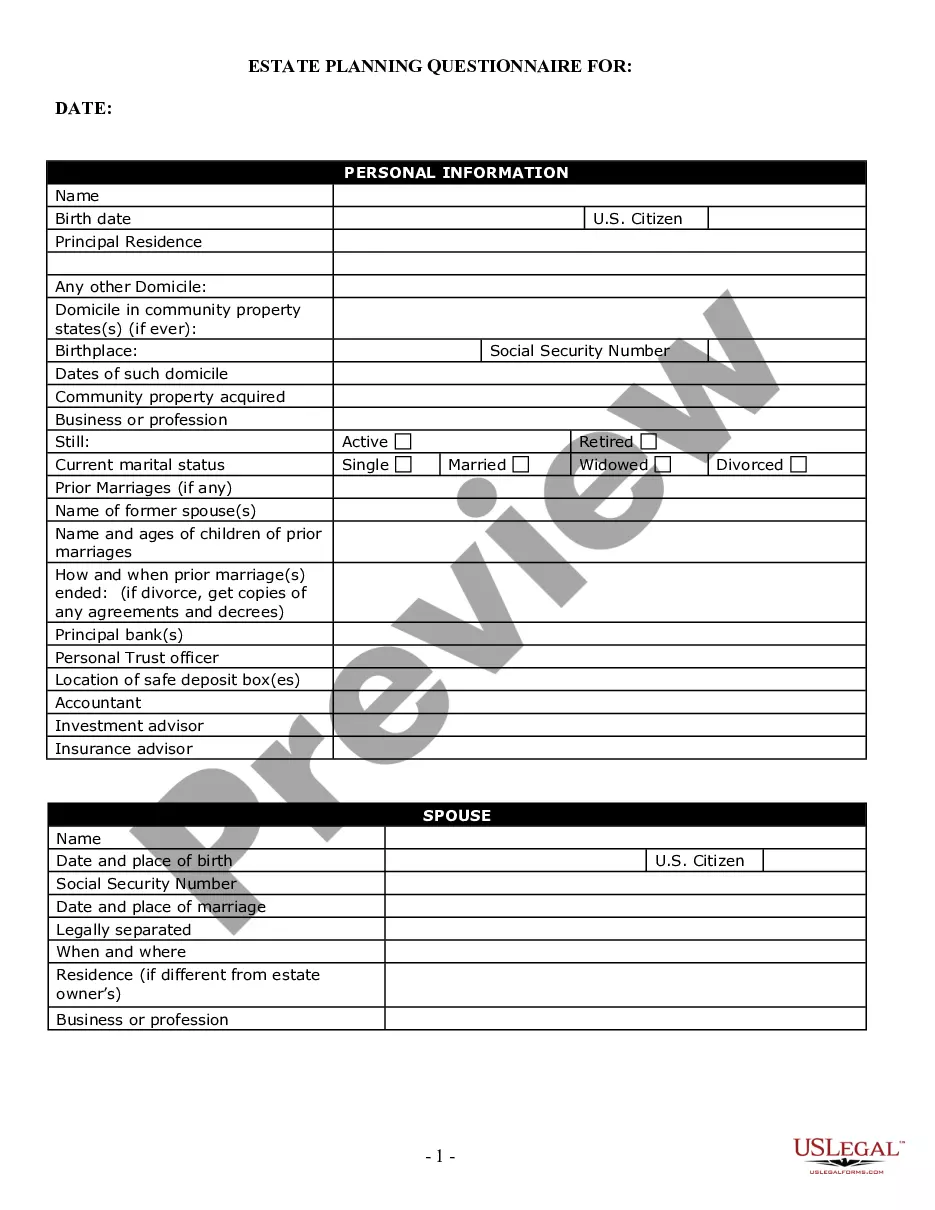

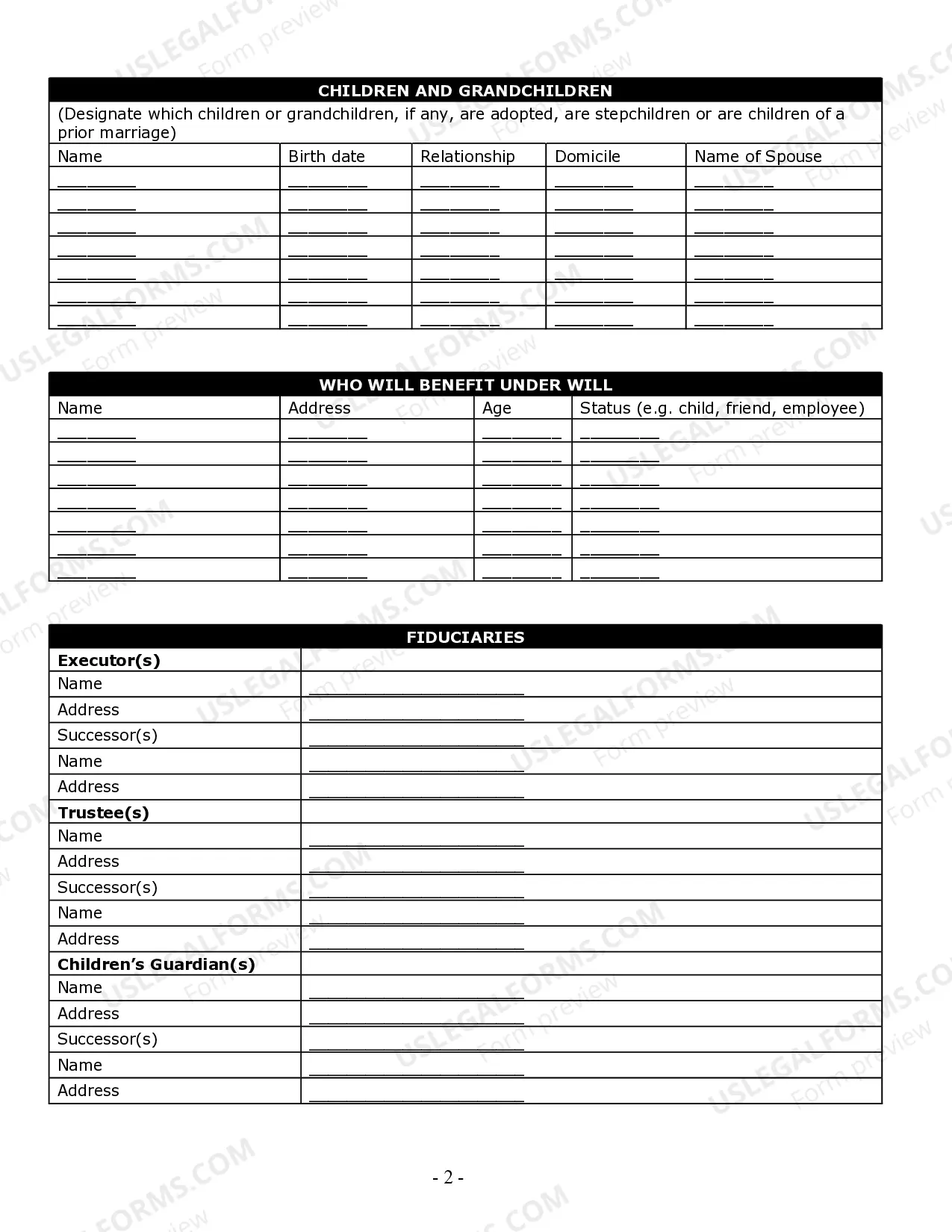

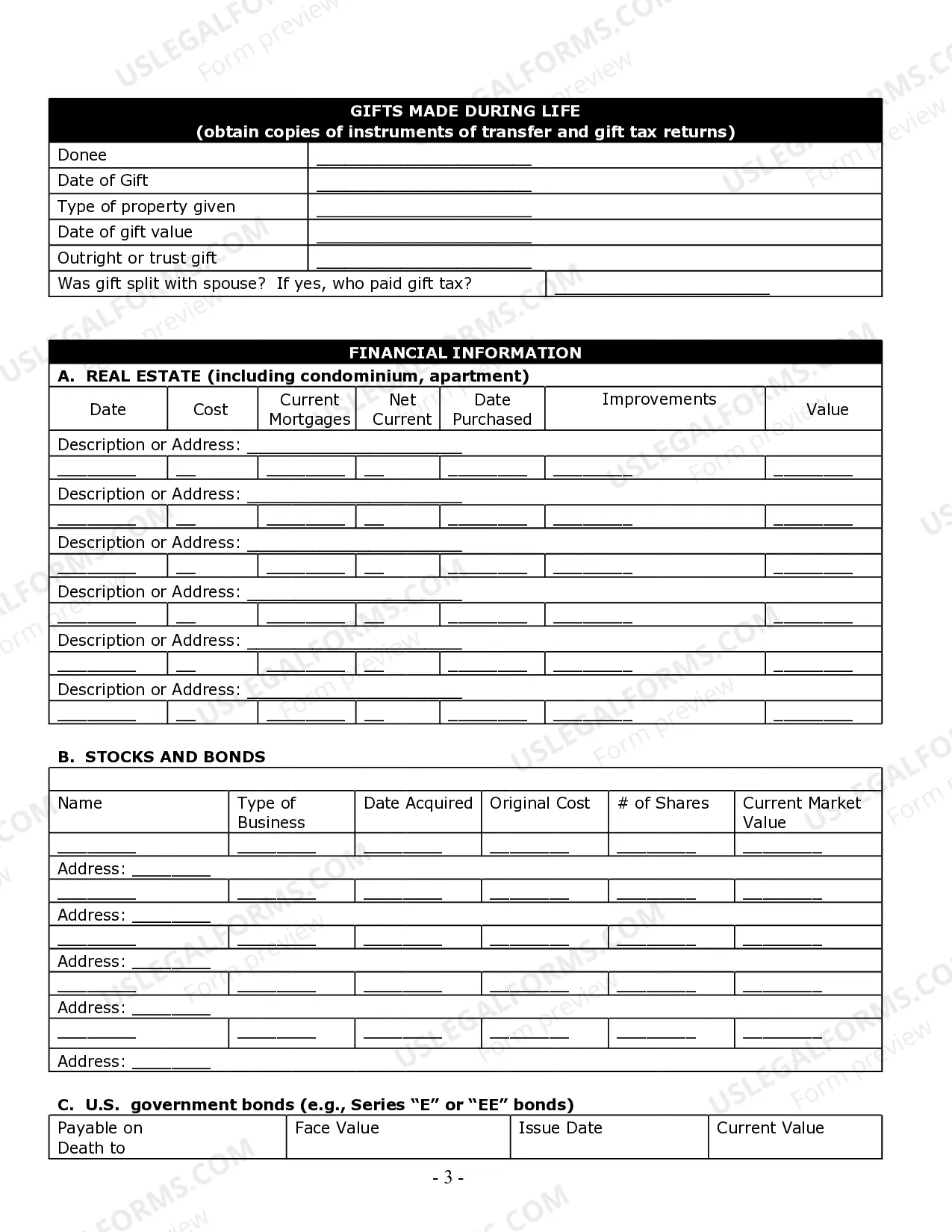

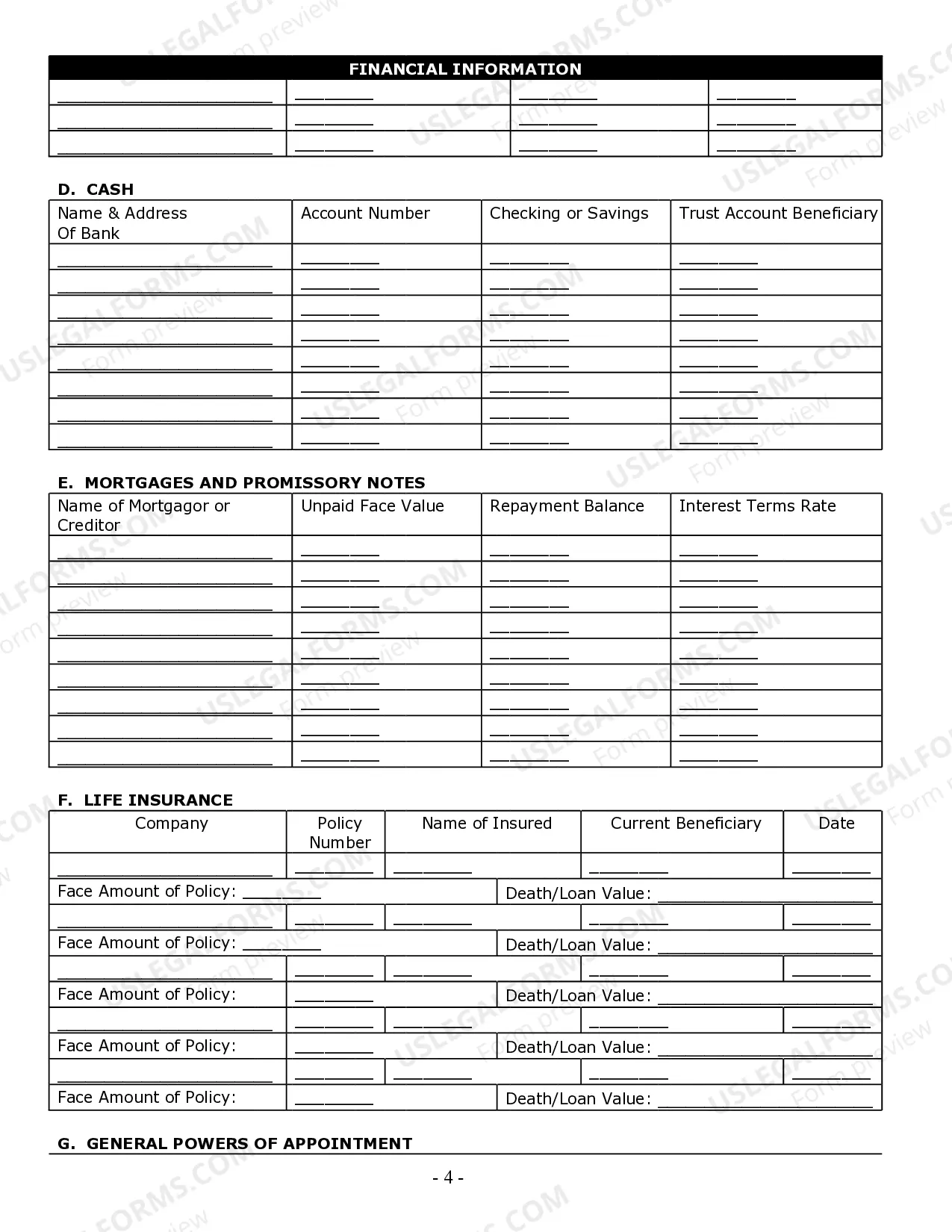

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

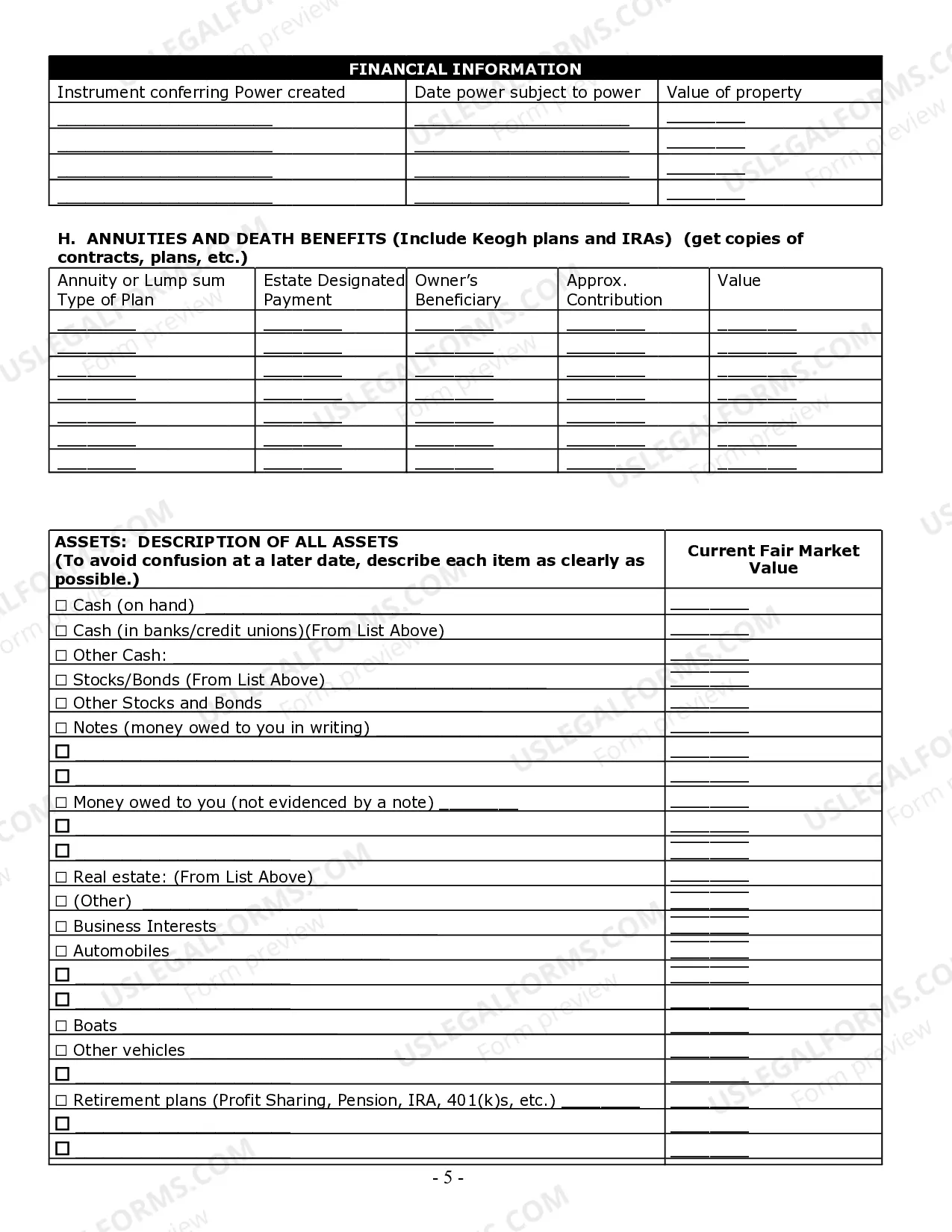

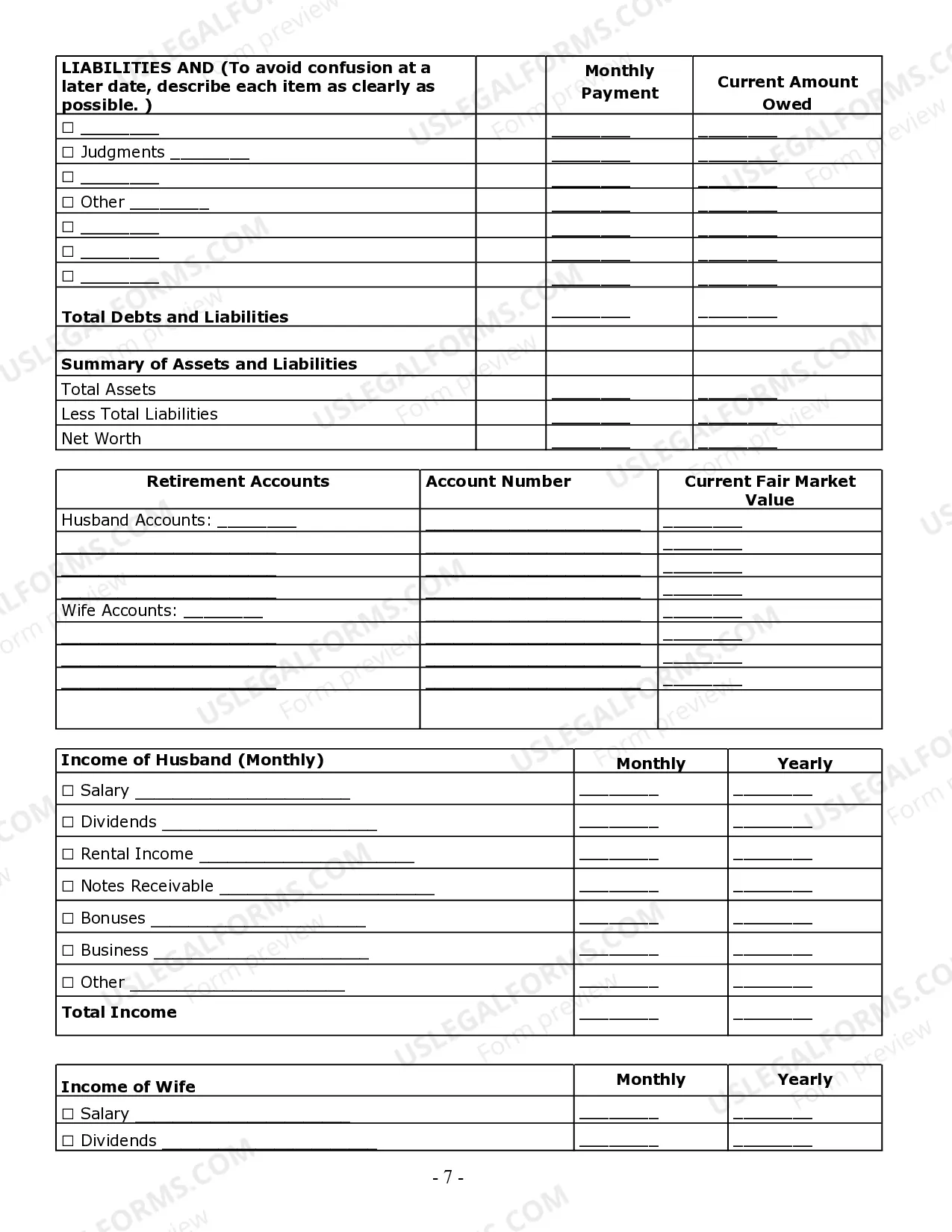

Seattle Washington Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals in organizing and documenting their estate planning requirements. These forms are widely used by estate planning attorneys or individuals seeking to plan and