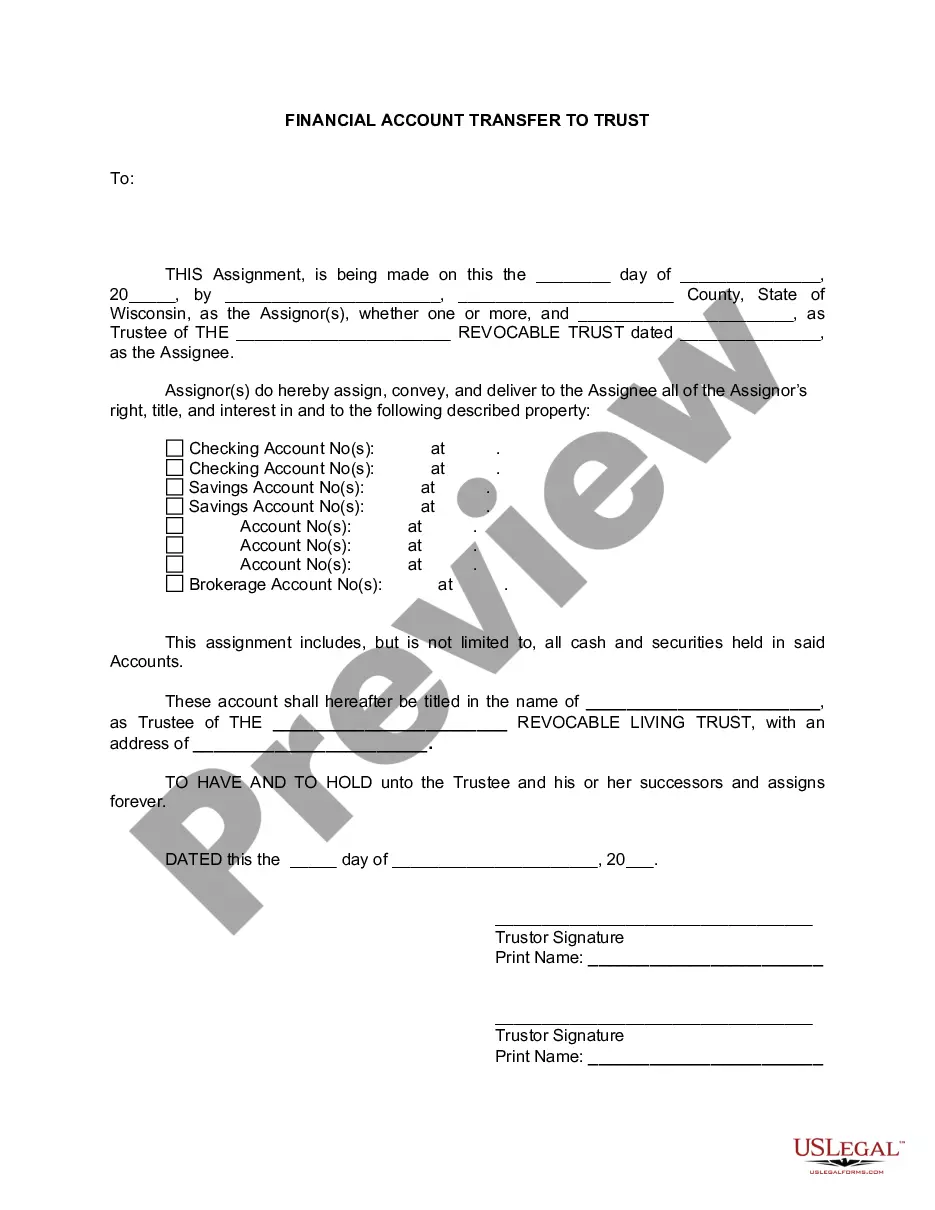

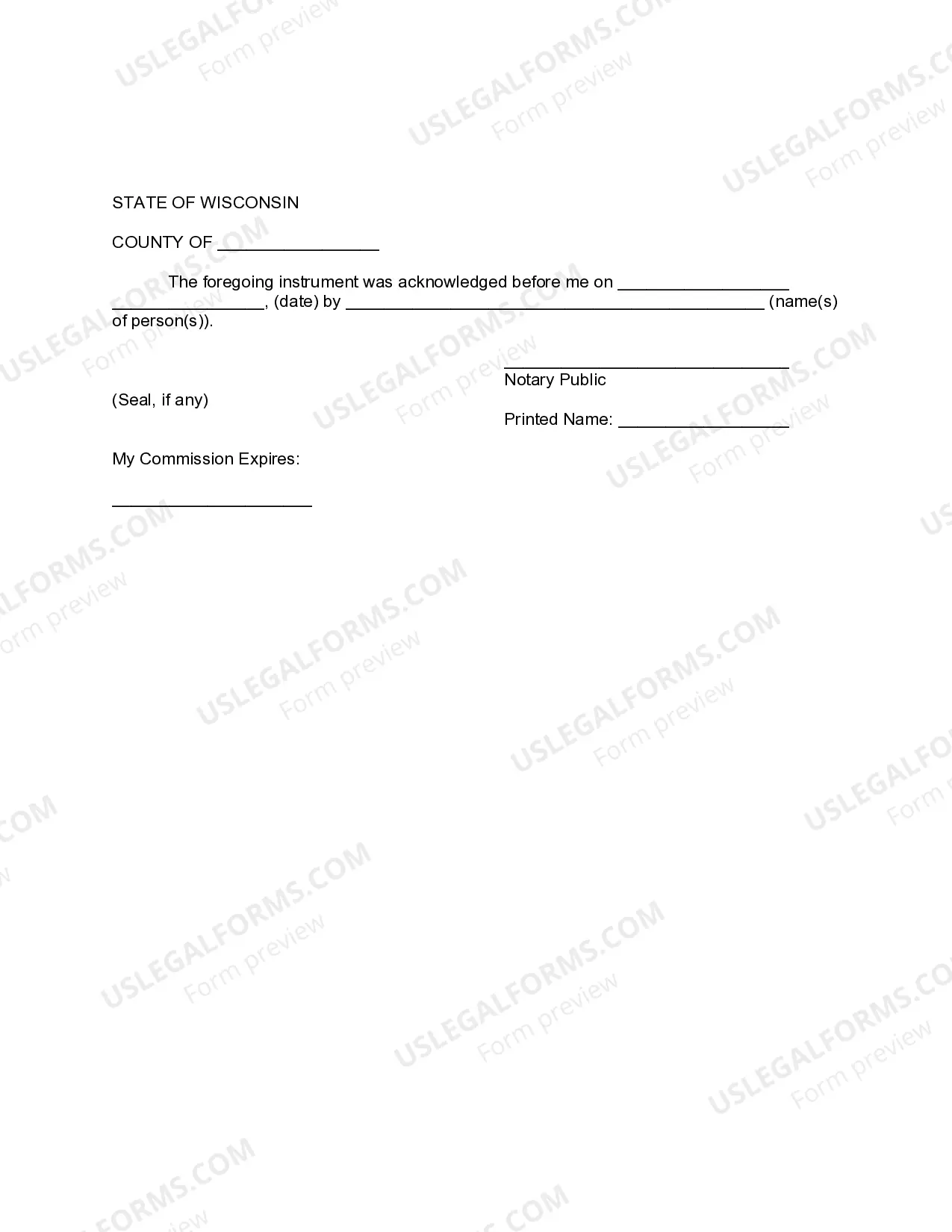

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Green Bay Wisconsin Financial Account Transfer to Living Trust — A Comprehensive Guide In Green Bay, Wisconsin, many individuals opt for the convenience and security of transferring their financial accounts to a living trust. This legal arrangement allows individuals to protect and manage their assets during their lifetime and efficiently transfer them to their beneficiaries upon their death, avoiding the need for probate. Types of Green Bay Wisconsin Financial Account Transfer to Living Trust: 1. Bank Account Transfer: One common type of financial account transfer to a living trust is a bank account transfer. This includes checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). By transferring these accounts to a living trust, individuals ensure that their funds are managed according to their wishes and can be easily accessed by their designated trustee in the event of incapacity or death. 2. Investment Account Transfer: Another type of financial account transfer to a living trust is an investment account transfer. This includes brokerage accounts, stocks, bonds, mutual funds, and other investment products. By transferring these accounts to a living trust, individuals maintain control over their investments and provide smooth management and distribution of assets to their beneficiaries. 3. Retirement Account Transfer: Green Bay residents can also transfer their retirement accounts, such as 401(k)s, IRAs (Individual Retirement Accounts), and pensions, to a living trust. It is important to consult with a financial advisor or tax professional to ensure that these transfers comply with IRS regulations and do not trigger unnecessary tax consequences. Benefits of Green Bay Wisconsin Financial Account Transfer to Living Trust: 1. Probate Avoidance: A living trust enables assets to bypass probate, the court-supervised process of distributing a deceased individual's assets. By avoiding probate, the transfer of the financial accounts to beneficiaries can be completed more efficiently and with less cost. 2. Privacy and Confidentiality: Probate proceedings are public records, which means anyone can access information about the deceased's assets and beneficiaries. By transferring financial accounts to a living trust, individuals can maintain privacy and keep their financial affairs confidential. 