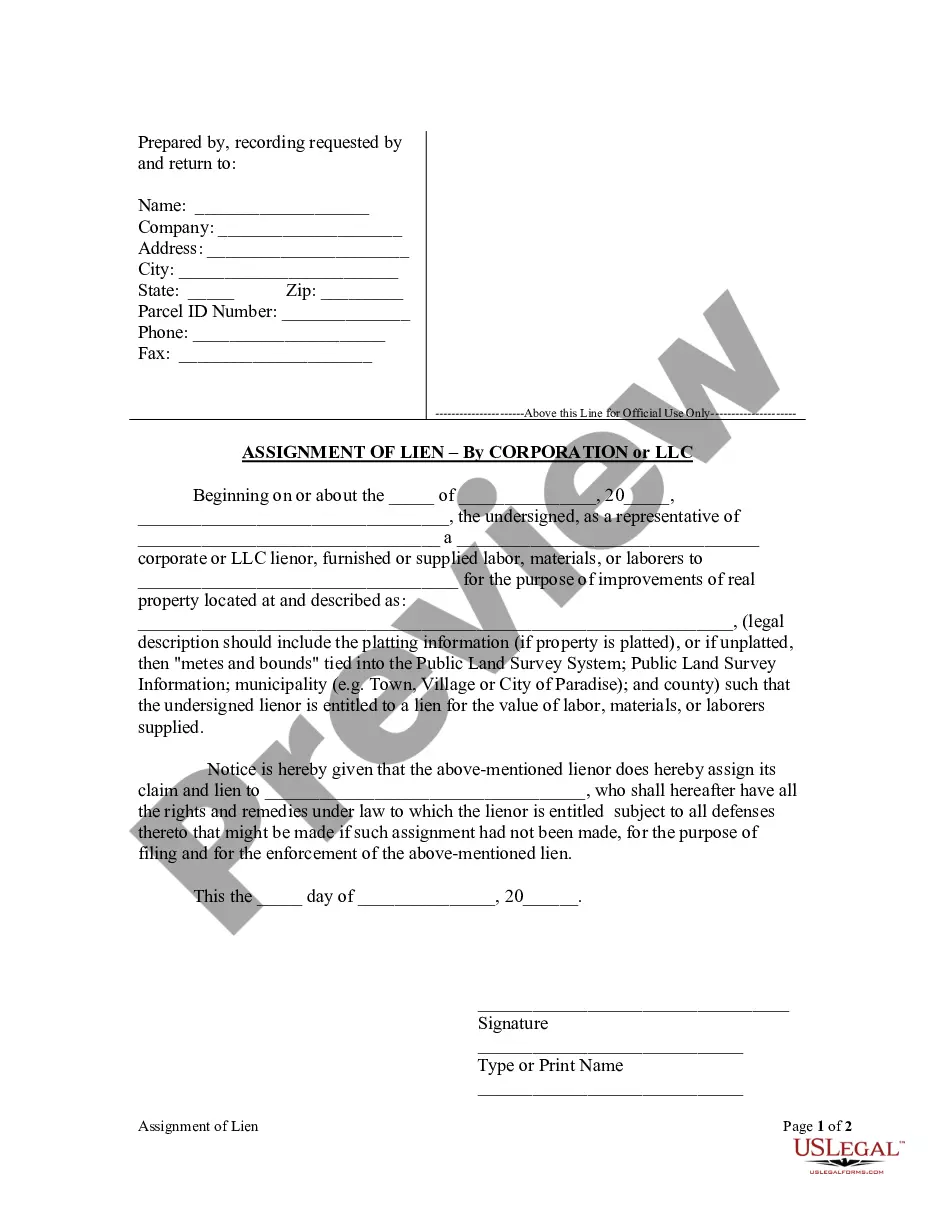

This Assignment of Lien is for use by a corporate lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lienor is entitled to a lien for the value of labor, materials, or laborers supplied, to provide notice that the lienor assigns the lienor's claim and lien to an individual who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

Green Bay, Wisconsin Assignment of Lien — Corporation: A Comprehensive Overview Keywords: Green Bay, Wisconsin, Assignment of Lien, Corporation, types Introduction: In Green Bay, Wisconsin, an Assignment of Lien — Corporation refers to the formal process where a corporation transfers its rights and interests in a lien to another party. This legal procedure allows the corporation to transfer its claim against a property as collateral or unpaid debt to a different entity. Understanding the intricacies of Assignment of Lien — Corporation is crucial for both businesses and individuals involved in property transactions within Green Bay. Types of Green Bay Wisconsin Assignment of Lien — Corporation: 1. Construction Lien Assignment: In the construction industry, businesses often assign their liens to other entities as a means to secure payments and protect their interests. This type of Assignment of Lien — Corporation is commonly utilized by contractors, subcontractors, and material suppliers who have not received full payment for services rendered or materials provided. 2. Tax Lien Assignment: When a corporation has unpaid taxes owed to the city, county, or state, it may assign the tax lien to another party. The assigned party then has the authority to collect the outstanding tax amount on behalf of the local taxing authority. 3. Debtor Lien Assignment: In cases where a corporation has a lien against a debtor, whether for unpaid loans or other financial obligations, it can assign that lien to another entity. This type of Assignment of Lien — Corporation is an effective way to recover funds owed to the assigning corporation. Process of Green Bay Wisconsin Assignment of Lien — Corporation: 1. Written Agreement: Both the assigning corporation and the assignee must enter into a written agreement outlining the terms and conditions of the lien assignment. This agreement acts as a legally binding document that sets the framework for the transfer of rights and obligations. 2. Recording of Assignment: To make the Assignment of Lien — Corporation valid and enforceable, it must be recorded with the appropriate Green Bay authorities. This step ensures that the public has notice of the lien assignment, preventing any conflicting claims or disputes. 3. Notice to Interested Parties: Once the Assignment of Lien — Corporation is recorded, the assignee must provide notice to all interested parties, such as property owners and other lien holders. This notice alerts them to the lien assignment and allows them to take necessary actions regarding their responsibilities and obligations. 4. Enforcement: After the lien assignment is in place, the assignee can proceed with enforcing the lien, pursuing legal action, or seeking payment from the appropriate parties. This enforcement typically follows the procedures laid out in Wisconsin state law, ensuring fairness and adherence to legal requirements. Conclusion: In Green Bay, Wisconsin, the process of Assignment of Lien — Corporation plays a vital role in various property transactions, providing corporations with a means to protect their financial interests. The three main types of assignments — construction, tax, and debtor lien— - offer corporations a range of options to recover outstanding payments, secure debts, and ensure compliance with tax obligations. Understanding the process and legal requirements behind Assignment of Lien — Corporation is crucial for businesses and individuals engaging in property dealings within Green Bay.