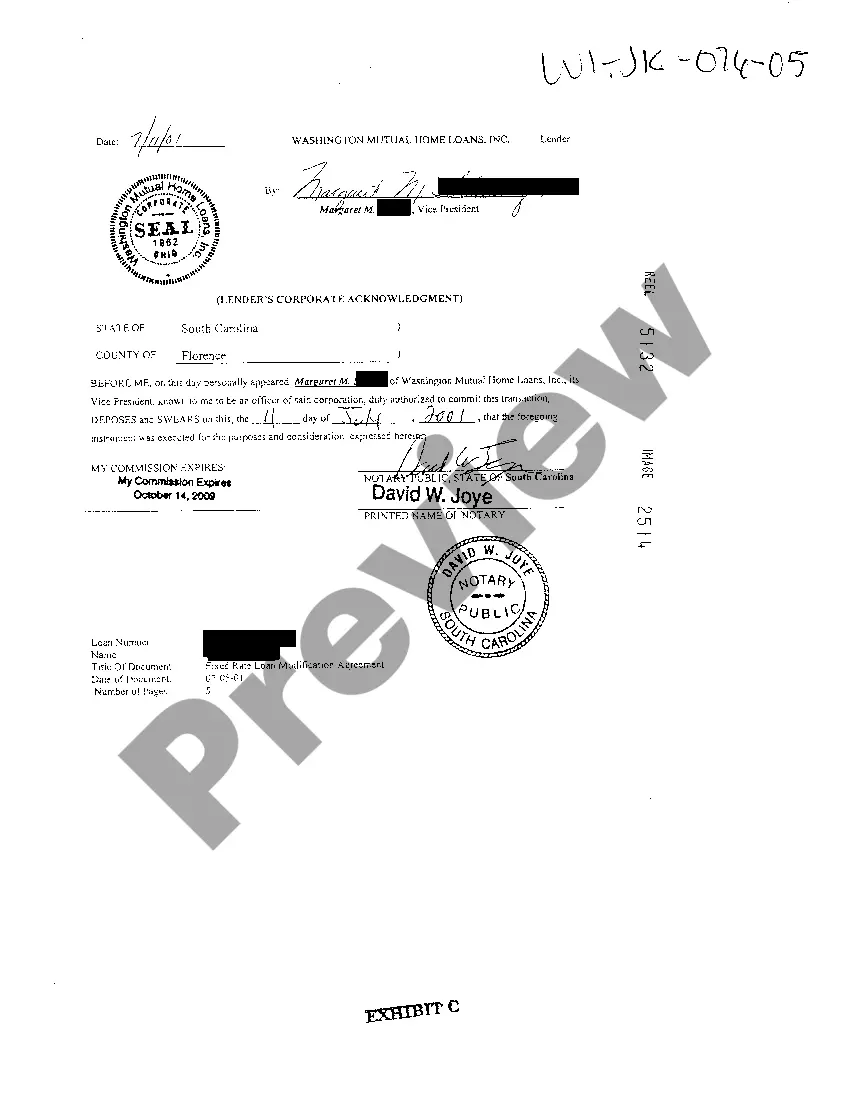

Green Bay Wisconsin Lender's Corporate Acknowledgment is a legal document that serves as evidence of a lender's acknowledgment of a corporation's existence and authorized borrowing capacity. This acknowledgment is essential when corporations require financing or loans for their business operations in Green Bay, Wisconsin. It confirms that the lender recognizes the corporation as a separate legal entity and accepts its ability to enter into financial contracts. The Green Bay Wisconsin Lender's Corporate Acknowledgment outlines the details of the corporation, including its legal name, registered address, and identification number. It also includes the names and positions of the corporation's authorized representatives who have the power to enter into loan agreements. This acknowledgment serves as protection for lenders, ensuring that they are dealing with a legitimate corporation that has the authority to borrow funds and is accountable for repaying the loans. It prevents situations where unauthorized individuals or entities attempt to secure loans on behalf of the corporation without proper authorization. Additionally, the Green Bay Wisconsin Lender's Corporate Acknowledgment may include provisions regarding the corporation's compliance with legal requirements, such as maintaining proper corporate records, filing annual reports, and obtaining necessary licenses and permits. These provisions ensure that the corporation is in good standing and capable of fulfilling its obligations to the lender. Please note that there may not be different types of Green Bay Wisconsin Lender's Corporate Acknowledgment explicitly specified. However, variations can exist based on individual lenders' requirements or specific circumstances of the loan transaction. It is recommended that corporations consult with their legal advisors or lenders to obtain the appropriate acknowledgment form that aligns with the lender's guidelines and preferences. In conclusion, the Green Bay Wisconsin Lender's Corporate Acknowledgment is a crucial legal document that confirms a corporation's legitimacy and borrowing capacity. It provides lenders with assurance that they are dealing with an authorized entity and helps protect their interests in loan transactions.

