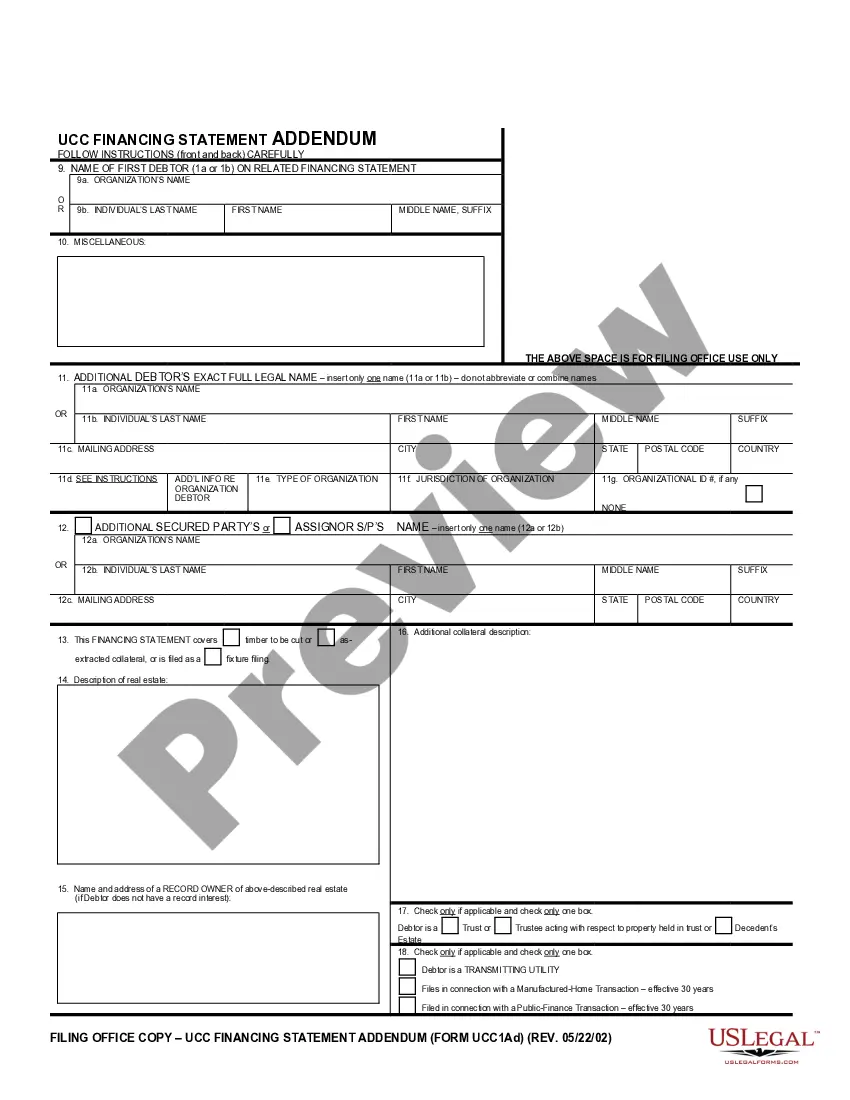

UCC1 - Financing Statement - Wisconsin - For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Green Bay Wisconsin UCC1 Financing Statement

Description

How to fill out Wisconsin UCC1 Financing Statement?

We consistently endeavor to mitigate or avert legal complications when managing intricate legal or financial issues.

To achieve this, we engage in legal solutions that are typically exorbitantly priced.

However, not all legal situations are equally intricate; many can be managed by us personally.

US Legal Forms is an online catalog of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it from the My documents tab.

- Our library empowers you to handle your issues independently without relying on legal advisors.

- We provide access to legal form templates that are not always readily accessible.

- Our templates are specific to each state and region, which significantly eases the search process.

- Benefit from US Legal Forms whenever you need to locate and download the Green Bay Wisconsin UCC1 Financing Statement or any other form swiftly and securely.

Form popularity

FAQ

Filing a UCC-1 Financing Statement on yourself can provide an added layer of protection for your personal assets. In Green Bay, Wisconsin, this action formally establishes your claim to collateral that you own, making it publicly recognized. It can serve as a proactive measure to safeguard your interests, especially if you engage in lending or financial agreements. USLegalForms offers resources that help you navigate this process effectively, ensuring you understand your rights.

Filling out a UCC-1 form correctly requires attention to detail, especially regarding the debtor's name and the collateral description. In Green Bay, Wisconsin, you should avoid using abbreviations and ensure that everything is spelled out clearly. It’s also crucial to provide the proper signatures where required. If you are uncertain about the process, consider using USLegalForms for comprehensive guidance that walks you through each step.

To properly fill out a UCC-1 Financing Statement in Green Bay, Wisconsin, begin by gathering accurate details about the debtor and secured party. Ensure that the description of the collateral is specific and comprehensive. Double-check all entries for accuracy, as any mistake could affect your filing. Utilizing resources like the USLegalForms platform can guide you step-by-step to ensure your document is filled out correctly.

A typical UCC Financing Statement resembles a standard form that includes fields for debtor and secured party information, a description of the collateral, and the signature of the debtor. In Green Bay, Wisconsin, you would see clear sections to enter details, making it straightforward to complete. There's usually a section for any additional information that may assist in identifying the collateral. Familiarizing yourself with this format can simplify your filing process.

In Green Bay, Wisconsin, the rules for filing a UCC-1 Financing Statement provide a legal framework for securing interests in personal property. The filing must include specific details about the debtor and secured party, along with a description of the collateral. Additionally, it must be filed with the appropriate state office, typically the Wisconsin Department of Financial Institutions. Understanding these rules ensures that your UCC-1 is valid and protects your interests.

To release your UCC financing statement in Green Bay, Wisconsin, start by completing a UCC-3 financing statement amendment. This document must be filed with the state, and it will declare that the secured party releases its interest in the collateral. Properly following this process updates public records to reflect the release. For convenient assistance, turn to uslegalforms, which offers step-by-step guidance.

Releasing a UCC financing statement in Green Bay, Wisconsin requires filing a UCC-3 amendment. This shows that the secured party has released its claim on the collateral. Submitting this statement properly ensures that your public records reflect that the lien is no longer active. Our uslegalforms platform provides easy-to-use templates to help you complete this task effectively.

To file a UCC fixture filing, such as a Green Bay Wisconsin UCC1 Financing Statement, head to the Secretary of State’s office in Wisconsin. A fixture filing generally pertains to goods that are considered part of real estate. This filing helps you secure your interest in these assets against potential claims. Using uslegalforms can make this process easier and more efficient.

A financing statement, like the Green Bay Wisconsin UCC1 Financing Statement, must typically be filed in the state's Secretary of State office where the debtor is located. This filing allows secured parties to claim rights over the debtor's assets. It's vital for maintaining legal priority among creditors. Consider uslegalforms to simplify your filing experience and ensure accuracy.

If you're dealing with a Green Bay Wisconsin UCC1 Financing Statement but need to understand UCC filings in New York, file with the New York Department of State. While the processes may differ, knowing where to file is essential for protecting your interests. Be sure to check state-specific requirements to ensure compliance. Our platform can guide you through these differences smoothly.