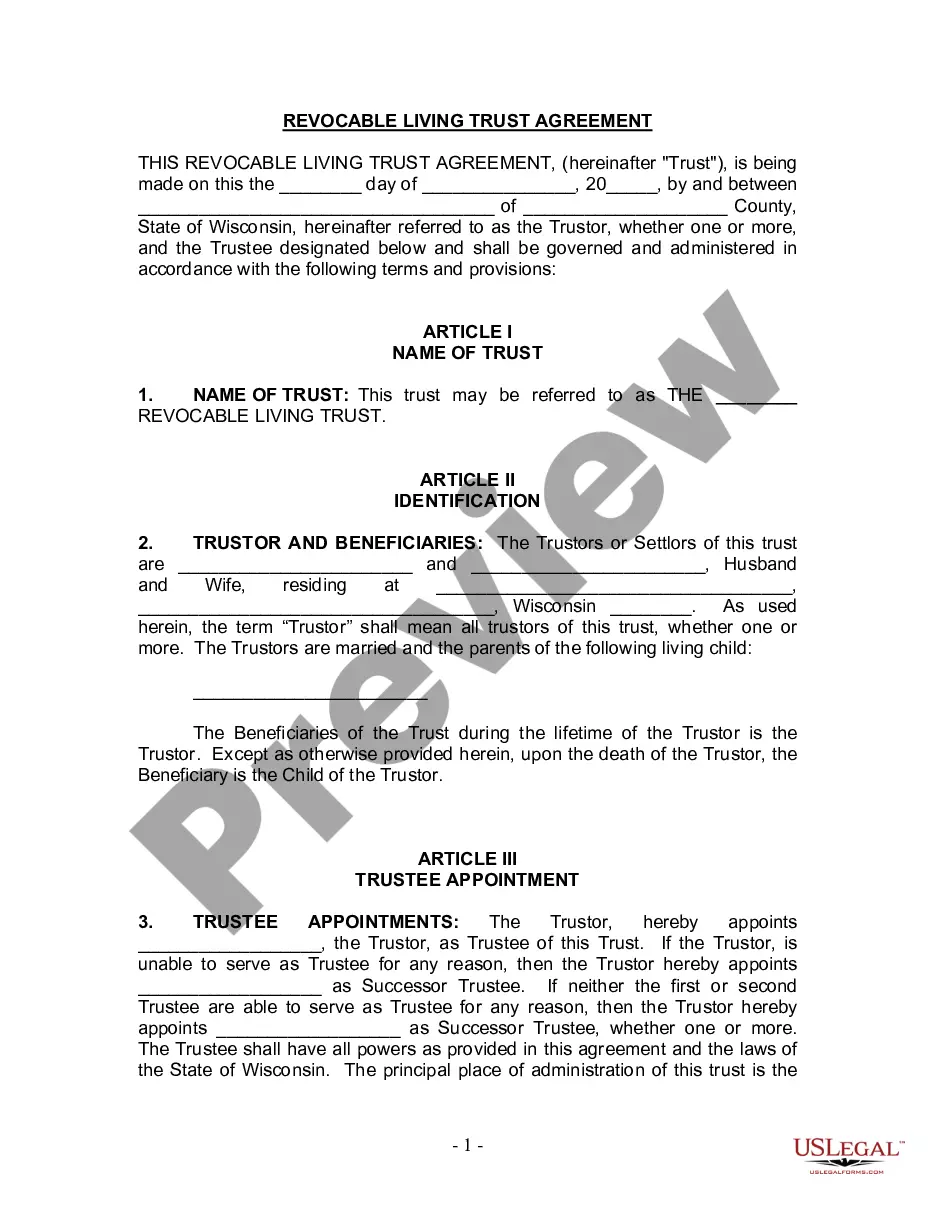

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Title: Green Bay Wisconsin Living Trust for Husband and Wife with One Child: A Comprehensive Guide Introduction: A Green Bay Wisconsin Living Trust for a Husband and Wife with One Child is a legal document created to protect and manage assets during the lifetime and after the death of the granters (the husband and wife), ensuring their child's financial security. This article will delve into the various aspects, benefits, and types of living trusts available in Green Bay, Wisconsin. 1. Understanding Living Trusts: A living trust, or an inter vivos trust, is established during the granters' lifetime and allows them to transfer their assets into a trust, managed for their benefit. It offers privacy, asset protection, and avoids probate, ensuring a seamless transfer of assets to beneficiaries. 2. Benefits of a Green Bay Wisconsin Living Trust: — Probate Avoidance: Living trusts bypass probate, saving time, costs, and maintaining privacy. — Efficient Asset Management: The trust provides a mechanism to manage and distribute assets in case of incapacitation or death. — Asset Protection: Assets within the trust are protected from creditors and potential legal challenges. — Control and Flexibility: Thgrantersrs retain complete control over the trust, allowing modifications, additions, or removal of assets as required. — Tax Planning: Living trusts provide opportunities for minimizing estate taxes and ensuring tax-efficient asset transfers. 3. Different Types of Green Bay Wisconsin Living Trusts for Husband and Wife with One Child: a) Revocable Living Trust: The most common type of trust, offering flexibility and control during the granters' lifetime. It can be amended or revoked as circumstances change, and assets within the trust are still considered marital property for tax purposes. b) Irrevocable Living Trust: Once established, this trust type cannot be revoked without the consent of beneficiaries. It provides greater asset protection, potential tax benefits, and removes the assets from the granters' taxable estate. c) Testamentary Trust: Established as part of a will, this trust type becomes effective upon the granters' death. It allows considerable flexibility for asset distribution, providing protection for minor children or those who may not handle financial matters aptly. Conclusion: A Green Bay Wisconsin Living Trust for Husband and Wife with One Child is an effective estate planning tool that ensures seamless asset management, probate avoidance, and asset protection. Whether you opt for a revocable, irrevocable, or testamentary trust, seeking legal counsel is crucial to tailor the trust to your specific needs, ensuring your