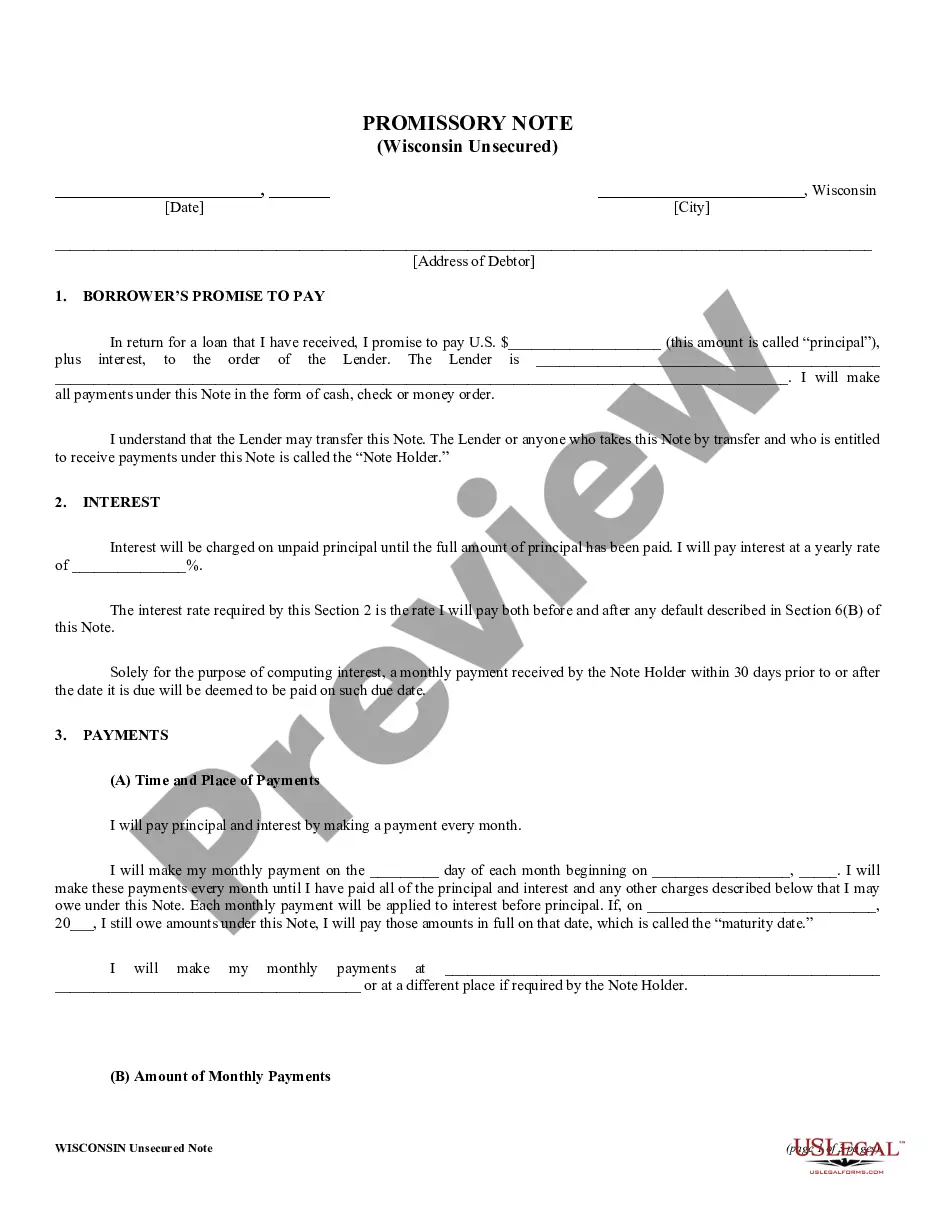

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

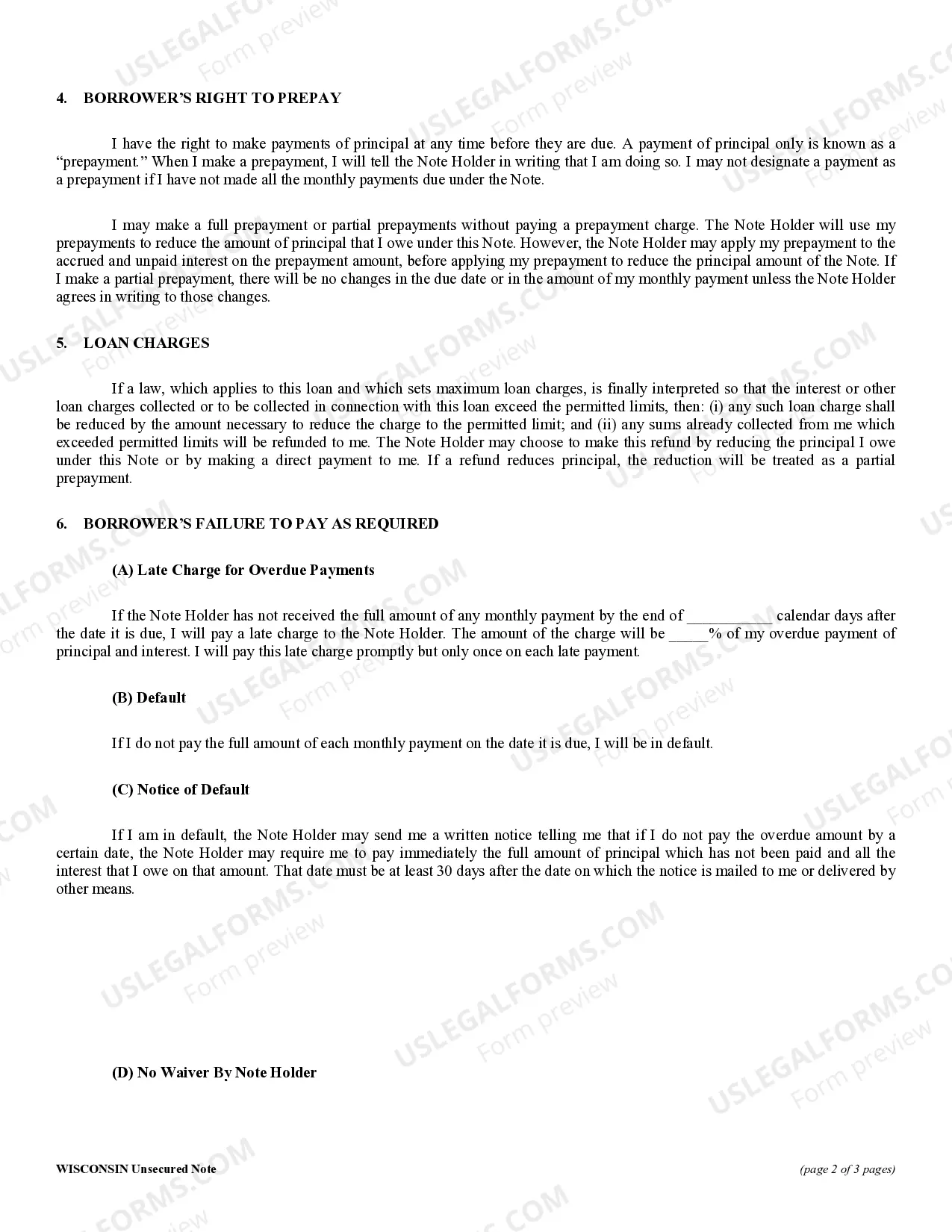

A Green Bay Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Green Bay, Wisconsin. This type of promissory note, which is unsecured, means that the borrower is not required to provide any collateral, such as property or assets, as security for the loan. The note specifies that the loan amount will be repaid by the borrower to the lender in a series of fixed-rate installment payments over a predetermined period of time. The fixed rate ensures that the interest rate assigned to the loan remains constant throughout the repayment term, providing both parties with stability and predictability. In Green Bay, Wisconsin, there are different variations of the Unsecured Installment Payment Promissory Note for Fixed Rate that a lender may offer, depending on factors such as the loan amount, repayment term, and specific requirements of the borrower. These notes may include: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for personal financial needs, such as funding education, paying medical expenses, or consolidating debts. 2. Business Loan Promissory Note: Designed for entrepreneurs or businesses in Green Bay, Wisconsin, this promissory note provides the necessary legal framework for borrowing funds to support business operations, expansion, or investment opportunities. 3. Student Loan Promissory Note: This type of promissory note is specifically tailored to students or their parents to fund higher education expenses, including tuition fees, books, and living costs. It often includes certain provisions and options specific to student loans, such as deferment or forbearance. 4. Construction Loan Promissory Note: This promissory note is utilized by individuals or businesses undertaking construction projects in Green Bay, Wisconsin. It includes provisions related to disbursements of funds based on specific construction milestones, which are crucial for managing the financing aspect of construction projects. It is important to note that these promissory notes serve as legal instruments to protect the rights and obligations of both the lender and the borrower. They contain detailed information about the loan amount, repayment schedule, interest rate, late payment penalties, and default provisions. It is advisable for both parties to seek legal advice before signing such an agreement to ensure they fully understand and agree to the terms outlined in