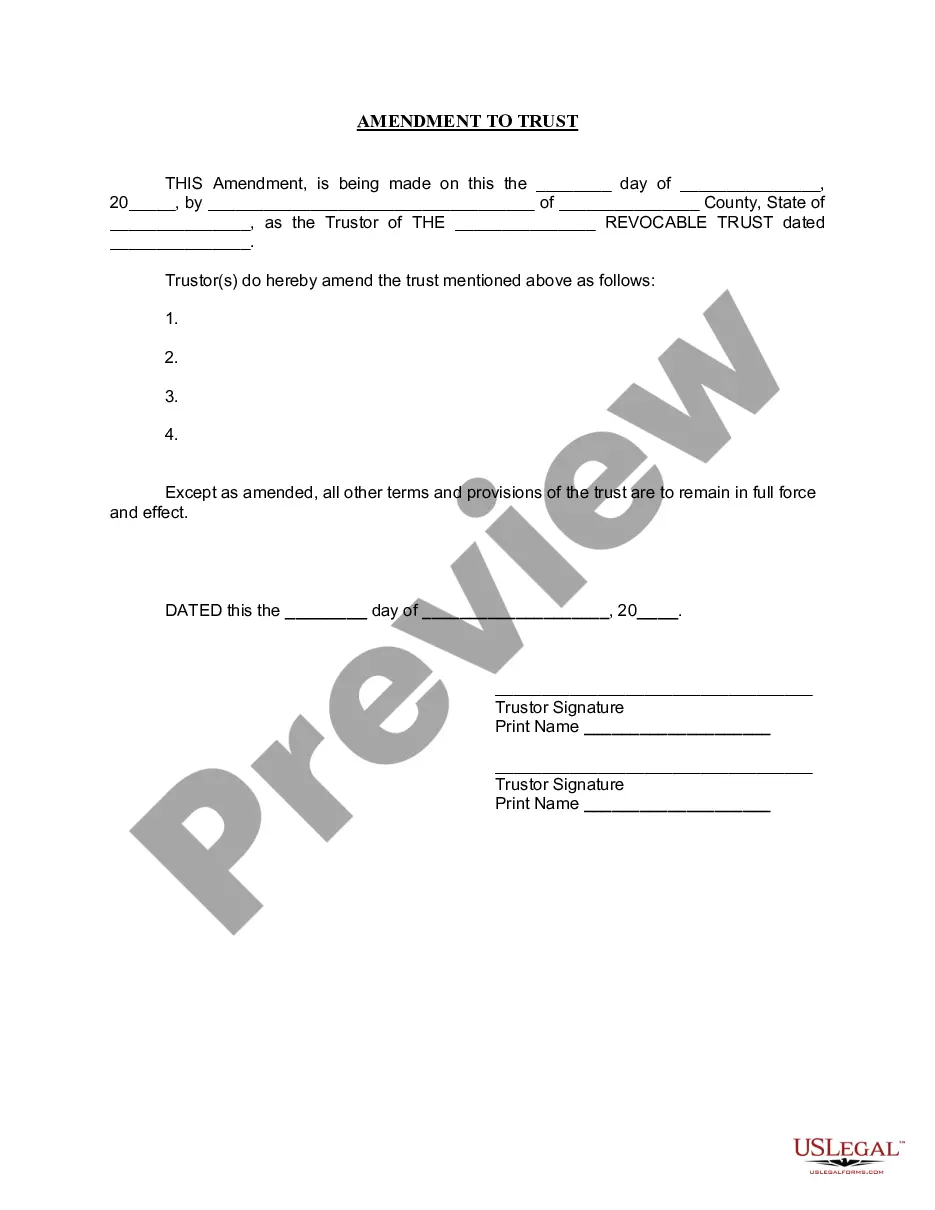

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Green Bay Wisconsin Amendment to Living Trust: A Comprehensive Guide to Modifying Trust Documents Introduction: A Green Bay Wisconsin Amendment to Living Trust refers to the legal process of modifying an existing living trust in Green Bay, Wisconsin. Living trusts are estate planning tools that allow individuals to protect and transfer their assets seamlessly while maintaining control during their lifetime. However, life can bring various changes, such as marriage, divorce, birth of a child, or changes in financial circumstances, which may necessitate adjustments to the original trust. Green Bay Wisconsin Amendment to Living Trust allows residents to make changes to their trust document and update it in accordance with their current wishes. Key Elements of a Green Bay Wisconsin Amendment to Living Trust: 1. Purpose and Scope: A Green Bay Wisconsin Amendment to Living Trust enables trustees to modify specific provisions within their living trust that are no longer applicable or require revision. It allows individuals to adapt their estate planning strategies to changing circumstances without having to create an entirely new trust. 2. Modification Types: Green Bay Wisconsin Amendment to Living Trust can involve multiple modifications, including but not limited to: a. Beneficiary Amendments: This allows trustees to add or remove beneficiaries from the trust, change the share allocated to beneficiaries, or alter the distribution criteria. b. Asset Amendments: Trustees can modify the assets included in the trust, add or remove properties, investments, or accounts, and update their valuation. c. Trustee Amendments: Changes in trustee appointments, successor trustees, or revisions to trustee powers and responsibilities can be made through this amendment. d. Trust Terms Amendments: This amendment allows trustees to modify specific terms or provisions of the trust, such as the age at which beneficiaries gain control over their inheritance or altering the trust's purpose. 3. Legal Requirements: In Green Bay, Wisconsin, a valid Amendment to Living Trust must adhere to certain legal requirements. These may include the need for the document to be in writing, signed by the creator of the trust (known as the settler), and witnessed by one or more individuals. It is important to consult with an experienced estate planning attorney to ensure compliance with all legal prerequisites. 4. Custody and Filing: Once a Green Bay Wisconsin Amendment to Living Trust is created, it should be kept with the original trust document and other estate planning papers in a secure location. While not required, it is recommended to file the amendment with the Register of Deeds office in Brown County to provide official notice of its existence. Types of Green Bay Wisconsin Amendment to Living Trust: 1. General Amendment: This type of amendment encompasses various modifications to the living trust, addressing multiple aspects as deemed necessary by the trustee. 2. Specific Amendment: Sometimes, only a particular provision or condition of the living trust needs modification. In such cases, a Specific Amendment can be utilized to address a single aspect without necessitating changes to the entire document. 3. Amendment and Restatement: When multiple changes or significant revisions are needed, trustees can choose to create an entirely new trust document incorporating the desired modifications. This process is referred to as amendment and restatement. Conclusion: By understanding the purpose, key elements, and various types of Green Bay Wisconsin Amendment to Living Trust, individuals can effectively adapt their trust documents to align with their evolving circumstances. Seeking professional legal advice is crucial to ensure compliance with state laws and maximize the benefits of trust modification, safeguarding the