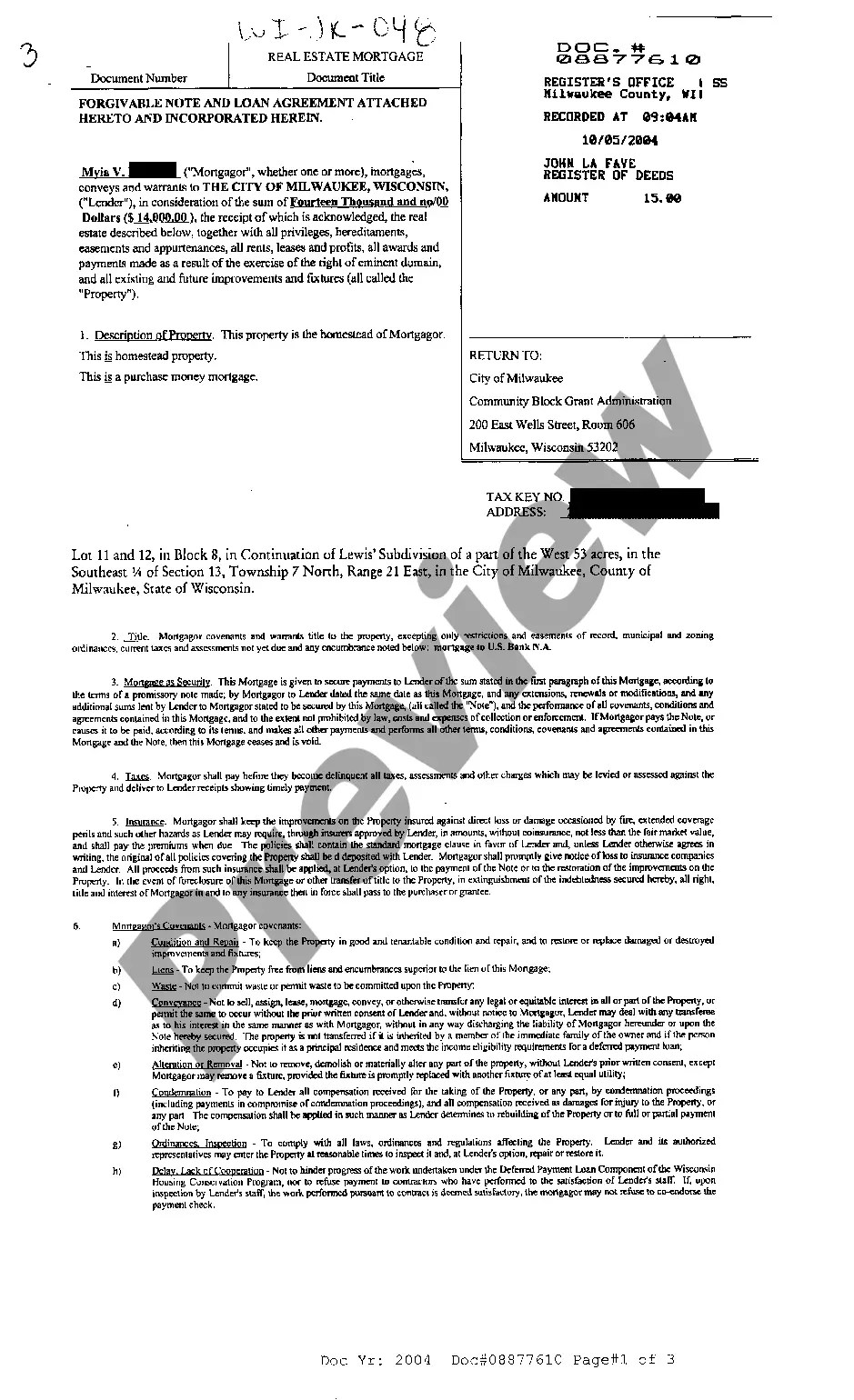

Green Bay Wisconsin Real Estate Mortgage for Forgivable Note and Loan Agreement is a legal document that outlines the terms and conditions of a mortgage loan agreement in the Green Bay, Wisconsin area. This agreement is primarily used in real estate transactions where a lender provides financing to a borrower for the purchase or refinancing of a property. The Forgivable Note and Loan Agreement typically consist of several key components, including: 1. Mortgage Loan: It is a financial agreement where the lender agrees to provide a loan to the borrower, secured by a mortgage on the property in Green Bay, Wisconsin. The loan amount, interest rate, repayment terms, and other loan-specific details are specified in this section. 2. Forgivable Note: Unlike traditional mortgages, the Forgivable Note includes a forgiveness component, wherein a certain portion of the loan is forgiven over time or upon meeting specific conditions. This forgiveness may be contingent on the borrower's continued ownership and occupancy of the property, improvements made to the property, or other agreed-upon terms. 3. Green Bay, Wisconsin Real Estate: This section includes details regarding the specific property in question. It may include the property's address, legal description, title information, and any other relevant details to identify and describe the property being mortgaged. 4. Loan Terms and Conditions: The agreement will outline various terms and conditions that both the lender and borrower must adhere to. These may include the loan repayment schedule, interest rate, late payment penalties, default provisions, and any additional fees or charges