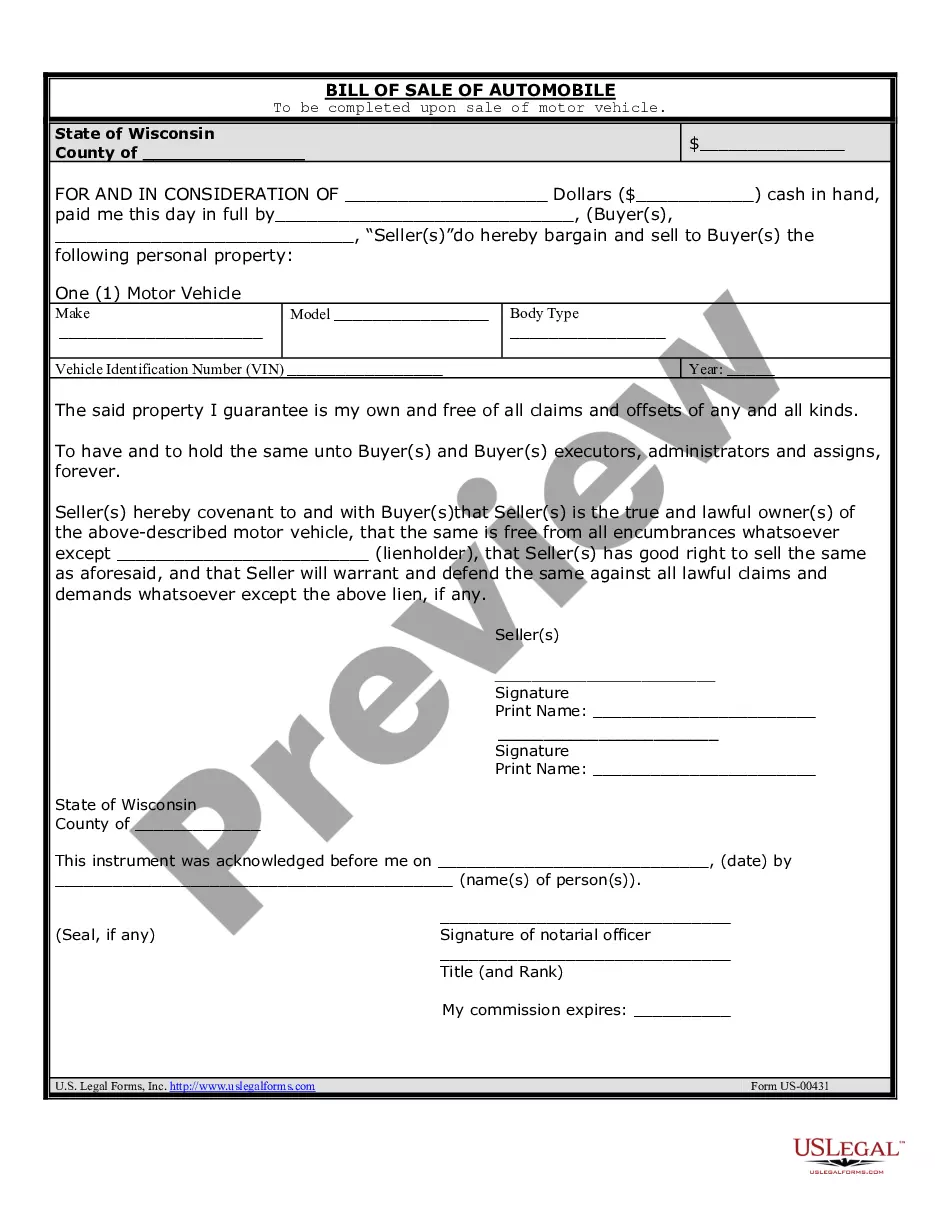

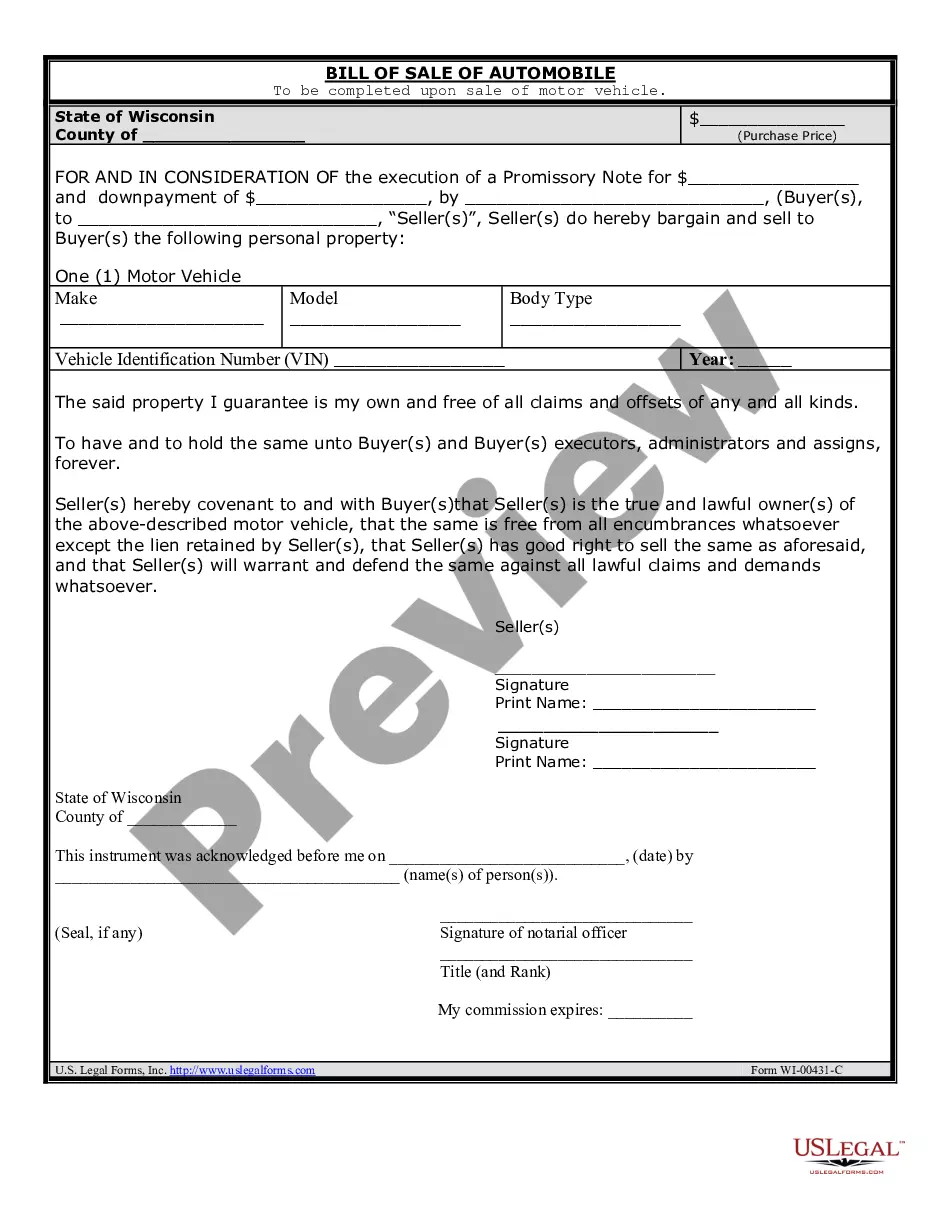

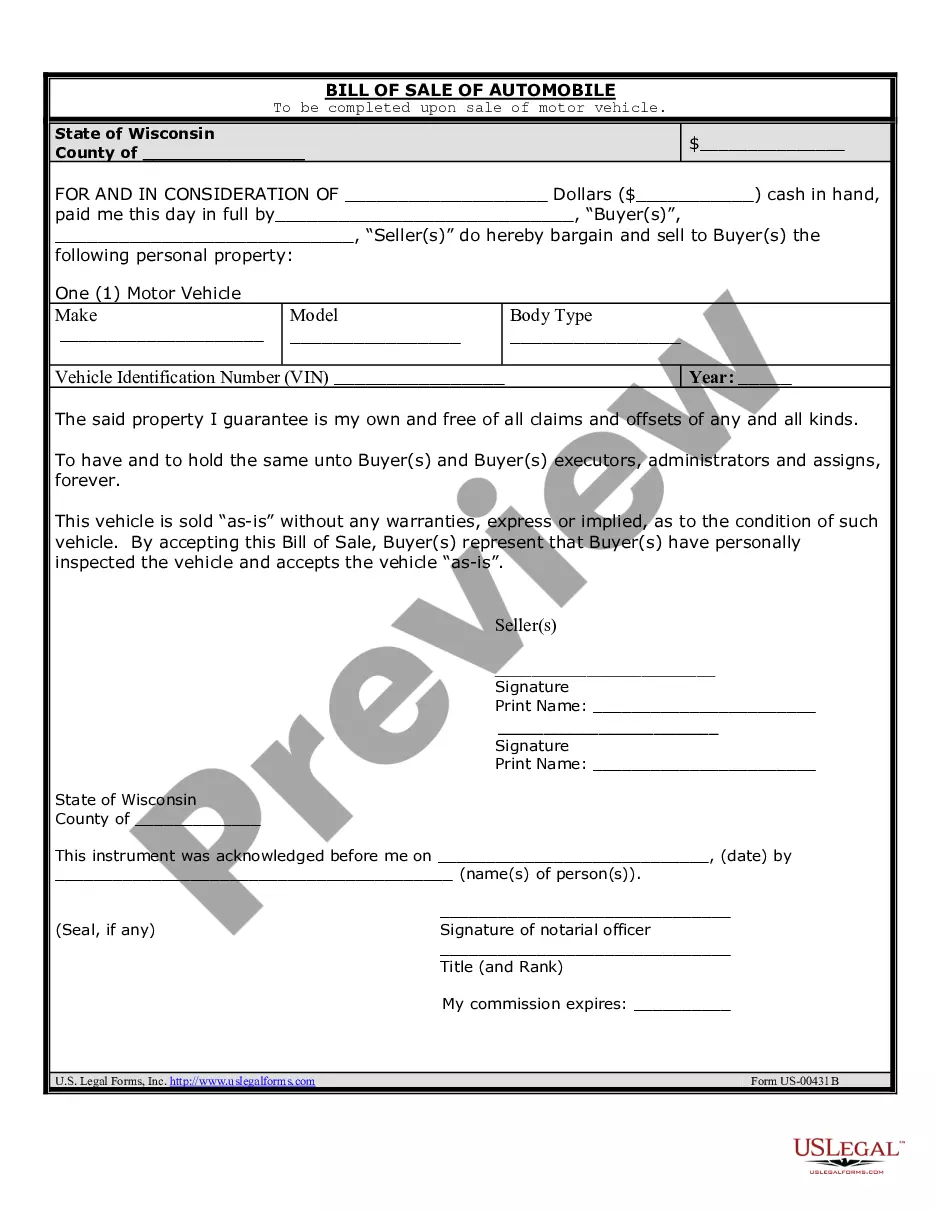

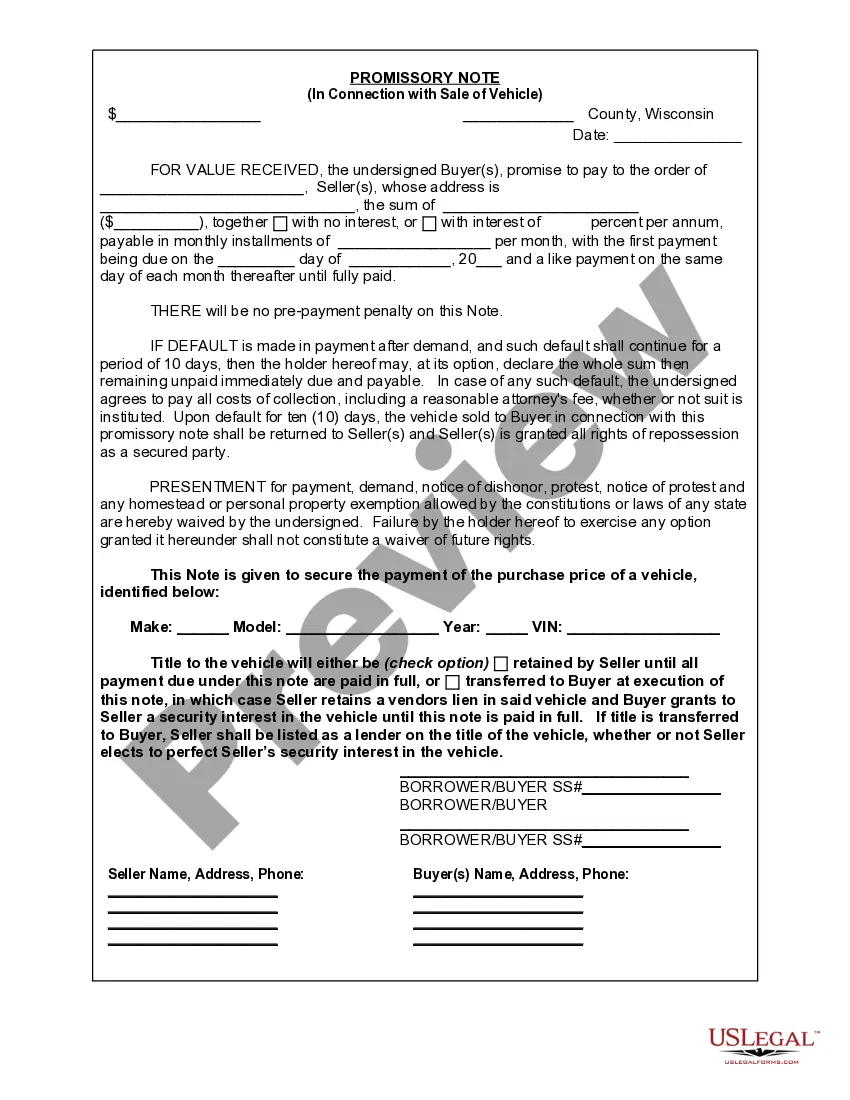

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Green Bay Wisconsin Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financing agreement between a buyer and a seller for the purchase of a vehicle. It serves as a legally binding contract that sets forth the agreed-upon terms of the sale, including the purchase price, payment schedule, interest rate (if applicable), and any other relevant terms. Keywords: Green Bay Wisconsin, promissory note, sale of vehicle, automobile, financing agreement, legal document, terms and conditions, purchase price, payment schedule, interest rate. There are different types of Green Bay Wisconsin Promissory Notes in Connection with Sale of Vehicle or Automobile, including: 1. Installment Promissory Note: This type of promissory note sets out a fixed payment schedule over a specific period of time, typically monthly, until the total amount owing is repaid in full. 