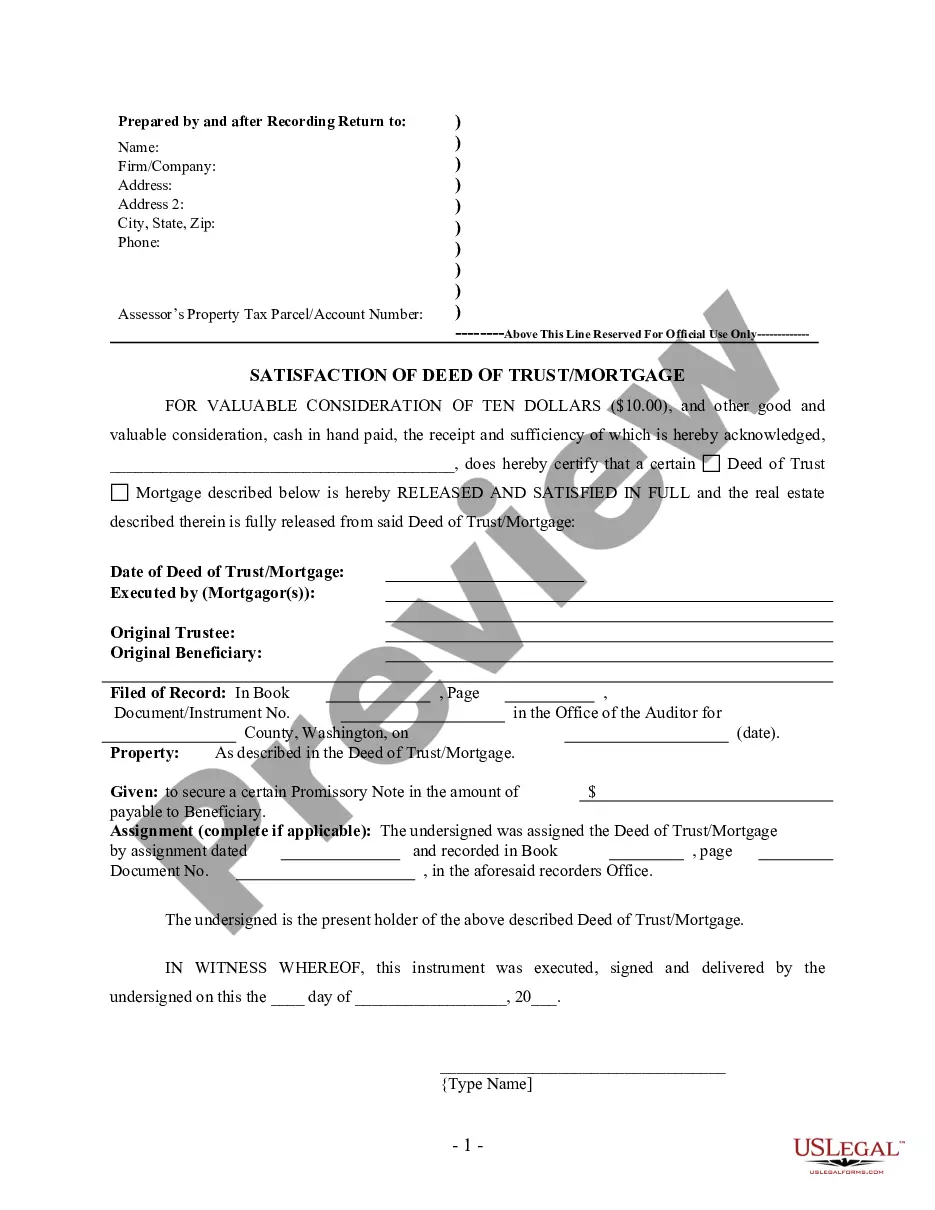

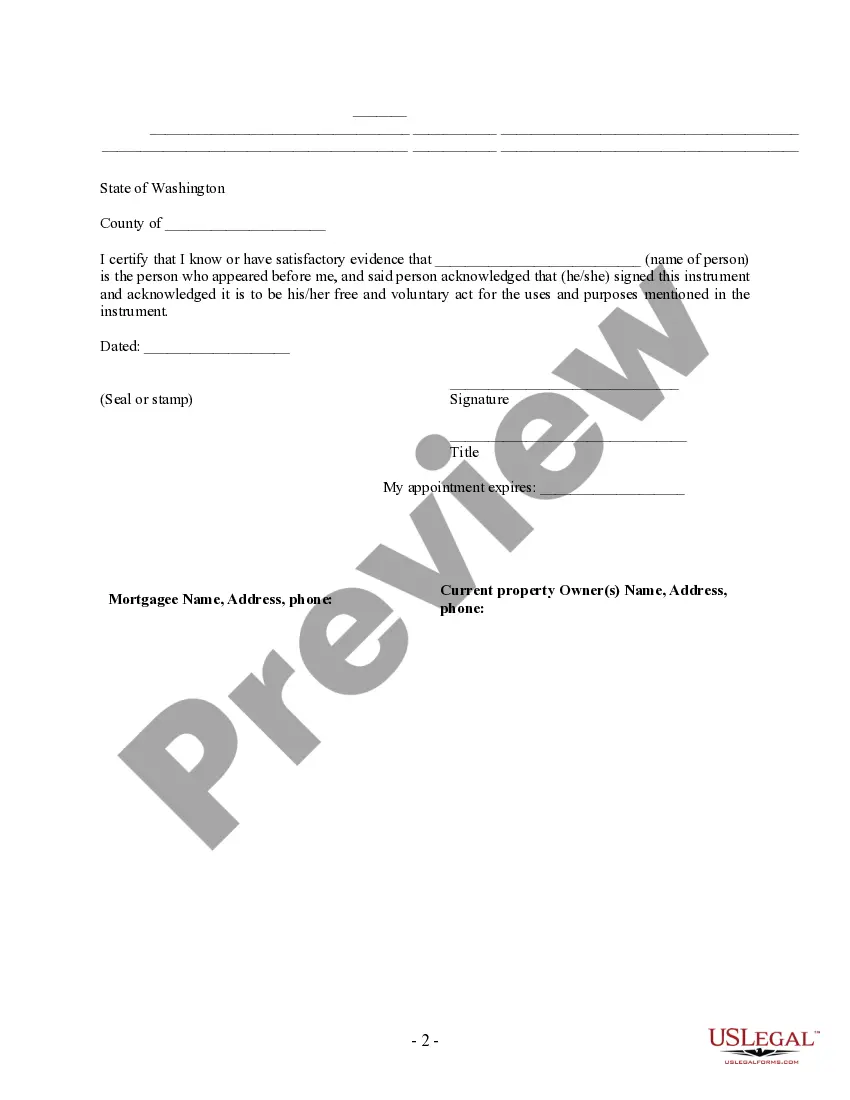

This form is for the satisfaction or release of a deed of trust for the state of Washington by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Seattle, Washington Satisfaction, Release or Cancellation of Deed of Trust by Individual: A Comprehensive Guide If you are a property owner in Seattle, Washington, and have recently paid off your mortgage or secured loan, you may need to undergo the process of Satisfaction, Release, or Cancellation of Deed of Trust. This process involves legally terminating the Deed of Trust, which is a legal document that serves as security for a loan against your property. This comprehensive guide will provide you with all the essential information you need to know regarding this process, including relevant keywords such as Satisfaction, Release, Cancellation, Deed of Trust, and Seattle, Washington. 1. Definition: Satisfaction, Release, or Cancellation of Deed of Trust refers to the legal procedure through which an individual (property owner) or their representative terminates a Deed of Trust once the underlying loan has been satisfied or paid off in full. This process releases the property from the encumbrance of the Deed of Trust, ensuring that the owner has full ownership rights and eliminating any legal claims on the property. 2. Importance: It is crucial to go through the proper Satisfaction, Release, or Cancellation of Deed of Trust process to clear any potential clouds on your property's title. Without completing this process, future title searches or property transactions may encounter complications, leading to delays or even legal disputes. By ensuring the release of the Deed of Trust, property owners can establish a clean and undisputed ownership record. 3. Parties Involved: a. Property Owner: The individual who has paid off the loan secured by the Deed of Trust. b. Lender: The financial institution or person who held the Deed of Trust as security for the loan. c. Trustee: The neutral third-party responsible for overseeing the Deed of Trust and its release or cancellation. 