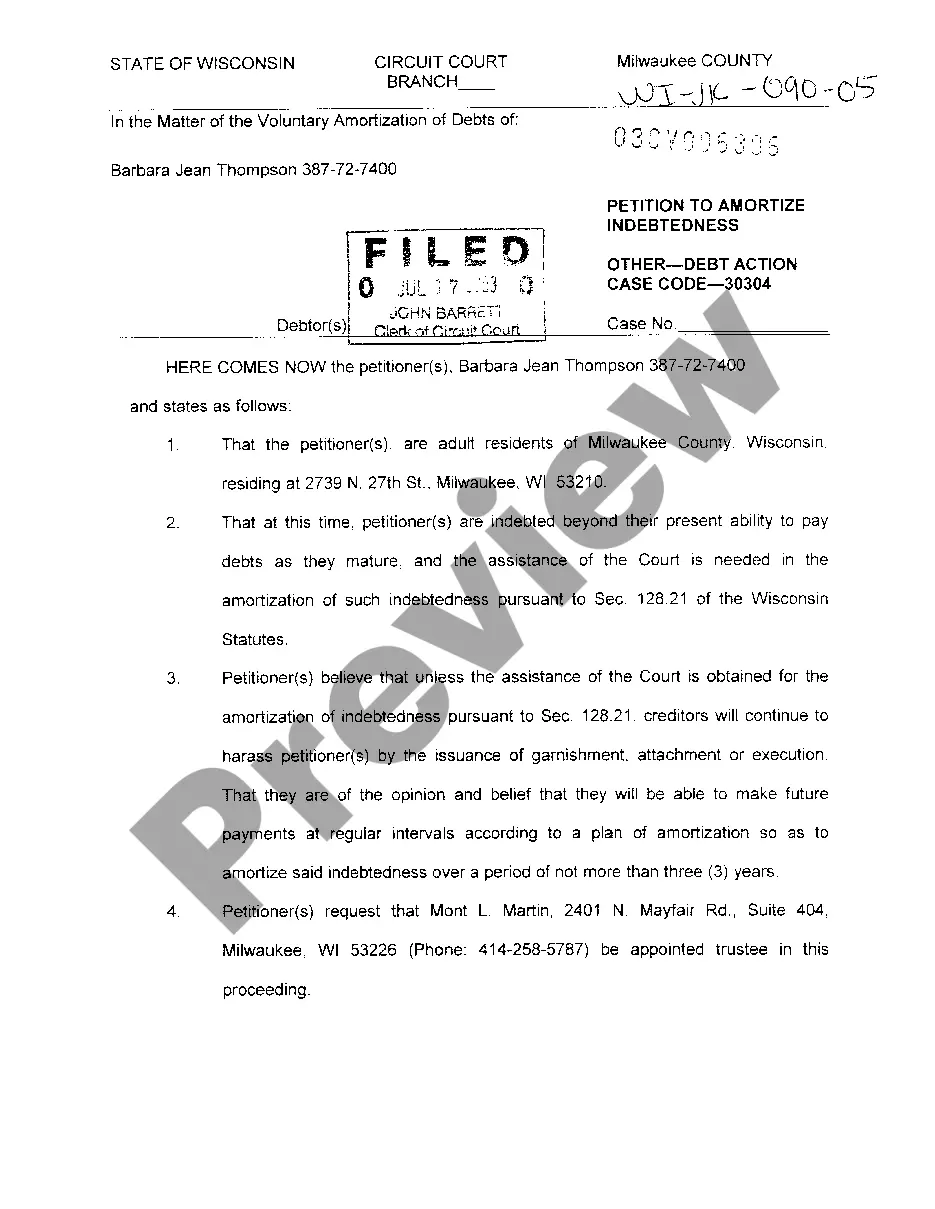

Title: Green Bay Wisconsin Petition to Amortize Indebtedness Due to Inability to Pay: A Comprehensive Overview Keywords: Green Bay Wisconsin, petition, amortize indebtedness, inability to pay, detailed description Introduction: The Green Bay Wisconsin Petition to Amortize Indebtedness Due to Inability to Pay is a legal document that allows individuals or businesses in Green Bay, Wisconsin, who are struggling to meet their financial obligations, to request the restructuring of their debts into manageable installments. This detailed description provides an in-depth understanding of the petition, its purpose, types, and how individuals can benefit from it. Types of Green Bay Wisconsin Petition to Amortize Indebtedness Due to Inability to Pay: 1. Personal Indebtedness Petition: This type specifically caters to individuals facing overwhelming debt burdens, such as credit card debt, medical bills, or mortgage payments. 2. Business Indebtedness Petition: Designed for small businesses, this petition allows businesses to seek relief from overwhelming debt that may threaten their operations and sustainability. Description: The Green Bay Wisconsin Petition to Amortize Indebtedness Due to Inability to Pay aims to provide a viable solution for those who genuinely cannot fulfill their financial obligations. It offers an opportunity to restructure outstanding debts, making them more manageable and sustainable over time. This petition takes into consideration compelling circumstances leading to the inability to pay, such as unforeseen medical expenses, job loss, reduced income, or other valid reasons affecting an individual or a business's financial stability. It aims to alleviate the immediate burden and create a reasonable path towards repaying debts. How to File the Petition: 1. Seek Legal Advice: Before proceeding with the petition, it is essential to consult with a qualified attorney familiar with bankruptcy laws and debt restructuring in Green Bay, Wisconsin. 2. Gathering Documentation: Collect and organize all relevant financial documentation, including income statements, expense reports, debt records, and supporting documents that demonstrate the inability to pay. 3. Prepare the Petition: Working with your attorney, complete the petition, providing accurate details of your finances, income, expenses, and a comprehensive list of creditors and outstanding debt. 4. File with the Court: Submit the completed petition to the appropriate court in Green Bay, Wisconsin, paying required filing fees and adhering to any additional local regulations. 5. Attend the Hearing: Once the petition is filed, a court hearing will be scheduled. Attend the hearing and respond to any questions or requests for additional information. Conclusion: The Green Bay Wisconsin Petition to Amortize Indebtedness Due to Inability to Pay offers individuals and businesses a lifeline when facing overwhelming financial burdens. With the opportunity to restructure debts into manageable payments, it provides a chance for debtors to regain control over their finances and navigate towards a more stable future. It is crucial to consult with legal professionals to understand the eligibility criteria, procedures, and potential consequences of pursuing this avenue.

Green Bay Wisconsin Petition To Amortize Indebtedness Due to Inability to Pay

Description

How to fill out Green Bay Wisconsin Petition To Amortize Indebtedness Due To Inability To Pay?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Green Bay Wisconsin Petition To Amortize Indebtedness Due to Inability to Pay? US Legal Forms is your go-to choice.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Green Bay Wisconsin Petition To Amortize Indebtedness Due to Inability to Pay conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to find out who and what the document is good for.

- Start the search over in case the form isn’t suitable for your legal scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Green Bay Wisconsin Petition To Amortize Indebtedness Due to Inability to Pay in any provided format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting hours learning about legal paperwork online once and for all.