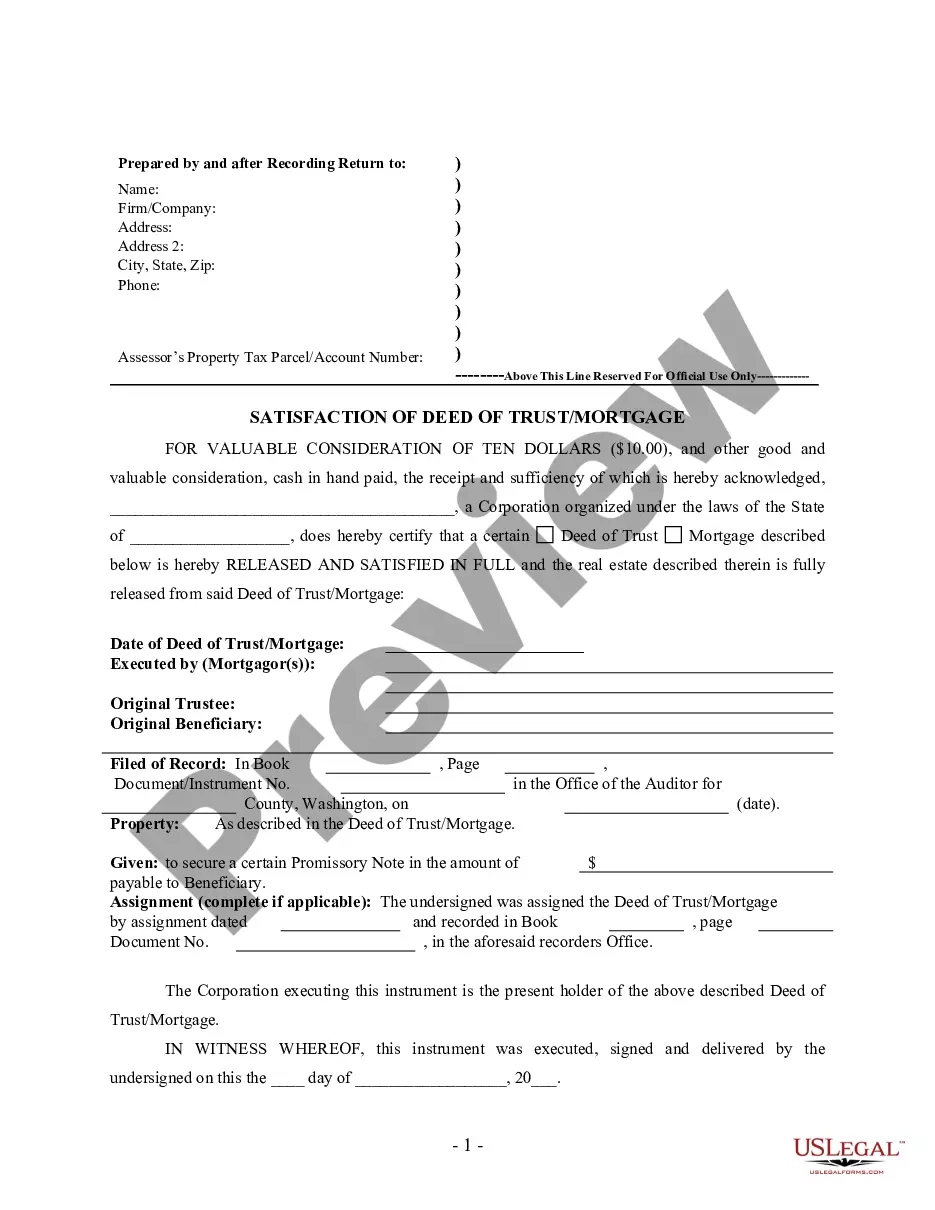

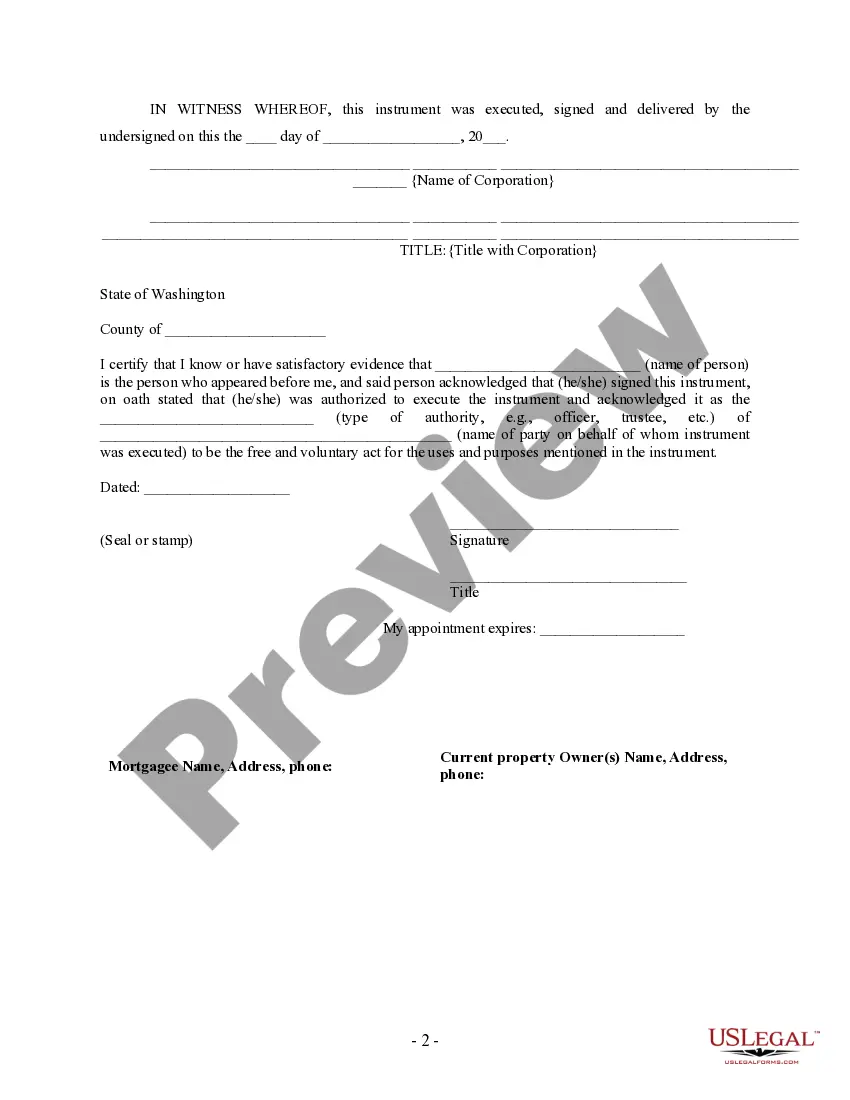

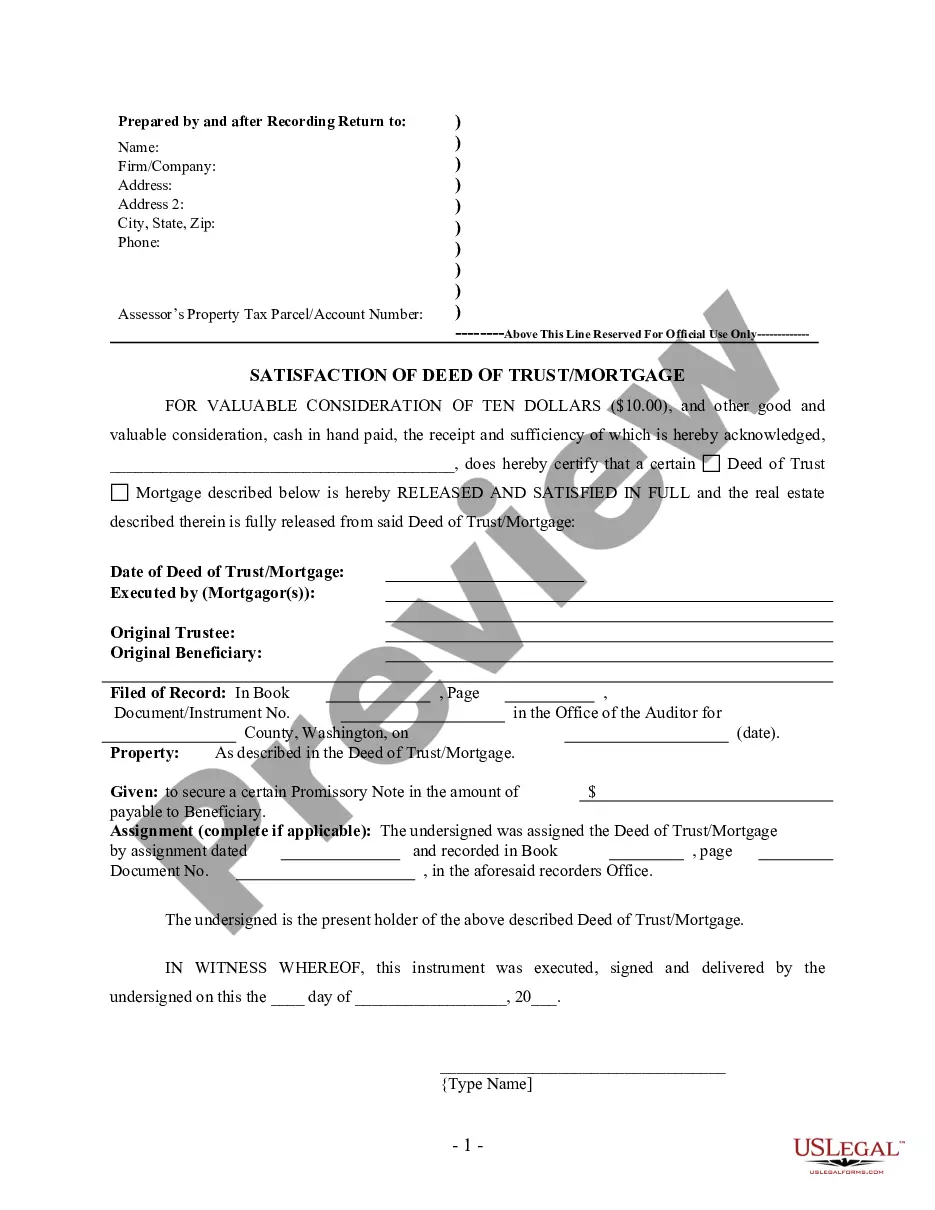

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Washington by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Everett Washington Satisfaction, Release or Cancellation of Deed of Trust by Corporation In Everett, Washington, the process of satisfaction, release, or cancellation of a deed of trust by a corporation is a crucial legal procedure when it comes to real estate transactions. A deed of trust is a document that secures a loan or mortgage on a property, acting as a legal instrument that outlines the terms and conditions of the agreement between a borrower and a lender. When a corporation has successfully paid off its debt obligation, it is important to initiate the satisfaction, release, or cancellation of the deed of trust to ensure the title to the property is clear and marketable for future transactions. Failure to properly handle this process can result in complications or potential disputes. There are generally two types of situations that may arise in Everett, Washington when dealing with the satisfaction, release, or cancellation of a deed of trust by a corporation: 1. Full Satisfaction or Release: This occurs when the corporation has fully repaid the loan or mortgage amount in accordance with the terms of the deed of trust. The corporation must then take steps to request a satisfaction or release of the deed of trust. This process may involve submitting relevant documentation to the appropriate parties, such as the lender or mortgagee, for the release of the deed of trust. The timing and specific requirements may vary, but the purpose remains the same — to evidence that the corporation's obligations have been met, allowing for the release of the encumbrance on the property. 