The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

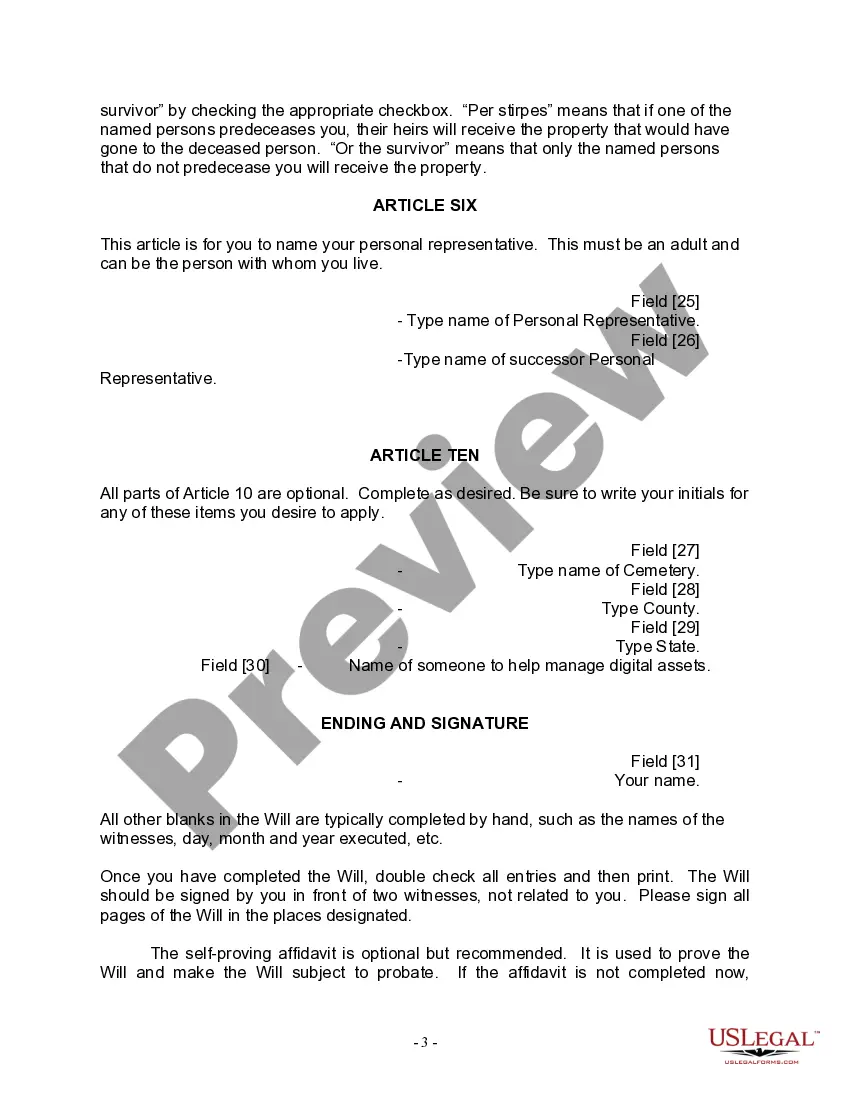

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

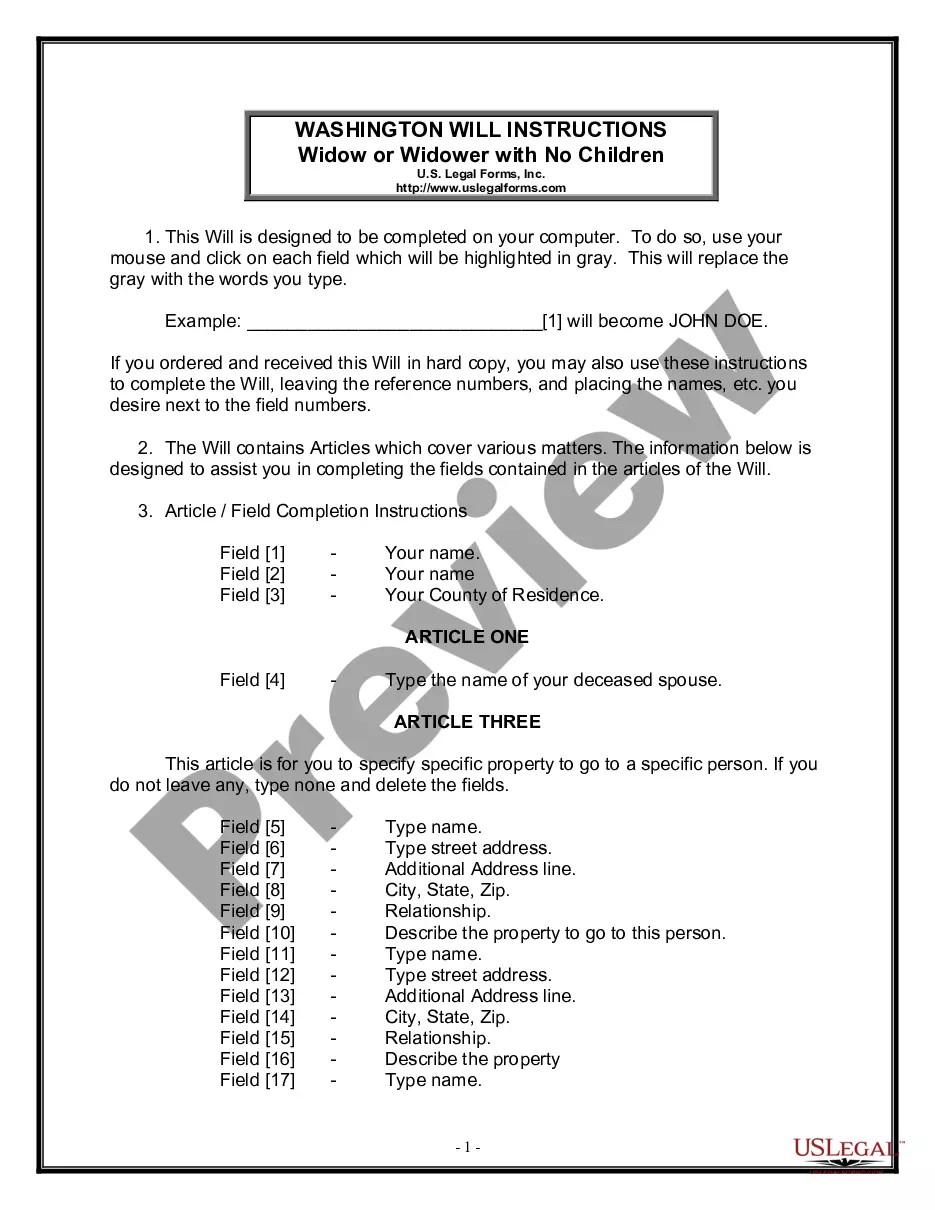

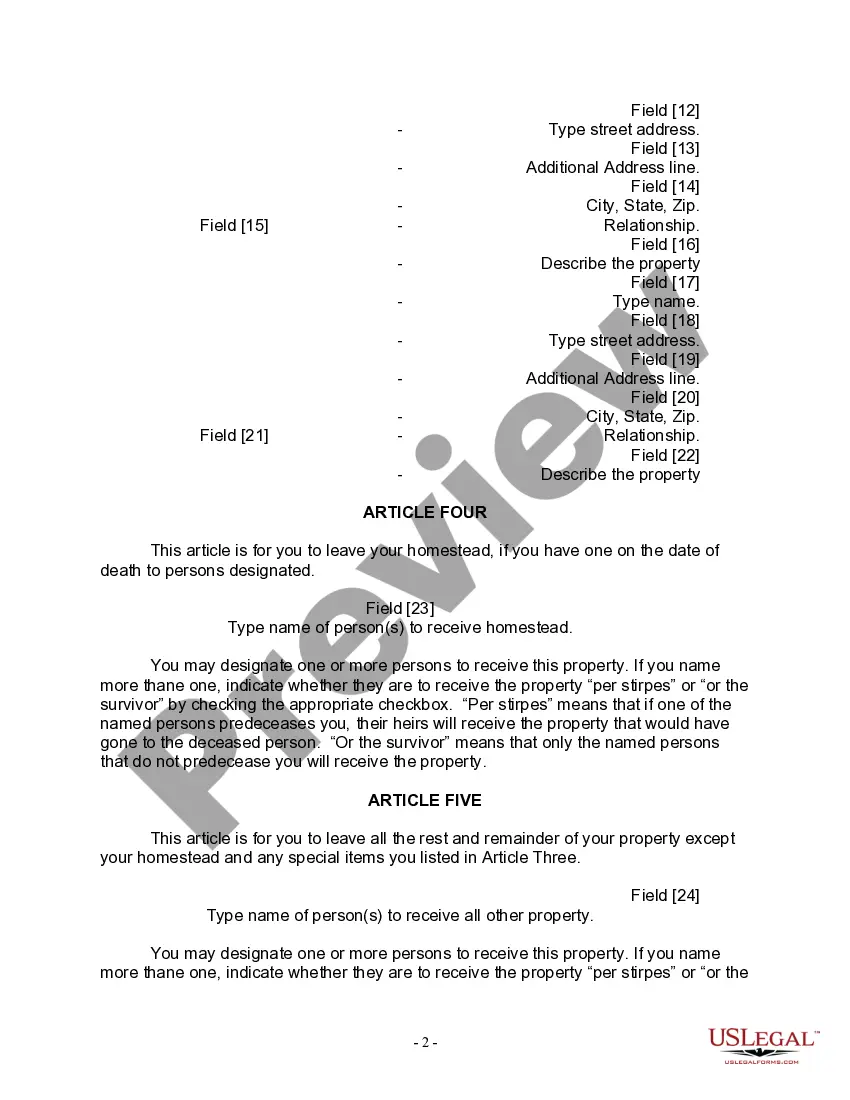

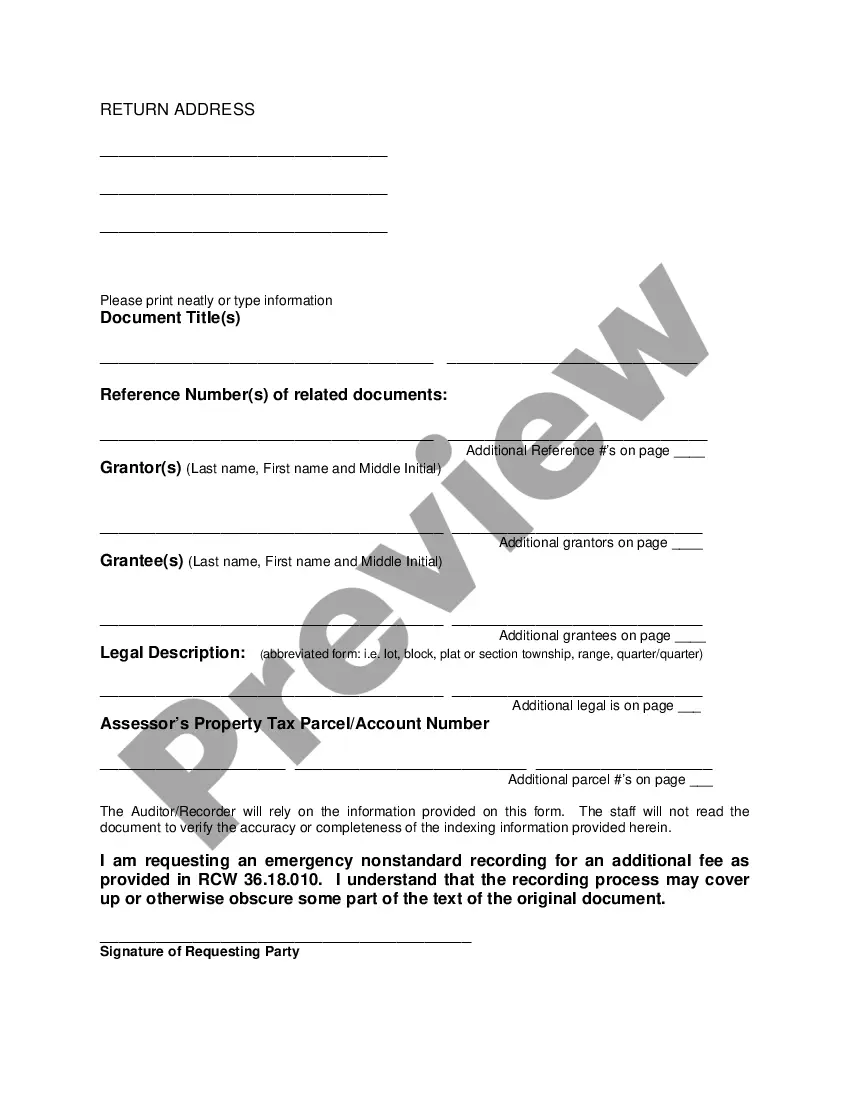

A Vancouver Washington Legal Last Will Form for a Widow or Widower with no children is a crucial legal document that allows individuals who have lost their spouse and have no children to outline their wishes regarding the distribution of their assets and the appointment of an executor to handle their estate after their passing. This document provides peace of mind to the widow or widower, ensuring their assets are allocated according to their desires. While specific legal last will forms may vary, here are a few essential elements that should be covered in such a document: 1. Introduction: The document should start with a heading such as "Last Will and Testament of [Full Name]," clearly identifying it as the individual's final will. 2. Personal Information: The widow or widower should include their full legal name, current address, and any relevant identifying details. 3. Executor Appointment: Designating an executor is crucial, as this person will carry out the deceased's wishes and handle legal matters. The will should explicitly name the chosen executor, providing their full name, address, and contact information. 