3. Incapacity Planning: A living trust allows individuals to designate a successor trustee who can take over the management of their financial accounts in case they become incapacitated. This ensures that their assets are still managed properly and their financial needs are met without the need for a court-appointed guardian. 4. Flexibility and Control: With a living trust, individuals have full control over their assets during their lifetime. They can amend or revoke the trust as long as they are mentally capable. They can also determine the terms and conditions under which their financial accounts are distributed to their beneficiaries. In conclusion, a Green Bay Wisconsin Financial Account Transfer to Living Trust offers numerous advantages for individuals seeking to protect their assets, maintain privacy, and efficiently transfer their financial accounts to their beneficiaries. Whether it's a bank account transfer, investment account transfer, or retirement account transfer, establishing a living trust ensures a smooth and secure transition of assets, as well as peace of mind for the granter and their loved ones.Green Bay Wisconsin Financial Account Transfer to Living Trust — A Comprehensive Guide In Green Bay, Wisconsin, many individuals opt for the convenience and security of transferring their financial accounts to a living trust. This legal arrangement allows individuals to protect and manage their assets during their lifetime and efficiently transfer them to their beneficiaries upon their death, avoiding the need for probate. Types of Green Bay Wisconsin Financial Account Transfer to Living Trust: 1. Bank Account Transfer: One common type of financial account transfer to a living trust is a bank account transfer. This includes checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). By transferring these accounts to a living trust, individuals ensure that their funds are managed according to their wishes and can be easily accessed by their designated trustee in the event of incapacity or death. 