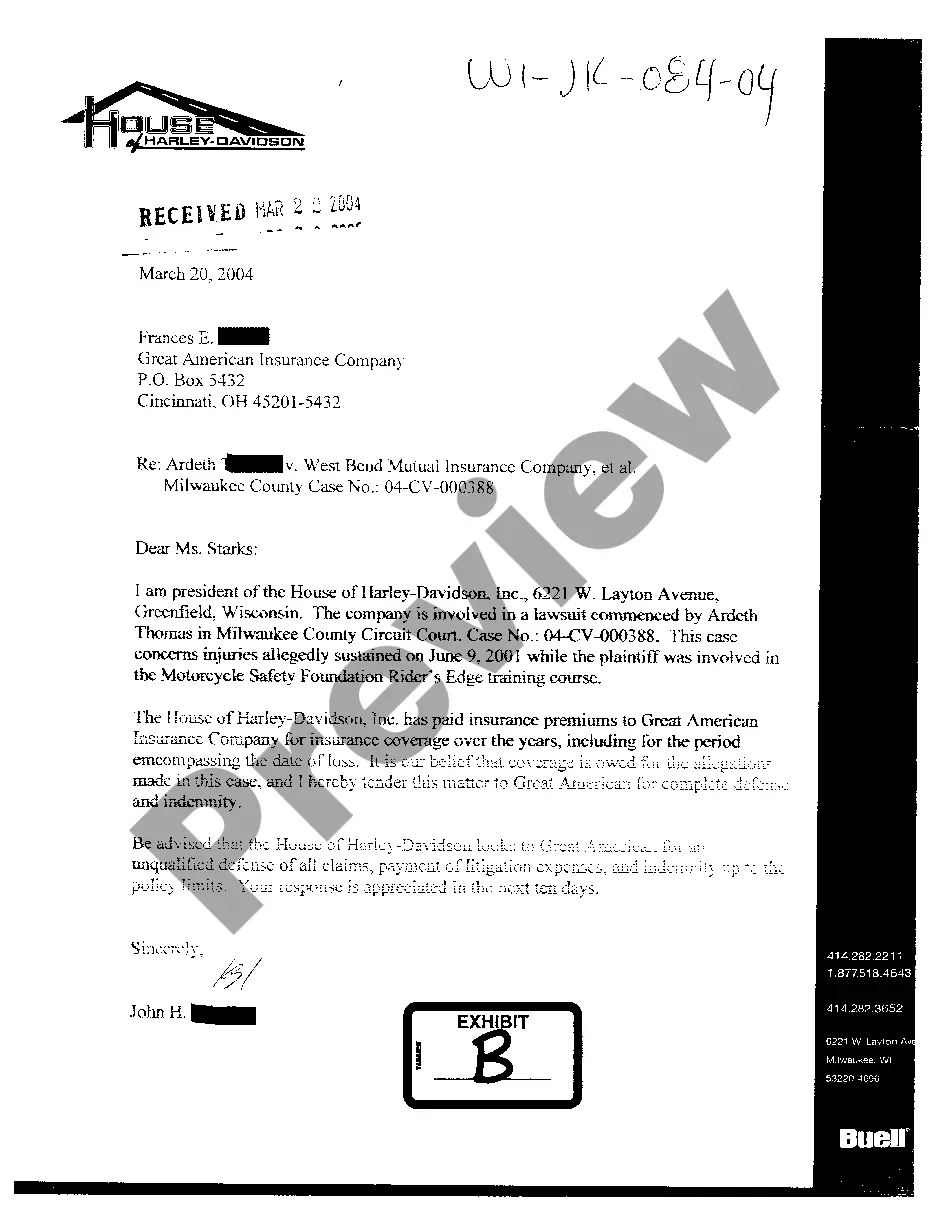

Title: Understanding Green Bay Wisconsin Exhibit B Letter regarding Insurance Acceptance of Liability Keywords: Green Bay Wisconsin, Exhibit B Letter, insurance acceptance, liability Introduction: In Green Bay, Wisconsin, Exhibit B Letters play a crucial role in the insurance acceptance of liability process. These letters serve as official documents that outline the terms and conditions under which an insurance company accepts liability for certain events, damages, or claims. This detailed description aims to provide an in-depth understanding of the Green Bay Wisconsin Exhibit B Letter regarding insurance acceptance of liability, its relevance, and types. Types of Green Bay Wisconsin Exhibit B Letters regarding Insurance Acceptance of Liability: 1. Personal Liability Insurance Exhibit B Letter: This type of Exhibit B Letter is typically used in personal insurance policies such as homeowner's insurance or renter's insurance. It outlines the specific liabilities covered by the policy, including bodily injury or property damage caused by the policyholder or their property. It also clarifies the extent of coverage provided by the insurance company. 2. Commercial Liability Insurance Exhibit B Letter: Commercial businesses in Green Bay, Wisconsin, often require liability insurance to protect themselves from potential lawsuits or claims. In this case, a Commercial Liability Insurance Exhibit B Letter is used to outline the specific liability coverage offered by the insurance company. It defines the scope of coverage related to property damage, bodily injury, or other liabilities arising from business operations. 3. Automobile Liability Insurance Exhibit B Letter: Automobile liability insurance is mandatory in most states, including Wisconsin. A Green Bay Wisconsin Exhibit B Letter regarding automobile liability insurance addresses the financial responsibility of the insured driver in case of accidents resulting in property damage or bodily injury. It outlines the minimum coverage required by Wisconsin law and any additional coverage offered by the insurance company. Relevance and Key Points of Green Bay Wisconsin Exhibit B Letter regarding Insurance Acceptance of Liability: 1. Coverage Details: The Exhibit B Letter primarily focuses on defining the scope of coverage provided by the insurance policy. It outlines the specific events or circumstances under which the insurance company will accept liability for damages or losses. 2. Limits and Deductibles: The letter also mentions the limits and deductibles set for the insurance policy. These limits indicate the maximum amount the insurance company will pay for a claim, while deductibles represent the amount the policyholder must pay out of pocket before the insurance coverage kicks in. 3. Terms and Exclusions: Green Bay Wisconsin Exhibit B Letters often include terms and exclusions related to liability coverage. These terms clarify any restrictions or conditions that may affect the insurance company's liability, ensuring that the policyholder fully understands the coverage provided. 4. Legal Compliance: Exhibit B Letters serve as legally binding agreements between the insurance company and the policyholder. By signing the letter, both parties acknowledge and accept the terms and conditions therein, ensuring legal compliance. Conclusion: Green Bay Wisconsin Exhibit B Letters regarding insurance acceptance of liability are essential documents that define the terms, conditions, and scope of coverage provided by insurance policies. Whether it's personal, commercial, or automobile liability insurance, these letters establish the insurance company's liability and the policyholder's rights and responsibilities. It's crucial for individuals and businesses in Green Bay to carefully review and understand their Exhibit B Letters to ensure adequate protection and compliance with legal requirements.

