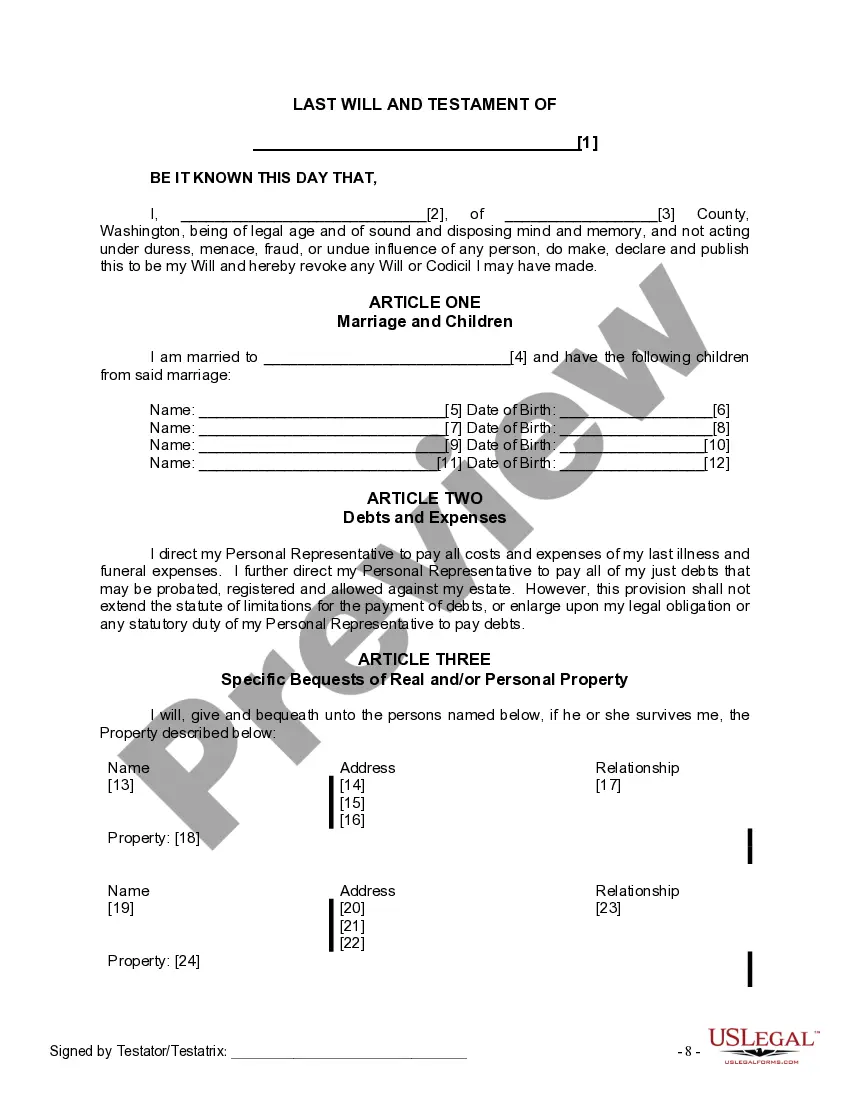

The Will you have found is for a married person with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse and children. It also establishes a trust and provides for the appointment of a trustee for the estate of the minor children.

