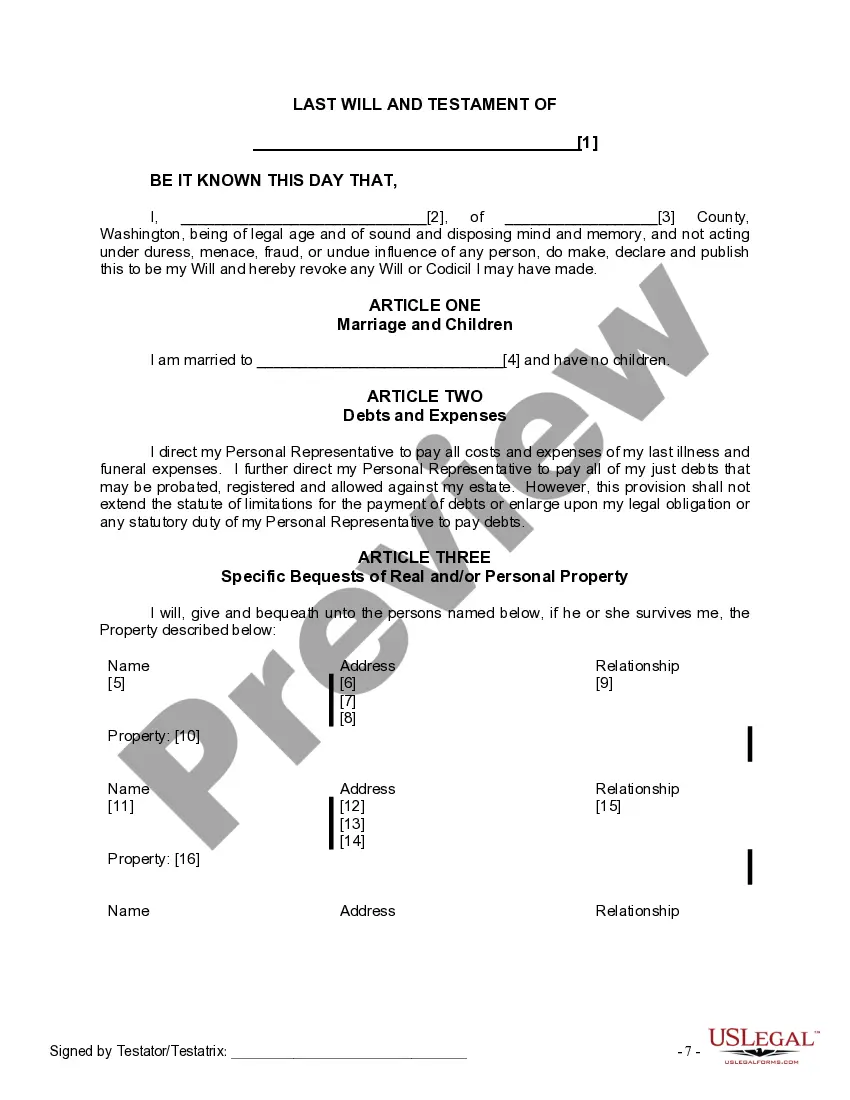

The Mutual Wills package with Last Wills and Testaments you have found is for a married couple with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse. This package contains two wills, one for each spouse. It also includes instructions.

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills.

