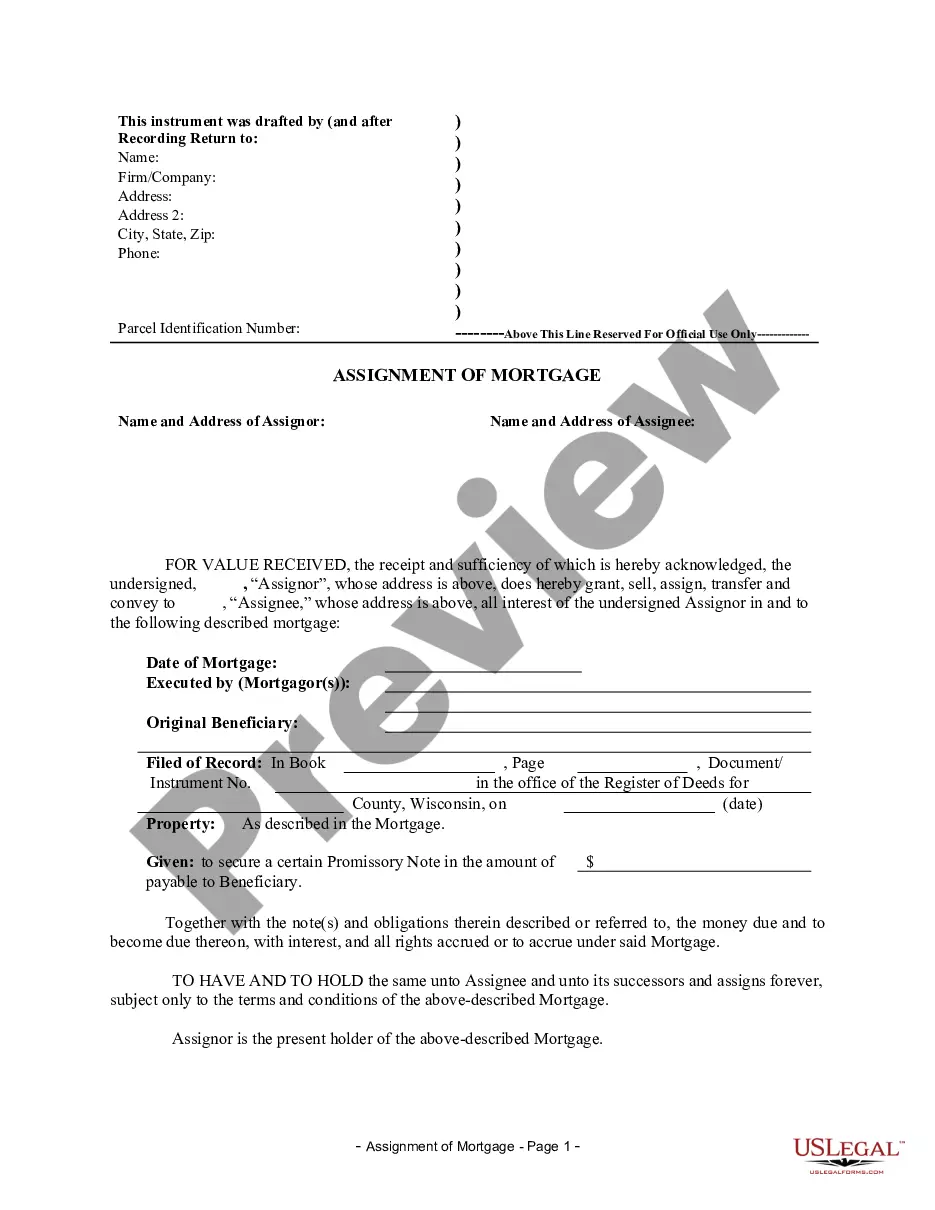

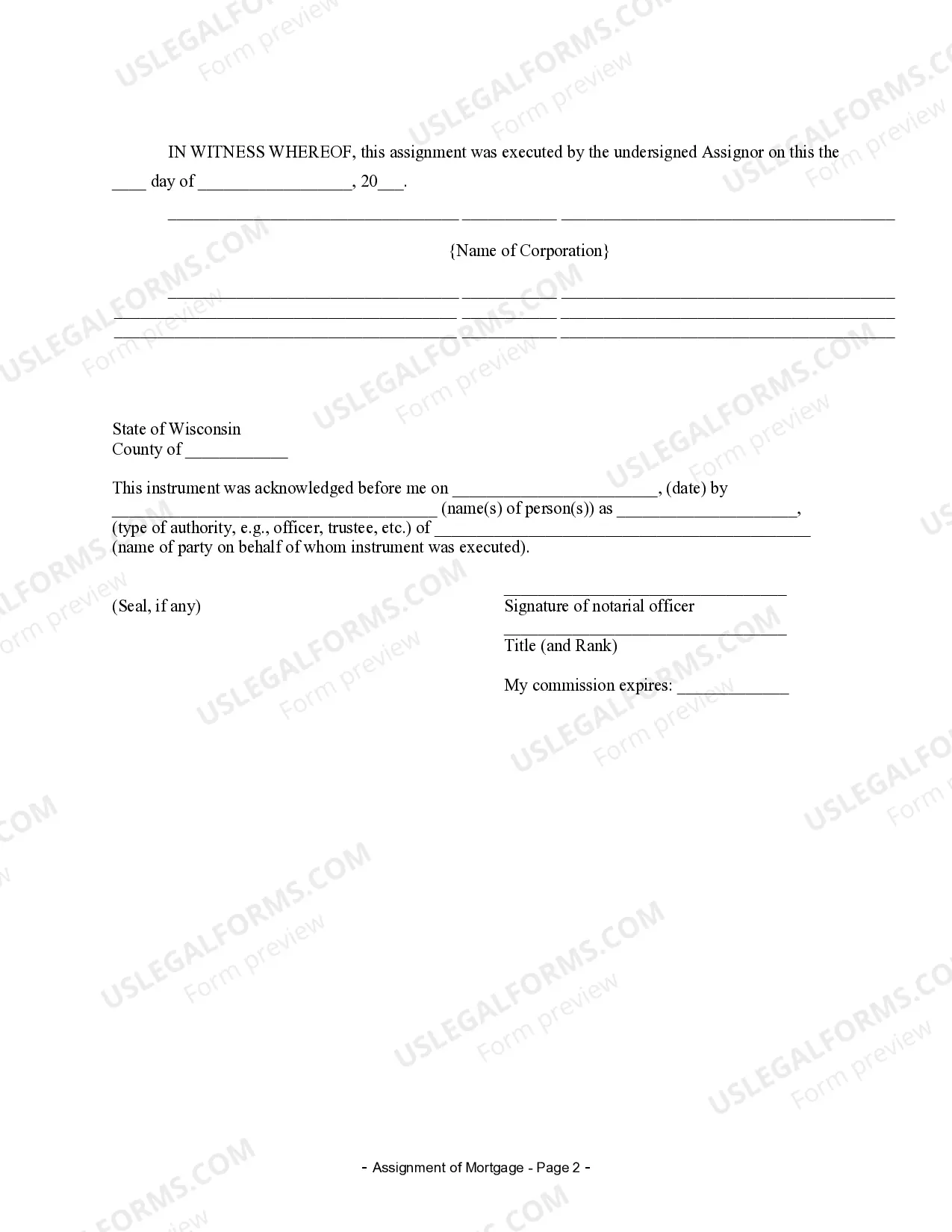

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Green Bay Wisconsin Assignment of Mortgage by Corporate Mortgage Holder is a legal process wherein a mortgage lender transfers the ownership and associated rights of a mortgage to another party. This document is executed when a corporate mortgage holder wishes to assign their interest in the mortgage loan to another entity. To understand the different types of Green Bay Wisconsin Assignment of Mortgage by Corporate Mortgage Holder, it is important to highlight some relevant keywords: 1. Assignment of Mortgage: This refers to the legal transfer of a mortgage from one entity to another. It involves the assignment of both the debt and the mortgage lien. 2. Corporate Mortgage Holder: A corporate mortgage holder is a business entity, such as a bank or lending institution, that holds the mortgage loan on a property. 3. Mortgage Loan: This is the financial agreement between a borrower and a lender, which provides funds for purchasing a property. The loan is secured by the property itself. 4. Ownership Transfer: In an Assignment of Mortgage, ownership of the mortgage loan is transferred from the original corporate mortgage holder to another party, often another lending institution or investor. 5. Mortgage Lien: A mortgage lien is a legal claim against a property to secure the repayment of the mortgage loan. The Assignment of Mortgage includes the transfer of this lien to the new entity. 6. Deed of Assignment: This is a similar document to the Assignment of Mortgage, and it involves the transfer of ownership of the mortgage from the original mortgage holder to a new entity. 