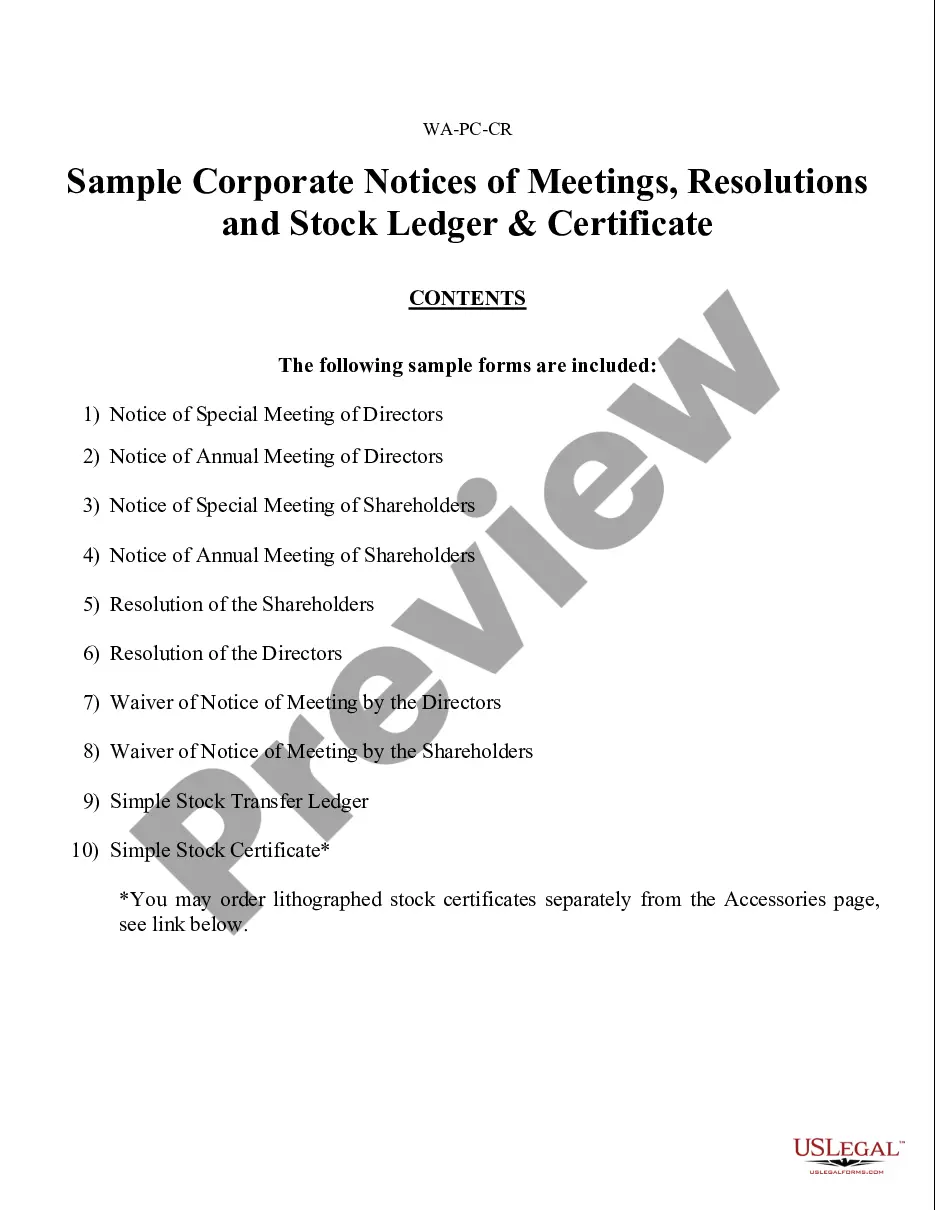

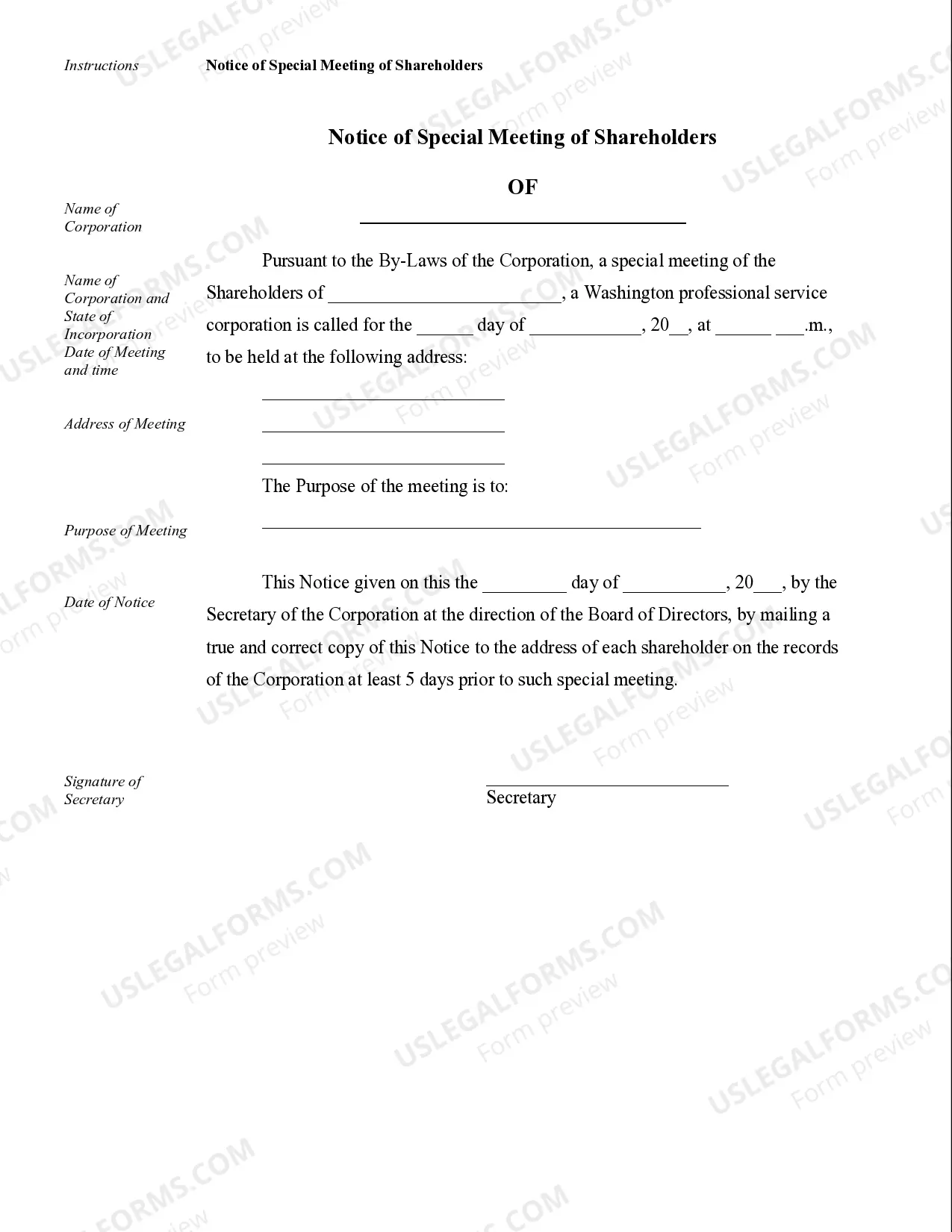

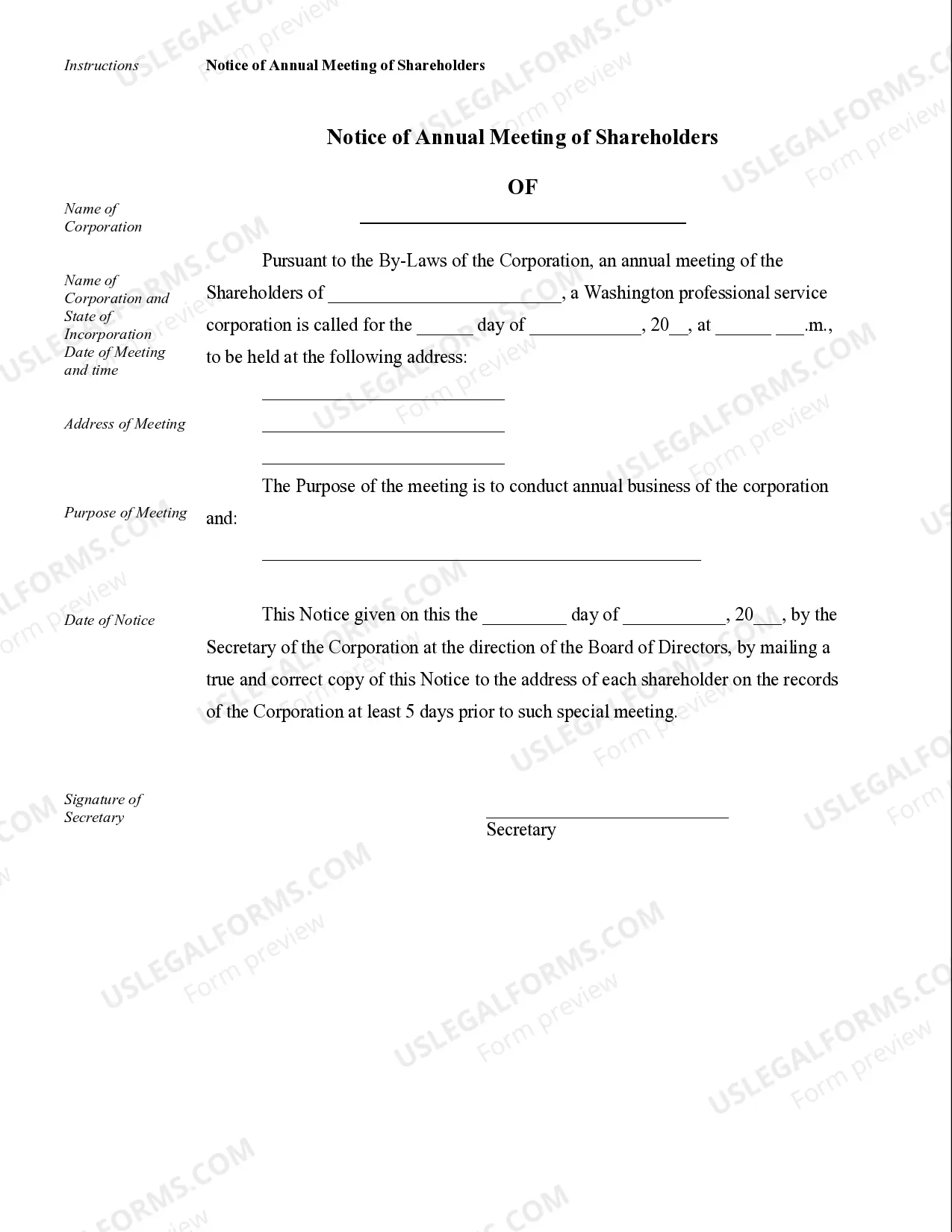

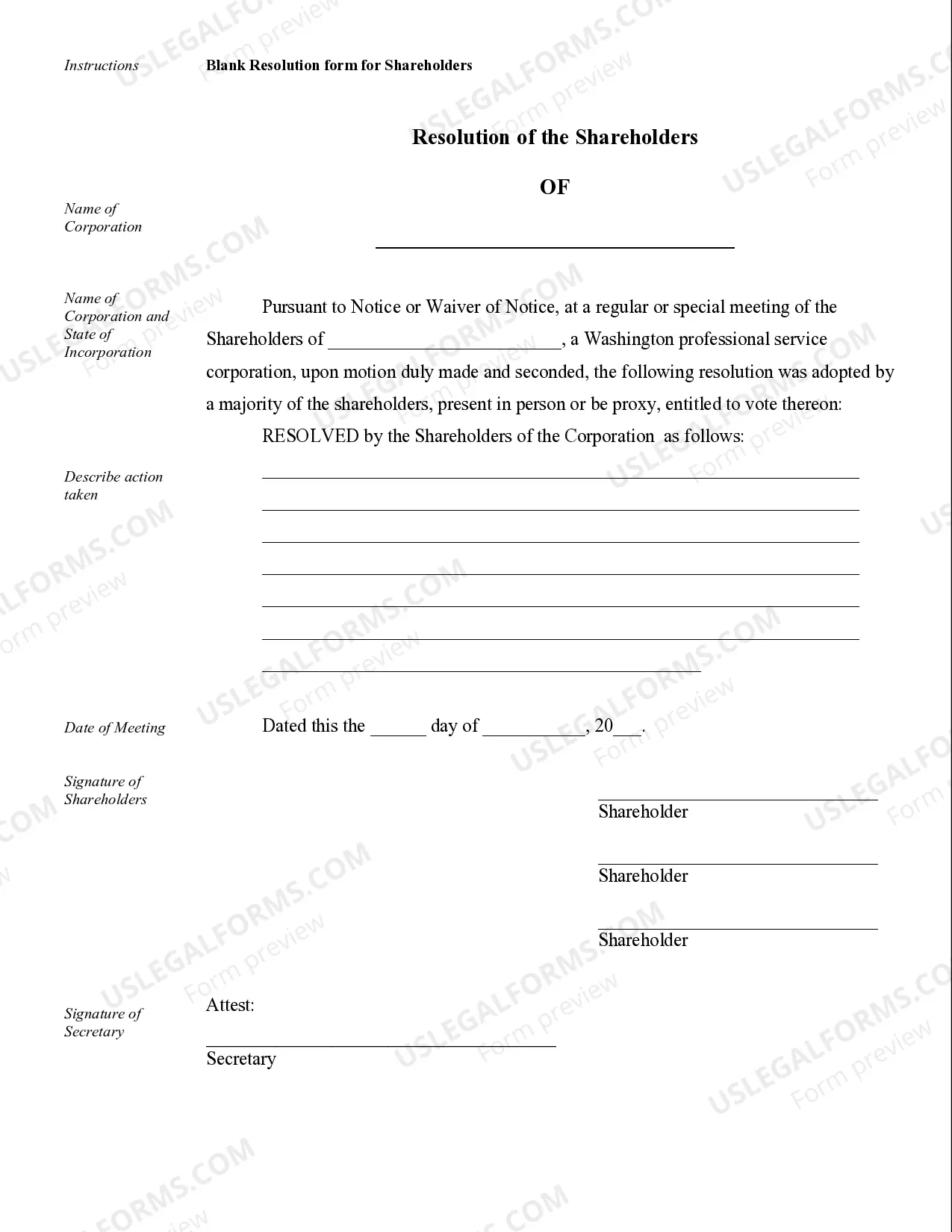

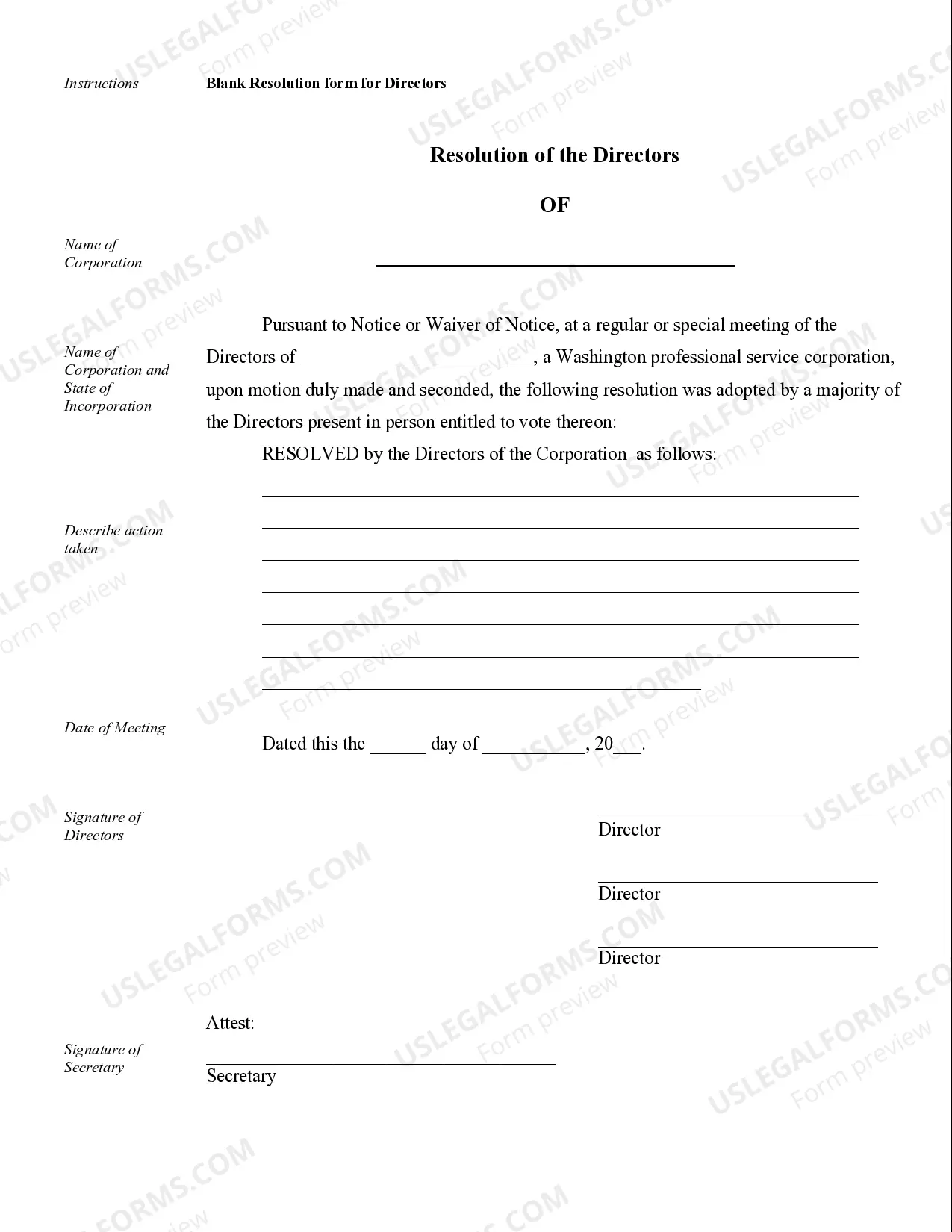

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

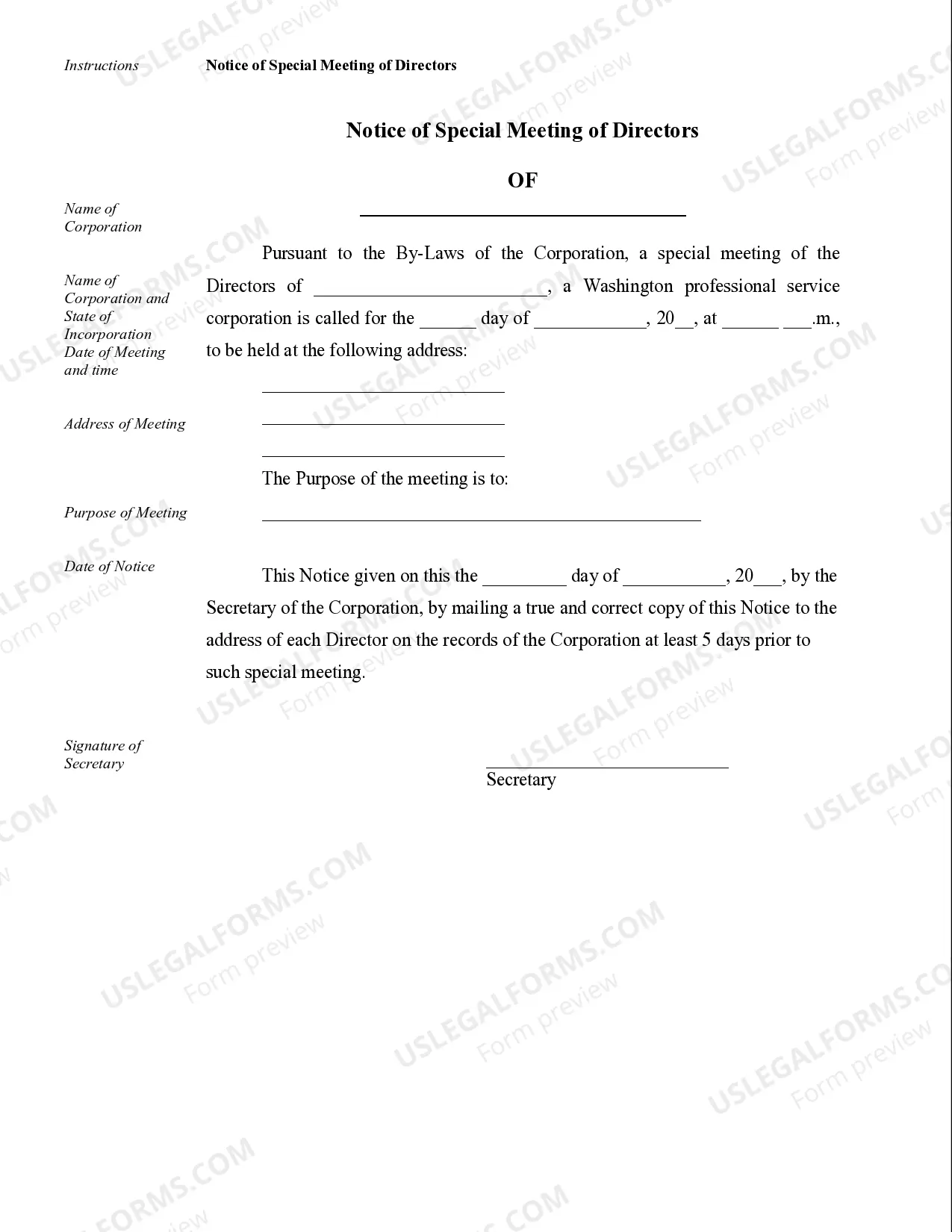

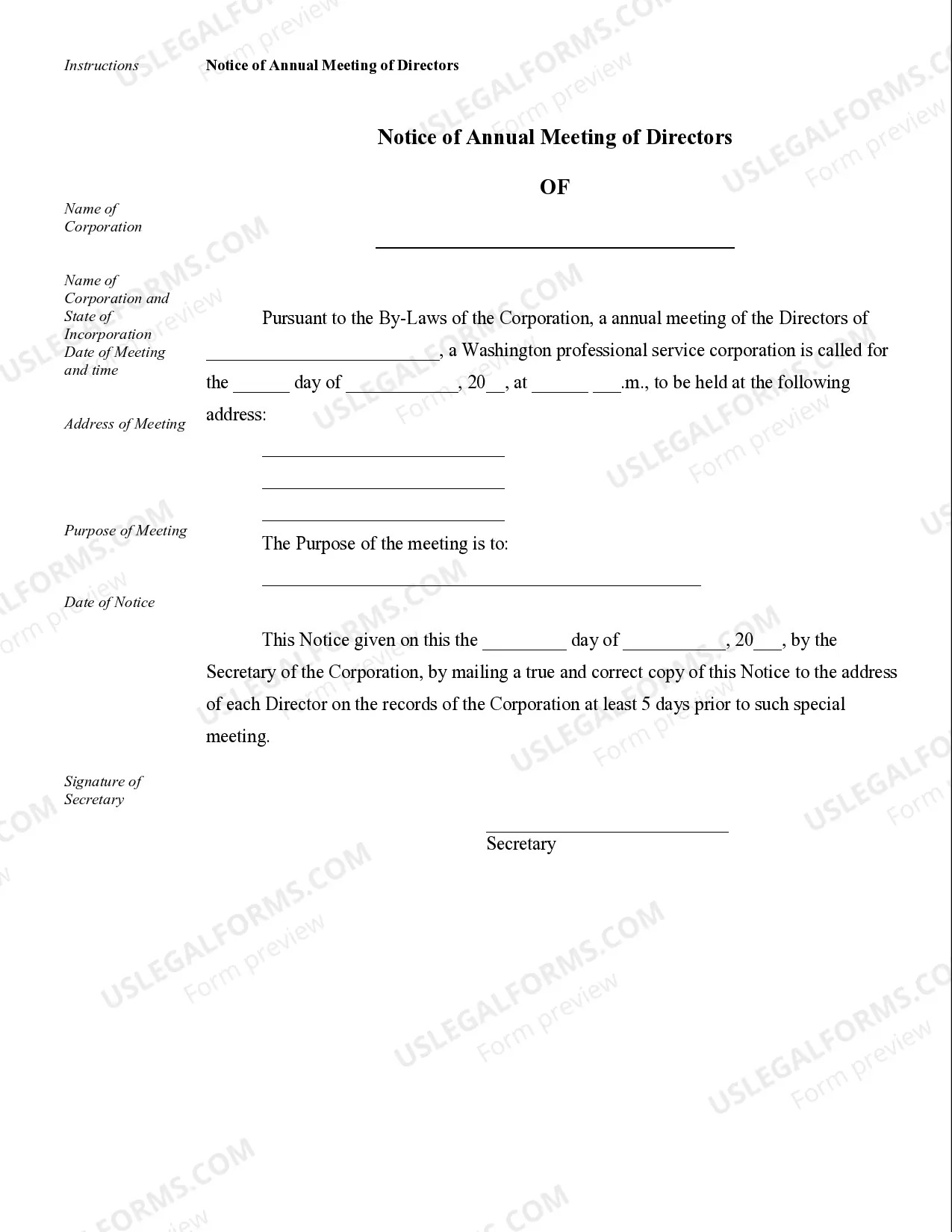

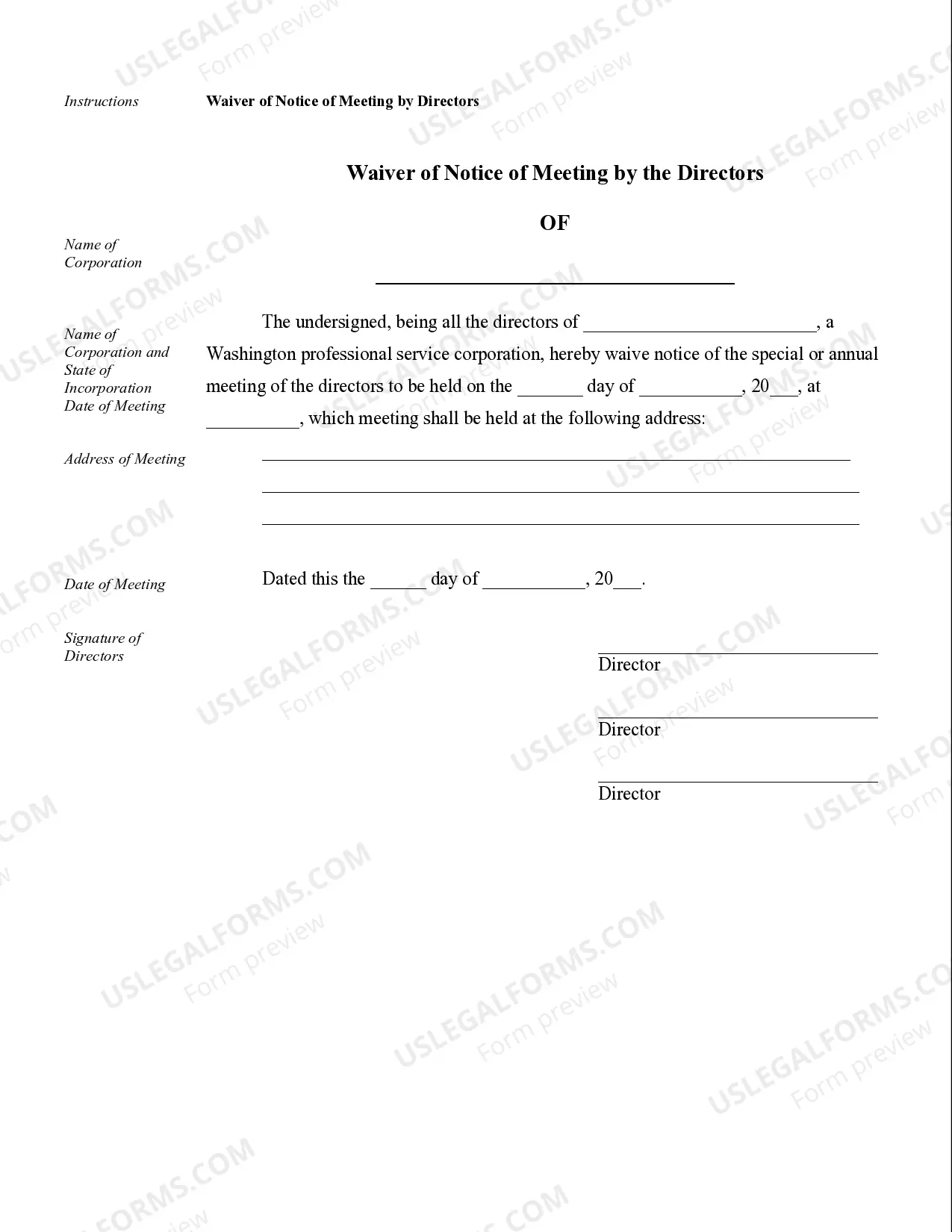

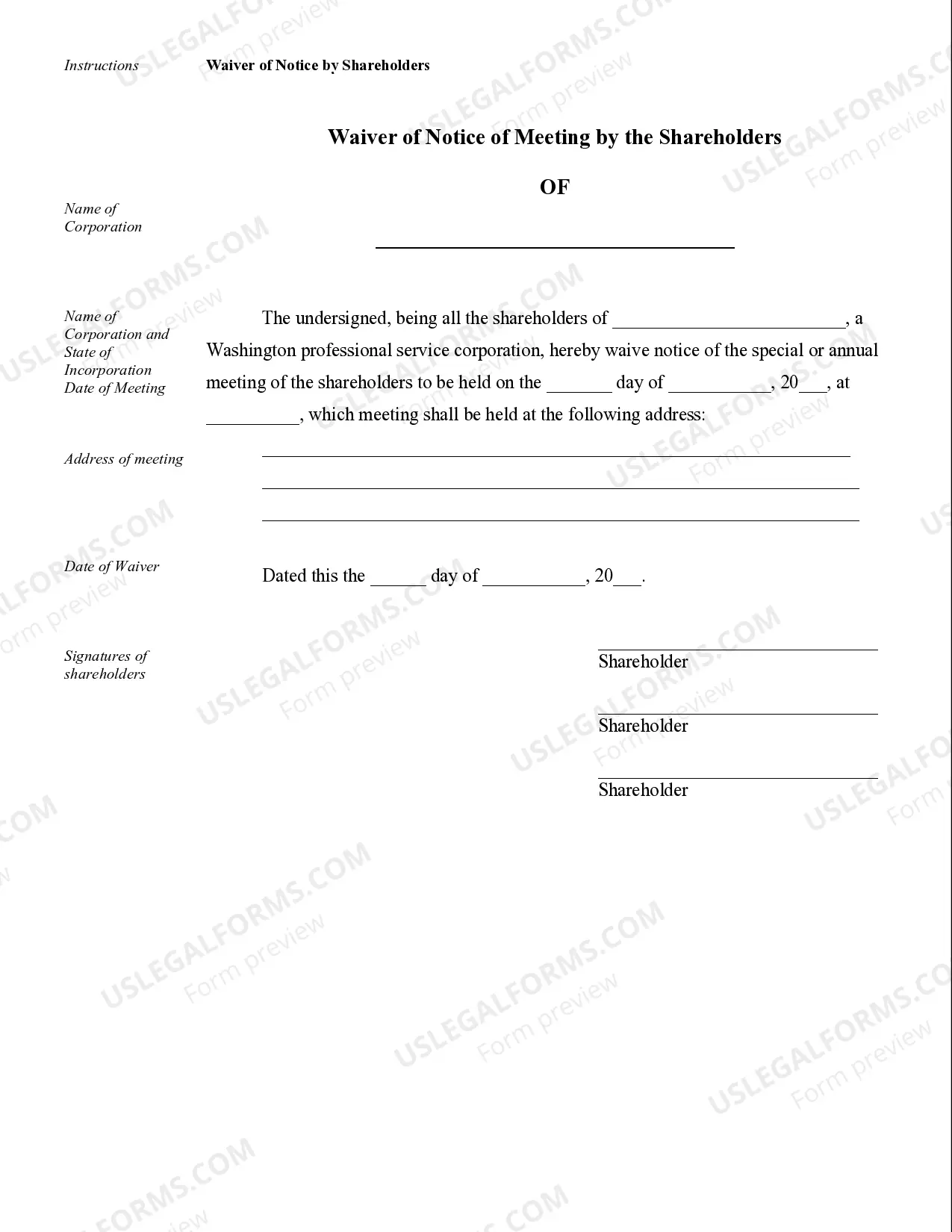

Tacoma Sample Corporate Records for a Washington Professional Corporation are the official documents and records that a professional corporation operating in Washington State must maintain to comply with legal requirements and ensure proper corporate governance. These records serve as a comprehensive record of the corporation's activities and decisions. The main types of Tacoma