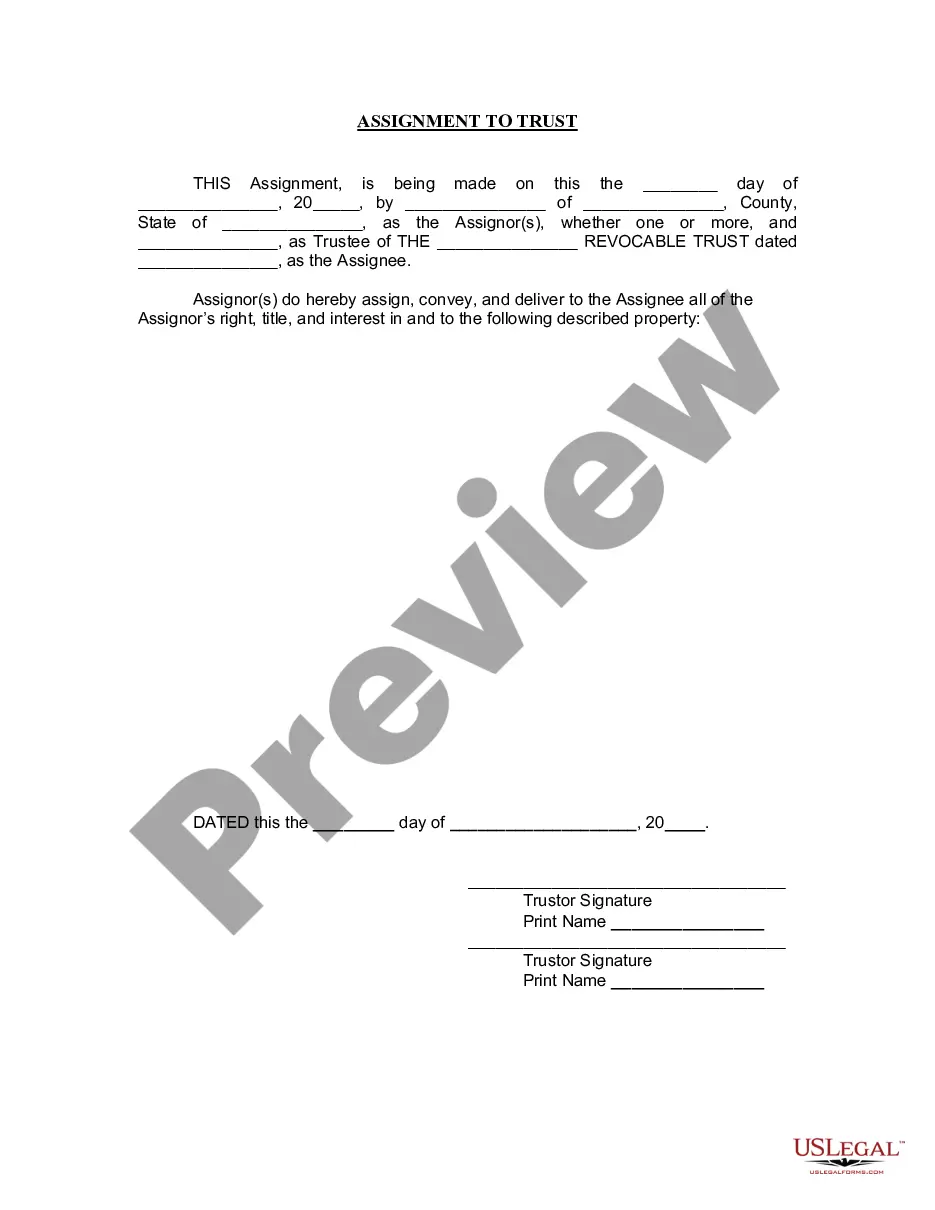

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

In Green Bay, Wisconsin, an assignment to a living trust is a legal process that enables individuals to transfer ownership or control of their assets and properties into a trust for management and distribution purposes. A living trust is a popular estate planning tool that offers numerous benefits for individuals concerned about the efficient management and distribution of their assets upon incapacitation or death. A Green Bay Wisconsin Assignment to Living Trust provides a comprehensive way to arrange, organize, and protect your assets. By transferring assets into a trust, individuals can ensure their wishes are carried out smoothly and efficiently, avoiding the lengthy and costly probate process. This legal mechanism also offers privacy for your estate, as it doesn't become public record like a will does. There are various types of Green Bay Wisconsin Assignments to Living Trust that individuals can utilize based on their specific needs and goals: 1. Revocable Living Trust: This type of trust allows the individual to retain control over their assets during their lifetime. They can modify or revoke the trust at any time, making it a flexible option. It also offers the advantage of avoiding probate and maintaining privacy. 2. Irrevocable Living Trust: With this type of trust, the individual surrenders control over the assets placed in the trust. Once established, it cannot be altered or revoked without the consent of the designated beneficiaries. It offers potential tax benefits and asset protection. 3. Testamentary Living Trust: This trust is created as part of an individual's last will and testament and only takes effect upon their death. It allows for the distribution of assets to beneficiaries according to the specified terms. 4. Special Needs Trust: This type of trust is designed to provide for the care and well-being of a person with disabilities without affecting their eligibility for government benefits. It ensures that the beneficiary's needs are met while preserving their eligibility for assistance programs. 5. Charitable Living Trust: A charitable trust allows individuals to support a cause or organization of their choice while still benefiting from the trust's income generated during their lifetime. It provides tax advantages and the satisfaction of making a positive impact. To embark on a Green Bay Wisconsin Assignment to Living Trust, you'll need to consult with an experienced estate planning attorney who can guide you through the entire process. They will assist in assessing your personal situation, explaining the different types of trusts available, and drafting the necessary legal documents tailored to your specific needs. In conclusion, a Green Bay Wisconsin Assignment to Living Trust is an effective estate planning tool that offers individuals peace of mind, privacy, and control over the management and distribution of their assets. By creating a living trust, individuals can ensure their desires are met, while minimizing complications