the Green Bay Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate.A Green Bay Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Green Bay, Wisconsin. This type of promissory note, which is unsecured, means that the borrower is not required to provide any collateral, such as property or assets, as security for the loan. The note specifies that the loan amount will be repaid by the borrower to the lender in a series of fixed-rate installment payments over a predetermined period of time. The fixed rate ensures that the interest rate assigned to the loan remains constant throughout the repayment term, providing both parties with stability and predictability. In Green Bay, Wisconsin, there are different variations of the Unsecured Installment Payment Promissory Note for Fixed Rate that a lender may offer, depending on factors such as the loan amount, repayment term, and specific requirements of the borrower. These notes may include: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for personal financial needs, such as funding education, paying medical expenses, or consolidating debts. 2. Business Loan Promissory Note: Designed for entrepreneurs or businesses in Green Bay, Wisconsin, this promissory note provides the necessary legal framework for borrowing funds to support business operations, expansion, or investment opportunities. 3. Student Loan Promissory Note: This type of promissory note is specifically tailored to students or their parents to fund higher education expenses, including tuition fees, books, and living costs. It often includes certain provisions and options specific to student loans, such as deferment or forbearance. 4. Construction Loan Promissory Note: This promissory note is utilized by individuals or businesses undertaking construction projects in Green Bay, Wisconsin. It includes provisions related to disbursements of funds based on specific construction milestones, which are crucial for managing the financing aspect of construction projects. It is important to note that these promissory notes serve as legal instruments to protect the rights and obligations of both the lender and the borrower. They contain detailed information about the loan amount, repayment schedule, interest rate, late payment penalties, and default provisions. It is advisable for both parties to seek legal advice before signing such an agreement to ensure they fully understand and agree to the terms outlined in the Green Bay Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate.