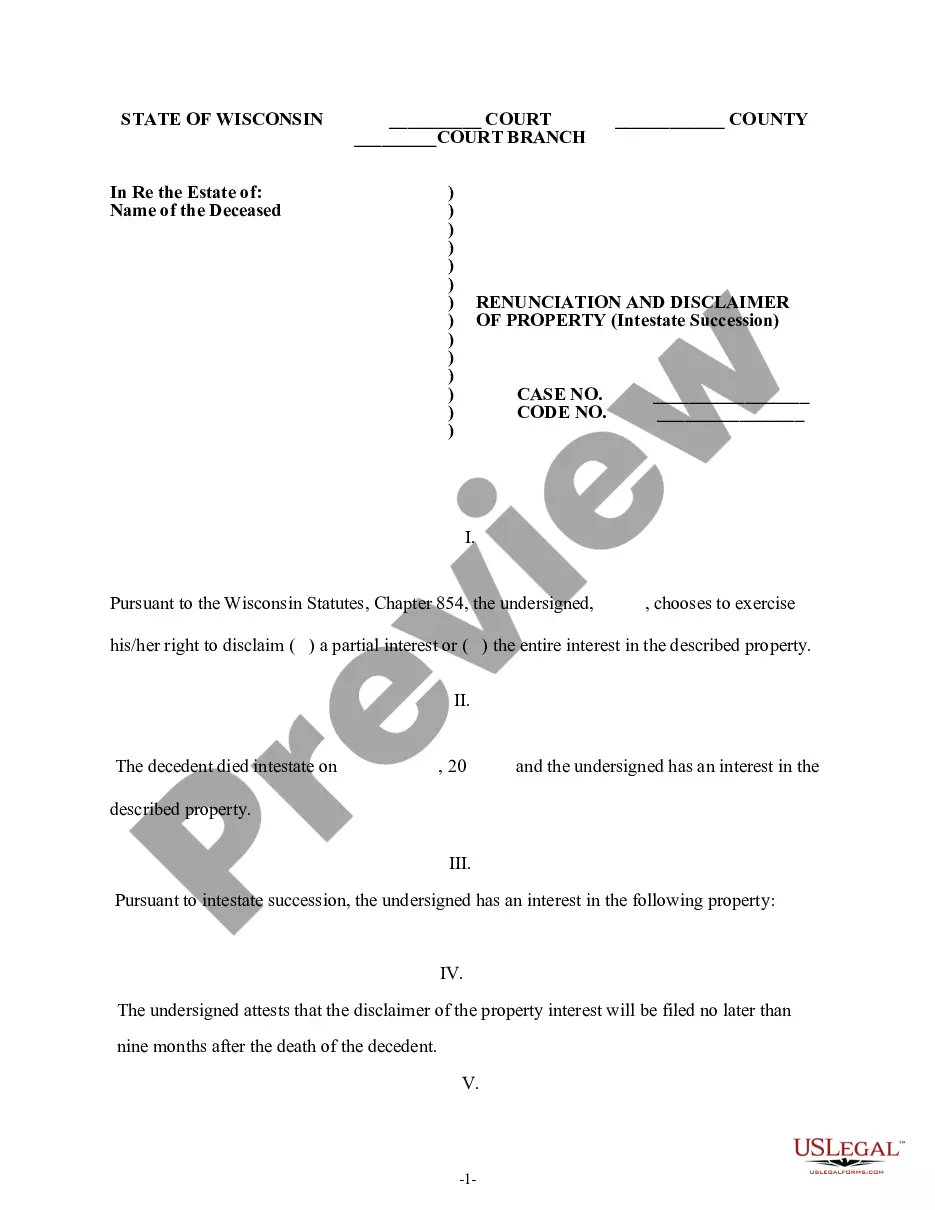

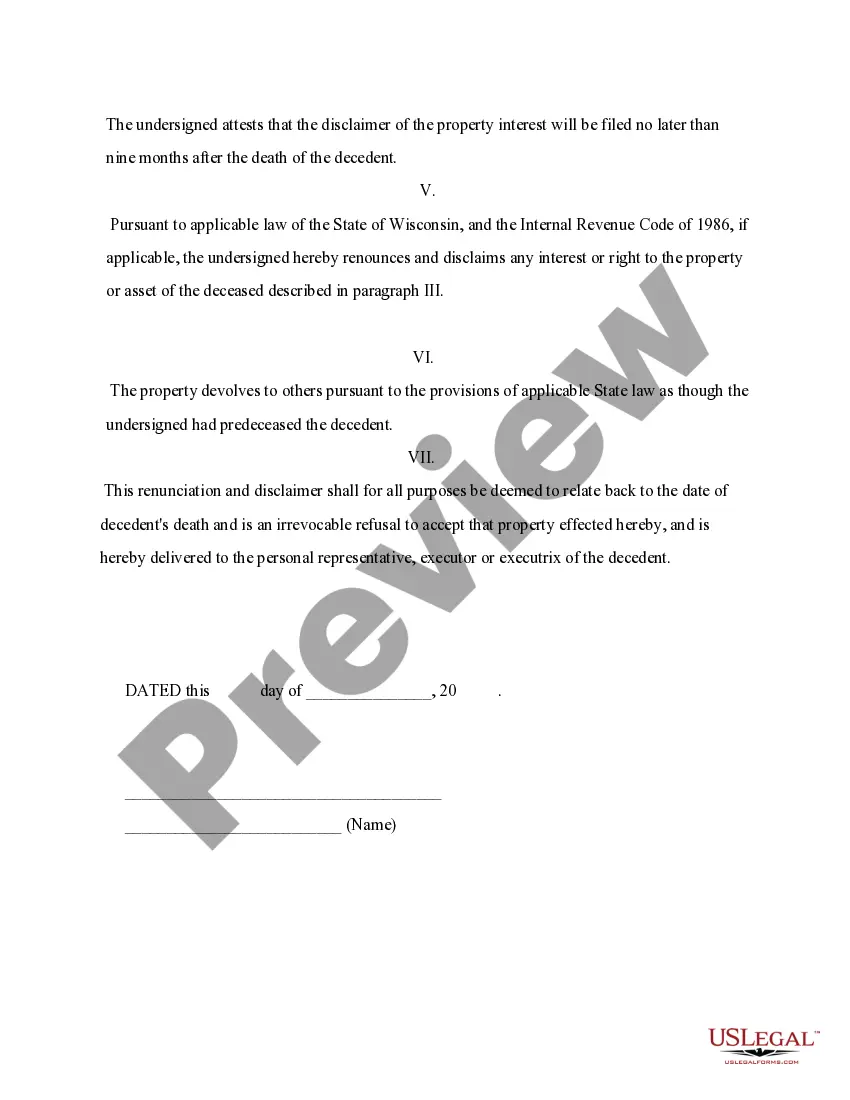

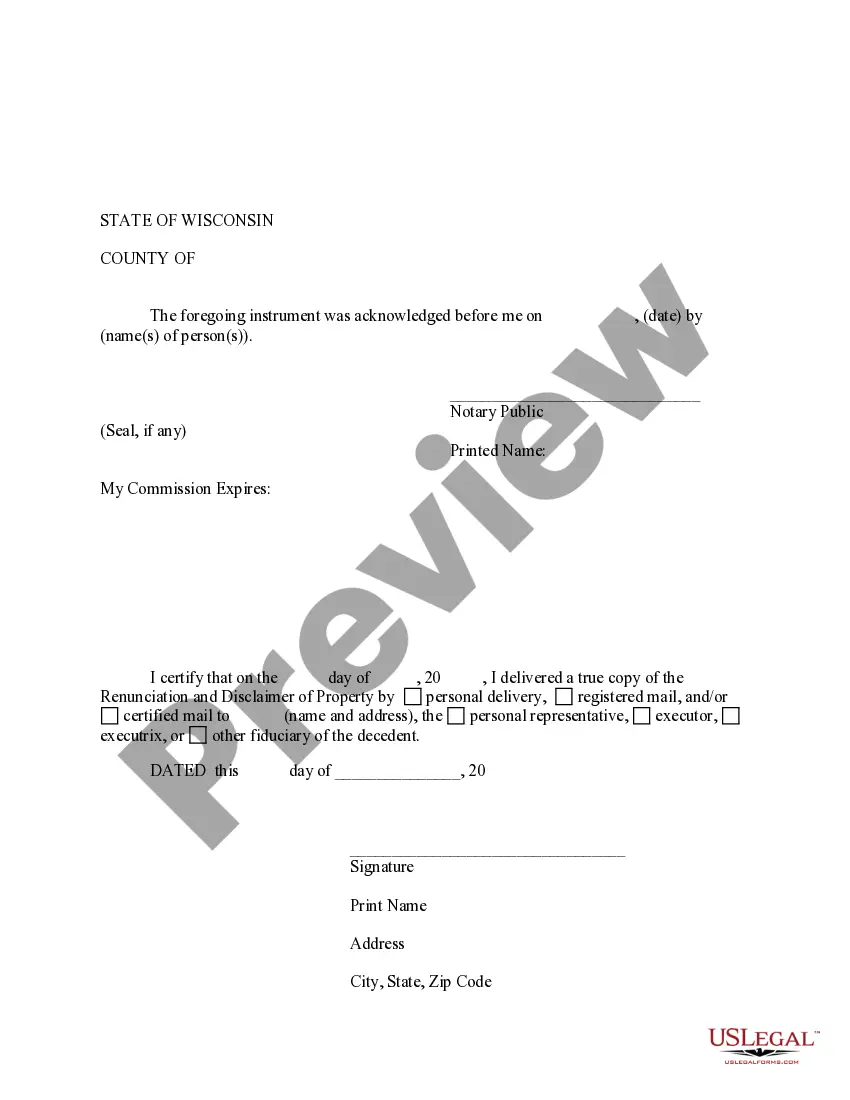

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through Intestate Succession, where the beneficiary gained an interest in the property upon the death of the decedent, but, has chosen to disclaim a portion of or the entire interest in the property pursuant to the Wisconsin Statutes, Chapter 854. The property will now pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment a certificate to verify the delivery of the documentation.