4. Types of Satisfaction, Release, or Cancellation of Deed of Trust: a. Full Satisfaction: When the property owner has fully paid off the mortgage or loan, they can request a Full Satisfaction of Deed of Trust. This releases the property from all encumbrances, and any claim or lien related to the debt is removed. b. Partial Satisfaction or Release: In some cases, property owners might pay off a portion of the loan rather than the entire amount. In such cases, they can seek a Partial Satisfaction or Release of Deed of Trust, which removes the lien related to the paid-off portion, while the remaining lien continues to exist. c. Release or Cancellation by Trustee: In situations where the lender fails to initiate the Satisfaction process within a specific period after the loan is paid off, the property owner can request the trustee to initiate the release or cancellation and obtain a Release or Cancellation of Deed of Trust by Trustee. In conclusion, Seattle, Washington Satisfaction, Release, or Cancellation of Deed of Trust by Individual involves legally terminating the Deed of Trust to ensure a clear title for the property owner. Whether it's Full or Partial Satisfaction or Release, or Cancellation by Trustee, undertaking this process diligently is essential to establish undisturbed ownership rights over your property.Seattle, Washington Satisfaction, Release or Cancellation of Deed of Trust by Individual: A Comprehensive Guide If you are a property owner in Seattle, Washington, and have recently paid off your mortgage or secured loan, you may need to undergo the process of Satisfaction, Release, or Cancellation of Deed of Trust. This process involves legally terminating the Deed of Trust, which is a legal document that serves as security for a loan against your property. This comprehensive guide will provide you with all the essential information you need to know regarding this process, including relevant keywords such as Satisfaction, Release, Cancellation, Deed of Trust, and Seattle, Washington. 1. Definition: Satisfaction, Release, or Cancellation of Deed of Trust refers to the legal procedure through which an individual (property owner) or their representative terminates a Deed of Trust once the underlying loan has been satisfied or paid off in full. This process releases the property from the encumbrance of the Deed of Trust, ensuring that the owner has full ownership rights and eliminating any legal claims on the property. 