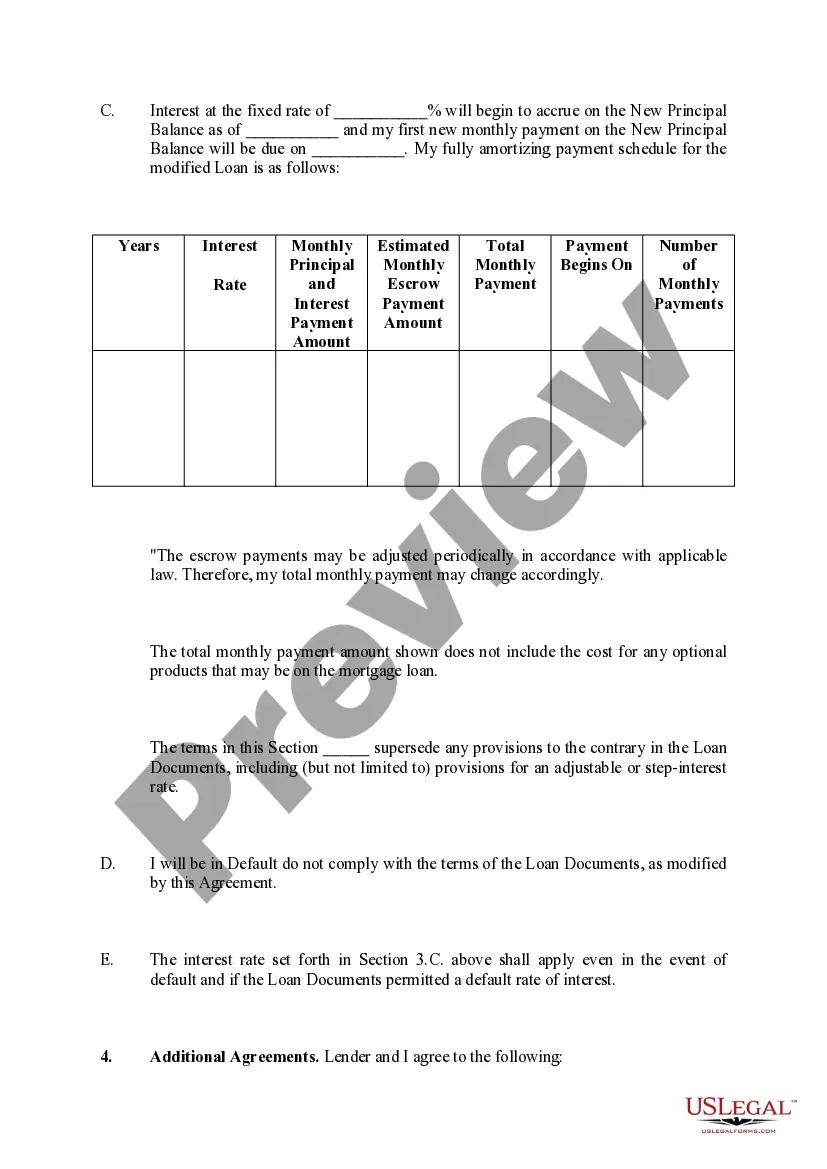

A Green Bay Wisconsin loan modification agreement refers to a legally binding contract that allows borrowers to modify the terms of their existing loan agreements. This agreement aims to provide financial relief to borrowers facing difficult circumstances such as financial hardship, job loss, or overwhelming debt by adjusting their existing loan terms and making them more affordable. Key elements of a Green Bay Wisconsin loan modification agreement include the adjustment of interest rates, extension of the loan term, reduction of monthly payments, or even the principal balance itself. These modifications are made in order to assist borrowers in staying current on their loan payments and to prevent foreclosure, ultimately helping them retain their homes and restore financial stability. Different types of loan modification agreements available in Green Bay, Wisconsin, include: 1. Interest Rate Modification: This type of modification involves lowering the interest rate on the loan. A reduction in the interest rate can significantly reduce monthly payments, making them more affordable for the borrower. 2. Term Extension: In some cases, the loan term can be extended, allowing borrowers more time to repay their loan. By spreading the repayment over a longer period, monthly payments can be reduced, providing financial relief to the borrower. 3. Principal Reduction: In certain situations, lenders may agree to decrease the principal balance owed by the borrower. This reduction aims to alleviate the financial burden by decreasing the overall debt and, subsequently, the borrower's monthly payments. 4. Payment Deferral: Lenders may also offer the option of temporarily deferring a portion of the borrower's payments. This provides borrowers with temporary financial relief but requires them to make up these deferred payments at a later agreed-upon date. It is important to note that the specific terms and conditions of a Green Bay Wisconsin loan modification agreement vary based on the borrower's individual circumstances, loan type, and the lender's policies. Seeking professional guidance and legal advice is highly recommended when considering a loan modification to ensure proper understanding of the agreement terms and potential implications. Overall, a Green Bay Wisconsin loan modification agreement offers borrowers an opportunity to restructure their loan terms, potentially reducing financial strain and enabling them to regain control of their finances.

Green Bay Wisconsin Loan Modification Agreement

Description

How to fill out Green Bay Wisconsin Loan Modification Agreement?

Are you looking for a reliable and inexpensive legal forms provider to buy the Green Bay Wisconsin Loan Modification Agreement? US Legal Forms is your go-to choice.

Whether you require a simple agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of particular state and county.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Green Bay Wisconsin Loan Modification Agreement conforms to the laws of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is intended for.

- Restart the search in case the template isn’t good for your legal scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Green Bay Wisconsin Loan Modification Agreement in any available format. You can return to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal papers online for good.