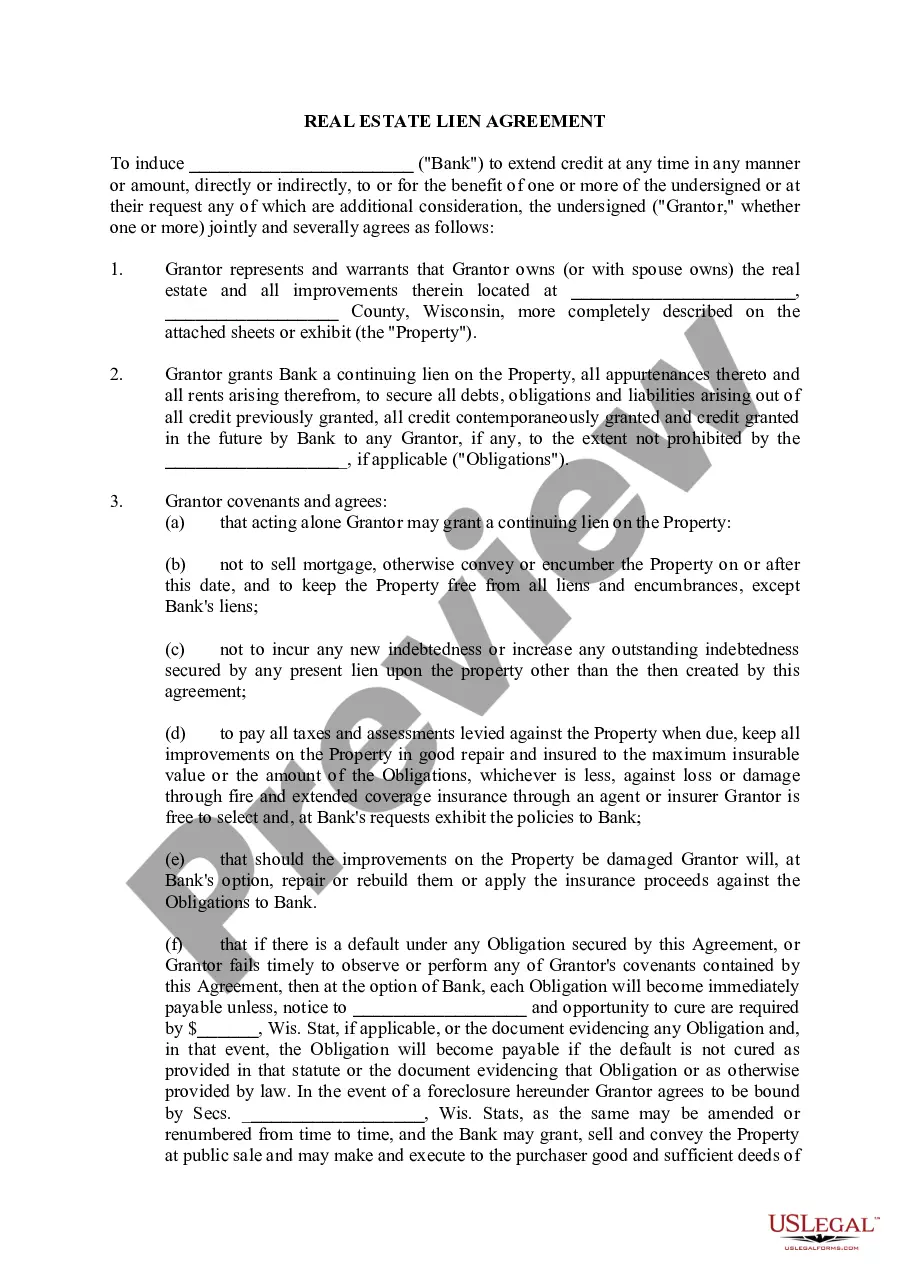

Green Bay, Wisconsin Real Estate Lien Agreement is a legally binding document that establishes a claim or encumbrance on a property to secure the repayment of a debt or obligation. It is critical in real estate transactions as it protects the interests of lenders or creditors when an individual or entity borrows money or owes a debt related to the property. The Green Bay, Wisconsin Real Estate Lien Agreement contains essential details such as the names of the parties involved, the property's legal description, and the amount of the debt or obligation. It also specifies the priority of the lien, which determines the order in which it will be satisfied if the property is sold or foreclosed upon. There are several types of Green Bay, Wisconsin Real Estate Lien Agreements, each serving a specific purpose: 1. Mortgage Lien Agreement: This type of lien agreement is the most common and is used when a property is purchased with a loan. The mortgage agreement grants the lender a lien on the property, allowing them to seize and sell the property if the borrower defaults on the loan. 2. Construction Lien Agreement: This lien agreement is utilized by contractors or suppliers who have provided labor, materials, or services for construction or renovation projects. It gives them the right to place a lien on the property if they are not paid for their work. 3. Mechanics Lien Agreement: Similar to a construction lien agreement, a mechanics lien agreement allows contractors, subcontractors, or laborers who have contributed to the improvement of a property to claim a lien if they have not been adequately compensated. 4. Judgment Lien Agreement: If a court awards a monetary judgment against a property owner, a judgment lien agreement can be used to place a lien on the property, ensuring that the creditor has a legal claim to the property until the debt is satisfied. 5. Tax Lien Agreement: A tax lien agreement is used by the government to secure unpaid taxes. When a property owner fails to pay property taxes, the government can issue a tax lien, giving them the right to foreclose on the property and sell it to recover the unpaid taxes. In summary, the Green Bay, Wisconsin Real Estate Lien Agreement is a crucial document in real estate transactions, safeguarding the interests of lenders, contractors, and creditors. Understanding the different types of lien agreements is vital for individuals involved in real estate activities to ensure proper financial protection and compliance with the law.

Green Bay Wisconsin Real Estate Lien Agreement

Category:

State:

Wisconsin

City:

Green Bay

Control #:

WI-LR053T

Format:

Word;

Rich Text

Instant download

Description

This form is used by the property owner to obtain unlimited credit with the offering a continuing lien on the property.