2. Importance: It is crucial to go through the proper Satisfaction, Release, or Cancellation of Deed of Trust process to clear any potential clouds on your property's title. Without completing this process, future title searches or property transactions may encounter complications, leading to delays or even legal disputes. By ensuring the release of the Deed of Trust, property owners can establish a clean and undisputed ownership record. 3. Parties Involved: a. Property Owner: The individual who has paid off the loan secured by the Deed of Trust. b. Lender: The financial institution or person who held the Deed of Trust as security for the loan. c. Trustee: The neutral third-party responsible for overseeing the Deed of Trust and its release or cancellation. 4. Types of Satisfaction, Release, or Cancellation of Deed of Trust: a. Full Satisfaction: When the property owner has fully paid off the mortgage or loan, they can request a Full Satisfaction of Deed of Trust. This releases the property from all encumbrances, and any claim or lien related to the debt is removed. b. Partial Satisfaction or Release: In some cases, property owners might pay off a portion of the loan rather than the entire amount. In such cases, they can seek a Partial Satisfaction or Release of Deed of Trust, which removes the lien related to the paid-off portion, while the remaining lien continues to exist. c. Release or Cancellation by Trustee: In situations where the lender fails to initiate the Satisfaction process within a specific period after the loan is paid off, the property owner can request the trustee to initiate the release or cancellation and obtain a Release or Cancellation of Deed of Trust by Trustee. In conclusion, Seattle, Washington Satisfaction, Release, or Cancellation of Deed of Trust by Individual involves legally terminating the Deed of Trust to ensure a clear title for the property owner. Whether it's Full or Partial Satisfaction or Release, or Cancellation by Trustee, undertaking this process diligently is essential to establish undisturbed ownership rights over your property.