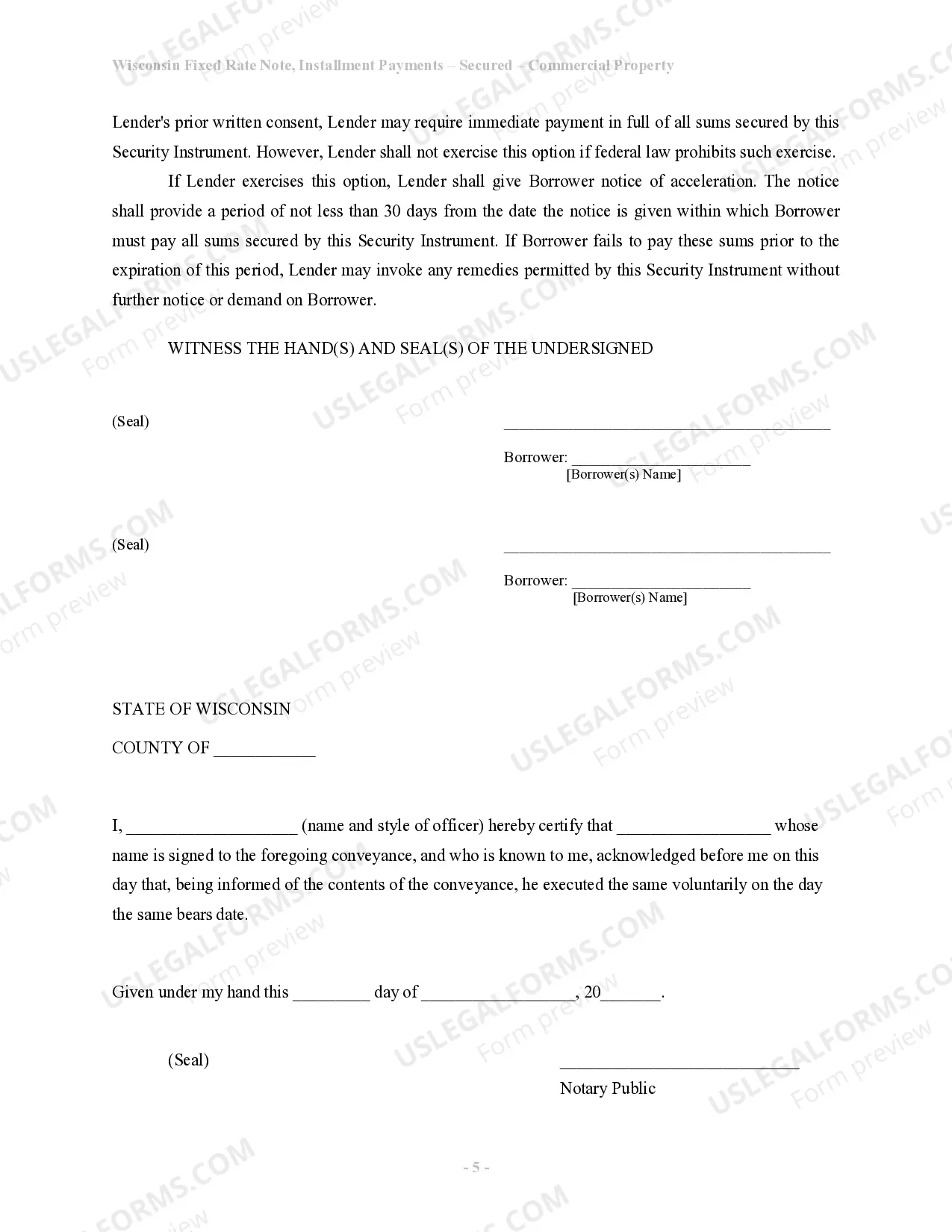

This is a Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Green Bay, Wisconsin Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a type of financial instrument that allows borrowers to obtain funding by providing a commercial property as collateral. This promissory note consists of a legally binding agreement between the borrower and the lender, outlining the terms and conditions of the loan. The note specifies detailed payment terms, including the amount borrowed, interest rate, repayment schedule, and the duration of the loan. This type of promissory note is specifically secured by commercial real estate in the Green Bay, Wisconsin area. It provides lenders with the assurance that in case of default, they can seize and sell the property to recover the outstanding debt. Commercial properties can include retail spaces, office buildings, warehouses, industrial facilities, or any other non-residential real estate. Green Bay, Wisconsin offers various types of Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate. These may vary slightly in terms of specific conditions or features. However, some common variants include: 1. Green Bay, Wisconsin Commercial Real Estate Loan: This promissory note is a general loan secured by commercial property in Green Bay. It caters to businesses or individuals seeking funding for purchasing, refinancing, or renovating commercial properties. 2. Green Bay, Wisconsin Construction Loan: This variant of the promissory note is specifically designed to finance the construction or development of commercial real estate in Green Bay. It provides the necessary capital to cover building costs, land acquisition, and other related expenses. 3. Green Bay, Wisconsin Bridge Loan: This type of promissory note is intended for borrowers in need of short-term financing while transitioning between properties or awaiting long-term financing. It offers temporary funding to bridge the gap between the purchase of a new commercial property and the sale of an existing one. 4. Green Bay, Wisconsin Commercial Real Estate Refinance Loan: This promissory note allows borrowers to replace an existing loan on a commercial property with a new loan that has more favorable terms. Refinancing can help businesses or individuals reduce monthly payments, access equity, or secure a lower interest rate. When considering a Green Bay, Wisconsin Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is essential to consult with financial advisors and legal professionals who can provide guidance specific to individual circumstances. Understanding the terms, risks, and benefits of each type of promissory note is crucial to make informed financial decisions.Green Bay, Wisconsin Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a type of financial instrument that allows borrowers to obtain funding by providing a commercial property as collateral. This promissory note consists of a legally binding agreement between the borrower and the lender, outlining the terms and conditions of the loan. The note specifies detailed payment terms, including the amount borrowed, interest rate, repayment schedule, and the duration of the loan. This type of promissory note is specifically secured by commercial real estate in the Green Bay, Wisconsin area. It provides lenders with the assurance that in case of default, they can seize and sell the property to recover the outstanding debt. Commercial properties can include retail spaces, office buildings, warehouses, industrial facilities, or any other non-residential real estate. Green Bay, Wisconsin offers various types of Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate. These may vary slightly in terms of specific conditions or features. However, some common variants include: 1. Green Bay, Wisconsin Commercial Real Estate Loan: This promissory note is a general loan secured by commercial property in Green Bay. It caters to businesses or individuals seeking funding for purchasing, refinancing, or renovating commercial properties. 2. Green Bay, Wisconsin Construction Loan: This variant of the promissory note is specifically designed to finance the construction or development of commercial real estate in Green Bay. It provides the necessary capital to cover building costs, land acquisition, and other related expenses. 3. Green Bay, Wisconsin Bridge Loan: This type of promissory note is intended for borrowers in need of short-term financing while transitioning between properties or awaiting long-term financing. It offers temporary funding to bridge the gap between the purchase of a new commercial property and the sale of an existing one. 4. Green Bay, Wisconsin Commercial Real Estate Refinance Loan: This promissory note allows borrowers to replace an existing loan on a commercial property with a new loan that has more favorable terms. Refinancing can help businesses or individuals reduce monthly payments, access equity, or secure a lower interest rate. When considering a Green Bay, Wisconsin Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is essential to consult with financial advisors and legal professionals who can provide guidance specific to individual circumstances. Understanding the terms, risks, and benefits of each type of promissory note is crucial to make informed financial decisions.