2. Cancellation of Deed of Trust: In some cases, a corporation may need to cancel a deed of trust for reasons unrelated to full repayment, such as errors, defects, or changes in circumstances. This can be achieved by filing a cancellation of the deed of trust in the appropriate county records office, typically within the county in which the property is located. The corporation must provide valid reasons for cancellation and comply with the relevant legal procedures to ensure the cancellation is properly recognized and recorded. It is important to note that the specific requirements and procedures for the satisfaction, release, or cancellation of a deed of trust by a corporation in Everett, Washington may be subject to local laws, guidelines, and the terms specified in the original deed of trust agreement. It is advisable to seek legal advice or consult with professionals experienced in real estate law to navigate the process effectively. In conclusion, whether a corporation in Everett, Washington seeks satisfaction, release, or cancellation of a deed of trust, it is crucial to follow the appropriate legal procedures and fulfill any requirements outlined in the original agreement or local regulations. Proper completion of this process ensures a clear and marketable title to the property, facilitating smooth real estate transactions and avoiding potential conflicts.Everett Washington Satisfaction, Release or Cancellation of Deed of Trust by Corporation In Everett, Washington, the process of satisfaction, release, or cancellation of a deed of trust by a corporation is a crucial legal procedure when it comes to real estate transactions. A deed of trust is a document that secures a loan or mortgage on a property, acting as a legal instrument that outlines the terms and conditions of the agreement between a borrower and a lender. When a corporation has successfully paid off its debt obligation, it is important to initiate the satisfaction, release, or cancellation of the deed of trust to ensure the title to the property is clear and marketable for future transactions. Failure to properly handle this process can result in complications or potential disputes. There are generally two types of situations that may arise in Everett, Washington when dealing with the