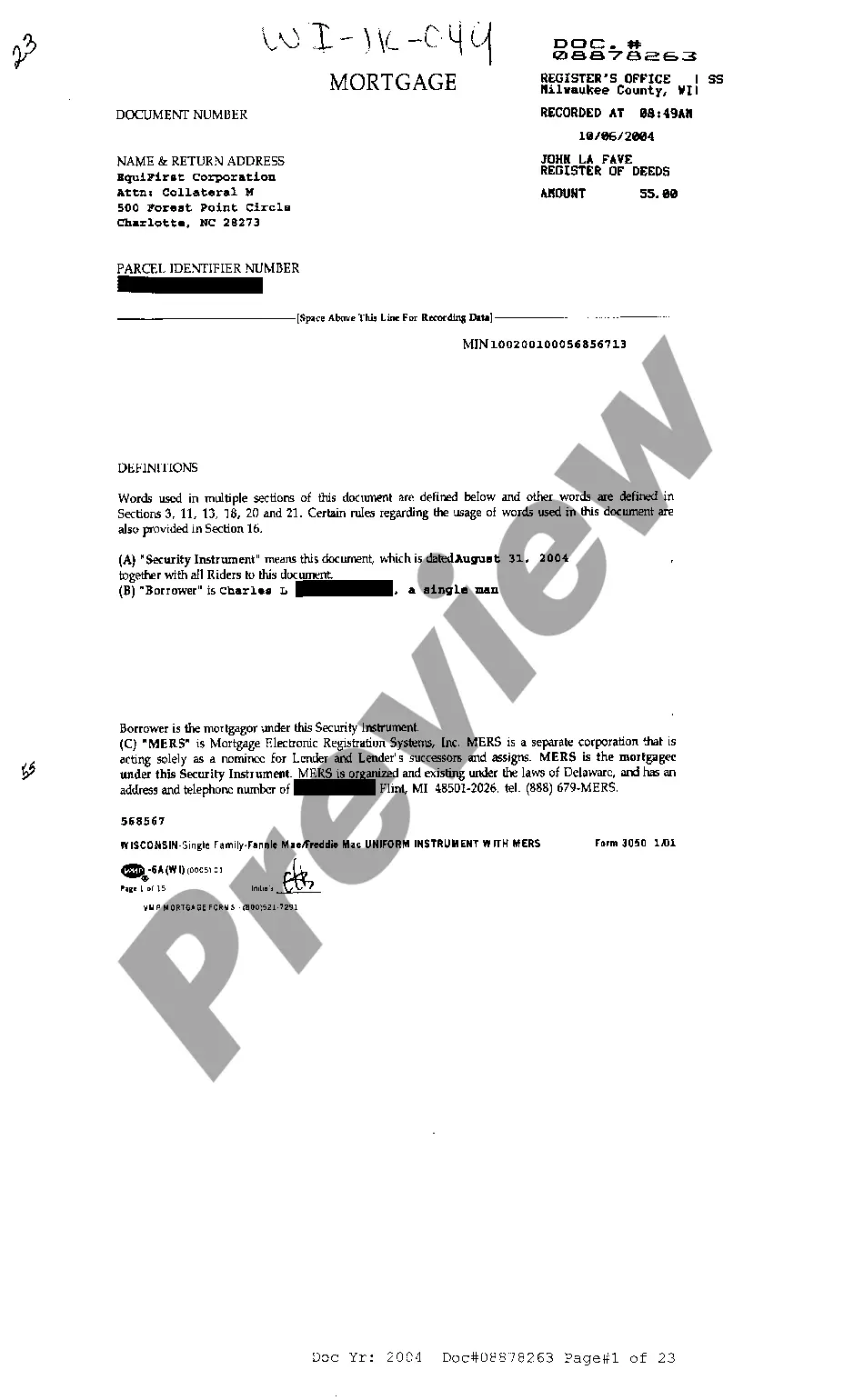

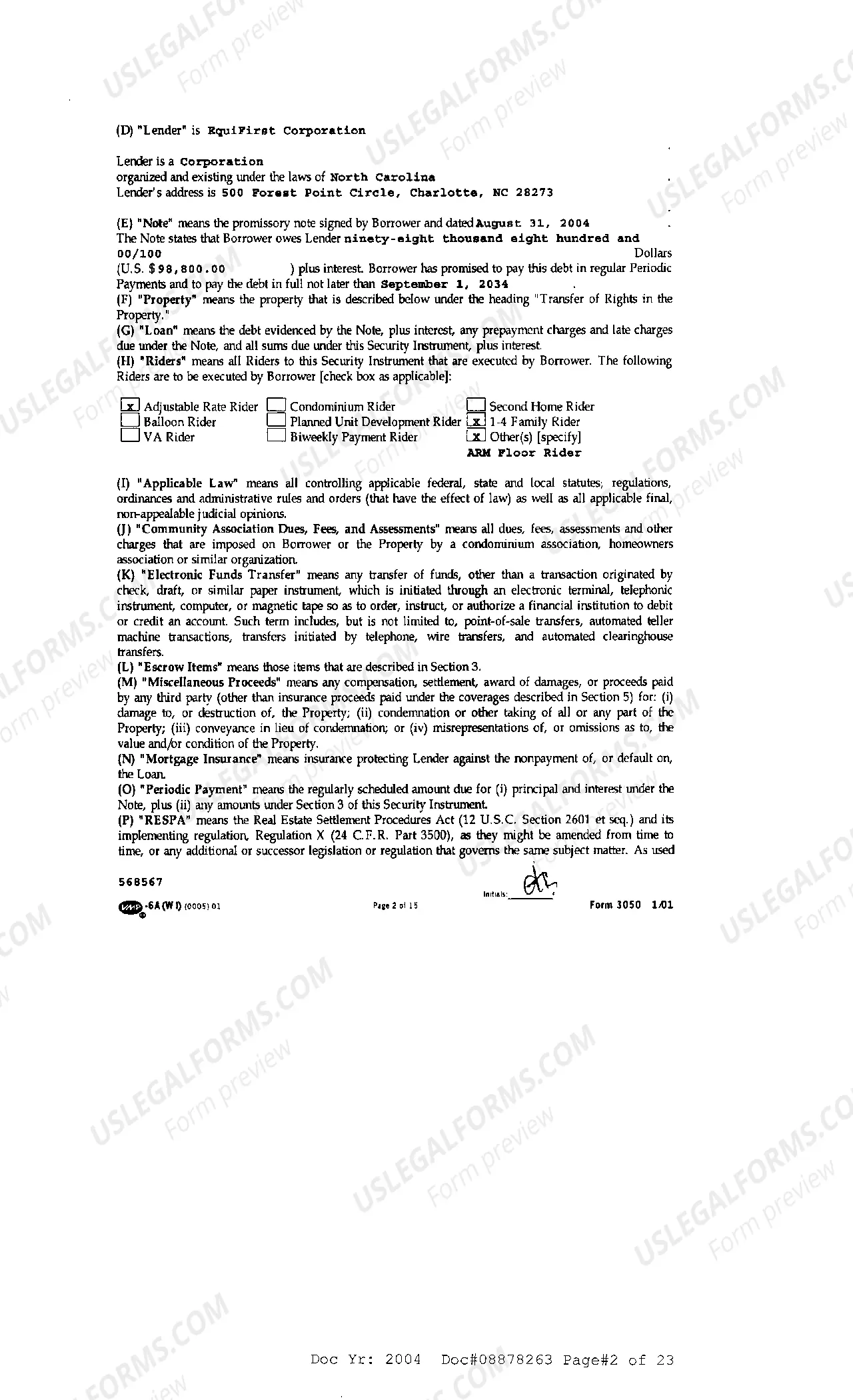

Green Bay Wisconsin Sample Mortgage A Green Bay Wisconsin Sample Mortgage is a mortgage loan offered in the city of Green Bay, Wisconsin. This loan is specifically designed to help potential homeowners in Green Bay finance their property purchases. Green Bay, located in Northeastern Wisconsin, is known for its beautiful landscapes, booming economy, and vibrant community. With its strong housing market and a variety of mortgage options, purchasing a home in Green Bay has never been easier. Mortgages in Green Bay Wisconsin Sample come in different types to cater to various financial situations and needs. Here are some common types of mortgages available in Green Bay: 1. Fixed-Rate Mortgage: This type of mortgage offers a stable interest rate throughout the loan term, typically 15 or 30 years. With a fixed-rate mortgage, homeowners can enjoy predictability and consistency in their monthly payments. 2. Adjustable-Rate Mortgage (ARM): An ARM offers an initial fixed interest rate for a specific period, usually 3, 5, 7, or 10 years, and then adjusts annually based on market conditions. This type of mortgage may be suitable for those planning to stay in their homes for a shorter duration or expecting their income to increase. 3. FHA Loan: The Federal Housing Administration (FHA) offers loans with reduced down payment requirements and more lenient credit score criteria. FHA loans are insured by the government, making them an attractive option for first-time homebuyers or those with limited down payment funds. 