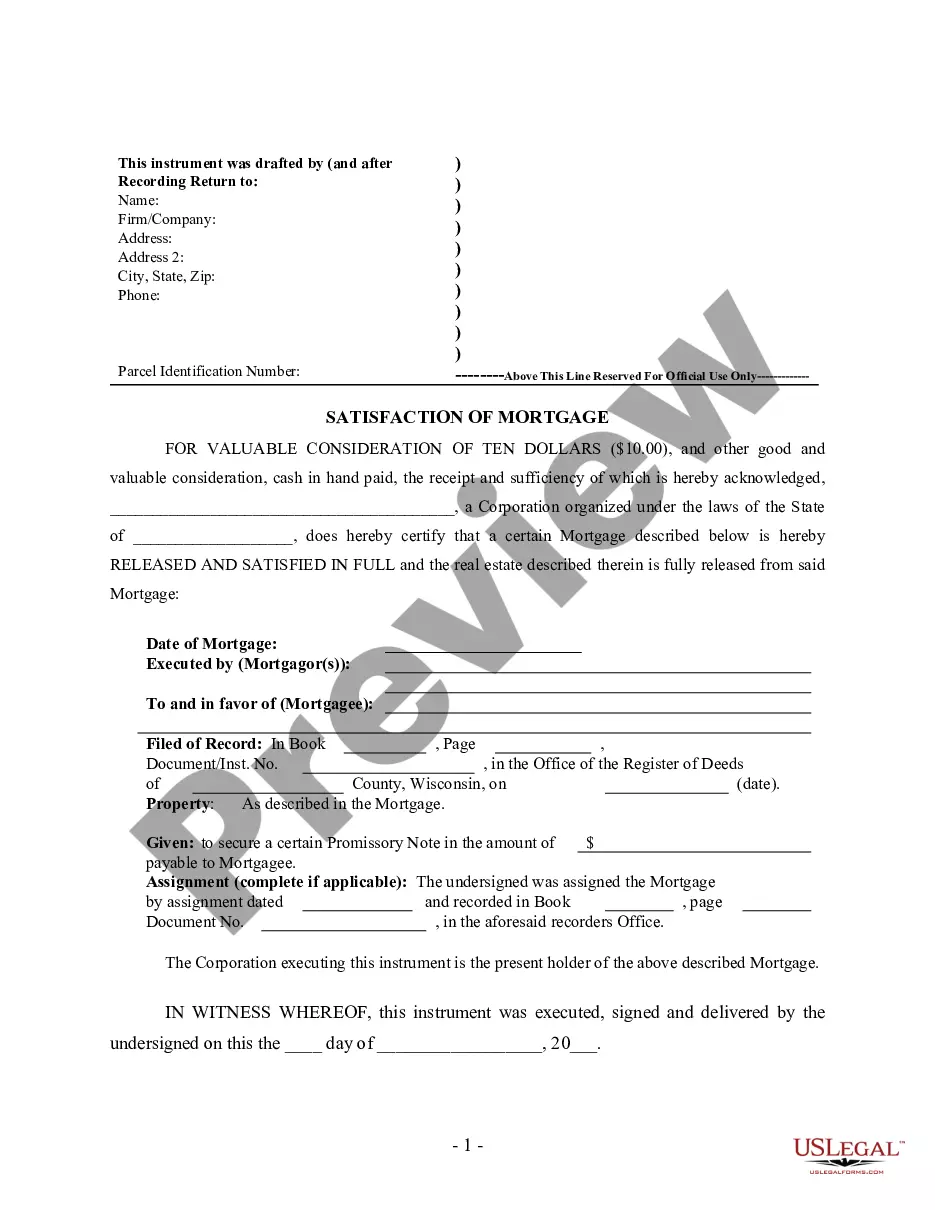

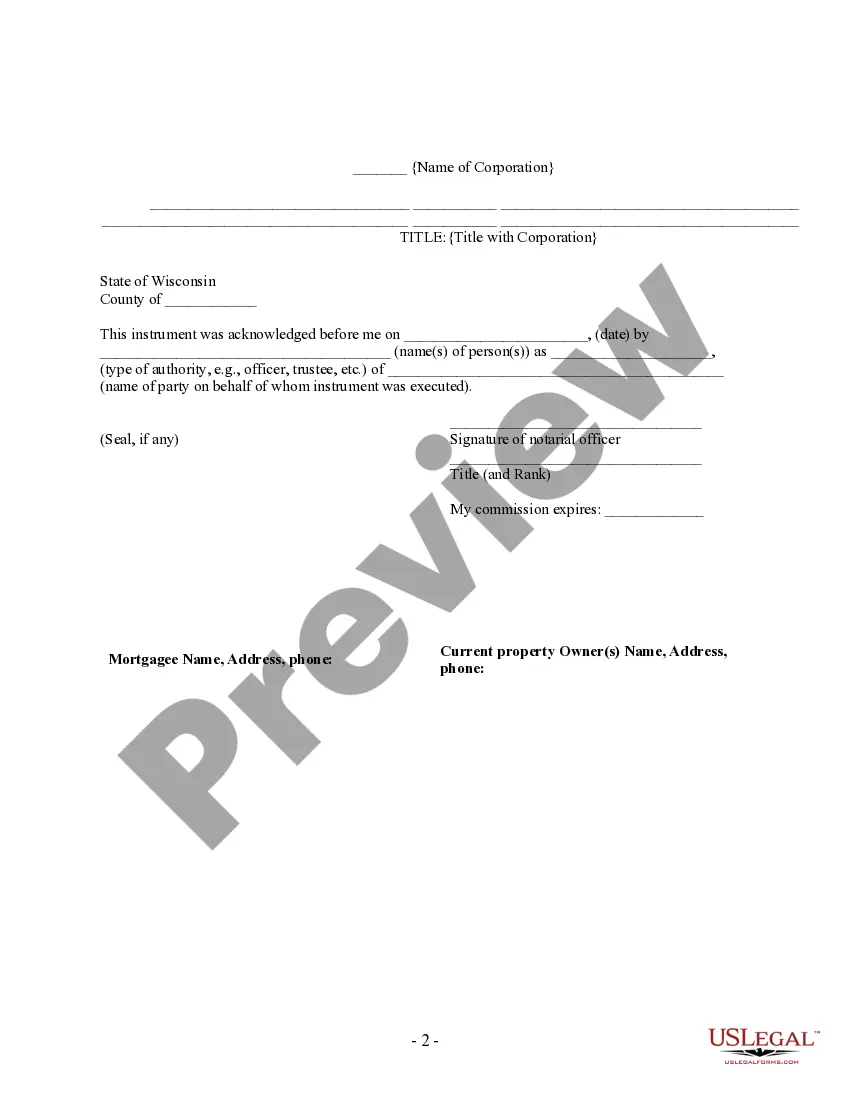

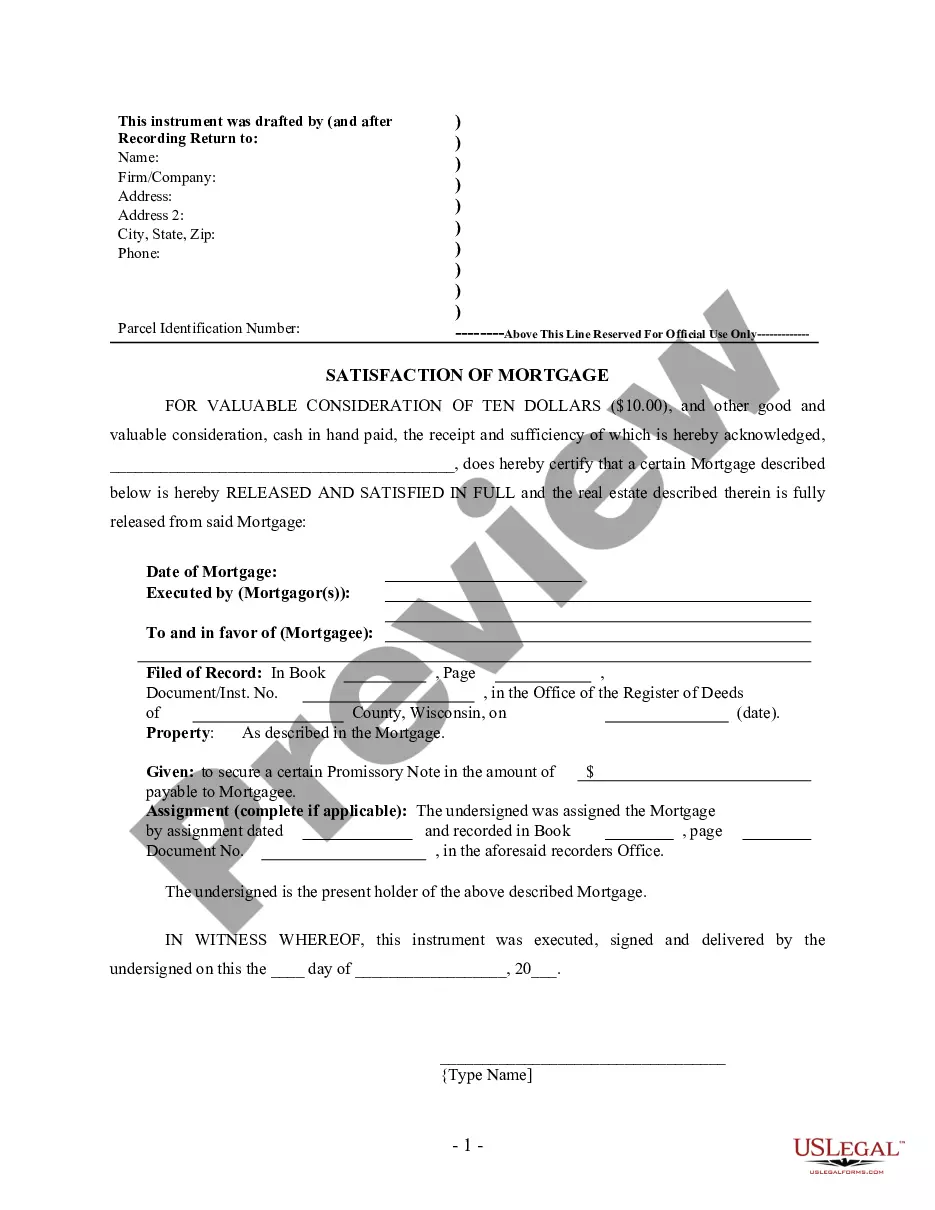

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Wisconsin by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Green Bay Wisconsin Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Wisconsin Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

If you've previously utilized our service, Log In to your account and retrieve the Green Bay Wisconsin Satisfaction, Release or Cancellation of Mortgage by Corporation on your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it as per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You maintain perpetual access to all documents you've acquired: they can be found in your profile within the My documents section whenever you want to access them again. Leverage the US Legal Forms service to swiftly find and download any template for your personal or professional requirements!

- Confirm you've found an appropriate document. Browse through the description and utilize the Preview option, if available, to verify if it satisfies your needs. If it doesn’t fit, use the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Green Bay Wisconsin Satisfaction, Release or Cancellation of Mortgage by Corporation. Choose the file format for your document and store it on your device.

- Fill out your form. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

An affidavit of rescission is a legal document you file to affirm your intent to rescind a mortgage agreement. It provides a sworn statement to confirm the cancellation, making it an essential part of your documentation. This step can be particularly helpful in the context of Green Bay Wisconsin Satisfaction, Release or Cancellation of Mortgage by Corporation, as it provides clarity and protection in your financial dealings.