Green Bay Wisconsin Exhibit B Letter regarding Insurance acceptance of Liability

State:

Wisconsin

City:

Green Bay

Control #:

WI-JK-084-04

Format:

PDF

Instant download

This form is available by subscription

Description

A08 Exhibit B Letter regarding Insurance acceptance of Liability

Title: Understanding Green Bay Wisconsin Exhibit B Letter regarding Insurance Acceptance of Liability Keywords: Green Bay Wisconsin, Exhibit B Letter, insurance acceptance, liability Introduction: In Green Bay, Wisconsin, Exhibit B Letters play a crucial role in the insurance acceptance of liability process. These letters serve as official documents that outline the terms and conditions under which an insurance company accepts liability for certain events, damages, or claims. This detailed description aims to provide an in-depth understanding of the Green Bay Wisconsin Exhibit B Letter regarding insurance acceptance of liability, its relevance, and types. Types of Green Bay Wisconsin Exhibit B Letters regarding Insurance Acceptance of Liability: 1. Personal Liability Insurance Exhibit B Letter: This type of Exhibit B Letter is typically used in personal insurance policies such as homeowner's insurance or renter's insurance. It outlines the specific liabilities covered by the policy, including bodily injury or property damage caused by the policyholder or their property. It also clarifies the extent of coverage provided by the insurance company. 2. Commercial Liability Insurance Exhibit B Letter: Commercial businesses in Green Bay, Wisconsin, often require liability insurance to protect themselves from potential lawsuits or claims. In this case, a Commercial Liability Insurance Exhibit B Letter is used to outline the specific liability coverage offered by the insurance company. It defines the scope of coverage related to property damage, bodily injury, or other liabilities arising from business operations. 3. Automobile Liability Insurance Exhibit B Letter: Automobile liability insurance is mandatory in most states, including Wisconsin. A Green Bay Wisconsin Exhibit B Letter regarding automobile liability insurance addresses the financial responsibility of the insured driver in case of accidents resulting in property damage or bodily injury. It outlines the minimum coverage required by Wisconsin law and any additional coverage offered by the insurance company. Relevance and Key Points of Green Bay Wisconsin Exhibit B Letter regarding Insurance Acceptance of Liability: 1. Coverage Details: The Exhibit B Letter primarily focuses on defining the scope of coverage provided by the insurance policy. It outlines the specific events or circumstances under which the insurance company will accept liability for damages or losses. 2. Limits and Deductibles: The letter also mentions the limits and deductibles set for the insurance policy. These limits indicate the maximum amount the insurance company will pay for a claim, while deductibles represent the amount the policyholder must pay out of pocket before the insurance coverage kicks in. 3. Terms and Exclusions: Green Bay Wisconsin Exhibit B Letters often include terms and exclusions related to liability coverage. These terms clarify any restrictions or conditions that may affect the insurance company's liability, ensuring that the policyholder fully understands the coverage provided. 4. Legal Compliance: Exhibit B Letters serve as legally binding agreements between the insurance company and the policyholder. By signing the letter, both parties acknowledge and accept the terms and conditions therein, ensuring legal compliance. Conclusion: Green Bay Wisconsin Exhibit B Letters regarding insurance acceptance of liability are essential documents that define the terms, conditions, and scope of coverage provided by insurance policies. Whether it's personal, commercial, or automobile liability insurance, these letters establish the insurance company's liability and the policyholder's rights and responsibilities. It's crucial for individuals and businesses in Green Bay to carefully review and understand their Exhibit B Letters to ensure adequate protection and compliance with legal requirements.

Free preview

How to fill out Green Bay Wisconsin Exhibit B Letter Regarding Insurance Acceptance Of Liability?

If you’ve already used our service before, log in to your account and download the Green Bay Wisconsin Exhibit B Letter regarding Insurance acceptance of Liability on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Green Bay Wisconsin Exhibit B Letter regarding Insurance acceptance of Liability. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!