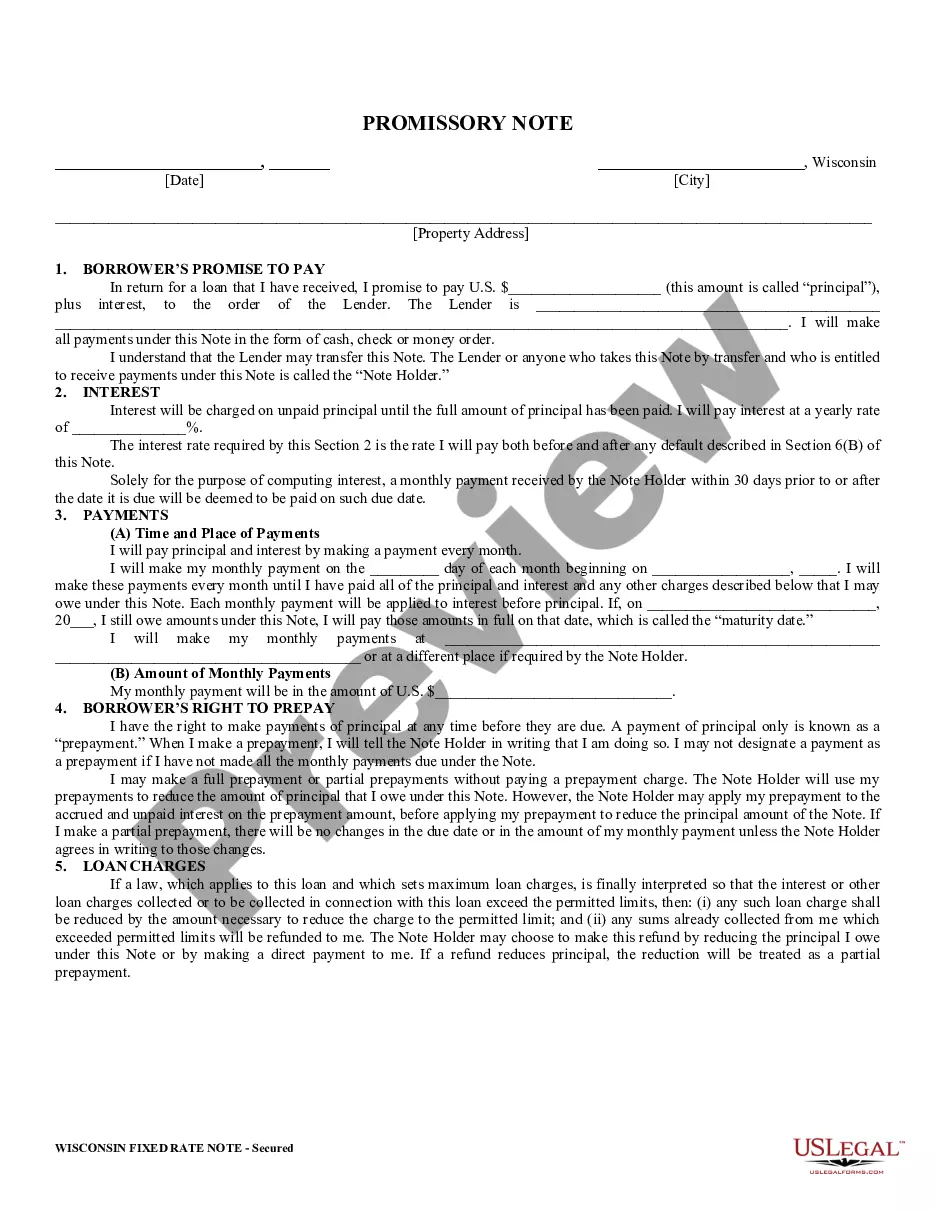

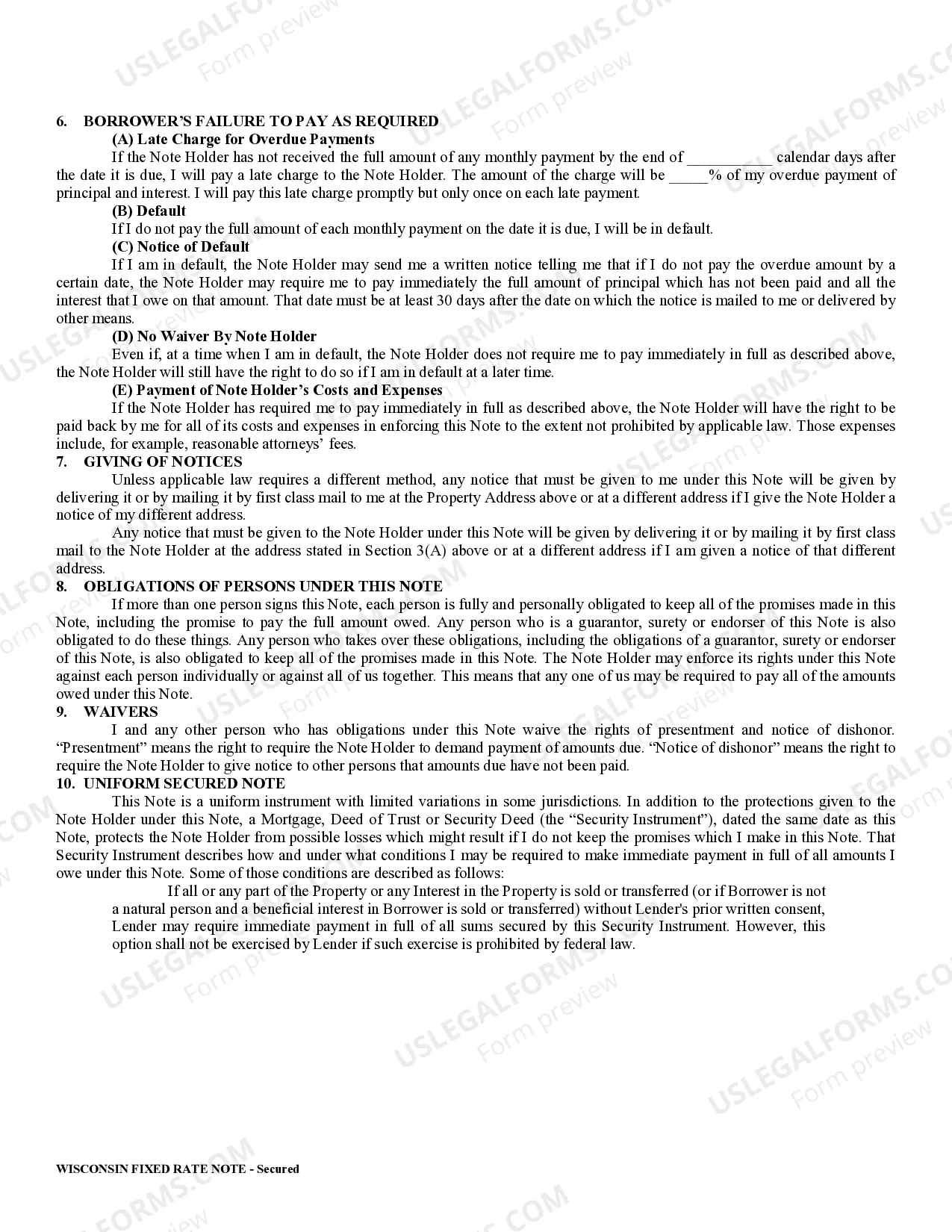

This is a Promissory Note for your state. The promissory note is secured, with a fixed interest rate, and contains a provision for installment payments.