associated with the loan. 5. Property Maintenance and Insurance: The borrower is typically obligated to maintain insurance coverage on the property and provide evidence of such coverage to the lender. The agreement may also outline the borrower's responsibilities regarding the maintenance and upkeep of the property during the loan term. Types of Green Bay Wisconsin Real Estate Mortgage for Forgivable Note and Loan Agreement may include: 1. First Mortgage: This is the primary mortgage that is recorded first and holds the first lien position on the property. It takes priority over any subsequent mortgages or loans on the property. 2. Second Mortgage: In some cases, a borrower may need additional financing and can secure a second mortgage on the property. The second mortgage ranks behind the first mortgage in terms of priority and repayment in case of default. 3. Refinance Mortgage: This type of mortgage is used when a borrower wishes to replace an existing mortgage with a new one, often to take advantage of better loan terms or interest rates. 4. Home Equity Loan: A home equity loan allows homeowners to borrow against the equity they have built up in their property. These loans are often used for renovations, debt consolidation, or other significant expenses. It is important to consult with a qualified real estate attorney or mortgage professional when entering into a Green Bay Wisconsin Real Estate Mortgage for Forgivable Note and Loan Agreement to ensure all legal requirements and obligations are properly addressed.

Green Bay Wisconsin Real Estate Mortgage for Forgivable Note and Loan Agreement

State:

Wisconsin

City:

Green Bay

Control #:

WI-JK-048

Format:

