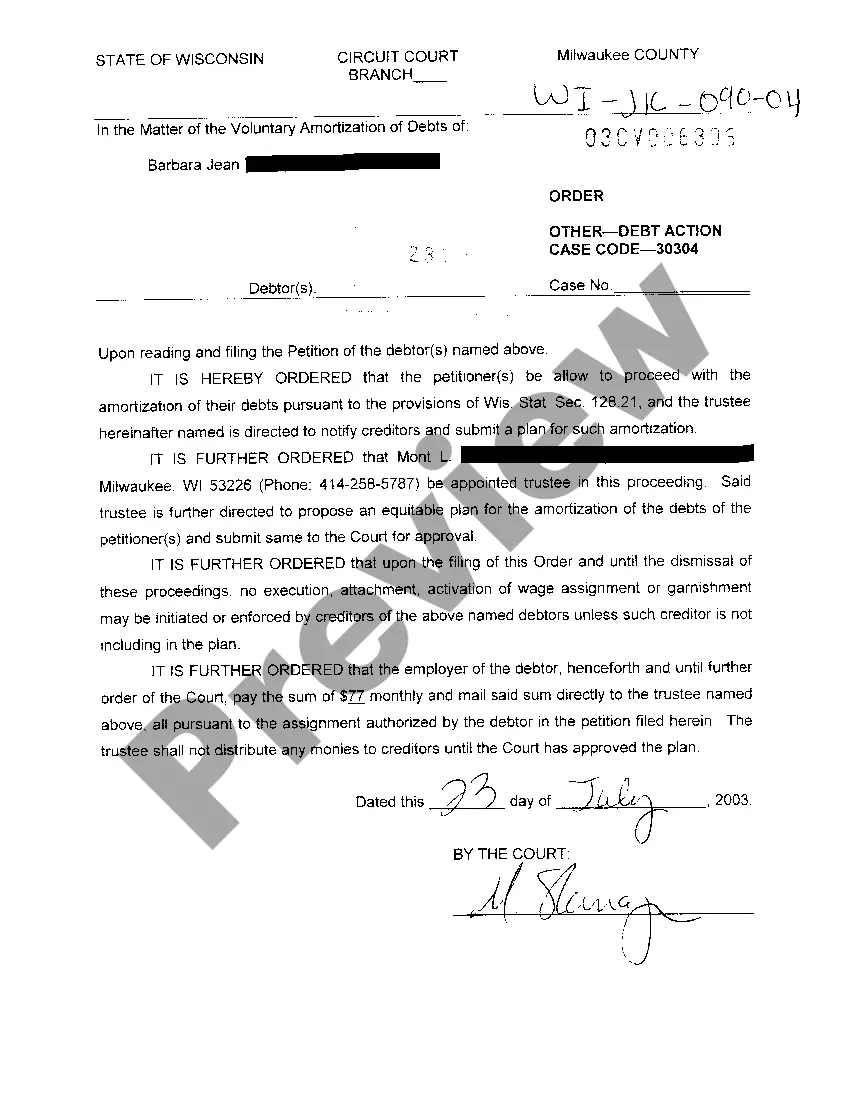

Green Bay Wisconsin Order — Debt Action is a legal process initiated by a creditor to recover outstanding debts owed by an individual or business residing in Green Bay, Wisconsin. This order is designed to compel the debtor to take action by either paying off the debt or providing the necessary financial information for the creditor to enforce the collection. Keywords: Green Bay Wisconsin, Order, Debt Action, legal process, creditor, outstanding debts, individual, business, debtor, paying off, financial information, collection. There are two main types of Green Bay Wisconsin Order — Debt Action: 1. Green Bay Wisconsin Garnishment Order — Debt Action: This type of debt action order allows a creditor to collect a portion of the debtor's wages directly from their employer. In Green Bay, Wisconsin, the creditor can garnish up to 20% of the debtor's disposable income, or the amount exceeding 30 times the federal minimum wage, whichever is lower. The garnishment order remains in effect until the debt is paid off in full or the court grants a release. Keywords: Green Bay Wisconsin, Garnishment Order, debt action, creditor, collect, wages, employer, disposable income, federal minimum wage, garnish, effect, court, release. 2. Green Bay Wisconsin Bank Levy Order — Debt Action: This debt action order empowers the creditor to freeze the debtor's bank accounts until the outstanding debt is settled. Once the order is issued, the creditor can notify financial institutions to freeze the debtor's accounts and prevent any further withdrawals or transactions. The funds held in these accounts will be used to satisfy the debt owed to the creditor. The bank levy order remains in effect until the debt is fully paid off. Keywords: Green Bay Wisconsin, Bank Levy Order, debt action, creditor, freeze, bank accounts, outstanding debt, issued, financial institutions, withdrawals, transactions, satisfy, fully paid off, effect. It's important for debtors in Green Bay, Wisconsin, to be aware of these debt action orders and to seek legal advice if faced with such situations. Understanding the rights and responsibilities associated with these orders can help navigate the debt resolution process effectively.

Green Bay Wisconsin Order - Debt Action

Description

How to fill out Green Bay Wisconsin Order - Debt Action?

If you are looking for a relevant form template, it’s difficult to choose a more convenient place than the US Legal Forms website – one of the most comprehensive libraries on the web. Here you can find a large number of templates for company and individual purposes by types and regions, or key phrases. With our advanced search feature, getting the latest Green Bay Wisconsin Order - Debt Action is as easy as 1-2-3. Furthermore, the relevance of each file is verified by a group of professional attorneys that regularly review the templates on our website and update them according to the most recent state and county requirements.

If you already know about our system and have a registered account, all you need to receive the Green Bay Wisconsin Order - Debt Action is to log in to your account and click the Download option.

If you make use of US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have discovered the sample you require. Look at its description and make use of the Preview function (if available) to explore its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to get the needed file.

- Confirm your choice. Choose the Buy now option. Following that, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the template. Pick the format and download it to your system.

- Make changes. Fill out, revise, print, and sign the obtained Green Bay Wisconsin Order - Debt Action.

Each and every template you add to your account does not have an expiration date and is yours forever. You can easily access them via the My Forms menu, so if you need to have an extra duplicate for editing or creating a hard copy, you may return and download it once again at any moment.

Take advantage of the US Legal Forms extensive collection to get access to the Green Bay Wisconsin Order - Debt Action you were seeking and a large number of other professional and state-specific samples on one website!