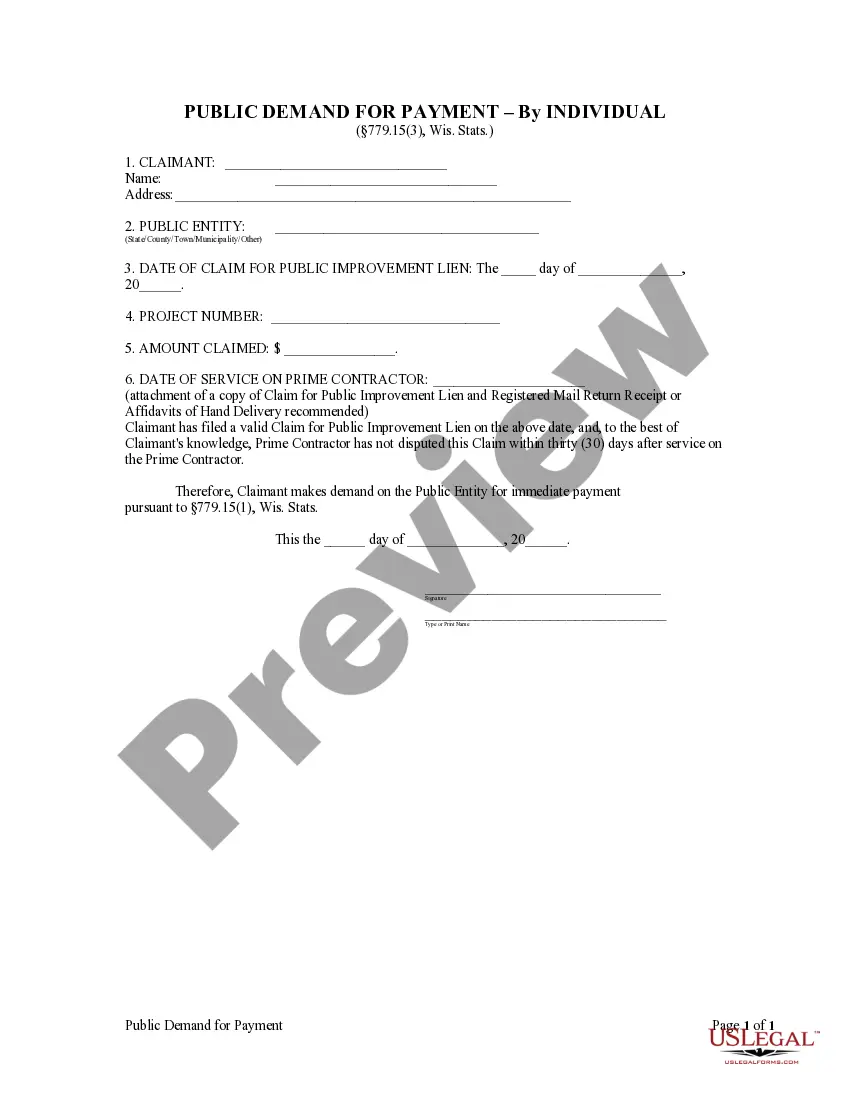

This Public Demand for Payment - Individual is a form notice attached to a construction contract. Every prime contractor who enters into a contract with the owner for a work of improvement on the owner's land and who has contracted or will contract with any subcontractors or materialmen to provide labor or materials for the work of improvement shall include in any written contract with the owner the notice required by this paragraph, and shall provide the owner with a copy of the written contract. If no written contract for the work of improvement is entered into, the notice shall be prepared separately and served personally or by registered mail on the owner or authorized agent within 10 days after the first labor or materials are furnished for the improvement by or pursuant to the authority of the prime contractor.

Green Bay Wisconsin Public Demand for Payment — Individual is a legal process initiated by the local government in Green Bay, Wisconsin, to collect unpaid debts or fines from individuals. This demand for payment aims to ensure that individuals meet their financial obligations to the city. The Green Bay Wisconsin Public Demand for Payment — Individual can be classified into two categories: 1. Tax Liabilities: This type of demand for payment is related to overdue tax obligations that individuals have failed to pay to the local government. It includes unpaid property taxes, income taxes, and other tax-related debts. 2. Fines and Penalties: The second category of demand for payment pertains to outstanding fines and penalties that individuals owe to the city. These fines can result from various municipal violations, including parking tickets, code violations, traffic offenses, and other infractions. To initiate the Green Bay Wisconsin Public Demand for Payment — Individual process, the local government sends a formal notice to the debtor, outlining the outstanding debt, the reasons for non-payment, and the necessary steps to settle the dues. This notice contains the payment amount, the payment deadline, and the consequences of non-compliance. In response to the demand for payment, the individual is expected to address the debt promptly and make the necessary payment according to the outlined terms. Failure to comply with the public demand for payment may result in further actions by the city, such as legal proceedings, additional fines, wage garnishments, property liens, or other measures to collect the outstanding debt. To resolve these issues with the Green Bay Wisconsin Public Demand for Payment — Individual, individuals are advised to contact the appropriate department or agency mentioned in the notice to discuss payment options, negotiate payment plans, or request an extension if needed. Promptly addressing the demand for payment helps individuals avoid legal consequences and ensures a responsible approach towards meeting their financial obligations to the city. In summary, the Green Bay Wisconsin Public Demand for Payment — Individual is a legally binding process by which the local government in Green Bay, Wisconsin, seeks to collect unpaid taxes, fines, and penalties from individuals. It serves as a mechanism to enforce timely payment and fulfill one's financial responsibilities to the city.Green Bay Wisconsin Public Demand for Payment — Individual is a legal process initiated by the local government in Green Bay, Wisconsin, to collect unpaid debts or fines from individuals. This demand for payment aims to ensure that individuals meet their financial obligations to the city. The Green Bay Wisconsin Public Demand for Payment — Individual can be classified into two categories: 1. Tax Liabilities: This type of demand for payment is related to overdue tax obligations that individuals have failed to pay to the local government. It includes unpaid property taxes, income taxes, and other tax-related debts. 2. Fines and Penalties: The second category of demand for payment pertains to outstanding fines and penalties that individuals owe to the city. These fines can result from various municipal violations, including parking tickets, code violations, traffic offenses, and other infractions. To initiate the Green Bay Wisconsin Public Demand for Payment — Individual process, the local government sends a formal notice to the debtor, outlining the outstanding debt, the reasons for non-payment, and the necessary steps to settle the dues. This notice contains the payment amount, the payment deadline, and the consequences of non-compliance. In response to the demand for payment, the individual is expected to address the debt promptly and make the necessary payment according to the outlined terms. Failure to comply with the public demand for payment may result in further actions by the city, such as legal proceedings, additional fines, wage garnishments, property liens, or other measures to collect the outstanding debt. To resolve these issues with the Green Bay Wisconsin Public Demand for Payment — Individual, individuals are advised to contact the appropriate department or agency mentioned in the notice to discuss payment options, negotiate payment plans, or request an extension if needed. Promptly addressing the demand for payment helps individuals avoid legal consequences and ensures a responsible approach towards meeting their financial obligations to the city. In summary, the Green Bay Wisconsin Public Demand for Payment — Individual is a legally binding process by which the local government in Green Bay, Wisconsin, seeks to collect unpaid taxes, fines, and penalties from individuals. It serves as a mechanism to enforce timely payment and fulfill one's financial responsibilities to the city.