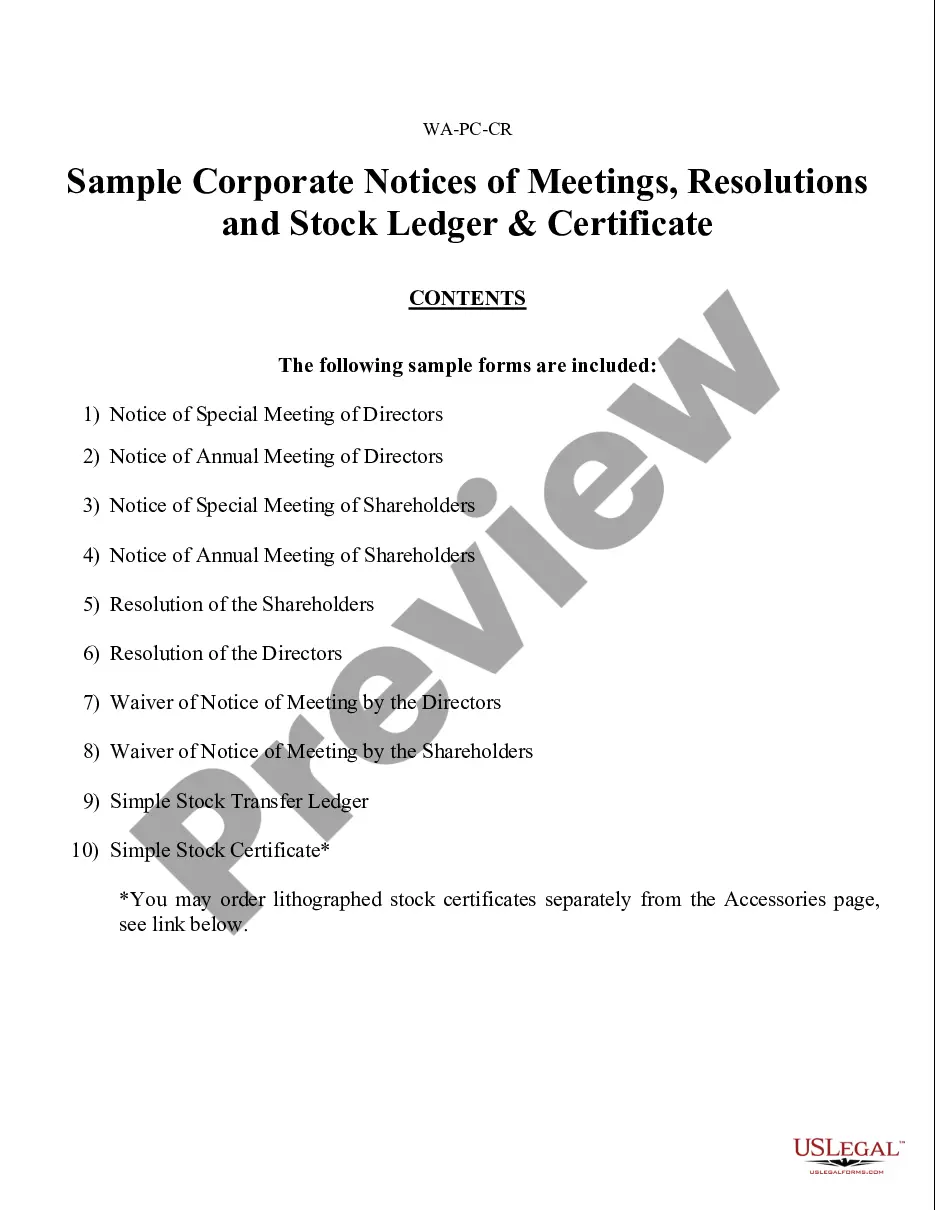

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

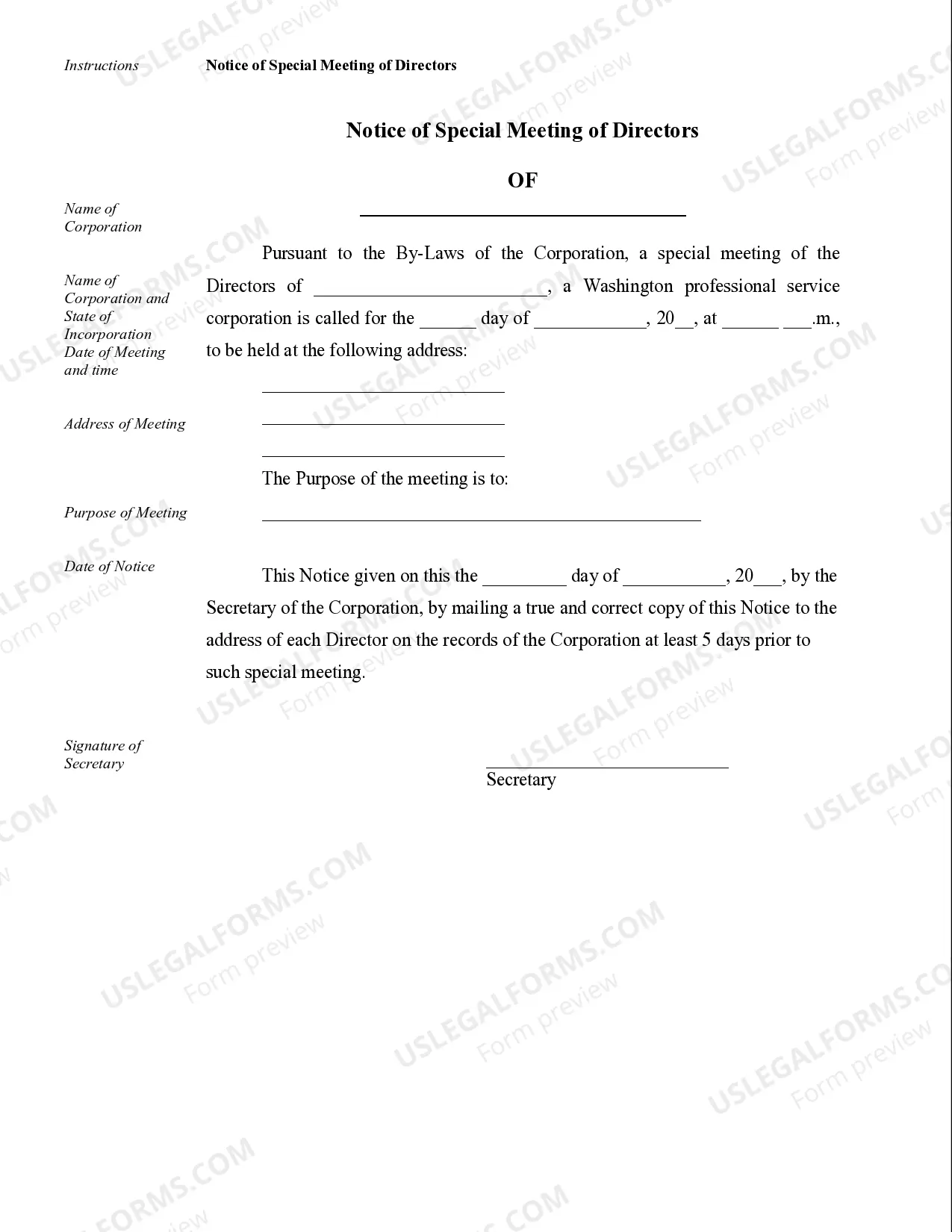

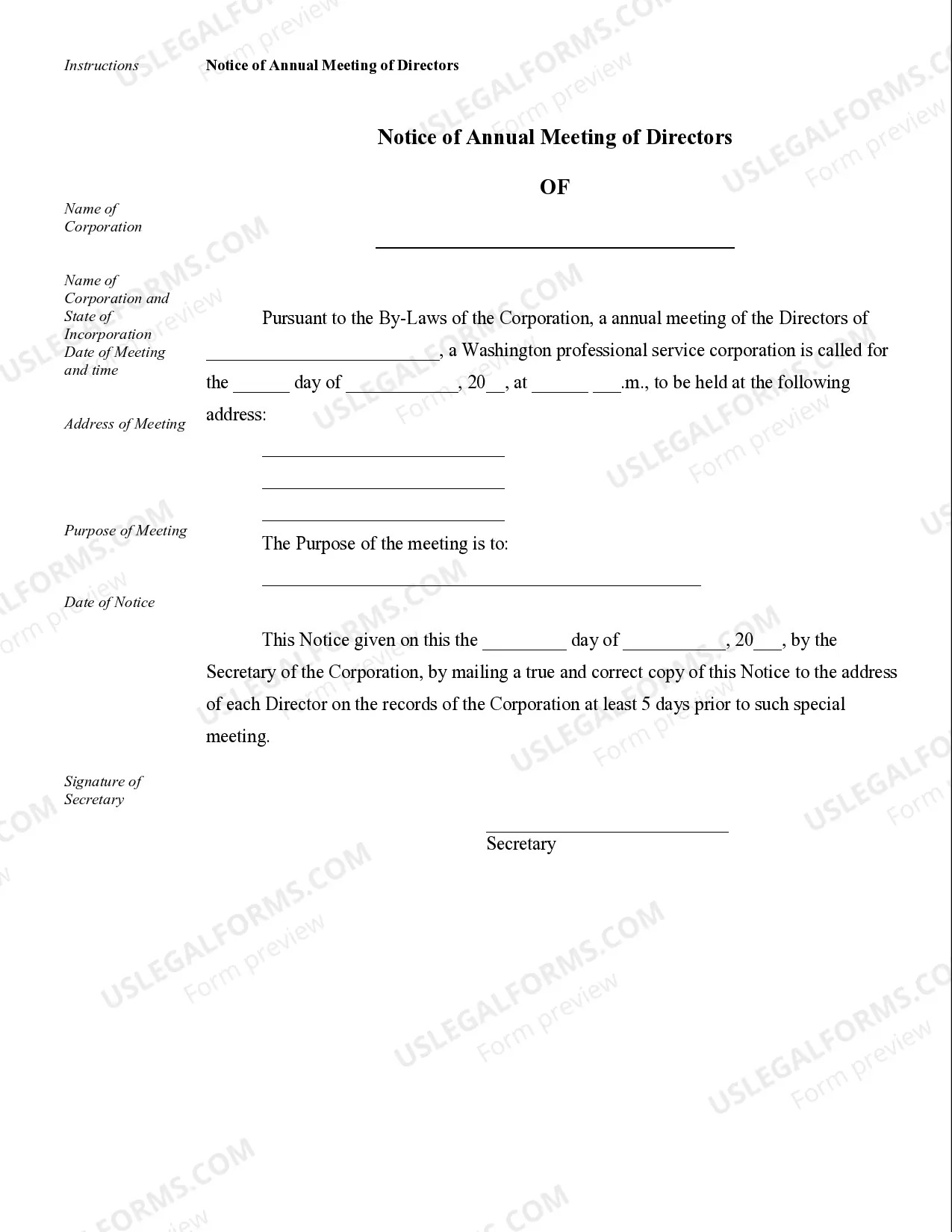

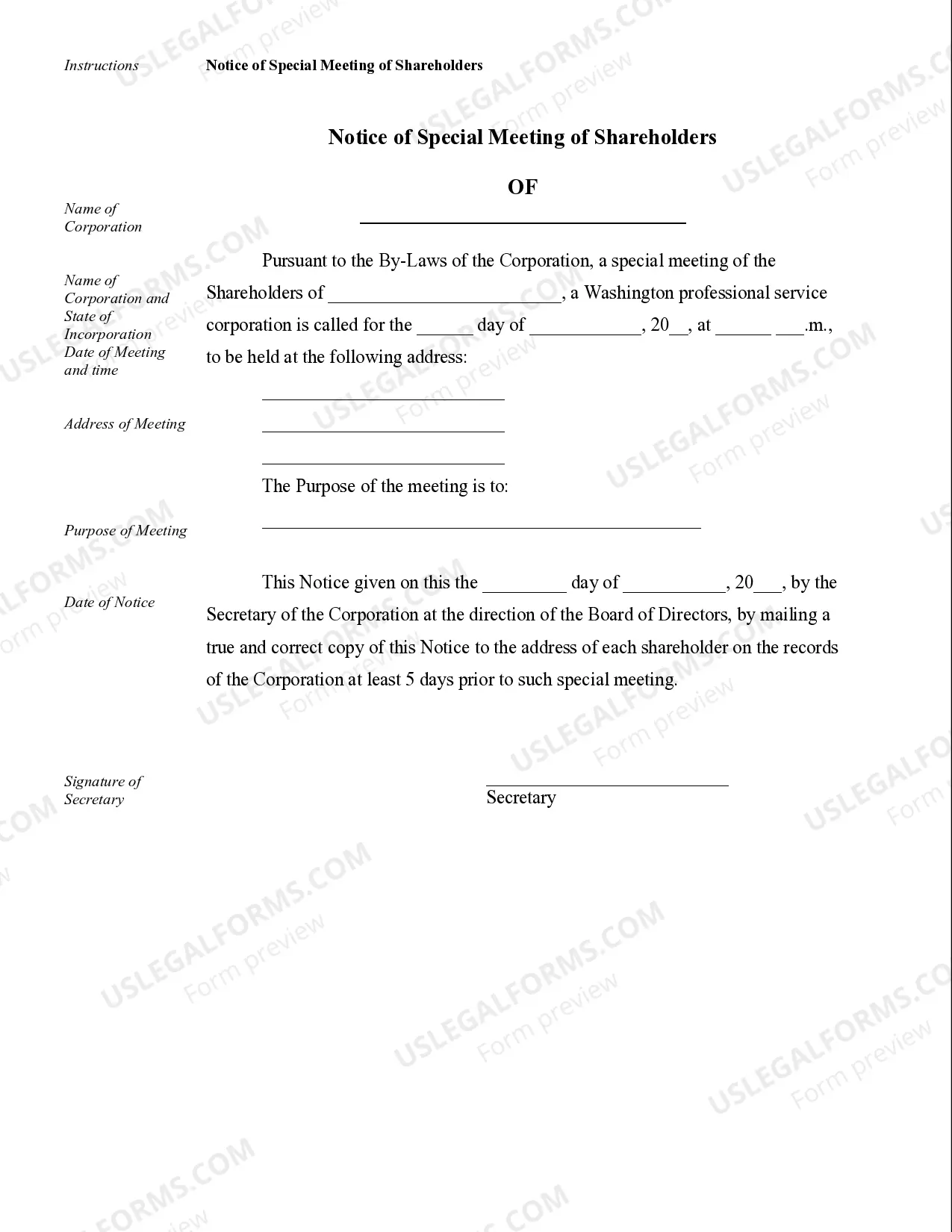

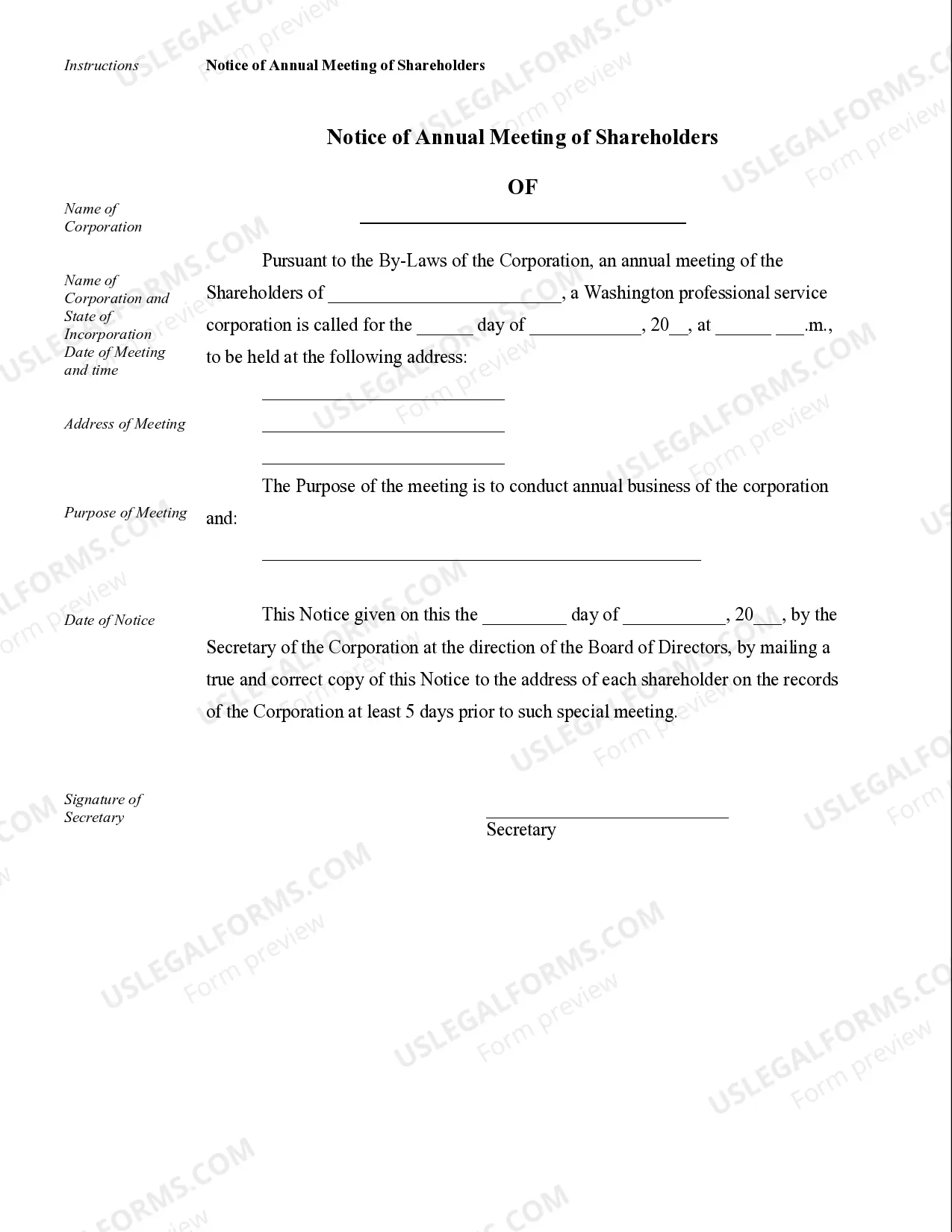

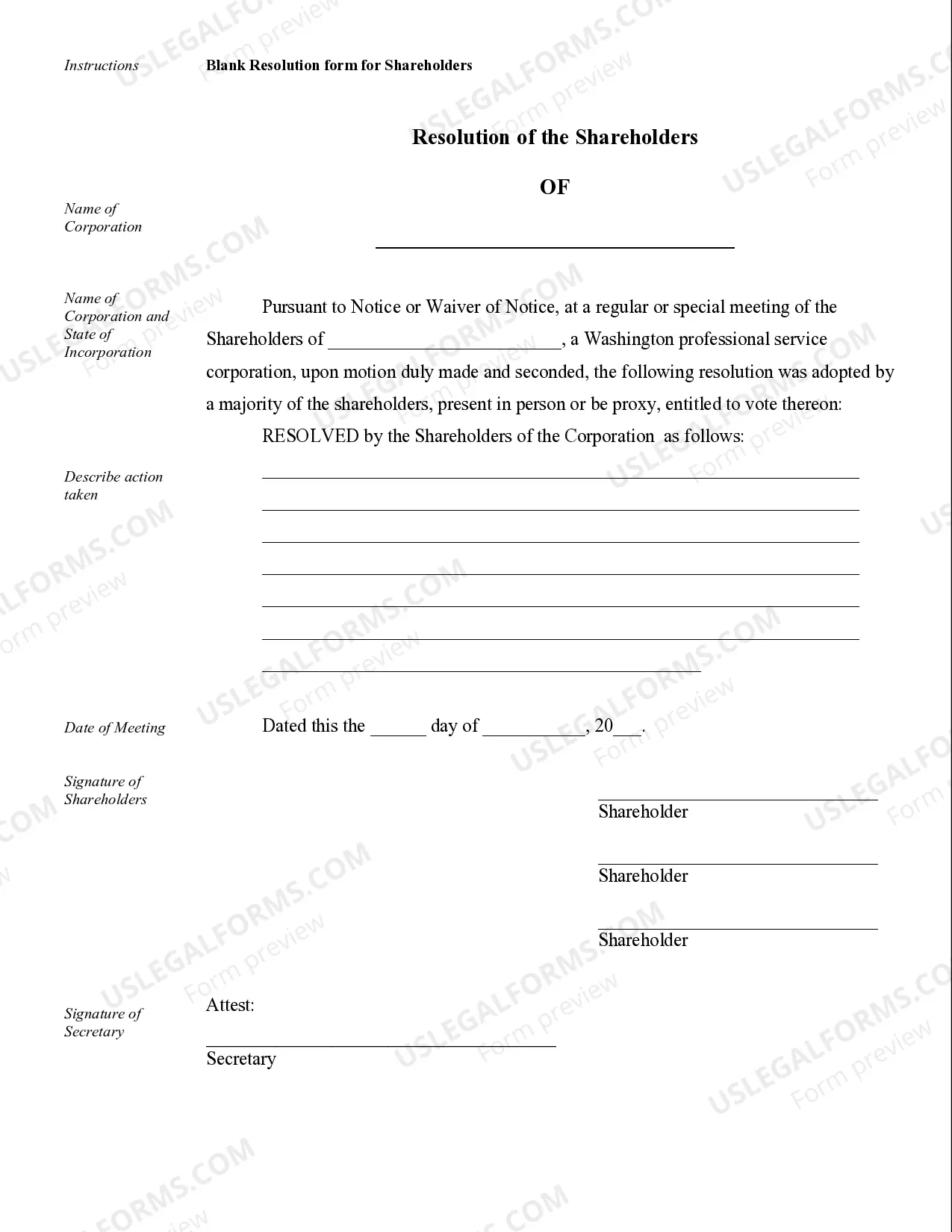

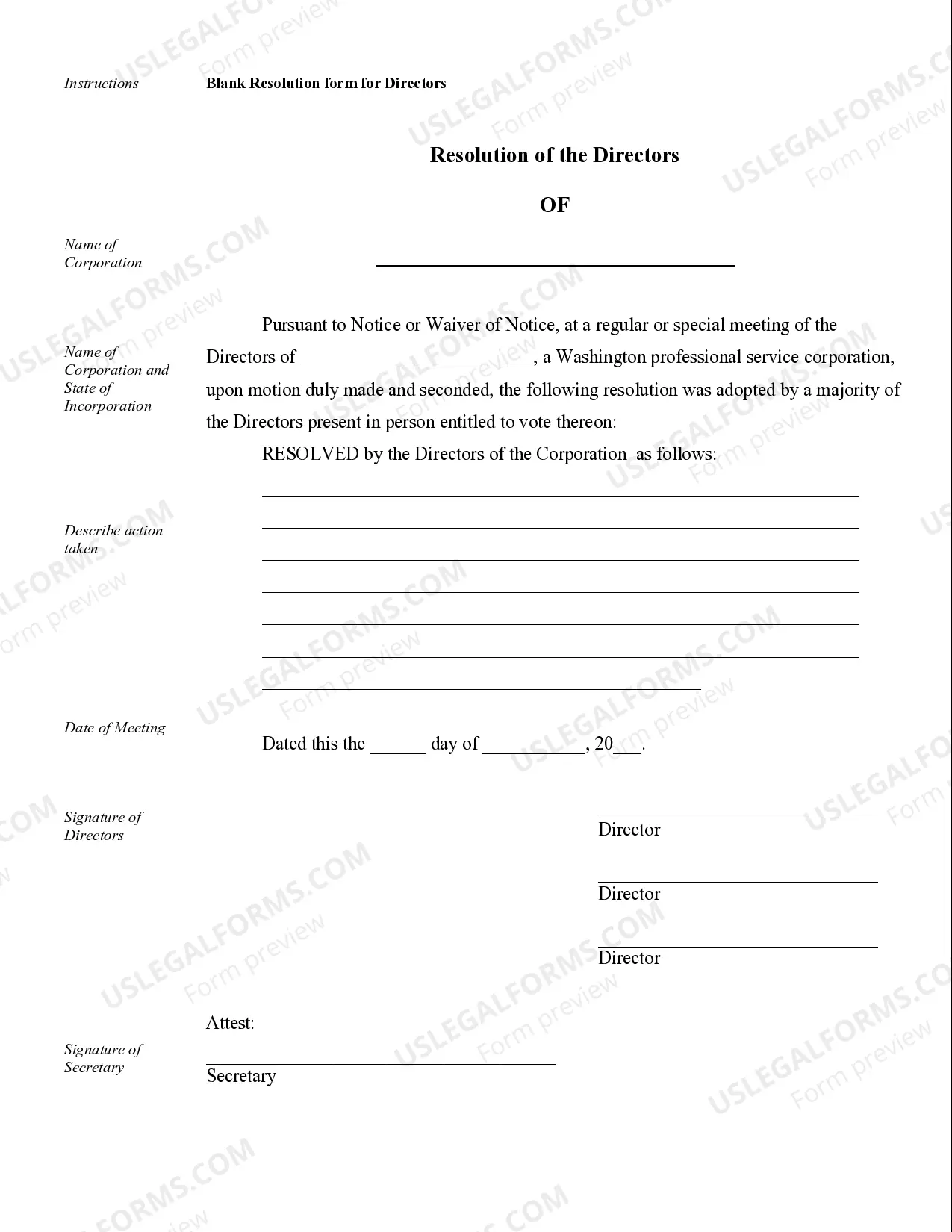

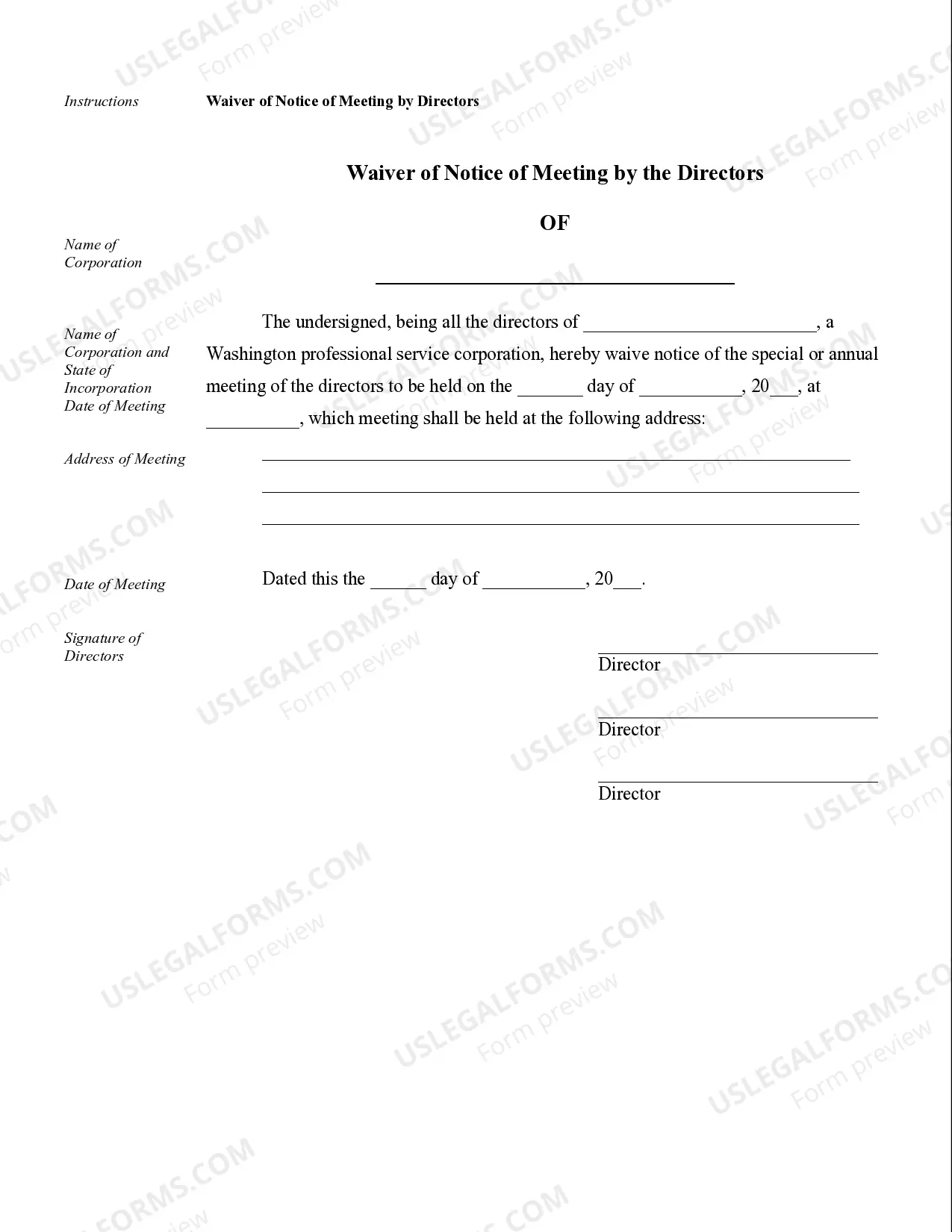

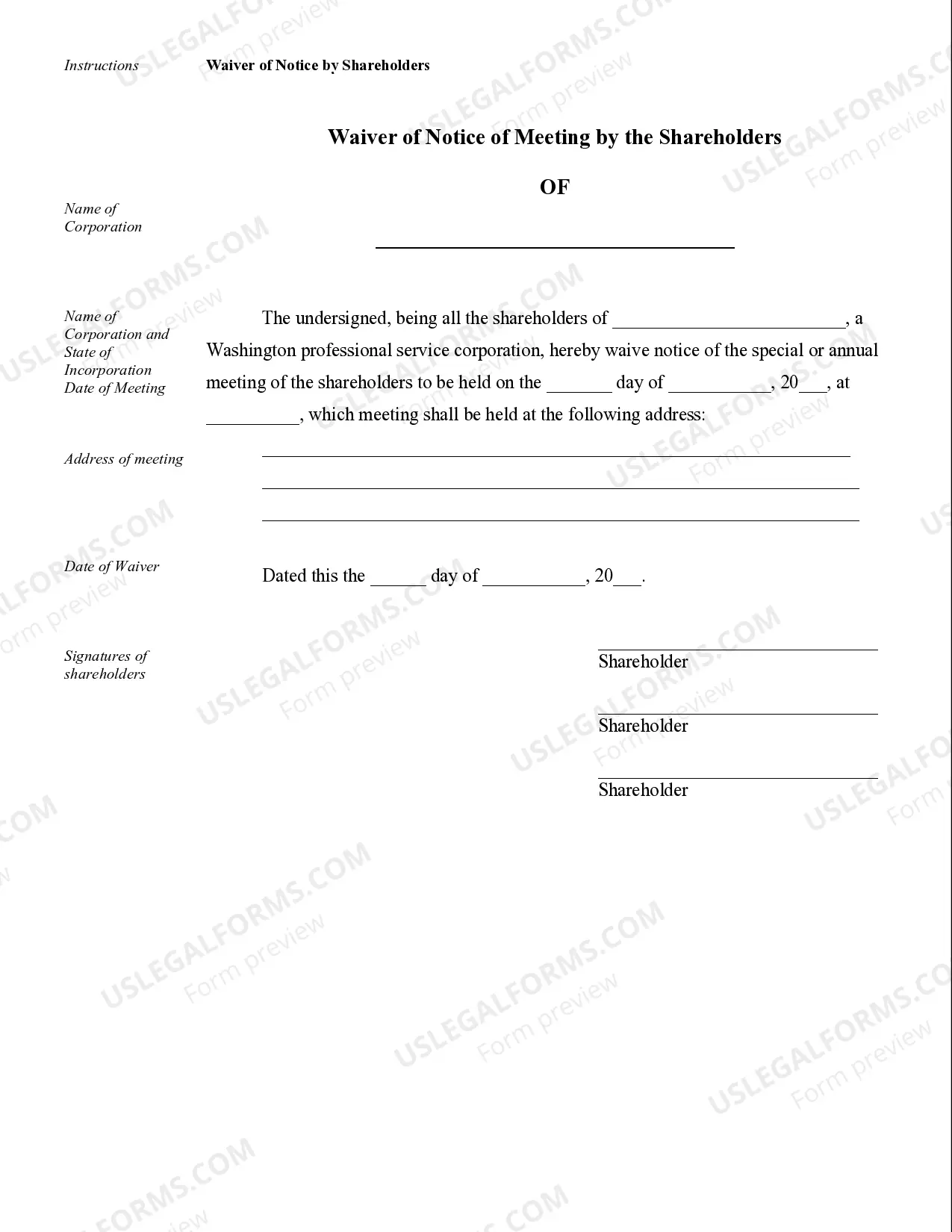

Spokane Valley Sample Corporate Records for a Washington Professional Corporation are essential documents that provide a comprehensive overview of the business's legal and financial activities. These records are used to maintain transparency, comply with state laws, and facilitate efficient business operations. Here are some of the different types of corporate records that are typically included for a Washington Professional Corporation. 