Sample Corporate Records for a Washington Professional Corporation include: 1. Articles of Incorporation: This document establishes the corporation as a legal entity and includes essential information such as the corporation's name, purpose, location, and the names and addresses of its directors and officers. 2. Bylaws: These are the rules and regulations that govern the internal operations and management of the corporation. Bylaws include provisions regarding shareholder meetings, director qualifications, officer roles, voting procedures, and more. 3. Meeting Minutes: Detailed records are kept for all meetings of the board of directors and shareholders. Meeting minutes document the topics discussed, decisions made, voting results, and any resolutions adopted during these meetings. 4. Shareholder Agreements: If the corporation has multiple shareholders, a shareholder agreement may be drafted to outline the rights, obligations, and responsibilities of each shareholder. This agreement may address issues such as share transfers, voting rights, dividend distributions, and dispute resolution. 5. Stock Certificates: These certificates represent the ownership of shares in the corporation. Each shareholder typically receives a stock certificate indicating the number of shares they own. 6. Financial Statements: Tacoma Sample Corporate Records also include financial statements, such as balance sheets, income statements, and cash flow statements. These statements provide a snapshot of the corporation's financial position and performance. 7. Annual Reports: Washington professional corporations are required to file annual reports with the Secretary of State. These reports update the state on the corporation's current information, such as its principal office address, registered agent information, and any changes in directors or officers. 8. Licensing and Regulatory Documents: Depending on the type of professional corporation, specific licenses or permits may be required. Samples of these documents should be included in the corporate records file, demonstrating compliance with regulatory requirements. It is crucial for a Washington Professional Corporation in Tacoma to maintain accurate and up-to-date corporate records as they serve as evidence of the corporation's legal existence, activities, and compliance with corporate formalities. These records may be requested by government agencies, auditors, shareholders, or potential