. It is important to note that these are just a few examples of the most common Seattle sample corporate records for a Washington professional corporation. Depending on the nature of the business and specific requirements, additional records or reports may be necessary. Keeping well-organized corporate records is critical for legal compliance, tax purposes, and ensuring transparency for shareholders and investors. Professional corporations in Seattle, Washington can use these sample corporate records as a guide to maintain accurate and efficient corporate documentation.