Green Bay Wisconsin Lender's Corporate Acknowledgment

Description

How to fill out Green Bay Wisconsin Lender's Corporate Acknowledgment?

If you are searching for a relevant form template, it’s impossible to choose a more convenient platform than the US Legal Forms site – one of the most extensive online libraries. Here you can find a huge number of form samples for organization and individual purposes by types and states, or keywords. With our high-quality search feature, getting the most up-to-date Green Bay Wisconsin Lender's Corporate Acknowledgment is as easy as 1-2-3. Additionally, the relevance of every record is confirmed by a team of skilled attorneys that regularly check the templates on our website and update them based on the newest state and county regulations.

If you already know about our system and have an account, all you should do to receive the Green Bay Wisconsin Lender's Corporate Acknowledgment is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the sample you require. Check its information and make use of the Preview feature (if available) to check its content. If it doesn’t meet your needs, use the Search field near the top of the screen to discover the proper file.

- Confirm your decision. Select the Buy now option. Following that, select your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the form. Indicate the file format and download it to your system.

- Make changes. Fill out, revise, print, and sign the acquired Green Bay Wisconsin Lender's Corporate Acknowledgment.

Each and every form you save in your profile does not have an expiry date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you need to get an extra duplicate for enhancing or printing, you may come back and export it once more at any time.

Make use of the US Legal Forms professional library to gain access to the Green Bay Wisconsin Lender's Corporate Acknowledgment you were seeking and a huge number of other professional and state-specific samples on one website!

Form popularity

FAQ

The Corporate Acknowledgment certificate is used when a duly authorized corporate officer or representative is signing and acknowledging on behalf of a corporation. Such designated officers may include the president, vice president, treasurer, secretary and attorney in fact.

How to Complete an Acknowledgment - YouTube YouTube Start of suggested clip End of suggested clip Now what do you fill in fill in the venue or county where you are notarizing the date you notarized.MoreNow what do you fill in fill in the venue or county where you are notarizing the date you notarized. Your name and title of office notary. Public next you fill in the name of your signer appearing.

How to Complete an Acknowledgment - YouTube YouTube Start of suggested clip End of suggested clip Now what do you fill in fill in the venue or county where you are notarizing the date you notarized.MoreNow what do you fill in fill in the venue or county where you are notarizing the date you notarized. Your name and title of office notary. Public next you fill in the name of your signer appearing.

The purpose of an acknowledgment is for a signer, whose identity has been verified, to declare to a Notary or notarial officer that he or she has willingly signed a document.

Florida does not require exact wording, but the certificate must include elements spelled out in Florida Statutes, 117.054, including the venue, name of signer, type and date of notarization, form of identification used, the Notary's signature, name and seal, and whether the signer appeared via physical presence or

An acknowledgment, on the other hand, does not require the Notary to witness the signature in most states. The customer may sign it in front of the Notary or even before coming to the Notary as long as they appear before the Notary to be identified and to acknowledge having signed the document.

Acknowledgements. An acknowledgement is used to verify the identity of the signer and to confirm that they signed the document. They are not swearing to the truthfulness or validity of the document, they are simply acknowledging that they signed the document.

An acknowledgment requires the following steps: The signer must physically appear before you. You as the notary must positively identify the signer according to your state's rules. The signer may either sign the document before appearing before you, or in your presence.

Definition of acknowledgement: notarial act in which a notary certifies having positively identified a document signer who admitted having signed the document (CCC 1188 and 1193)