Green Bay, Wisconsin Real Estate Lien Agreement is a legally binding document that establishes a claim or encumbrance on a property to secure the repayment of a debt or obligation. It is critical in real estate transactions as it protects the interests of lenders or creditors when an individual or entity borrows money or owes a debt related to the property. The Green Bay, Wisconsin Real Estate Lien Agreement contains essential details such as the names of the parties involved, the property's legal description, and the amount of the debt or obligation. It also specifies the priority of the lien, which determines the order in which it will be satisfied if the property is sold or foreclosed upon. There are several types of Green Bay, Wisconsin Real Estate Lien Agreements, each serving a specific purpose: 1. Mortgage Lien Agreement: This type of lien agreement is the most common and is used when a property is purchased with a loan. The mortgage agreement grants the lender a lien on the property, allowing them to seize and sell the property if the borrower defaults on the loan. 2. Construction Lien Agreement: This lien agreement is utilized by contractors or suppliers who have provided labor, materials, or services for construction or renovation projects. It gives them the right to place a lien on the property if they are not paid for their work. 3. Mechanics Lien Agreement: Similar to a construction lien agreement, a mechanics lien agreement allows contractors, subcontractors, or laborers who have contributed to the improvement of a property to claim a lien if they have not been adequately compensated. 4. Judgment Lien Agreement: If a court awards a monetary judgment against a property owner, a judgment lien agreement can be used to place a lien on the property, ensuring that the creditor has a legal claim to the property until the debt is satisfied. 5. Tax Lien Agreement: A tax lien agreement is used by the government to secure unpaid taxes. When a property owner fails to pay property taxes, the government can issue a tax lien, giving them the right to foreclose on the property and sell it to recover the unpaid taxes. In summary, the Green Bay, Wisconsin Real Estate Lien Agreement is a crucial document in real estate transactions, safeguarding the interests of lenders, contractors, and creditors. Understanding the different types of lien agreements is vital for individuals involved in real estate activities to ensure proper financial protection and compliance with the law.

Free preview

How to fill out Green Bay Wisconsin Real Estate Lien Agreement?

If you’ve already used our service before, log in to your account and save the Green Bay Wisconsin Real Estate Lien Agreement on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Green Bay Wisconsin Real Estate Lien Agreement. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!