4. Assets Distribution: The document should outline how the widow or widower wishes to distribute their assets to specific beneficiaries or charitable organizations. This may include details about financial accounts, real estate, personal possessions, investments, or any other assets owned. It is crucial to clearly indicate the name of each beneficiary and their relationship to the individual, as well as their share or specific asset allocation. 5. Alternate Beneficiaries: In case any of the named beneficiaries predecease the widow or widower or refuse their inheritance, it is advisable to name alternate beneficiaries who will receive the allocated assets. 6. Debts and Expenses: The will should mention if the widow or widower wants their debts, funeral expenses, and any outstanding taxes to be paid from their estate. 7. Additional Wishes and Provisions: The individual can include any additional provisions or specific instructions they want the executor to follow, such as specific funeral arrangements, charitable donations, establishing trusts, or managing digital assets. 8. Witnesses and Signatures: According to Washington state law, a last will document must be signed by the testator (widow or widower) in the presence of two competent witnesses who are not beneficiaries. The witnesses should acknowledge their signatures and affirm that the testator appeared to be of sound mind and not under any duress while signing. While there may not be different types of Vancouver Washington Legal Last Will Forms specifically tailored for widows or widowers with no children, individuals can consult legal professionals who specialize in estate planning to ensure they have the appropriate documentation and guidance during the process.A Vancouver Washington Legal Last Will Form for a Widow or Widower with no children is a crucial legal document that allows individuals who have lost their spouse and have no children to outline their wishes regarding the distribution of their assets and the appointment of an executor to handle their estate after their passing. This document provides peace of mind to the widow or widower, ensuring their assets are allocated according to their desires. While specific legal last will forms may vary, here are a few essential elements that should be covered in such a document: 1. Introduction: The document should start with a heading such as "Last Will and Testament of [Full Name]," clearly identifying it as the individual's final will. 2. Personal Information: The widow or widower should include their full legal name, current address, and any relevant identifying details. 3. Executor Appointment: Designating an executor is crucial, as this person will carry out the deceased's wishes and handle legal matters. The will should explicitly name the chosen executor, providing their full name, address, and contact information. 4. Assets Distribution: The document should outline how the widow or widower wishes to distribute their assets to specific beneficiaries or charitable organizations. This may include details about financial accounts, real estate, personal possessions, investments, or any other assets owned. It is crucial to clearly indicate the name of each beneficiary and their relationship to the individual, as well as their share or specific asset allocation. 5. Alternate Beneficiaries: In case any of the named beneficiaries predecease the widow or widower or refuse their inheritance, it is advisable to name alternate beneficiaries who will receive the allocated assets. 6. Debts and Expenses: The will should mention if the widow or widower wants their debts, funeral expenses, and any outstanding taxes to be paid from their estate. 7. Additional Wishes and Provisions: The individual can include any additional provisions or specific instructions they want the executor to follow, such as specific funeral arrangements, charitable donations, establishing trusts, or managing digital assets. 8. Witnesses and Signatures: According to Washington state law, a last will document must be signed by the testator (widow or widower) in the presence of two competent witnesses who are not beneficiaries. The witnesses should acknowledge their signatures and affirm that the testator appeared to be of sound mind and not under any duress while signing. While there may not be different types of Vancouver Washington Legal Last Will Forms specifically tailored for widows or widowers with no children, individuals can consult legal professionals who specialize in estate planning to ensure they have the appropriate documentation and guidance during the process.