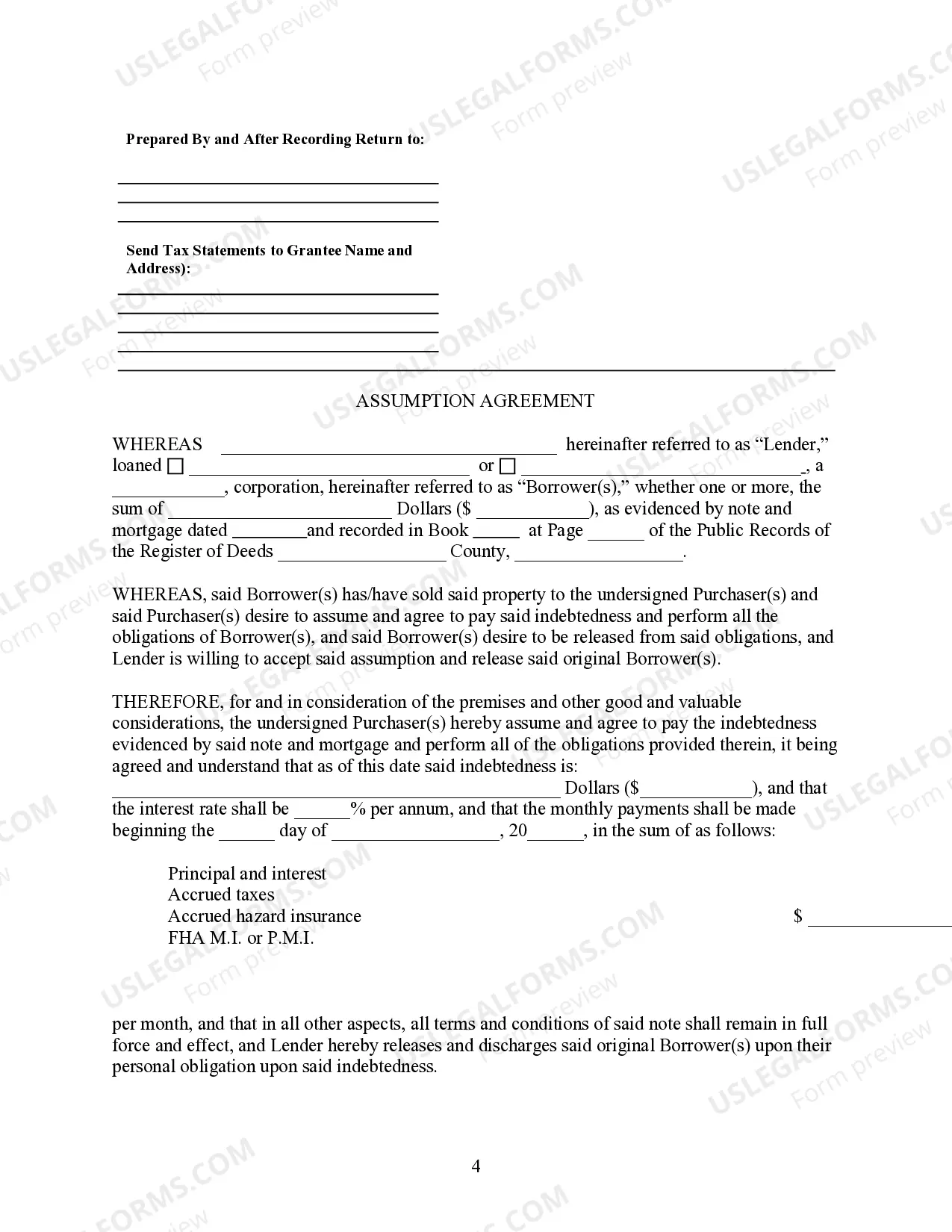

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Green Bay Wisconsin Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the terms and conditions of transferring a mortgage from the original mortgagor to a new party, known as the assumption. This agreement is commonly used in real estate transactions in the Green Bay Area of Wisconsin. The Assumption Agreement of Mortgage serves as a record of the transfer of the mortgage liability, ensuring that all parties involved are aware of their rights and responsibilities. It offers protection to both the original mortgagor and the assumption, as they agree to assume the obligations associated with the existing mortgage. Keywords: Green Bay Wisconsin, Assumption Agreement, Mortgage, Release, Original Mortgagors, Real Estate Transactions, Liability, Obligations, Legal Document Different types of Green Bay Wisconsin Assumption Agreement of Mortgage and Release of Original Mortgagors may include: 1. Residential Assumption Agreement: This type of assumption agreement applies to residential properties, such as single-family homes, townhouses, or condominiums. It outlines the terms that both parties, the original mortgagor and the assumption, agree upon for the assumption of the mortgage. 2. Commercial Assumption Agreement: As the name suggests, this agreement applies to commercial properties, including office buildings, retail spaces, or industrial facilities. It may have different clauses and provisions specific to commercial real estate transactions. 3. FHA Assumption Agreement: If the original mortgage was insured by the Federal Housing Administration (FHA), a specialized assumption agreement may be required. The FHA may have additional guidelines and requirements for the transfer of the mortgage, which need to be adhered to in the agreement. 4. VA Assumption Agreement: If the mortgage is backed by the Department of Veterans Affairs (VA) for a property owned by a veteran, a VA-specific assumption agreement may be necessary. This agreement would follow the VA's regulations and may require the approval of the VA before the assumption can take place. 5. Conventional Assumption Agreement: This type of assumption agreement is applicable when the mortgage is not insured or guaranteed by a specialized government entity, such as the FHA or VA. It typically follows local laws and regulations governing mortgage assumptions in the Green Bay, Wisconsin area. It is essential to consult with a real estate attorney or a mortgage professional experienced in Green Bay, Wisconsin, to ensure that the Assumption Agreement of Mortgage and Release of Original Mortgagors is prepared