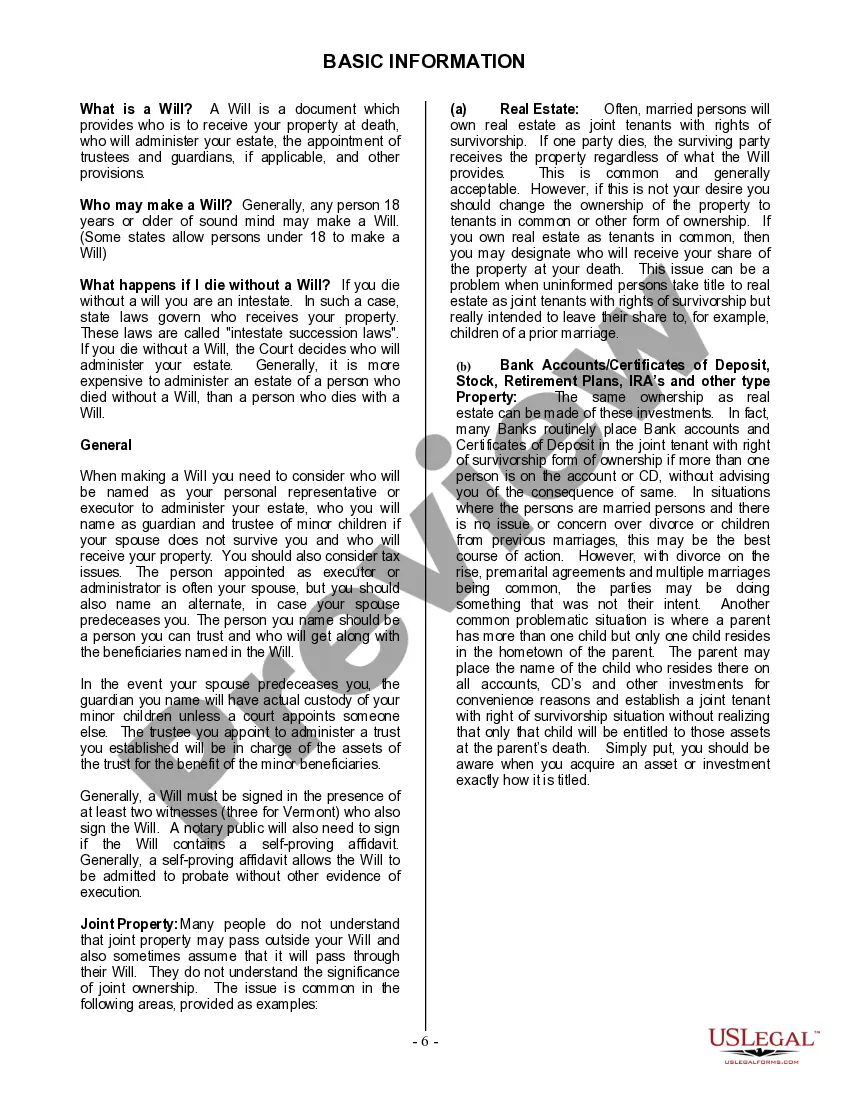

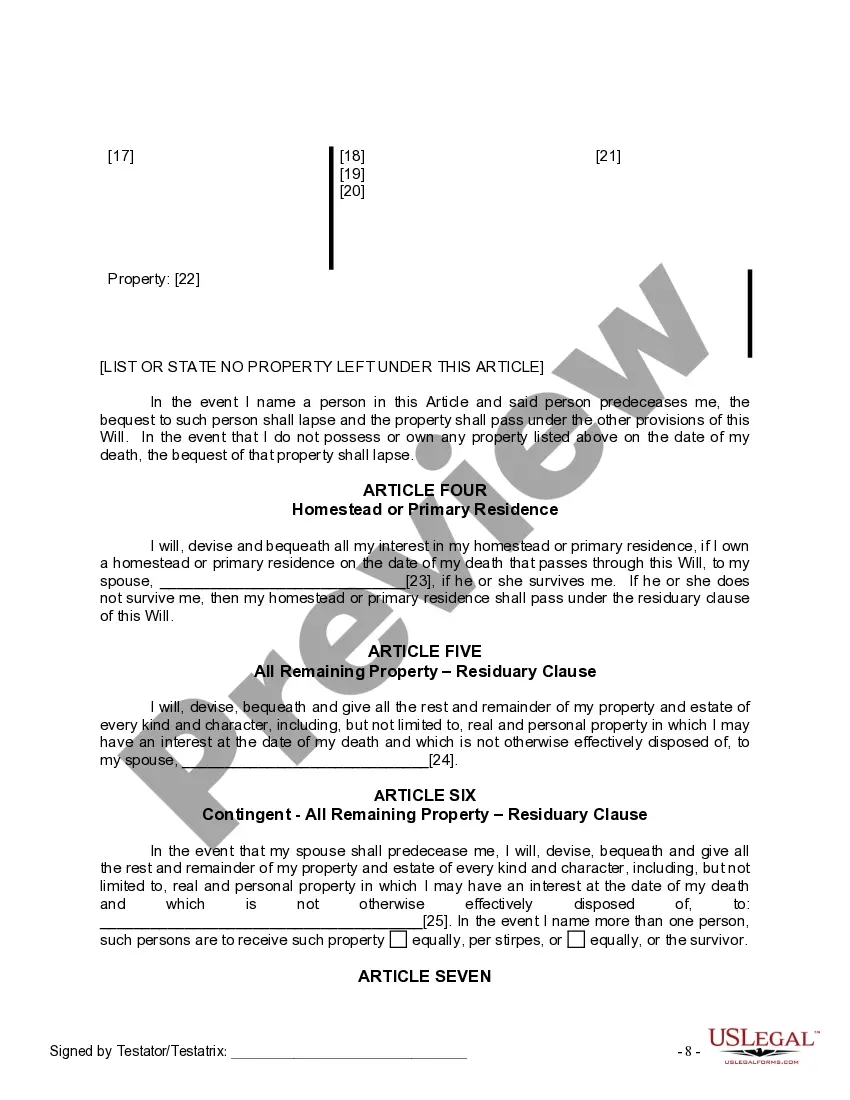

Spokane Valley Washington Mutual Wills package with Last Wills and Testaments for Married Couple with No Children is a comprehensive legal solution designed to protect the assets and interests of married couples in the absence of children. This package includes a set of legally binding documents that dictate how the estate will be managed and distributed after the death of either spouse. The primary purpose of a Last Will and Testament is to ensure that your final wishes are carried out and that your loved ones are taken care of after your passing. In the case of married couples with no children, it becomes all the more important to establish a clear plan for the distribution of assets and the appointment of executors without the presence of direct heirs. The Spokane Valley Washington Mutual Wills package for Married Couples with No Children may include the following key elements: 1. Last Will and Testament: This document outlines how your assets, such as property, investments, and personal belongings will be distributed among your chosen beneficiaries, typically including your spouse, family members, or charitable organizations. 2. Executor Designation: You can name an executor in your Last Will and Testament, who will be responsible for managing your estate, settling outstanding debts, and ensuring the proper distribution of assets according to your wishes. 3. Appointment of Alternate Beneficiaries: In the event that your spouse predeceases you or both of you pass away simultaneously, this provision allows you to designate alternative beneficiaries to inherit your assets. 4. Power of Attorney: This document grants authority to a trusted individual, known as the attorney-in-fact, to make important financial and legal decisions on your behalf if you become incapacitated or unable to manage your own affairs. 5. Healthcare Directive or Living Will: This legal instrument outlines your preferences for medical treatment and end-of-life care, ensuring that your wishes are respected and that difficult decisions regarding life-sustaining treatments are addressed. The Spokane Valley Washington Mutual Wills package may offer additional customization options, including provisions for specific bequests, trust creation, or business succession planning. It is always recommended consulting with an experienced estate planning attorney to assess your individual needs and choose the package that best suits your situation. Other potential variations of Spokane Valley Washington Mutual Wills package for Married Couples with No Children may include specific features catering to unique circumstances, such as blended families, high net worth estates, or individuals with complex healthcare requirements. These variations are designed to provide a tailored estate planning solution that aligns with the