1. Articles of Incorporation: The Articles of Incorporation is a critical document submitted to the Washington Secretary of State, officially establishing the existence of the professional corporation. It includes information such as the corporation's name, purpose, registered agent, initial directors, and authorized shares. 2. Bylaws: The corporate bylaws outline the internal rules and regulations that govern the operations of the professional corporation. It includes provisions regarding voting rights, meeting procedures, officer duties, and the overall management structure. 3. Meeting Minutes: Meeting minutes are comprehensive notes taken during board of director meetings or shareholder meetings. These records document the discussions, decisions, and actions taken during these meetings, such as the election of officers, approval of contracts, or any major corporate changes. 4. Shareholder Agreements: Shareholder agreements specify the rights and obligations of the corporation's shareholders. It outlines the procedures for buying or selling shares, voting rights, dividend distribution, and any restrictions on transferring shares. 5. Financial Statements: Financial statements include balance sheets, income statements, and cash flow statements, which provide a snapshot of the corporation's financial performance. These records are crucial for tax filings, obtaining loans or investment, and evaluating the company's financial health. 6. Employment Agreements: Employment agreements detail the terms and conditions of employment for key employees, including executives, officers, or professionals. It includes compensation details, non-disclosure clauses, non-compete agreements, and other contractual obligations. 