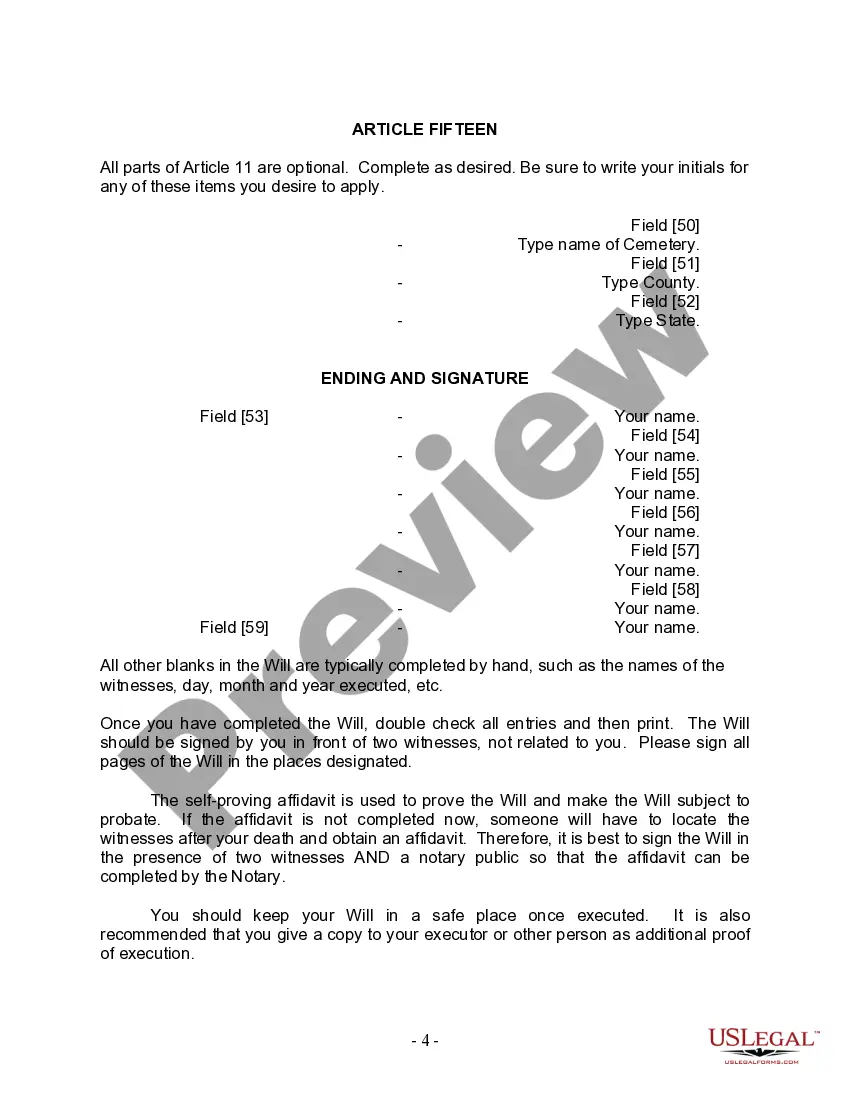

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

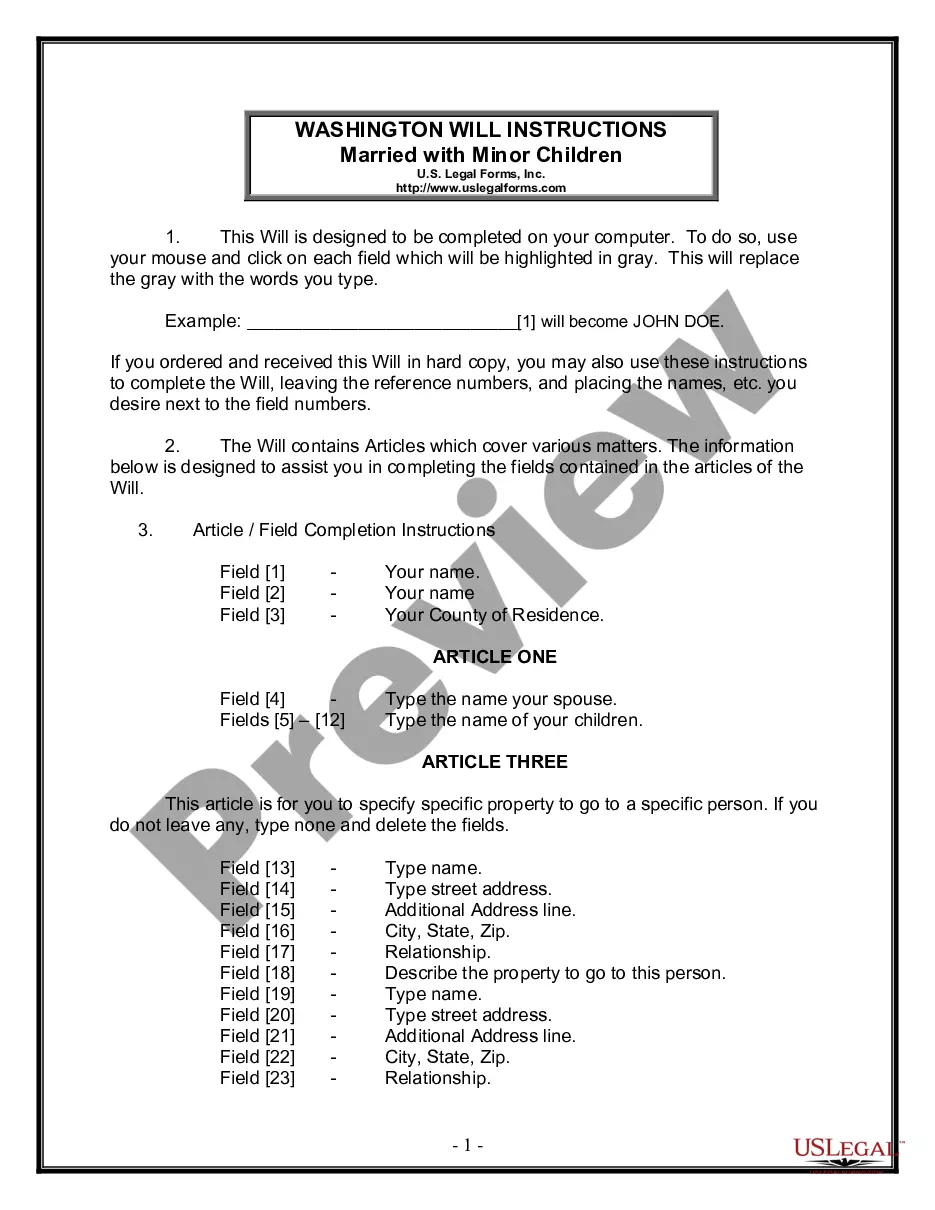

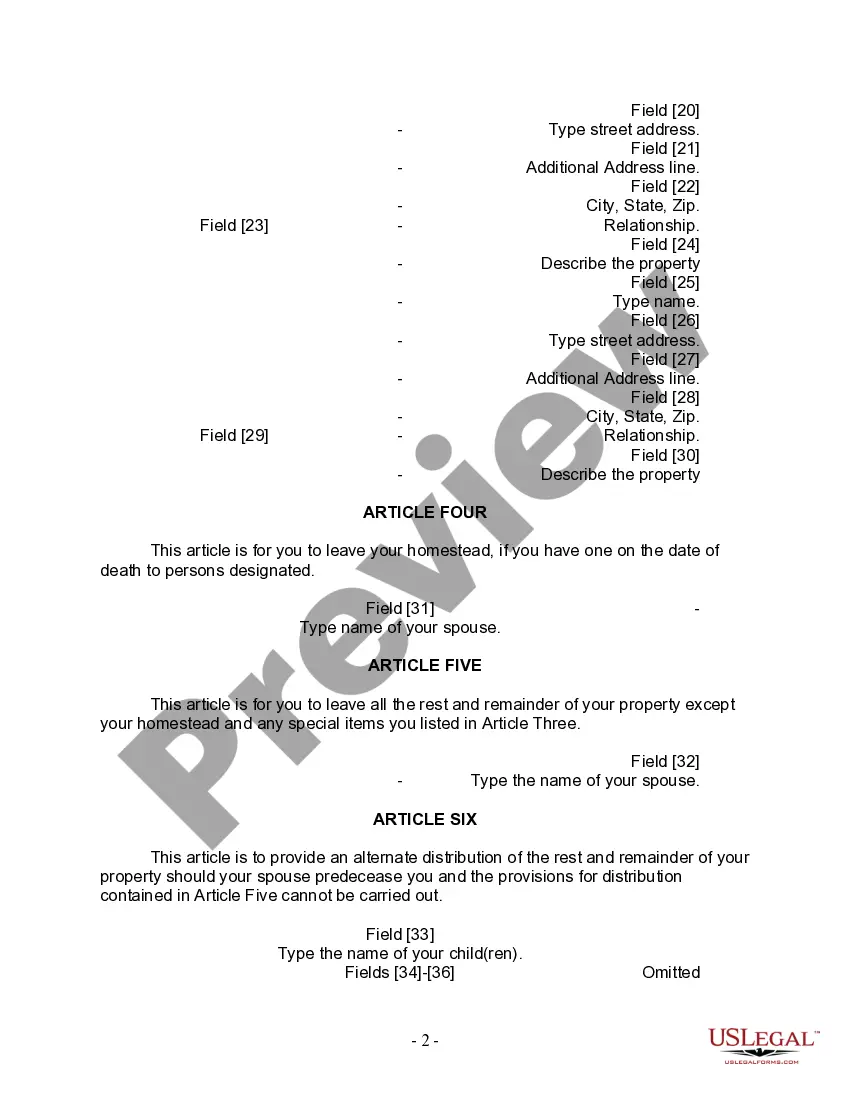

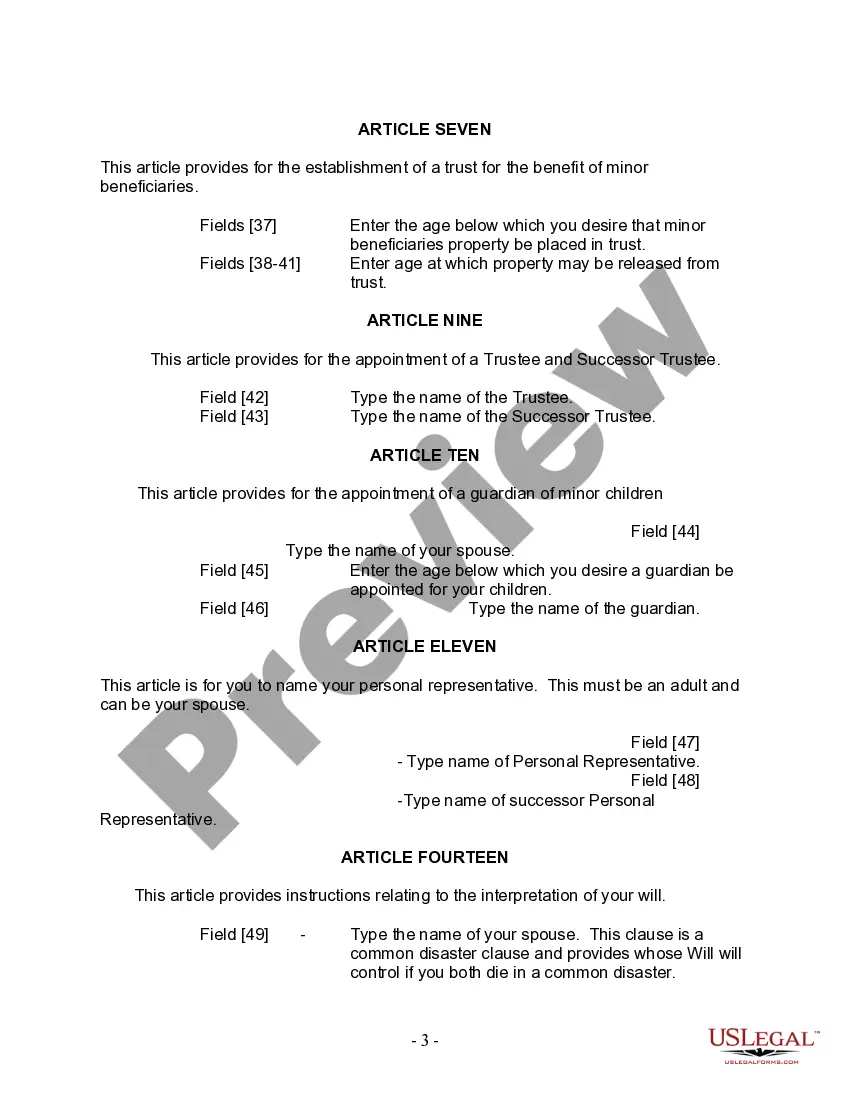

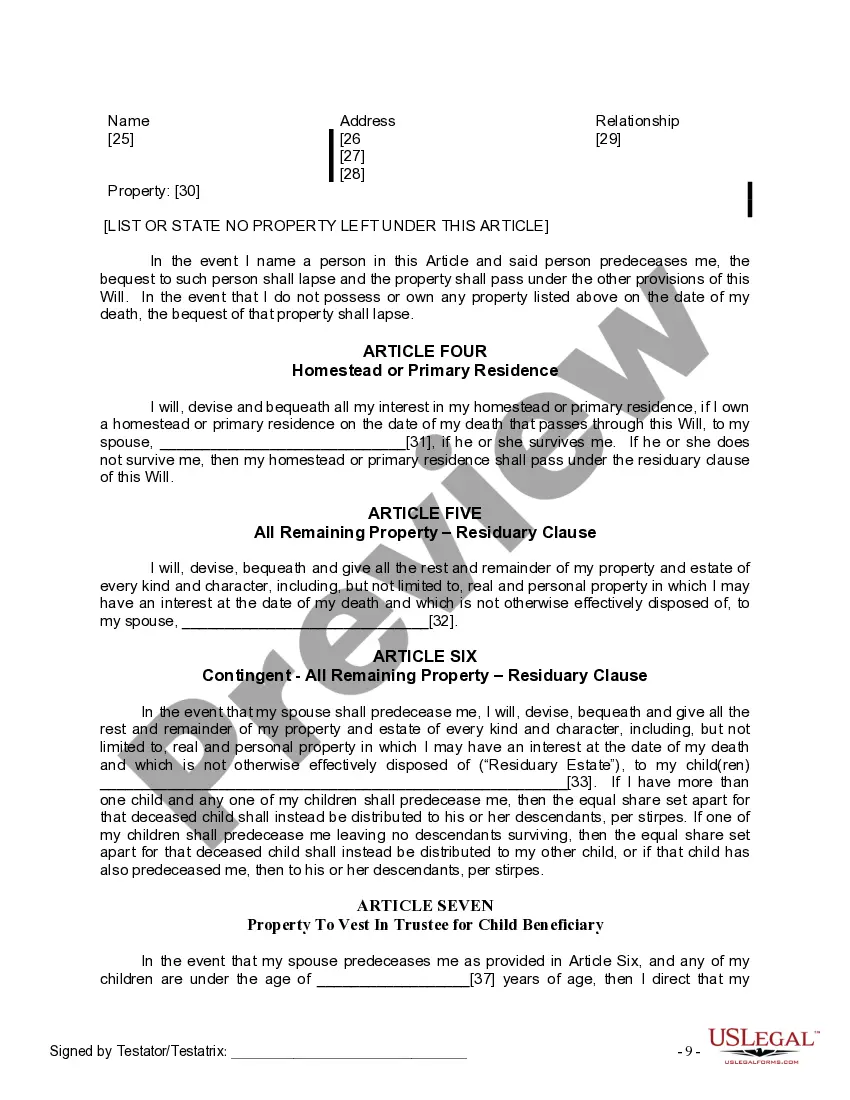

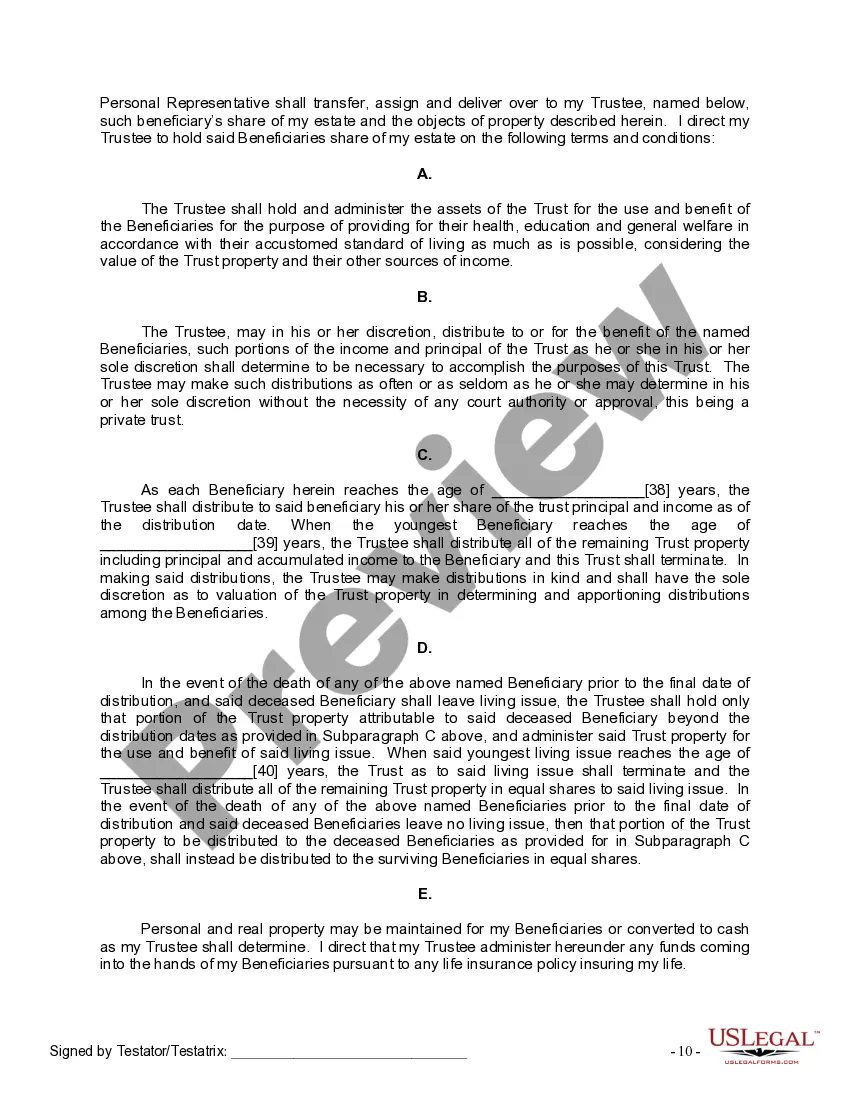

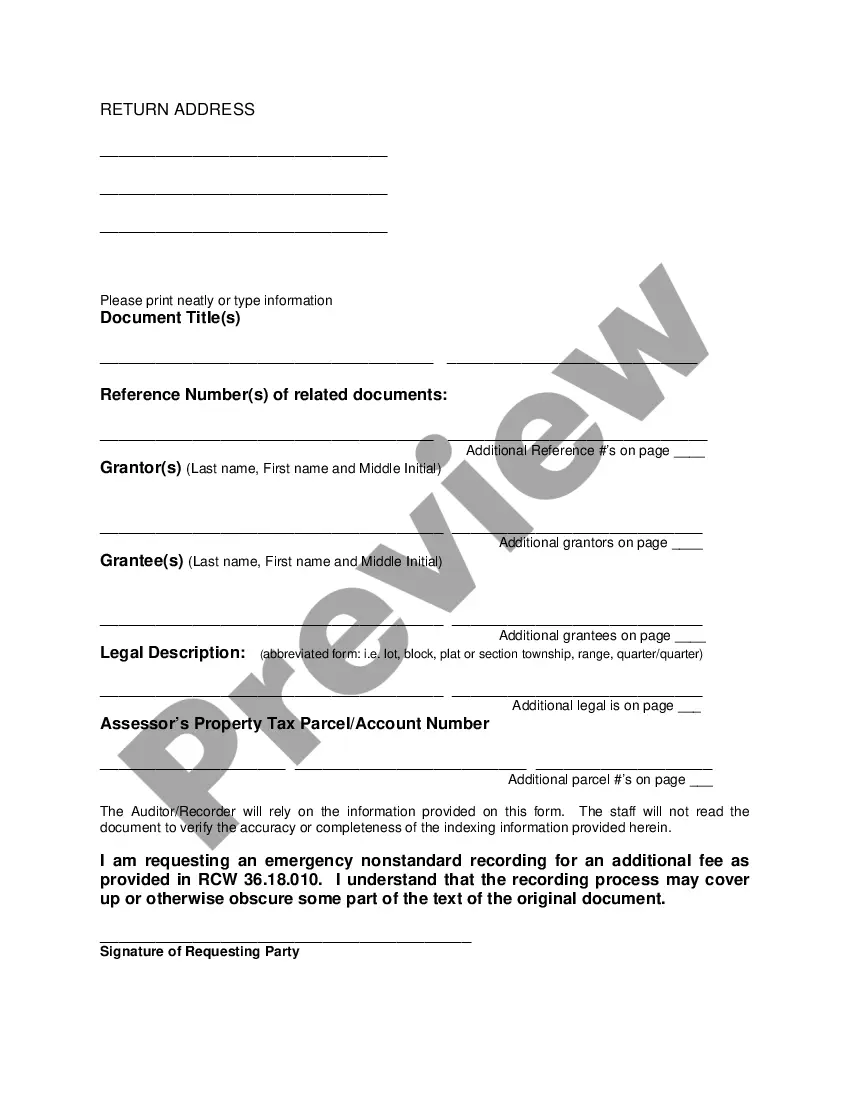

Seattle Washington Legal Last Will and Testament Form for Married Person with Minor Children is a legally binding document that outlines the wishes and distribution of assets for a married individual who has minor children in the state of Washington. This comprehensive legal form enables individuals to ensure the proper care and distribution of their assets after their death, in accordance with their wishes. The Seattle Washington Legal Last Will and Testament Form for Married Person with Minor Children includes various sections that cover important aspects of estate planning, such as: 1. Identification of Testator: This section requires the full legal name, residential address, and contact details of the individual creating the will (referred to as the "testator"). 