2. Investment Account Transfer: Another type of financial account transfer to a living trust is an investment account transfer. This includes brokerage accounts, stocks, bonds, mutual funds, and other investment products. By transferring these accounts to a living trust, individuals maintain control over their investments and provide smooth management and distribution of assets to their beneficiaries. 3. Retirement Account Transfer: Green Bay residents can also transfer their retirement accounts, such as 401(k)s, IRAs (Individual Retirement Accounts), and pensions, to a living trust. It is important to consult with a financial advisor or tax professional to ensure that these transfers comply with IRS regulations and do not trigger unnecessary tax consequences. Benefits of Green Bay Wisconsin Financial Account Transfer to Living Trust: 1. Probate Avoidance: A living trust enables assets to bypass probate, the court-supervised process of distributing a deceased individual's assets. By avoiding probate, the transfer of the financial accounts to beneficiaries can be completed more efficiently and with less cost. 2. Privacy and Confidentiality: Probate proceedings are public records, which means anyone can access information about the deceased's assets and beneficiaries. By transferring financial accounts to a living trust, individuals can maintain privacy and keep their financial affairs confidential. 3. Incapacity Planning: A living trust allows individuals to designate a successor trustee who can take over the management of their financial accounts in case they become incapacitated. This ensures that their assets are still managed properly and their financial needs are met without the need for a court-appointed guardian. 4. Flexibility and Control: With a living trust, individuals have full control over their assets during their lifetime. They can amend or revoke the trust as long as they are mentally capable. They can also determine the terms and conditions under which their financial accounts are distributed to their beneficiaries. In conclusion, a Green Bay Wisconsin Financial Account Transfer to Living Trust offers numerous advantages for individuals seeking to protect their assets, maintain privacy, and efficiently transfer their financial accounts to their beneficiaries. Whether it's a bank account transfer, investment account transfer, or retirement account transfer, establishing a living trust ensures a smooth and secure transition of assets, as well as peace of mind for the granter and their loved ones.