and costs for their loved ones in the future.In Green Bay, Wisconsin, an assignment to a living trust is a legal process that enables individuals to transfer ownership or control of their assets and properties into a trust for management and distribution purposes. A living trust is a popular estate planning tool that offers numerous benefits for individuals concerned about the efficient management and distribution of their assets upon incapacitation or death. A Green Bay Wisconsin Assignment to Living Trust provides a comprehensive way to arrange, organize, and protect your assets. By transferring assets into a trust, individuals can ensure their wishes are carried out smoothly and efficiently, avoiding the lengthy and costly probate process. This legal mechanism also offers privacy for your estate, as it doesn't become public record like a will does. There are various types of Green Bay Wisconsin Assignments to Living Trust that individuals can utilize based on their specific needs and goals: 1. Revocable Living Trust: This type of trust allows the individual to retain control over their assets during their lifetime. They can modify or revoke the trust at any time, making it a flexible option. It also offers the advantage of avoiding probate and maintaining privacy. 2. Irrevocable Living Trust: With this type of trust, the individual surrenders control over the assets placed in the trust. Once established, it cannot be altered or revoked without the consent of the designated beneficiaries. It offers potential tax benefits and asset protection. 3. Testamentary Living Trust: This trust is created as part of an individual's last will and testament and only takes effect upon their death. It allows for the distribution of assets to beneficiaries according to the specified terms. 4. Special Needs Trust: This type of trust is designed to provide for the care and well-being of a person with disabilities without affecting their eligibility for government benefits. It ensures that the beneficiary's needs are met while preserving their eligibility for assistance programs. 5. Charitable Living Trust: A charitable trust allows individuals to support a cause or organization of their choice while still benefiting from the trust's income generated during their lifetime. It provides tax advantages and the satisfaction of making a positive impact. To embark on a Green Bay Wisconsin Assignment to Living Trust, you'll need to consult with an experienced estate planning attorney who can guide you through the entire process. They will assist in assessing your personal situation, explaining the different types of trusts available, and drafting the necessary legal documents tailored to your specific needs. In conclusion, a Green Bay Wisconsin Assignment to Living Trust is an effective estate planning tool that offers individuals peace of mind, privacy, and control over the management and distribution of their assets. By creating a living trust, individuals can ensure their desires are met, while minimizing complications and costs for their loved ones in the future.