7. Mortgage Servicing: Sometimes, the corporate mortgage holder may transfer the servicing rights of the mortgage loan while retaining ownership. This means that another company will handle the collection of payments and borrower communication. 8. Recording and Filing: In Wisconsin, the Assignment of Mortgage by Corporate Mortgage Holder must be properly recorded and filed with the county registrar's office to ensure its legality and protect the interests of all parties involved. It is crucial to consult with a legal professional to ensure compliance with all the laws and regulations surrounding the Assignment of Mortgage in Green Bay, Wisconsin. Understanding the intricacies of this process is essential whether you are a corporate mortgage holder looking to assign a mortgage or a borrower affected by a change in ownership of your mortgage loan.Green Bay Wisconsin Assignment of Mortgage by Corporate Mortgage Holder is a legal process wherein a mortgage lender transfers the ownership and associated rights of a mortgage to another party. This document is executed when a corporate mortgage holder wishes to assign their interest in the mortgage loan to another entity. To understand the different types of Green Bay Wisconsin Assignment of Mortgage by Corporate Mortgage Holder, it is important to highlight some relevant keywords: 1. Assignment of Mortgage: This refers to the legal transfer of a mortgage from one entity to another. It involves the assignment of both the debt and the mortgage lien. 2. Corporate Mortgage Holder: A corporate mortgage holder is a business entity, such as a bank or lending institution, that holds the mortgage loan on a property. 