7. Contracts and Leases: Any contracts or leases entered into by the corporation should be recorded. These contracts can include agreements with clients, vendors, landlords, or lenders. It is important to maintain copies of these documents, as they govern the rights and obligations of the corporation. 8. Annual Reports: Washington state requires professional corporations to file annual reports that disclose key information about the corporation, including address, registered agent, directors, and officers. These reports help ensure accurate and up-to-date information is available to the public and regulatory bodies. By maintaining these Spokane Valley Sample Corporate Records for a Washington Professional Corporation, businesses can preserve their legal standing, protect their shareholders' interests, and ensure compliance with regulations. These records also serve as a valuable source of information for potential investors, auditors, or legal authorities when needed.Spokane Valley Sample Corporate Records for a Washington Professional Corporation are essential documents that provide a comprehensive overview of the business's legal and financial activities. These records are used to maintain transparency, comply with state laws, and facilitate efficient business operations. Here are some of the different types of corporate records that are typically included for a Washington Professional Corporation. 1. Articles of Incorporation: The Articles of Incorporation is a critical document submitted to the Washington Secretary of State, officially establishing the existence of the professional corporation. It includes information such as the corporation's name, purpose, registered agent, initial directors, and authorized shares. 2. Bylaws: The corporate bylaws outline the internal rules and regulations that govern the operations of the professional corporation. It includes provisions regarding voting rights, meeting procedures, officer duties, and the overall management structure. 3. Meeting Minutes: Meeting minutes are comprehensive notes taken during board of director meetings or shareholder meetings. These records document the discussions, decisions, and actions taken during these meetings, such as the election of officers, approval of contracts, or any major corporate changes. 4. Shareholder Agreements: Shareholder agreements specify the rights and obligations of the corporation's shareholders. It outlines the procedures for buying or selling shares, voting rights, dividend distribution, and any restrictions on transferring shares. 5. Financial Statements: Financial statements include balance sheets, income statements, and cash flow statements, which provide a snapshot of the corporation's financial performance. These records are crucial for tax filings, obtaining loans or investment, and evaluating the company's financial health. 6. Employment Agreements: Employment agreements detail the terms and conditions of employment for key employees, including executives, officers, or professionals. It includes compensation details, non-disclosure clauses, non-compete agreements, and other contractual obligations. 7. Contracts and Leases: Any contracts or leases entered into by the corporation should be recorded. These contracts can include agreements with clients, vendors, landlords, or lenders. It is important to maintain copies of these documents, as they govern the rights and obligations of the corporation. 8. Annual Reports: Washington state requires professional corporations to file annual reports that disclose key information about the corporation, including address, registered agent, directors, and officers. These reports help ensure accurate and up-to-date information is available to the public and regulatory bodies. By maintaining these Spokane Valley Sample Corporate Records for a Washington Professional Corporation, businesses can preserve their legal standing, protect their shareholders' interests, and ensure compliance with regulations. These records also serve as a valuable source of information for potential investors, auditors, or legal authorities when needed.