4. VA Loan: Veterans, active-duty service members, and eligible surviving spouses can utilize a VA loan, which is guaranteed by the Department of Veterans Affairs. VA loans often offer low or no down payment options and competitive interest rates for qualified borrowers. 5. Jumbo Loan: If you're looking to purchase a high-value property in Green Bay, a jumbo loan might be the right choice. Jumbo loans exceed the conforming loan limits set by Fannie Mae and Freddie Mac and are typically used for luxury homes or properties in high-cost areas. When applying for a Green Bay Wisconsin Sample Mortgage, it's important to consider factors such as credit score, income, debt-to-income ratio, and the amount of the down payment. Working with a reputable mortgage lender or consulting with a mortgage broker can help prospective homebuyers find the right mortgage option that suits their financial situation and goals. In conclusion, Green Bay Wisconsin Sample Mortgages provide homebuyers in Green Bay with various options to finance their dream homes. Whether you prefer a fixed-rate mortgage, an adjustable-rate mortgage, a government-backed loan, or a jumbo loan, Green Bay offers a range of mortgage products to cater to different financial needs and situations.

Green Bay Wisconsin Sample Mortgage

Description

How to fill out Green Bay Wisconsin Sample Mortgage?

We always want to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are very expensive. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Green Bay Wisconsin Sample Mortgage or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Green Bay Wisconsin Sample Mortgage adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Green Bay Wisconsin Sample Mortgage is proper for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!