loved ones' financial security in the long run.Title: Green Bay Wisconsin Living Trust for Husband and Wife with One Child: A Comprehensive Guide Introduction: A Green Bay Wisconsin Living Trust for a Husband and Wife with One Child is a legal document created to protect and manage assets during the lifetime and after the death of the granters (the husband and wife), ensuring their child's financial security. This article will delve into the various aspects, benefits, and types of living trusts available in Green Bay, Wisconsin. 1. Understanding Living Trusts: A living trust, or an inter vivos trust, is established during the granters' lifetime and allows them to transfer their assets into a trust, managed for their benefit. It offers privacy, asset protection, and avoids probate, ensuring a seamless transfer of assets to beneficiaries. 2. Benefits of a Green Bay Wisconsin Living Trust: — Probate Avoidance: Living trusts bypass probate, saving time, costs, and maintaining privacy. — Efficient Asset Management: The trust provides a mechanism to manage and distribute assets in case of incapacitation or death. — Asset Protection: Assets within the trust are protected from creditors and potential legal challenges. — Control and Flexibility: Thgrantersrs retain complete control over the trust, allowing modifications, additions, or removal of assets as required. — Tax Planning: Living trusts provide opportunities for minimizing estate taxes and ensuring tax-efficient asset transfers. 3. Different Types of Green Bay Wisconsin Living Trusts for Husband and Wife with One Child: a) Revocable Living Trust: The most common type of trust, offering flexibility and control during the granters' lifetime. It can be amended or revoked as circumstances change, and assets within the trust are still considered marital property for tax purposes. b) Irrevocable Living Trust: Once established, this trust type cannot be revoked without the consent of beneficiaries. It provides greater asset protection, potential tax benefits, and removes the assets from the granters' taxable estate. c) Testamentary Trust: Established as part of a will, this trust type becomes effective upon the granters' death. It allows considerable flexibility for asset distribution, providing protection for minor children or those who may not handle financial matters aptly. Conclusion: A Green Bay Wisconsin Living Trust for Husband and Wife with One Child is an effective estate planning tool that ensures seamless asset management, probate avoidance, and asset protection. Whether you opt for a revocable, irrevocable, or testamentary trust, seeking legal counsel is crucial to tailor the trust to your specific needs, ensuring your loved ones' financial security in the long run.