interests of both the settler and beneficiaries.Green Bay Wisconsin Amendment to Living Trust: A Comprehensive Guide to Modifying Trust Documents Introduction: A Green Bay Wisconsin Amendment to Living Trust refers to the legal process of modifying an existing living trust in Green Bay, Wisconsin. Living trusts are estate planning tools that allow individuals to protect and transfer their assets seamlessly while maintaining control during their lifetime. However, life can bring various changes, such as marriage, divorce, birth of a child, or changes in financial circumstances, which may necessitate adjustments to the original trust. Green Bay Wisconsin Amendment to Living Trust allows residents to make changes to their trust document and update it in accordance with their current wishes. Key Elements of a Green Bay Wisconsin Amendment to Living Trust: 1. Purpose and Scope: A Green Bay Wisconsin Amendment to Living Trust enables trustees to modify specific provisions within their living trust that are no longer applicable or require revision. It allows individuals to adapt their estate planning strategies to changing circumstances without having to create an entirely new trust. 2. Modification Types: Green Bay Wisconsin Amendment to Living Trust can involve multiple modifications, including but not limited to: a. Beneficiary Amendments: This allows trustees to add or remove beneficiaries from the trust, change the share allocated to beneficiaries, or alter the distribution criteria. b. Asset Amendments: Trustees can modify the assets included in the trust, add or remove properties, investments, or accounts, and update their valuation. c. Trustee Amendments: Changes in trustee appointments, successor trustees, or revisions to trustee powers and responsibilities can be made through this amendment. d. Trust Terms Amendments: This amendment allows trustees to modify specific terms or provisions of the trust, such as the age at which beneficiaries gain control over their inheritance or altering the trust's purpose. 3. Legal Requirements: In Green Bay, Wisconsin, a valid Amendment to Living Trust must adhere to certain legal requirements. These may include the need for the document to be in writing, signed by the creator of the trust (known as the settler), and witnessed by one or more individuals. It is important to consult with an experienced estate planning attorney to ensure compliance with all legal prerequisites. 4. Custody and Filing: Once a Green Bay Wisconsin Amendment to Living Trust is created, it should be kept with the original trust document and other estate planning papers in a secure location. While not required, it is recommended to file the amendment with the Register of Deeds office in Brown County to provide official notice of its existence. Types of Green Bay Wisconsin Amendment to Living Trust: 1. General Amendment: This type of amendment encompasses various modifications to the living trust, addressing multiple aspects as deemed necessary by the trustee. 2. Specific Amendment: Sometimes, only a particular provision or condition of the living trust needs modification. In such cases, a Specific Amendment can be utilized to address a single aspect without necessitating changes to the entire document. 3. Amendment and Restatement: When multiple changes or significant revisions are needed, trustees can choose to create an entirely new trust document incorporating the desired modifications. This process is referred to as amendment and restatement. Conclusion: By understanding the purpose, key elements, and various types of Green Bay Wisconsin Amendment to Living Trust, individuals can effectively adapt their trust documents to align with their evolving circumstances. Seeking professional legal advice is crucial to ensure compliance with state laws and maximize the benefits of trust modification, safeguarding the interests of both the settler and beneficiaries.