manage their estate effectively. The questionnaires and worksheets act as a framework for gathering necessary information and facilitating better communication with legal professionals. Below is a breakdown of the different types of Seattle Washington Estate Planning Questionnaire and Worksheets: 1. Basic Personal Information: This section collects essential details such as name, address, contact information, and marital status. It establishes a foundation for the entire estate planning process. 2. Assets and Liabilities: This category focuses on documenting an individual's assets, including real estate properties, investments, bank accounts, retirement accounts, and personal belongings. Additionally, one is required to disclose any outstanding debts or liabilities. 3. Beneficiaries and Successors: These questionnaires and worksheets guide individuals to list their preferred beneficiaries, including immediate family members and charitable organizations, should the need arise. Successor trustees and executors are also identified to ensure smooth management of the estate. 4. Healthcare and End-of-Life Planning: This section addresses critical healthcare decisions, including the appointment of healthcare proxies or medical power of attorney and the provision of specific instructions regarding end-of-life care, organ donation, and funeral arrangements. 5. Guardianship and Minor Children: If there are minor children involved, this part serves the purpose of appointing guardians or determining appropriate custody arrangements in case of parental incapacitation or demise. 6. Special Instructions and Requests: Individuals can provide specific guidance or instructions related to their estate plan, including philanthropic contributions, family heirlooms, or any other requirements they wish their legal representatives to honor. 7. Business Succession Planning: For individuals with business interests, these questionnaires delve into crucial information regarding the transfer or continuation of their business, partnerships, or investments. 8. Tax Planning: Seattle Washington Estate Planning Questionnaire and Worksheets may also incorporate sections dedicated to tax planning, covering aspects such as gift taxes, estate taxes, and strategies to minimize tax liabilities. By utilizing these Seattle Washington Estate Planning Questionnaire and Worksheets, individuals can comprehensively outline their estate planning preferences, thereby assisting legal professionals in creating personalized and tailored estate plans. These questionnaires and worksheets provide a convenient and organized approach to ensure that all elements of estate planning are thoroughly considered and attended to.