2. Guardianship: This section allows the testator to nominate a guardian for their minor children in the event of their death. The designated guardian will be responsible for the care, well-being, and upbringing of the children. 3. Appointment of Executor: The testator can appoint an executor who will be responsible for overseeing the distribution of assets and carrying out the instructions specified in the will. 4. Asset Distribution: This section enables the testator to specify how their assets, including financial accounts, real estate, personal belongings, and investments, should be distributed among their beneficiaries. It provides the flexibility to allocate specific assets or percentages of the estate to different individuals, taking into consideration the needs and circumstances of the minor children. 5. Trust Provisions: If desired, the testator can establish trusts for the minor children to ensure that their financial needs and education expenses are adequately covered until they reach a certain age or milestone. The will contains provisions for naming trustees responsible for administering these trusts. 6. Residual Estate: The residual estate section deals with any remaining assets or property not specifically mentioned in the will. The testator can specify how these assets should be distributed, whether among specific beneficiaries or through charitable donations. 7. Signatures and Witnesses: To ensure the legal validity of the will, it must be signed by the testator in the presence of at least two witnesses who must also sign the document. Additionally, it is advisable to have the will notarized. While there may be variations in specific details, there are generally no distinct types of Seattle Washington Legal Last Will and Testament Forms for Married Person with Minor Children. However, it