satisfaction, release, or cancellation of a deed of trust by a corporation: 1. Full Satisfaction or Release: This occurs when the corporation has fully repaid the loan or mortgage amount in accordance with the terms of the deed of trust. The corporation must then take steps to request a satisfaction or release of the deed of trust. This process may involve submitting relevant documentation to the appropriate parties, such as the lender or mortgagee, for the release of the deed of trust. The timing and specific requirements may vary, but the purpose remains the same — to evidence that the corporation's obligations have been met, allowing for the release of the encumbrance on the property. 2. Cancellation of Deed of Trust: In some cases, a corporation may need to cancel a deed of trust for reasons unrelated to full repayment, such as errors, defects, or changes in circumstances. This can be achieved by filing a cancellation of the deed of trust in the appropriate county records office, typically within the county in which the property is located. The corporation must provide valid reasons for cancellation and comply with the relevant legal procedures to ensure the cancellation is properly recognized and recorded. It is important to note that the specific requirements and procedures for the satisfaction, release, or cancellation of a deed of trust by a corporation in Everett, Washington may be subject to local laws, guidelines, and the terms specified in the original deed of trust agreement. It is advisable to seek legal advice or consult with professionals experienced in real estate law to navigate the process effectively. In conclusion, whether a corporation in Everett, Washington seeks satisfaction, release, or cancellation of a deed of trust, it is crucial to follow the appropriate legal procedures and fulfill any requirements outlined in the original agreement or local regulations. Proper completion of this process ensures a clear and marketable title to the property, facilitating smooth real estate transactions and avoiding potential conflicts.