2. Balloon Promissory Note: This note structure involves smaller monthly payments over a fixed period, followed by a larger "balloon" payment due at the end of the term. It allows the buyer to make smaller regular payments with a lump sum payment due at final maturity. 3. Secured Promissory Note: This type of promissory note includes a collateral clause that allows the seller to secure the vehicle as collateral for the debt in case of default. 4. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require any collateral for the transaction, making it riskier for the seller but potentially more favorable for the buyer. 5. Simple Promissory Note: This note outlines the basic terms of the sale, including the amount owed, interest rate (if applicable), and payment schedule. 6. Acceleration Promissory Note: This note gives the seller the right to demand immediate payment of the entire remaining balance if the buyer defaults on any payment obligation. It's important to note that the specific terms and conditions of a promissory note may vary between individual transactions, and parties involved should consult with legal professionals to ensure compliance with local laws and regulations.Green Bay Wisconsin Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financing agreement between a buyer and a seller for the purchase of a vehicle. It serves as a legally binding contract that sets forth the agreed-upon terms of the sale, including the purchase price, payment schedule, interest rate (if applicable), and any other relevant terms. Keywords: Green Bay Wisconsin, promissory note, sale of vehicle, automobile, financing agreement, legal document, terms and conditions, purchase price, payment schedule, interest rate. There are different types of Green Bay Wisconsin Promissory Notes in Connection with Sale of Vehicle or Automobile, including: 1. Installment Promissory Note: This type of promissory note sets out a fixed payment schedule over a specific period of time, typically monthly, until the total amount owing is repaid in full. 2. Balloon Promissory Note: This note structure involves smaller monthly payments over a fixed period, followed by a larger "balloon" payment due at the end of the term. It allows the buyer to make smaller regular payments with a lump sum payment due at final maturity. 3. Secured Promissory Note: This type of promissory note includes a collateral clause that allows the seller to secure the vehicle as collateral for the debt in case of default. 4. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require any collateral for the transaction, making it riskier for the seller but potentially more favorable for the buyer. 5. Simple Promissory Note: This note outlines the basic terms of the sale, including the amount owed, interest rate (if applicable), and payment schedule. 6. Acceleration Promissory Note: This note gives the seller the right to demand immediate payment of the entire remaining balance if the buyer defaults on any payment obligation. It's important to note that the specific terms and conditions of a promissory note may vary between individual transactions, and parties involved should consult with legal professionals to ensure compliance with local laws and regulations.