A Green Bay Wisconsin secured promissory note is a legal document that outlines the terms of a loan agreement between a lender and a borrower, where the borrower pledges collateral to secure the loan. This type of promissory note provides an added layer of security for the lender by offering assurance that if the borrower defaults on the loan, the lender can claim the specified collateral to recoup their losses. Keywords: Green Bay Wisconsin, secured promissory note, loan agreement, lender, borrower, collateral, default, losses. There are different types of Green Bay Wisconsin secured promissory notes that serve various purposes. Some of these include: 1. Real estate secured promissory note: This type of promissory note is commonly used in Green Bay Wisconsin for real estate financing. It outlines the loan terms for a mortgage, where the borrower pledges the property as collateral. In case of default, the lender can foreclose on the property to recover the loan amount. 2. Vehicle secured promissory note: This promissory note is used when financing the purchase of a vehicle in Green Bay Wisconsin. The borrower pledges the vehicle as collateral for the loan. If the borrower defaults, the lender can repossess the vehicle to compensate for the outstanding loan amount. 3. Business asset secured promissory note: This type of promissory note is utilized when a business owner needs financing and pledges specific business assets as collateral. The note outlines the loan terms and details the assets pledged. In the event of default, the lender can seize the specified assets to satisfy the outstanding loan balance. 4. Equipment secured promissory note: Businesses in Green Bay Wisconsin often require financing for equipment purchases. This note outlines the loan terms and lists the equipment pledged as collateral. If the borrower fails to repay the loan, the lender may claim the equipment to recover the loan amount. 5. Inventory secured promissory note: This promissory note is commonly used by businesses that need financing and pledge their inventory as collateral. It specifies the loan terms and details the inventory being pledged. In case of default, the lender can take possession of the pledged inventory to cover the loan balance. These types of Green Bay Wisconsin secured promissory notes protect the lender's interests by offering a means to recover their investment in case the borrower fails to honor the loan agreement. It is important for both parties involved to carefully review and understand the terms before signing the promissory note.A Green Bay Wisconsin secured promissory note is a legal document that outlines the terms of a loan agreement between a lender and a borrower, where the borrower pledges collateral to secure the loan. This type of promissory note provides an added layer of security for the lender by offering assurance that if the borrower defaults on the loan, the lender can claim the specified collateral to recoup their losses. Keywords: Green Bay Wisconsin, secured promissory note, loan agreement, lender, borrower, collateral, default, losses. There are different types of Green Bay Wisconsin secured promissory notes that serve various purposes. Some of these include: 1. Real estate secured promissory note: This type of promissory note is commonly used in Green Bay Wisconsin for real estate financing. It outlines the loan terms for a mortgage, where the borrower pledges the property as collateral. In case of default, the lender can foreclose on the property to recover the loan amount. 2. Vehicle secured promissory note: This promissory note is used when financing the purchase of a vehicle in Green Bay Wisconsin. The borrower pledges the vehicle as collateral for the loan. If the borrower defaults, the lender can repossess the vehicle to compensate for the outstanding loan amount. 3. Business asset secured promissory note: This type of promissory note is utilized when a business owner needs financing and pledges specific business assets as collateral. The note outlines the loan terms and details the assets pledged. In the event of default, the lender can seize the specified assets to satisfy the outstanding loan balance. 4. Equipment secured promissory note: Businesses in Green Bay Wisconsin often require financing for equipment purchases. This note outlines the loan terms and lists the equipment pledged as collateral. If the borrower fails to repay the loan, the lender may claim the equipment to recover the loan amount. 5. Inventory secured promissory note: This promissory note is commonly used by businesses that need financing and pledge their inventory as collateral. It specifies the loan terms and details the inventory being pledged. In case of default, the lender can take possession of the pledged inventory to cover the loan balance. These types of Green Bay Wisconsin secured promissory notes protect the lender's interests by offering a means to recover their investment in case the borrower fails to honor the loan agreement. It is important for both parties involved to carefully review and understand the terms before signing the promissory note.