investors seeking transparency and accountability. Failure to maintain proper corporate records can result in legal complications, fines, or potential loss of limited liability protection for corporation members.Tacoma Sample Corporate Records for a Washington Professional Corporation are the official documents and records that a professional corporation operating in Washington State must maintain to comply with legal requirements and ensure proper corporate governance. These records serve as a comprehensive record of the corporation's activities and decisions. The main types of Tacoma Sample Corporate Records for a Washington Professional Corporation include: 1. Articles of Incorporation: This document establishes the corporation as a legal entity and includes essential information such as the corporation's name, purpose, location, and the names and addresses of its directors and officers. 2. Bylaws: These are the rules and regulations that govern the internal operations and management of the corporation. Bylaws include provisions regarding shareholder meetings, director qualifications, officer roles, voting procedures, and more. 3. Meeting Minutes: Detailed records are kept for all meetings of the board of directors and shareholders. Meeting minutes document the topics discussed, decisions made, voting results, and any resolutions adopted during these meetings. 4. Shareholder Agreements: If the corporation has multiple shareholders, a shareholder agreement may be drafted to outline the rights, obligations, and responsibilities of each shareholder. This agreement may address issues such as share transfers, voting rights, dividend distributions, and dispute resolution. 5. Stock Certificates: These certificates represent the ownership of shares in the corporation. Each shareholder typically receives a stock certificate indicating the number of shares they own. 6. Financial Statements: Tacoma Sample Corporate Records also include financial statements, such as balance sheets, income statements, and cash flow statements. These statements provide a snapshot of the corporation's financial position and performance. 7. Annual Reports: Washington professional corporations are required to file annual reports with the Secretary of State. These reports update the state on the corporation's current information, such as its principal office address, registered agent information, and any changes in directors or officers. 8. Licensing and Regulatory Documents: Depending on the type of professional corporation, specific licenses or permits may be required. Samples of these documents should be included in the corporate records file, demonstrating compliance with regulatory requirements. It is crucial for a Washington Professional Corporation in Tacoma to maintain accurate and up-to-date corporate records as they serve as evidence of the corporation's legal existence, activities, and compliance with corporate formalities. These records may be requested by government agencies, auditors, shareholders, or potential investors seeking transparency and accountability. Failure to maintain proper corporate records can result in legal complications, fines, or potential loss of limited liability protection for corporation members.