PDF

Instant download

This form is available by subscription

Description

Real Estate Mortgage for Forgivable Note and Loan Agreement

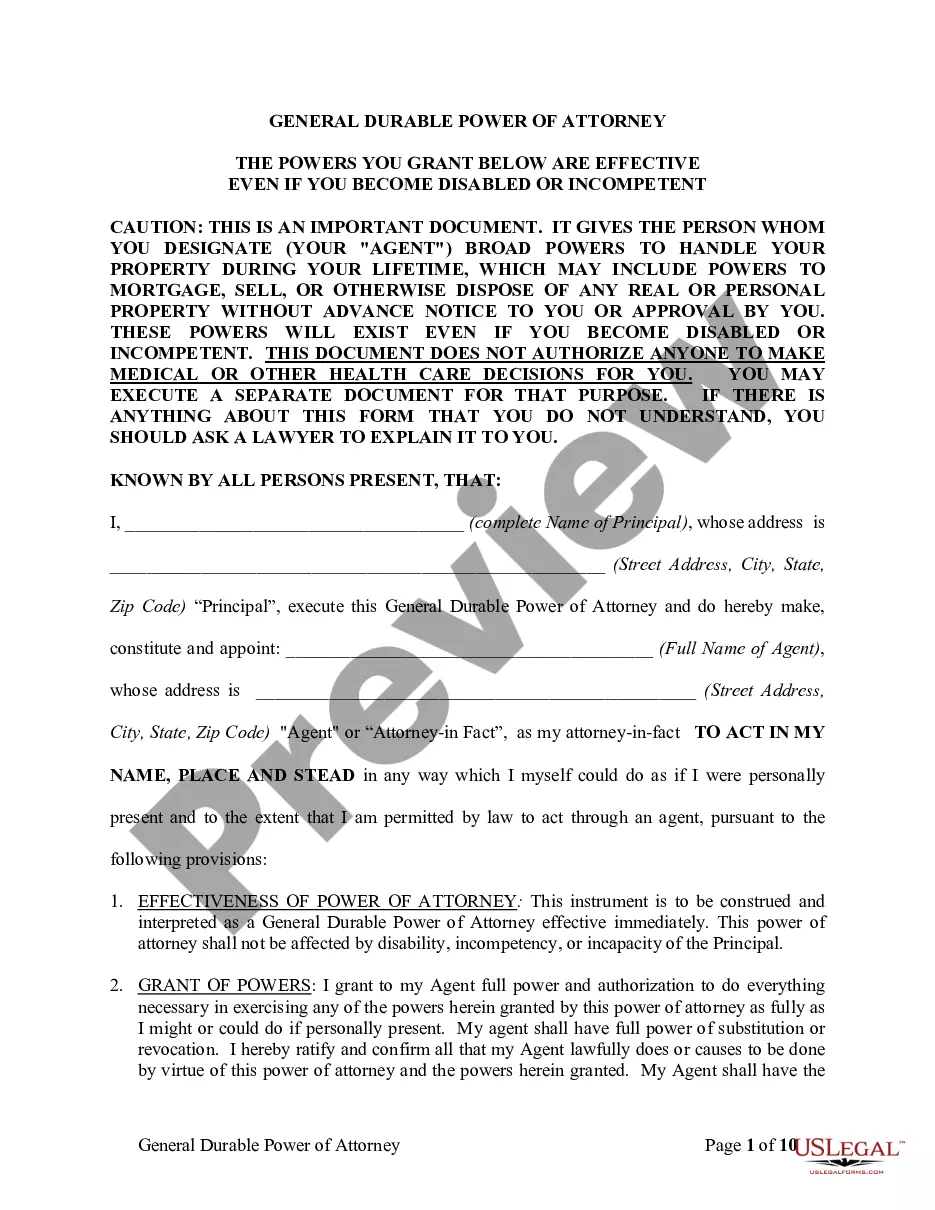

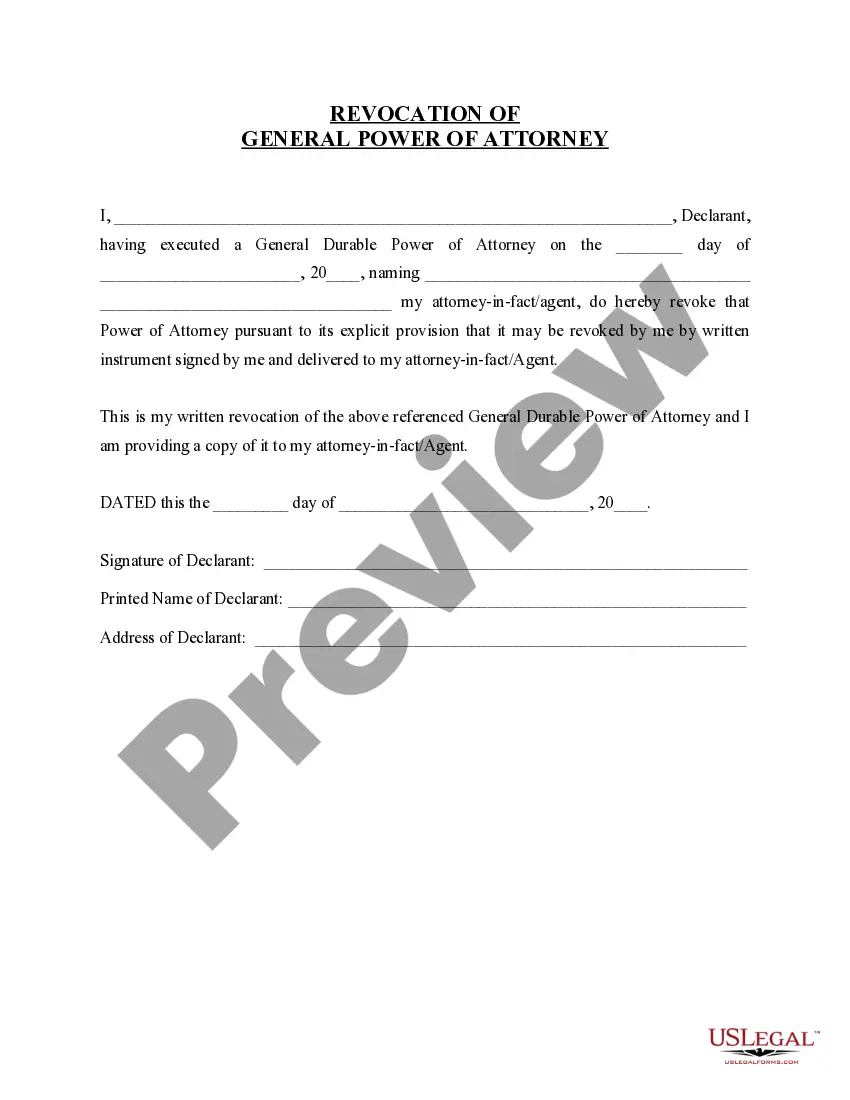

Green Bay Wisconsin Real Estate Mortgage for Forgivable Note and Loan Agreement is a legal document that outlines the terms and conditions of a mortgage loan agreement in the Green Bay, Wisconsin area. This agreement is primarily used in real estate transactions where a lender provides financing to a borrower for the purchase or refinancing of a property. The Forgivable Note and Loan Agreement typically consist of several key components, including: 1. Mortgage Loan: It is a financial agreement where the lender agrees to provide a loan to the borrower, secured by a mortgage on the property in Green Bay, Wisconsin. The loan amount, interest rate, repayment terms, and other loan-specific details are specified in this section. 2. Forgivable Note: Unlike traditional mortgages, the Forgivable Note includes a forgiveness component, wherein a certain portion of the loan is forgiven over time or upon meeting specific conditions. This forgiveness may be contingent on the borrower's continued ownership and occupancy of the property, improvements made to the property, or other agreed-upon terms. 3. Green Bay, Wisconsin Real Estate: This section includes details regarding the specific property in question. It may include the property's address, legal description, title information, and any other relevant details to identify and describe the property being mortgaged. 4. Loan Terms and Conditions: The agreement will outline various terms and conditions that both the lender and borrower must adhere to. These may include the loan repayment schedule, interest rate, late payment penalties, default provisions, and any additional fees or charges associated with the loan. 5. Property Maintenance and Insurance: The borrower is typically obligated to maintain insurance coverage on the property and provide evidence of such coverage to the lender. The agreement may also outline the borrower's responsibilities regarding the maintenance and upkeep of the property during the loan term. Types of Green Bay Wisconsin Real Estate Mortgage for Forgivable Note and Loan Agreement may include: 1. First Mortgage: This is the primary mortgage that is recorded first and holds the first lien position on the property. It takes priority over any subsequent mortgages or loans on the property. 2. Second Mortgage: In some cases, a borrower may need additional financing and can secure a second mortgage on the property. The second mortgage ranks behind the first mortgage in terms of priority and repayment in case of default. 3. Refinance Mortgage: This type of mortgage is used when a borrower wishes to replace an existing mortgage with a new one, often to take advantage of better loan terms or interest rates. 4. Home Equity Loan: A home equity loan allows homeowners to borrow against the equity they have built up in their property. These loans are often used for renovations, debt consolidation, or other significant expenses. It is important to consult with a qualified real estate attorney or mortgage professional when entering into a Green Bay Wisconsin Real Estate Mortgage for Forgivable Note and Loan Agreement to ensure all legal requirements and obligations are properly addressed.

Free preview

How to fill out Green Bay Wisconsin Real Estate Mortgage For Forgivable Note And Loan Agreement?

If you’ve already used our service before, log in to your account and save the Green Bay Wisconsin Real Estate Mortgage for Forgivable Note and Loan Agreement on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Green Bay Wisconsin Real Estate Mortgage for Forgivable Note and Loan Agreement. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!