A document of rescission is a written notice that states your intent to rescind a previously signed mortgage agreement. In Wisconsin, this document serves as a formal request to cancel the mortgage and releases you from any obligations. Including this document in your Green Bay Wisconsin Satisfaction, Release or Cancellation of Mortgage by Corporation process can help simplify your transaction and protect your interests.

To acquire a mortgage release in Green Bay, Wisconsin, you should start by reaching out to your lender or mortgage servicer once you have completed your mortgage payments. They will provide you with the necessary documents to finalize the release. If you're unsure of the steps, consider using USLegalForms, which can guide you through the comprehensive process seamlessly.

In Green Bay, Wisconsin, it is common for a satisfaction of mortgage document to require notarization for it to be recorded properly. This ensures that the document is legally binding and proves the authenticity of the parties involved. Always consult with your lender to understand their specific requirements. Using services from platforms like USLegalForms can help you navigate notarization processes effectively.

In Wisconsin, a satisfaction of mortgage does not typically require notarization to be valid. However, having it notarized can strengthen its authenticity when filed in public records. To ensure all legal bases are covered, consult with your lender for their specific requirements. Involving a platform like USLegalForms can provide guidance and necessary documents related to your satisfaction of mortgage.

To obtain a mortgage satisfaction letter in Green Bay, contact your lender directly after paying off your mortgage. They are legally obligated to provide this documentation. If you're unsure how to navigate this process, consider using USLegalForms, which offers templates and instructions to simplify obtaining your mortgage satisfaction letter. Timely action helps eliminate confusion regarding ownership of your property.

