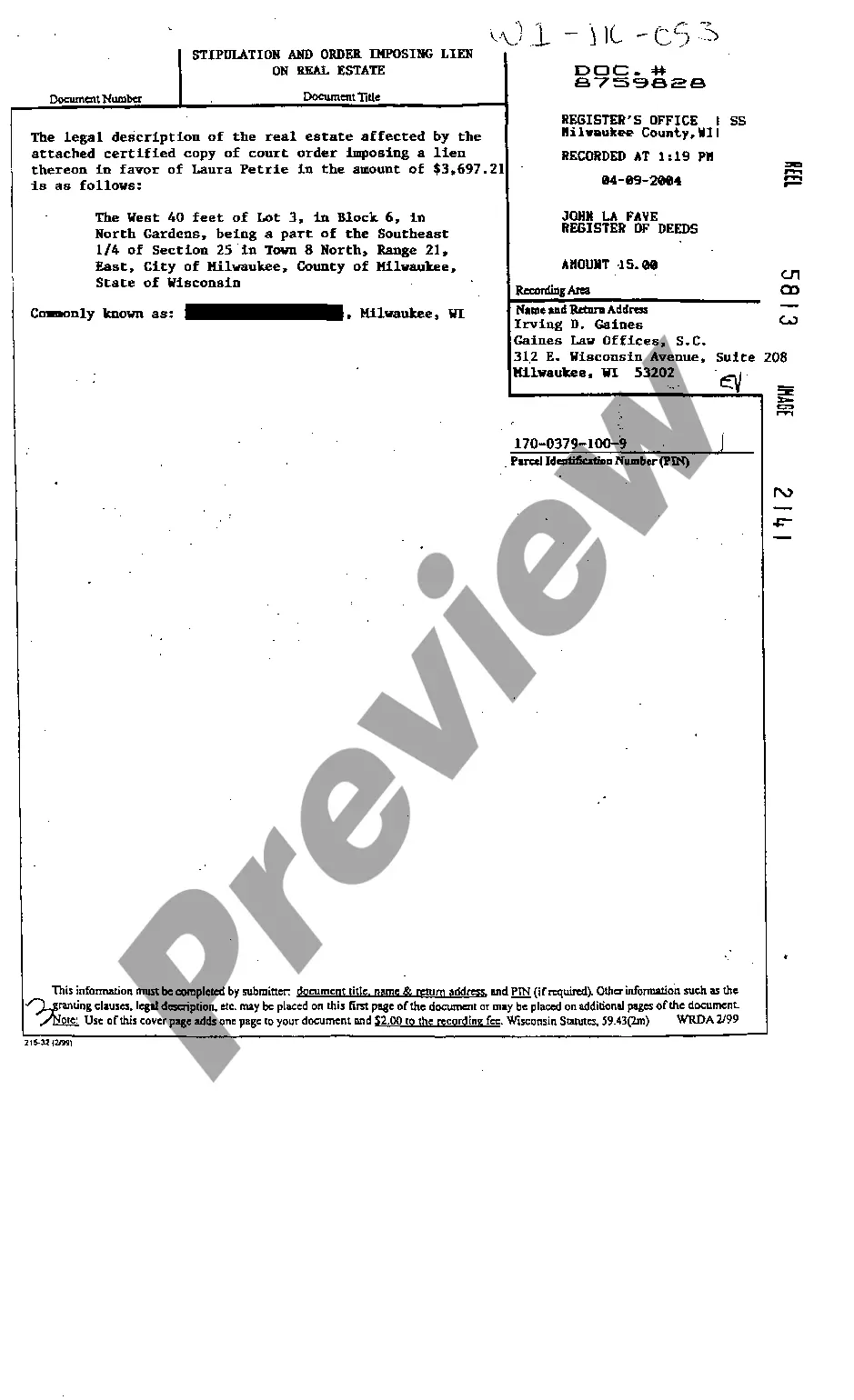

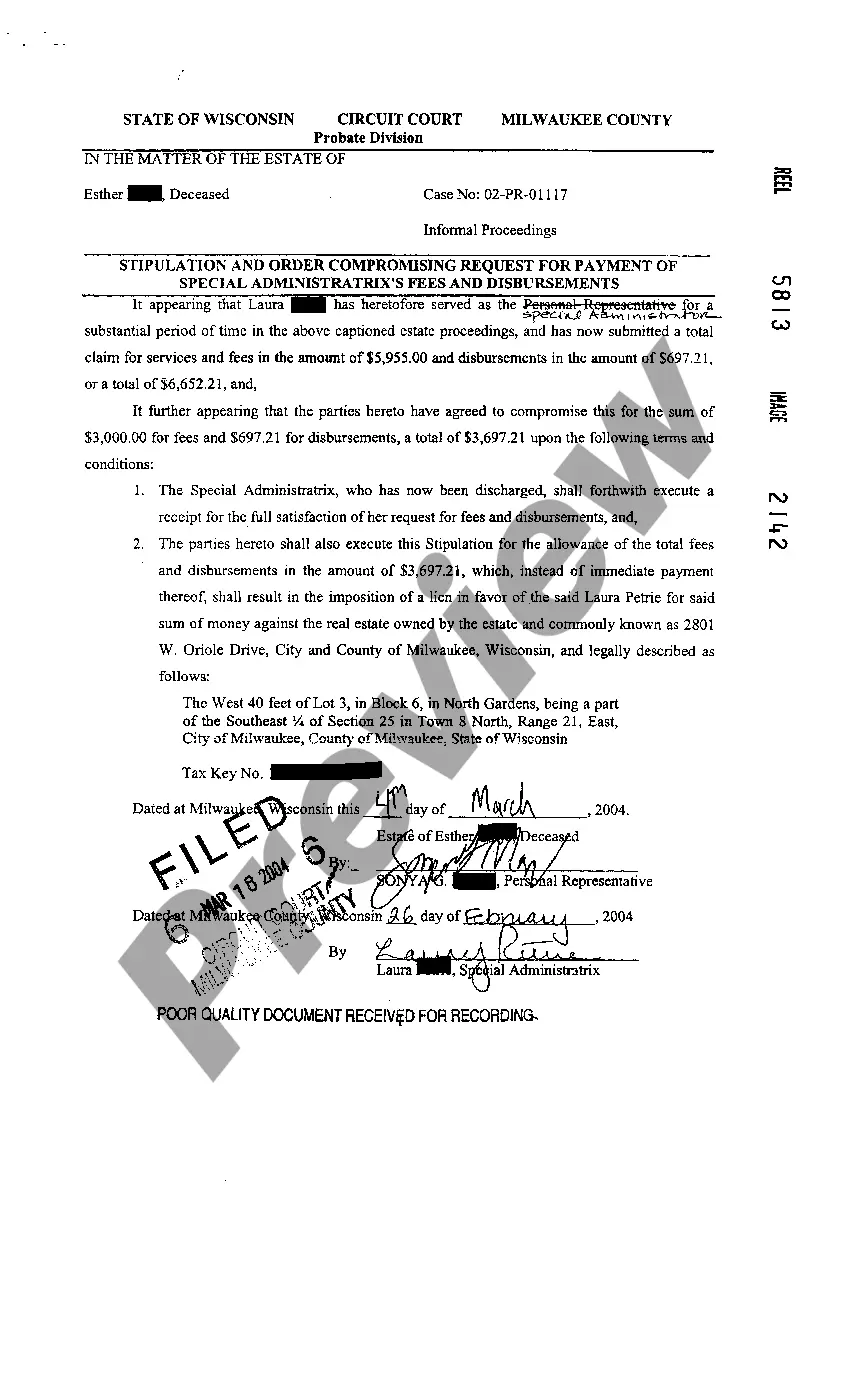

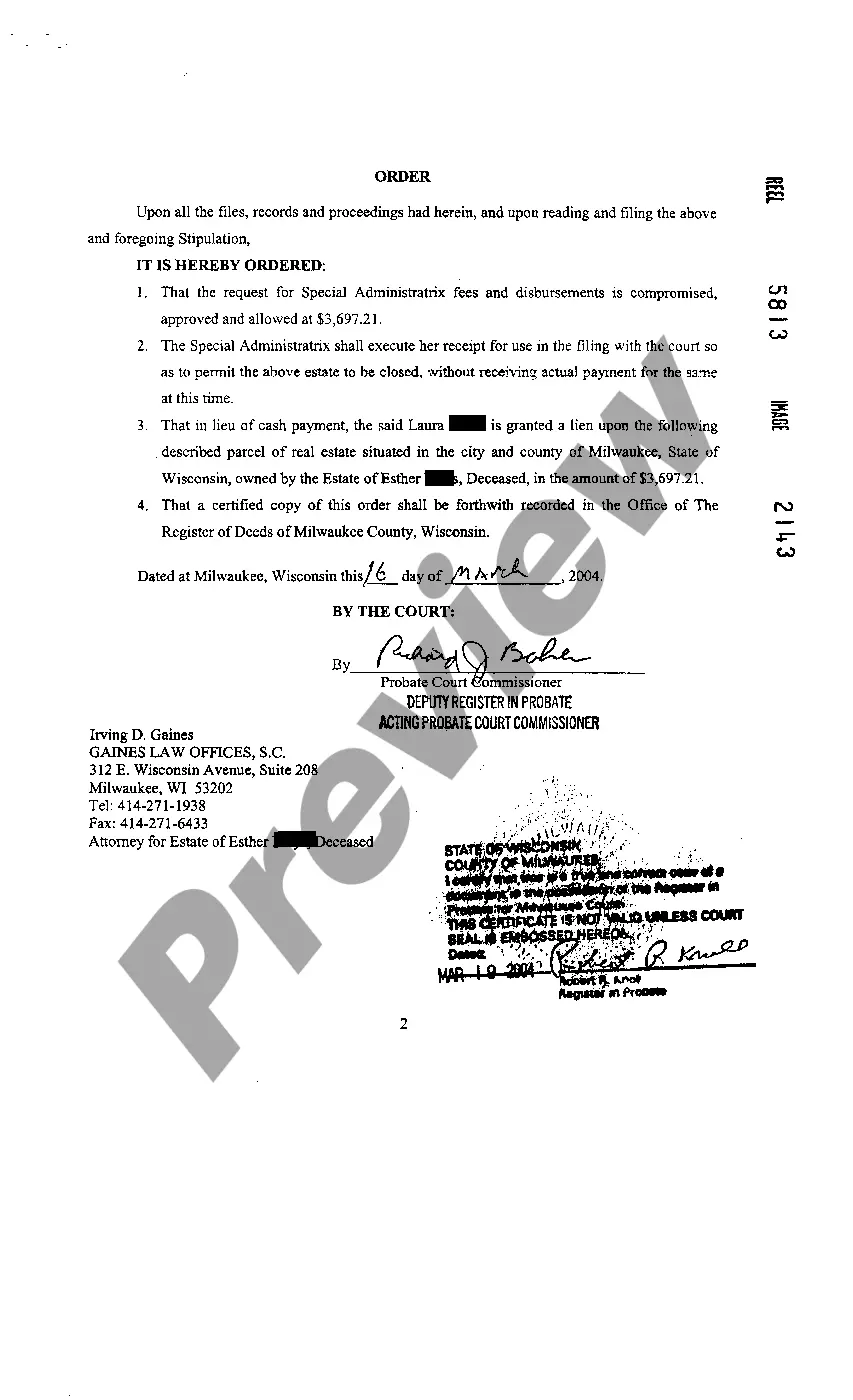

A Green Bay Wisconsin stipulation and order imposing lien on real estate for a special administrator is a legal document that establishes a claim or encumbrance on a property in Green Bay, Wisconsin. This stipulation and order are typically filed when a special administrator is appointed to handle the estate of a deceased individual and there are outstanding debts, taxes, or expenses that need to be paid. Keywords: Green Bay Wisconsin, stipulation and order, imposing lien, real estate, special administrator. Different types of Green Bay Wisconsin stipulation and order imposing lien on real estate for a special administrator may include: 1. Estate Tax Lien Stipulation and Order: This type of stipulation and order is filed when the estate of the deceased individual