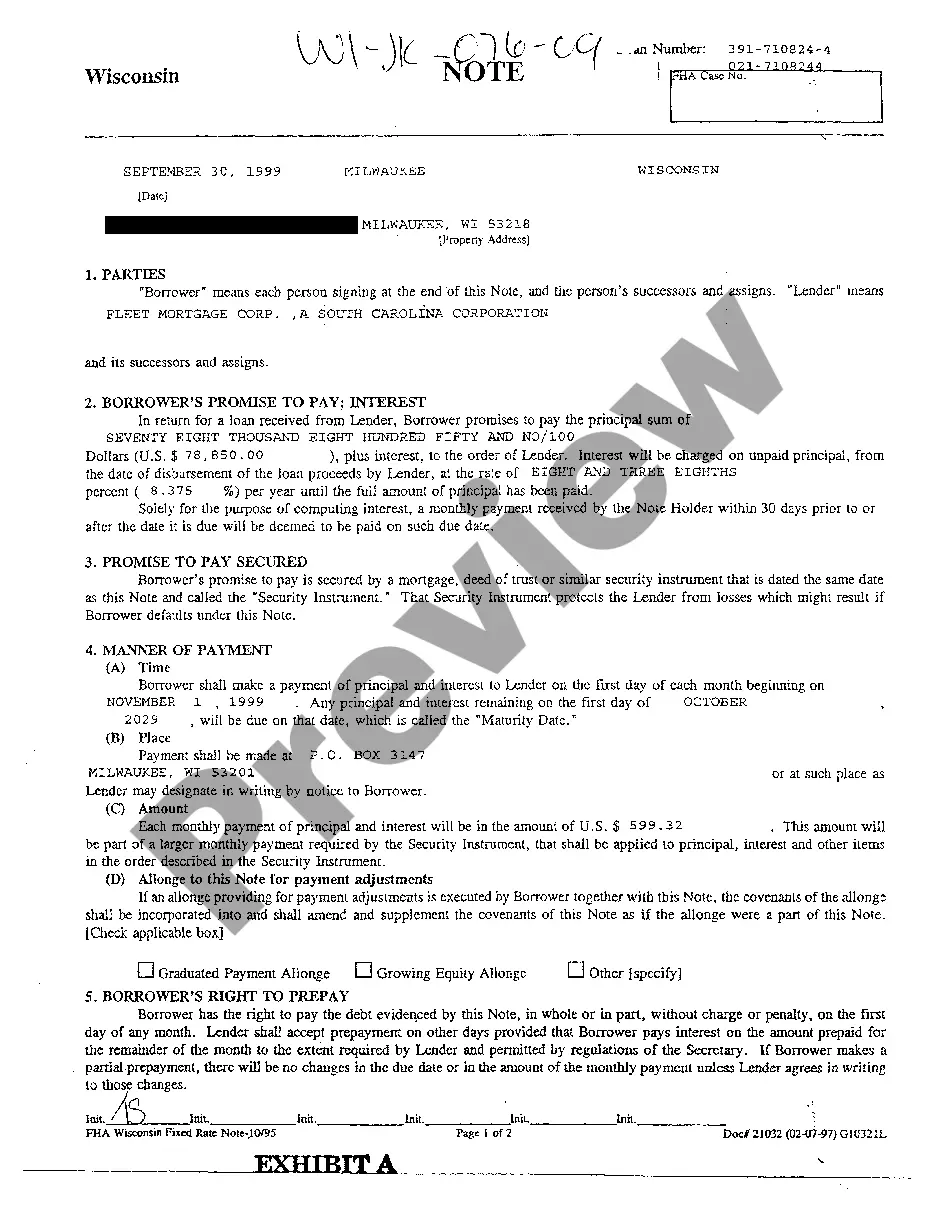

A Green Bay Wisconsin Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the Green Bay Area of Wisconsin. It serves as evidence of the borrower's promise to repay the borrowed amount within a defined time frame and includes crucial details such as the amount borrowed, interest rate, repayment schedule, late fees, and any other relevant terms. There are several types of Green Bay Wisconsin Promissory Notes that cater to different loan scenarios. Some notable types include: 1. Secured Promissory Note: This type of promissory note is backed by collateral, typically an asset of value. In Green Bay, Wisconsin, the collateral can be a property, vehicle, or any other valuable item that provides security to the lender in case of default. 2. Unsecured Promissory Note: In contrast to a secured promissory note, an unsecured promissory note is not backed by collateral. The borrower's creditworthiness and trustworthiness play a significant role in obtaining this type of loan. However, it is important to note that lenders may charge higher interest rates for unsecured loans to mitigate the associated risks. 3. Demand Promissory Note: This type of promissory note allows the lender to demand full repayment of the loan at any time, without any prior notice. This flexibility is commonly used in situations where the lender wants the option to call in the debt quickly when needed. 4. Installment Promissory Note: With an installment promissory note, the borrowed amount is repaid in equal payments over a specified period of time. Each payment consists of both principal and interest, ensuring gradual repayment of the loan within a predetermined schedule. 5. Balloon Promissory Note: This type of promissory note is structured so that the majority of the loan's principal is repaid at the end of the loan term, while smaller periodic payments are made throughout the loan duration. Balloon notes are advantageous for borrowers who anticipate having a bulk sum of money available at the end of the term, such as through the sale of an asset. Green Bay Wisconsin Promissory Notes are crucial in establishing a clear legal agreement between lenders and borrowers, ensuring both parties are aware of their obligations. It is crucial for individuals involved in loan arrangements in Green Bay, Wisconsin, to familiarize themselves with these various types of notes to select the one that suits their borrowing or lending requirements best.

Green Bay Wisconsin Promissory Note

Description

How to fill out Green Bay Wisconsin Promissory Note?

If you are searching for a relevant form template, it’s extremely hard to choose a better service than the US Legal Forms site – one of the most comprehensive libraries on the web. Here you can find a huge number of form samples for business and personal purposes by categories and regions, or keywords. With the advanced search feature, finding the most recent Green Bay Wisconsin Promissory Note is as elementary as 1-2-3. Furthermore, the relevance of each file is confirmed by a group of professional lawyers that regularly review the templates on our platform and revise them according to the most recent state and county requirements.

If you already know about our platform and have a registered account, all you need to get the Green Bay Wisconsin Promissory Note is to log in to your profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have discovered the sample you need. Look at its explanation and utilize the Preview option (if available) to check its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to get the appropriate file.

- Affirm your choice. Click the Buy now option. Next, pick the preferred subscription plan and provide credentials to register an account.

- Process the purchase. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the template. Choose the file format and download it to your system.

- Make adjustments. Fill out, edit, print, and sign the obtained Green Bay Wisconsin Promissory Note.

Each template you add to your profile has no expiration date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to receive an additional version for modifying or printing, you can return and download it again at any time.

Take advantage of the US Legal Forms extensive library to get access to the Green Bay Wisconsin Promissory Note you were looking for and a huge number of other professional and state-specific samples on one website!