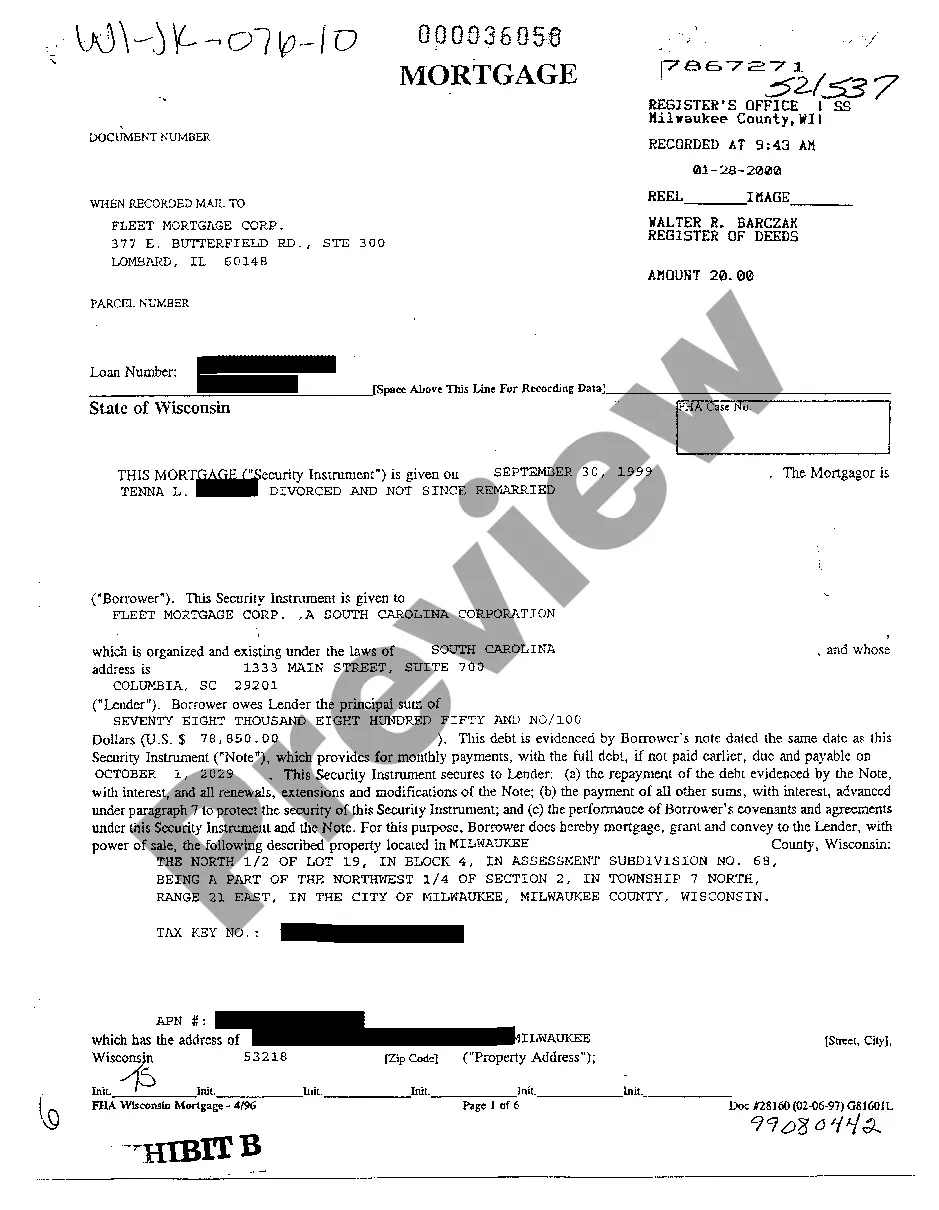

Green Bay Wisconsin Mortgage: A Comprehensive Overview of Mortgage Options and Services If you are planning to buy a home in the beautiful city of Green Bay, Wisconsin, understanding the various mortgage options available to you is crucial. A mortgage is essentially a loan provided by a lender, typically a bank or lending institution, to help individuals or families finance the purchase of a property. Green Bay, Wisconsin, like any other city, offers several types of mortgages tailored to cater to different needs and financial situations. In this article, we will provide a detailed description of Green Bay Wisconsin Mortgage, including various types and their key features. 1. Conventional Mortgage: A conventional mortgage is often the most common type of mortgage that homebuyers in Green Bay opt for. It typically requires a down payment of at least 3% to 20% of the property's purchase price. Conventional mortgages usually have fixed or adjustable interest rates with loan terms ranging from 15 to 30 years. 2. FHA (Federal Housing Administration) Loan: An FHA loan is backed by the Federal Housing Administration, making it an attractive choice for first-time homebuyers in Green Bay with limited down payment capabilities or lower credit scores. These loans require a down payment as low as 3.5% and have less stringent credit score requirements compared to conventional mortgages. 3. VA (Veterans Affairs) Loan: Available exclusively to eligible military members, veterans, and their spouses, a VA loan offers several advantages, including no down payment, competitive interest rates, and limited closing costs. Green Bay is home to many military personnel and veterans, making VA loans a popular choice in the area. 4. USDA (United States Department of Agriculture) Loan: Designed to promote rural development, a USDA loan is available to individuals buying homes in designated rural areas of Green Bay, Wisconsin. These loans offer 100% financing and low-interest rates, making homeownership more accessible for those who meet the income and location eligibility requirements. 5. Jumbo Mortgage: A jumbo mortgage is a loan that exceeds the limits set by Fannie Mae and Freddie Mac, the government-sponsored enterprises that buy most mortgages in the United States. Green Bay residents who wish to purchase higher-priced homes may require a jumbo mortgage. These loans often have different eligibility criteria and may require a higher down payment compared to conventional mortgages. 6. Fixed-Rate Mortgages: With fixed-rate mortgages, buyers in Green Bay can lock in an interest rate for the entire loan term. This type of mortgage offers stability as the monthly payment remains the same throughout, making budgeting easier. 7. Adjustable-Rate Mortgages (ARM's): Arms are mortgages that have a fixed interest rate for an initial period, after which the rate adjusts periodically based on market conditions. Green Bay residents considering ARM's should carefully evaluate their financial goals and the potential for fluctuating interest rates. 8. Home Equity Loans and Lines of Credit: Existing homeowners in Green Bay may consider utilizing the equity they have built in their properties to secure a loan or line of credit. These products allow homeowners to borrow against the value of their homes for various purposes, such as home improvements or debt consolidation. When exploring Green Bay Wisconsin Mortgage options, it is crucial to work closely with reputable lenders or mortgage brokers who can guide you through the process and help you choose the most suitable mortgage option based on your unique financial circumstances and homeownership goals.

Green Bay Wisconsin Mortgage

Description

How to fill out Green Bay Wisconsin Mortgage?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Green Bay Wisconsin Mortgage gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Green Bay Wisconsin Mortgage takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Green Bay Wisconsin Mortgage. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!