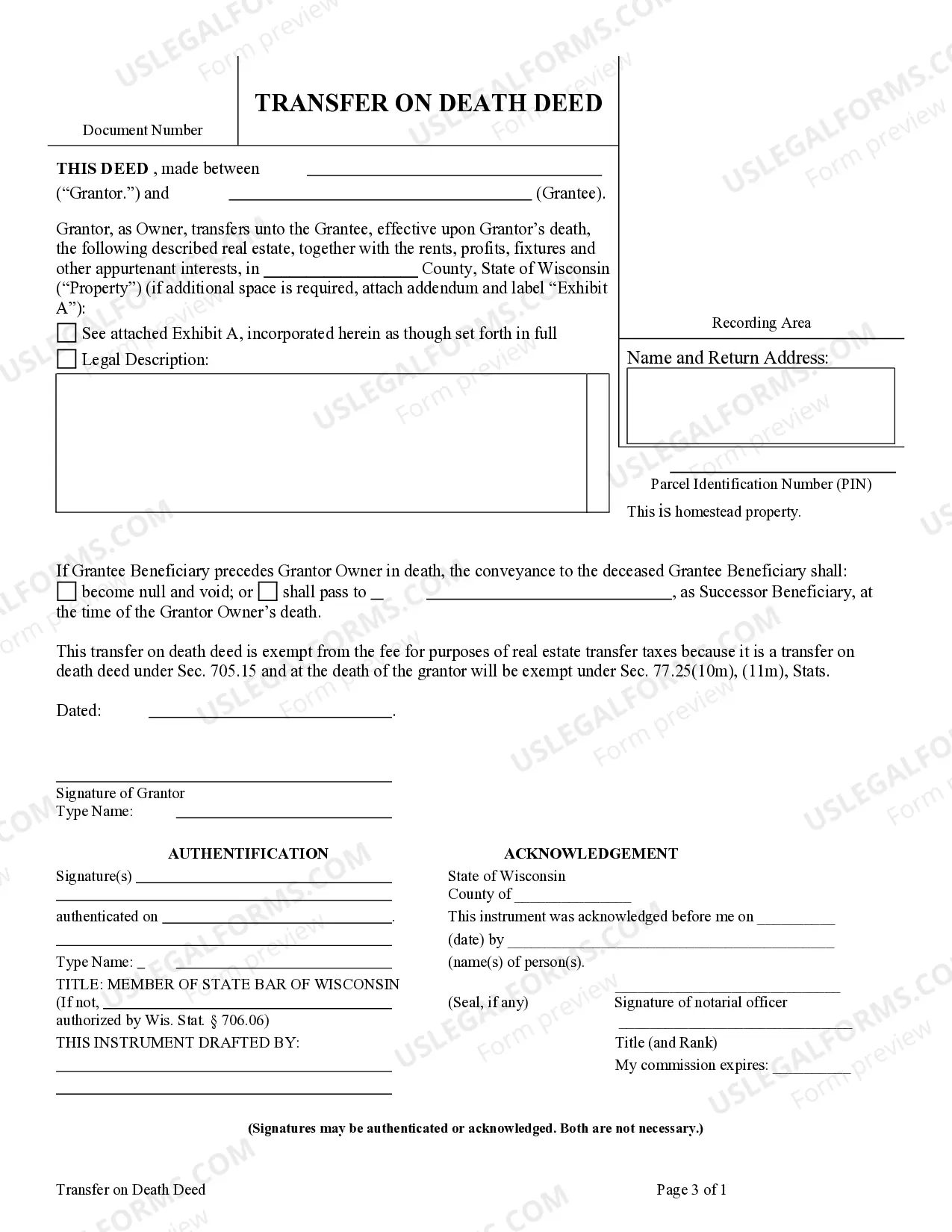

This form is a Transfer on Death Deed where the Grantor is an Individual and the Grantee is an Individual. This transfer is revocable by Grantor until his/her death and effective only upon the death of the Grantor. Includes provision for alternative beneficiary in the event primary beneficiary does not survive Grantor. This deed complies with all state statutory laws.

A Green Bay Wisconsin Transfer on Death Deed, also known as a TOD — Beneficiary Deed from Individual to Individual includes an Alternate Beneficiary Provision, is a legal document that allows an individual to transfer their residential property or real estate to a designated beneficiary upon their death, bypassing the need for probate. This type of deed is commonly used in estate planning to ensure a smooth transfer of assets to loved ones without the necessity of going through the lengthy probate process. By utilizing this deed, individuals can have control over their property even after passing away and ensure that their intentions are carried out. The Green Bay Wisconsin Transfer on Death Deed or TOD — Beneficiary Deed from Individual to Individual includes an Alternate Beneficiary Provision specifically allows for the appointment of alternate beneficiaries in the event that the primary beneficiary is unable or unwilling to inherit the property. This provision gives the property owner added flexibility and peace of mind, ensuring that the property will still be transferred to a secondary beneficiary chosen by the original owner. In Green Bay Wisconsin, there are several types of Transfer on Death Deeds or TOD — Beneficiary Deeds from Individual to Individual with an Alternate Beneficiary Provision available. They include: 1. Transfer on Death Deed — Single Beneficiary: This type of deed allows for the transfer of the property to a single beneficiary upon the death of the property owner. 2. Transfer on Death Deed — Multiple Beneficiaries: This type of deed enables the property owner to specify multiple beneficiaries who will inherit the property in equal or specified shares upon their death. 3. Transfer on Death Deed — Joint Tenancy with Right of Survivorship: This type of deed allows for the transfer of ownership to a joint owner (typically a spouse or partner) with the right of survivorship, meaning that upon the death of one owner, the surviving owner automatically inherits the property. 4. Transfer on Death Deed — Community Property with Right of Survivorship: This type of deed is applicable to married or registered domestic partners and allows for the automatic transfer of the property to the surviving spouse or partner upon the death of one owner. It is important to consult with an experienced estate planning attorney when considering utilizing a Green Bay Wisconsin Transfer on Death Deed or TOD — Beneficiary Deed from Individual to Individual with an Alternate Beneficiary Provision. They can provide guidance based on individual circumstances and ensure that the appropriate type of deed is chosen to meet specific needs and goals.