Green Bay Wisconsin Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to decline their inheritance rights to property that would be obtained through intestate succession. Intestate succession refers to the distribution of a deceased person's assets when they did not leave a valid will. Green Bay, Wisconsin has specific laws and procedures in place to handle renunciations and disclaimers of property received through intestate succession. This legal action can help individuals who do not wish to accept their entitled share of the deceased person's estate for various reasons. There are several types of Green Bay Wisconsin Renunciation and Disclaimer of Property received by Intestate Succession, including: 1. General Renunciation: This involves a complete renunciation and disclaimer of all rights to inherit any property under intestate succession. By signing a general renunciation, individuals relinquish their rights to receive any assets, effectively removing themselves from the distribution of the deceased person's estate. 2. Partial Renunciation: Sometimes, an individual may only wish to decline their inheritance rights to certain assets or properties. In such cases, a partial renunciation can be made. By specifying which properties or assets they renounce, individuals can forfeit their rights to those specific items while still retaining entitlement to other parts of the estate. 3. Alternate Beneficiary Designation: This option allows individuals to renounce their inheritance rights in favor of a designated alternate beneficiary. This means that the renouncing party declines their share of the estate, redirecting it to the chosen alternate beneficiary instead. The alternate beneficiary must be specified in the renunciation document. 4. Qualified Disclaimer: In certain situations, an individual may find it necessary to disclaim their inheritance due to potential legal or financial consequences. By submitting a qualified disclaimer, individuals are able to avoid any legal obligations or tax liabilities associated with the inherited property. This type of renunciation often requires meeting specific legal requirements, such as filing the disclaimer within a certain timeframe after the decedent's death. Green Bay Wisconsin Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that should be approached with caution and properly executed according to the state's laws. It is recommended to seek professional legal advice from an attorney experienced in estate planning and probate procedures to ensure compliance with all necessary legal requirements.Green Bay Wisconsin Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to decline their inheritance rights to property that would be obtained through intestate succession. Intestate succession refers to the distribution of a deceased person's assets when they did not leave a valid will. Green Bay, Wisconsin has specific laws and procedures in place to handle renunciations and disclaimers of property received through intestate succession. This legal action can help individuals who do not wish to accept their entitled share of the deceased person's estate for various reasons. There are several types of Green Bay Wisconsin Renunciation and Disclaimer of Property received by Intestate Succession, including: 1. General Renunciation: This involves a complete renunciation and disclaimer of all rights to inherit any property under intestate succession. By signing a general renunciation, individuals relinquish their rights to receive any assets, effectively removing themselves from the distribution of the deceased person's estate. 2. Partial Renunciation: Sometimes, an individual may only wish to decline their inheritance rights to certain assets or properties. In such cases, a partial renunciation can be made. By specifying which properties or assets they renounce, individuals can forfeit their rights to those specific items while still retaining entitlement to other parts of the estate. 3. Alternate Beneficiary Designation: This option allows individuals to renounce their inheritance rights in favor of a designated alternate beneficiary. This means that the renouncing party declines their share of the estate, redirecting it to the chosen alternate beneficiary instead. The alternate beneficiary must be specified in the renunciation document. 4. Qualified Disclaimer: In certain situations, an individual may find it necessary to disclaim their inheritance due to potential legal or financial consequences. By submitting a qualified disclaimer, individuals are able to avoid any legal obligations or tax liabilities associated with the inherited property. This type of renunciation often requires meeting specific legal requirements, such as filing the disclaimer within a certain timeframe after the decedent's death. Green Bay Wisconsin Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that should be approached with caution and properly executed according to the state's laws. It is recommended to seek professional legal advice from an attorney experienced in estate planning and probate procedures to ensure compliance with all necessary legal requirements.