is recommended to consult with an attorney or legal professional who can guide individuals through the specific nuances and requirements of estate planning in Washington State.Seattle Washington Legal Last Will and Testament Form for Married Person with Minor Children is a legally binding document that outlines the wishes and distribution of assets for a married individual who has minor children in the state of Washington. This comprehensive legal form enables individuals to ensure the proper care and distribution of their assets after their death, in accordance with their wishes. The Seattle Washington Legal Last Will and Testament Form for Married Person with Minor Children includes various sections that cover important aspects of estate planning, such as: 1. Identification of Testator: This section requires the full legal name, residential address, and contact details of the individual creating the will (referred to as the "testator"). 2. Guardianship: This section allows the testator to nominate a guardian for their minor children in the event of their death. The designated guardian will be responsible for the care, well-being, and upbringing of the children. 3. Appointment of Executor: The testator can appoint an executor who will be responsible for overseeing the distribution of assets and carrying out the instructions specified in the will. 4. Asset Distribution: This section enables the testator to specify how their assets, including financial accounts, real estate, personal belongings, and investments, should be distributed among their beneficiaries. It provides the flexibility to allocate specific assets or percentages of the estate to different individuals, taking into consideration the needs and circumstances of the minor children. 5. Trust Provisions: If desired, the testator can establish trusts for the minor children to ensure that their financial needs and education expenses are adequately covered until they reach a certain age or milestone. The will contains provisions for naming trustees responsible for administering these trusts. 6. Residual Estate: The residual estate section deals with any remaining assets or property not specifically mentioned in the will. The testator can specify how these assets should be distributed, whether among specific beneficiaries or through charitable donations. 7. Signatures and Witnesses: To ensure the legal validity of the will, it must be signed by the testator in the presence of at least two witnesses who must also sign the document. Additionally, it is advisable to have the will notarized. While there may be variations in specific details, there are generally no distinct types of Seattle Washington Legal Last Will and Testament Forms for Married Person with Minor Children. However, it is recommended to consult with an attorney or legal professional who can guide individuals through the specific nuances and requirements of estate planning in Washington State.