accurately and meets all legal requirements.The Green Bay Wisconsin Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the terms and conditions of transferring a mortgage from the original mortgagor to a new party, known as the assumption. This agreement is commonly used in real estate transactions in the Green Bay Area of Wisconsin. The Assumption Agreement of Mortgage serves as a record of the transfer of the mortgage liability, ensuring that all parties involved are aware of their rights and responsibilities. It offers protection to both the original mortgagor and the assumption, as they agree to assume the obligations associated with the existing mortgage. Keywords: Green Bay Wisconsin, Assumption Agreement, Mortgage, Release, Original Mortgagors, Real Estate Transactions, Liability, Obligations, Legal Document Different types of Green Bay Wisconsin Assumption Agreement of Mortgage and Release of Original Mortgagors may include: 1. Residential Assumption Agreement: This type of assumption agreement applies to residential properties, such as single-family homes, townhouses, or condominiums. It outlines the terms that both parties, the original mortgagor and the assumption, agree upon for the assumption of the mortgage. 2. Commercial Assumption Agreement: As the name suggests, this agreement applies to commercial properties, including office buildings, retail spaces, or industrial facilities. It may have different clauses and provisions specific to commercial real estate transactions. 3. FHA Assumption Agreement: If the original mortgage was insured by the Federal Housing Administration (FHA), a specialized assumption agreement may be required. The FHA may have additional guidelines and requirements for the transfer of the mortgage, which need to be adhered to in the agreement. 4. VA Assumption Agreement: If the mortgage is backed by the Department of Veterans Affairs (VA) for a property owned by a veteran, a VA-specific assumption agreement may be necessary. This agreement would follow the VA's regulations and may require the approval of the VA before the assumption can take place. 5. Conventional Assumption Agreement: This type of assumption agreement is applicable when the mortgage is not insured or guaranteed by a specialized government entity, such as the FHA or VA. It typically follows local laws and regulations governing mortgage assumptions in the Green Bay, Wisconsin area. It is essential to consult with a real estate attorney or a mortgage professional experienced in Green Bay, Wisconsin, to ensure that the Assumption Agreement of Mortgage and Release of Original Mortgagors is prepared accurately and meets all legal requirements.