3. Mortgage Loan: This is the financial agreement between a borrower and a lender, which provides funds for purchasing a property. The loan is secured by the property itself. 4. Ownership Transfer: In an Assignment of Mortgage, ownership of the mortgage loan is transferred from the original corporate mortgage holder to another party, often another lending institution or investor. 5. Mortgage Lien: A mortgage lien is a legal claim against a property to secure the repayment of the mortgage loan. The Assignment of Mortgage includes the transfer of this lien to the new entity. 6. Deed of Assignment: This is a similar document to the Assignment of Mortgage, and it involves the transfer of ownership of the mortgage from the original mortgage holder to a new entity. 7. Mortgage Servicing: Sometimes, the corporate mortgage holder may transfer the servicing rights of the mortgage loan while retaining ownership. This means that another company will handle the collection of payments and borrower communication. 8. Recording and Filing: In Wisconsin, the Assignment of Mortgage by Corporate Mortgage Holder must be properly recorded and filed with the county registrar's office to ensure its legality and protect the interests of all parties involved. It is crucial to consult with a legal professional to ensure compliance with all the laws and regulations surrounding the Assignment of Mortgage in Green Bay, Wisconsin. Understanding the intricacies of this process is essential whether you are a corporate mortgage holder looking to assign a mortgage or a borrower affected by a change in ownership of your mortgage loan.