The timeframe to receive a satisfaction of mortgage in Green Bay may vary, but typically, it takes a few weeks. After paying off your mortgage, the lender is responsible for sending the satisfaction document to you. Once you receive it, you can file it with the local records office for your property. Delays can occur, so remaining proactive in following up with your lender is a good idea.

When no satisfaction of mortgage is recorded in Green Bay, Wisconsin, the lender retains the legal right to the property. This means you may still appear as liable for the mortgage on public records, which can affect your credit history. You might face challenges when trying to sell or refinance the property, as potential buyers may see the outstanding mortgage. It's essential to ensure that a satisfaction document is filed to avoid these potential complications.

Filling out a satisfaction of mortgage form requires you to provide specific information, including the mortgage’s original details and the borrower’s information. Ensure all sections are completed accurately to avoid complications. If you seek guidance on this process, uslegalforms offers templates tailored for the Green Bay Wisconsin Satisfaction, Release or Cancellation of Mortgage by Corporation that simplify your experience.

Typically, the borrower is responsible for the payment associated with the satisfaction of a mortgage. However, in some cases, the lender may cover the costs, especially if they are eager to finalize the release. It's essential to review your mortgage agreement to understand your specific situation regarding the Green Bay Wisconsin Satisfaction, Release or Cancellation of Mortgage by Corporation.