owes estate taxes to the state or federal government. The special administrator will work with the tax authorities to determine the outstanding amount and negotiate a payment plan or request a waiver. 2. Creditor's Lien Stipulation and Order: When the deceased individual had outstanding debts, such as credit card balances, loans, or mortgages, this stipulation and order is filed to impose a lien on the property to secure the payment of these debts. The special administrator will work with creditors to negotiate repayment terms or settle the debts. 3. Probate Administration Lien Stipulation and Order: In cases where the deceased individual's estate requires administrative expenses, such as attorney fees, court costs, and other professional fees, this stipulation and order is filed to impose a lien on the property. The special administrator will ensure that these expenses are paid from the proceeds of the property sale or other assets of the estate. 4. Judgment Lien Stipulation and Order: If there were any legal judgments against the deceased individual, such as unpaid court judgments or liens resulting from lawsuits, this stipulation and order can be filed to impose a lien on the property. The special administrator will work to satisfy or settle these judgments to clear the title and transfer the property to the rightful heirs or beneficiaries. In summary, a Green Bay Wisconsin stipulation and order imposing lien on real estate for a special administrator is a legal document that establishes a claim or encumbrance on a property. Types of such stipulations and orders can include estate tax liens, creditor's liens, probate administration liens, and judgment liens. These documents aim to address outstanding debts, taxes, or expenses related to the deceased individual's estate.

Green Bay Wisconsin Stipulation And Order Imposing Lien On Real Estate for Special Administrator

Description

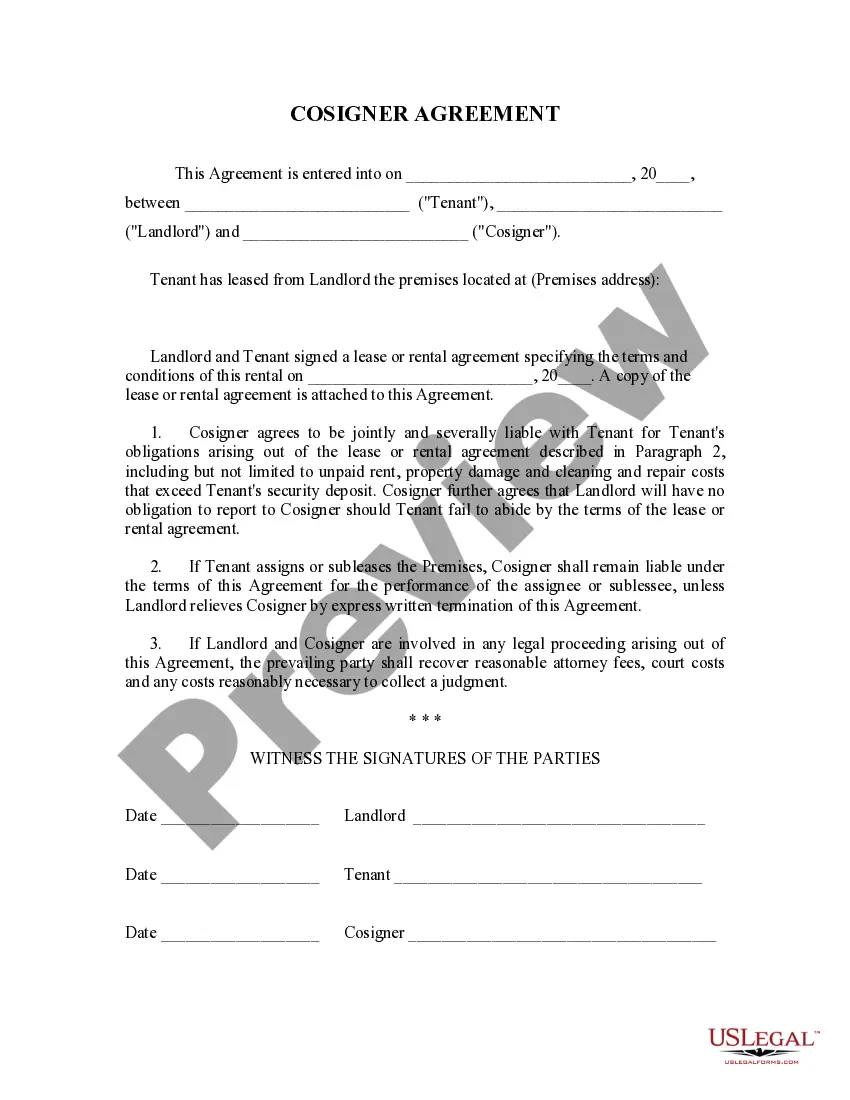

How to fill out Green Bay Wisconsin Stipulation And Order Imposing Lien On Real Estate For Special Administrator?

Make use of the US Legal Forms and obtain instant access to any form you need. Our helpful website with a large number of documents simplifies the way to find and get virtually any document sample you want. You can export, complete, and certify the Green Bay Wisconsin Stipulation And Order Imposing Lien On Real Estate for Special Administrator in just a matter of minutes instead of browsing the web for hours searching for an appropriate template.

Using our collection is a superb strategy to improve the safety of your document filing. Our experienced lawyers on a regular basis review all the records to ensure that the templates are relevant for a particular region and compliant with new laws and polices.

How do you obtain the Green Bay Wisconsin Stipulation And Order Imposing Lien On Real Estate for Special Administrator? If you already have a profile, just log in to the account. The Download option will appear on all the documents you view. Additionally, you can find all the earlier saved documents in the My Forms menu.

If you haven’t registered an account yet, follow the instruction listed below:

- Open the page with the template you need. Make certain that it is the template you were seeking: examine its headline and description, and make use of the Preview feature when it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the saving procedure. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Choose the format to obtain the Green Bay Wisconsin Stipulation And Order Imposing Lien On Real Estate for Special Administrator and change and complete, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable template libraries on the web. Our company is always happy to assist you in any legal case, even if it is just downloading the Green Bay Wisconsin Stipulation And Order Imposing Lien On Real Estate for Special Administrator.

Feel free to benefit from our platform and make your document experience as efficient as possible!