specific needs and concerns of each couple.Spokane Valley Washington Mutual Wills package with Last Wills and Testaments for Married Couple with No Children is a comprehensive legal solution designed to protect the assets and interests of married couples in the absence of children. This package includes a set of legally binding documents that dictate how the estate will be managed and distributed after the death of either spouse. The primary purpose of a Last Will and Testament is to ensure that your final wishes are carried out and that your loved ones are taken care of after your passing. In the case of married couples with no children, it becomes all the more important to establish a clear plan for the distribution of assets and the appointment of executors without the presence of direct heirs. The Spokane Valley Washington Mutual Wills package for Married Couples with No Children may include the following key elements: 1. Last Will and Testament: This document outlines how your assets, such as property, investments, and personal belongings will be distributed among your chosen beneficiaries, typically including your spouse, family members, or charitable organizations. 2. Executor Designation: You can name an executor in your Last Will and Testament, who will be responsible for managing your estate, settling outstanding debts, and ensuring the proper distribution of assets according to your wishes. 3. Appointment of Alternate Beneficiaries: In the event that your spouse predeceases you or both of you pass away simultaneously, this provision allows you to designate alternative beneficiaries to inherit your assets. 4. Power of Attorney: This document grants authority to a trusted individual, known as the attorney-in-fact, to make important financial and legal decisions on your behalf if you become incapacitated or unable to manage your own affairs. 5. Healthcare Directive or Living Will: This legal instrument outlines your preferences for medical treatment and end-of-life care, ensuring that your wishes are respected and that difficult decisions regarding life-sustaining treatments are addressed. The Spokane Valley Washington Mutual Wills package may offer additional customization options, including provisions for specific bequests, trust creation, or business succession planning. It is always recommended consulting with an experienced estate planning attorney to assess your individual needs and choose the package that best suits your situation. Other potential variations of Spokane Valley Washington Mutual Wills package for Married Couples with No Children may include specific features catering to unique circumstances, such as blended families, high net worth estates, or individuals with complex healthcare requirements. These variations are designed to provide a tailored estate planning solution that aligns with the specific needs and concerns of each couple.