- US Legal Forms

-

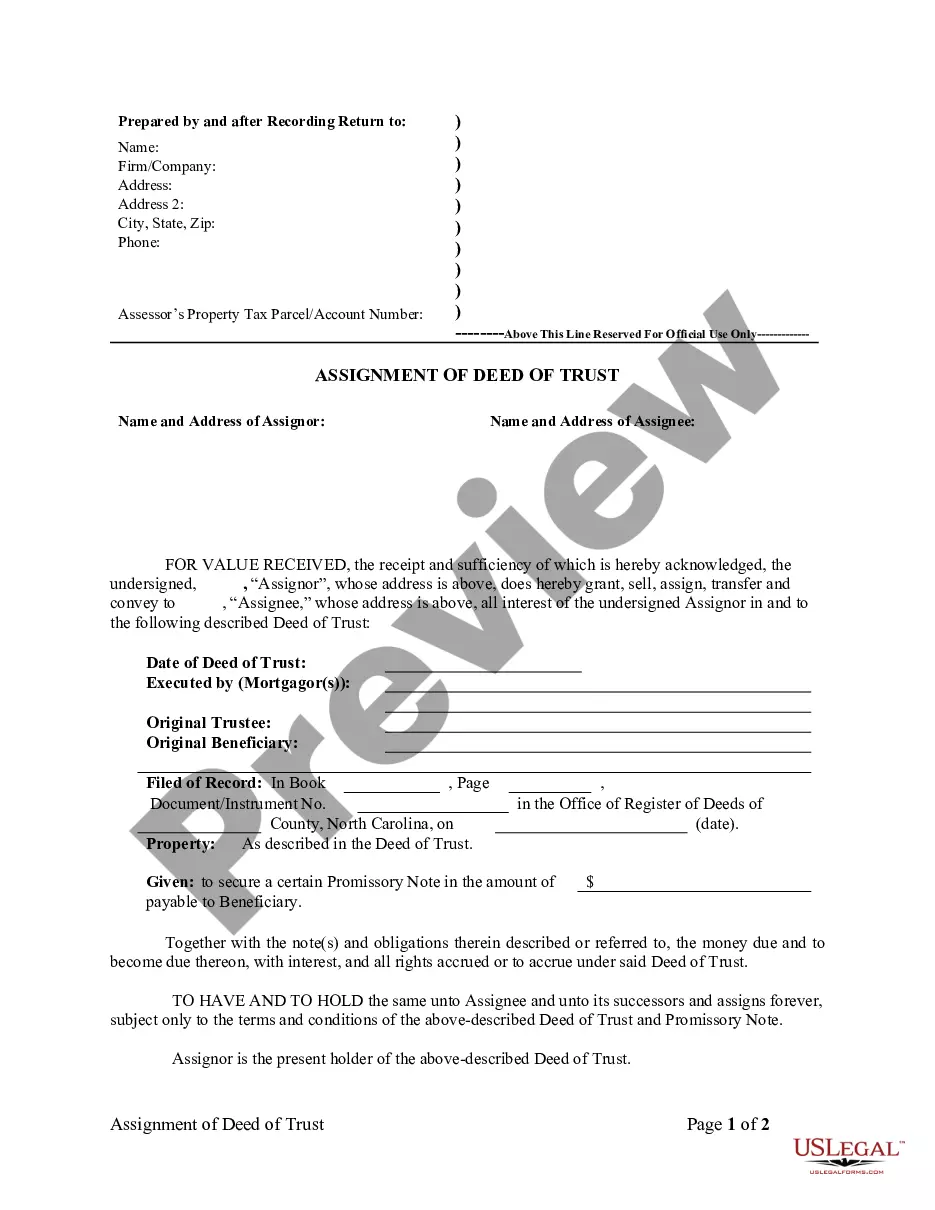

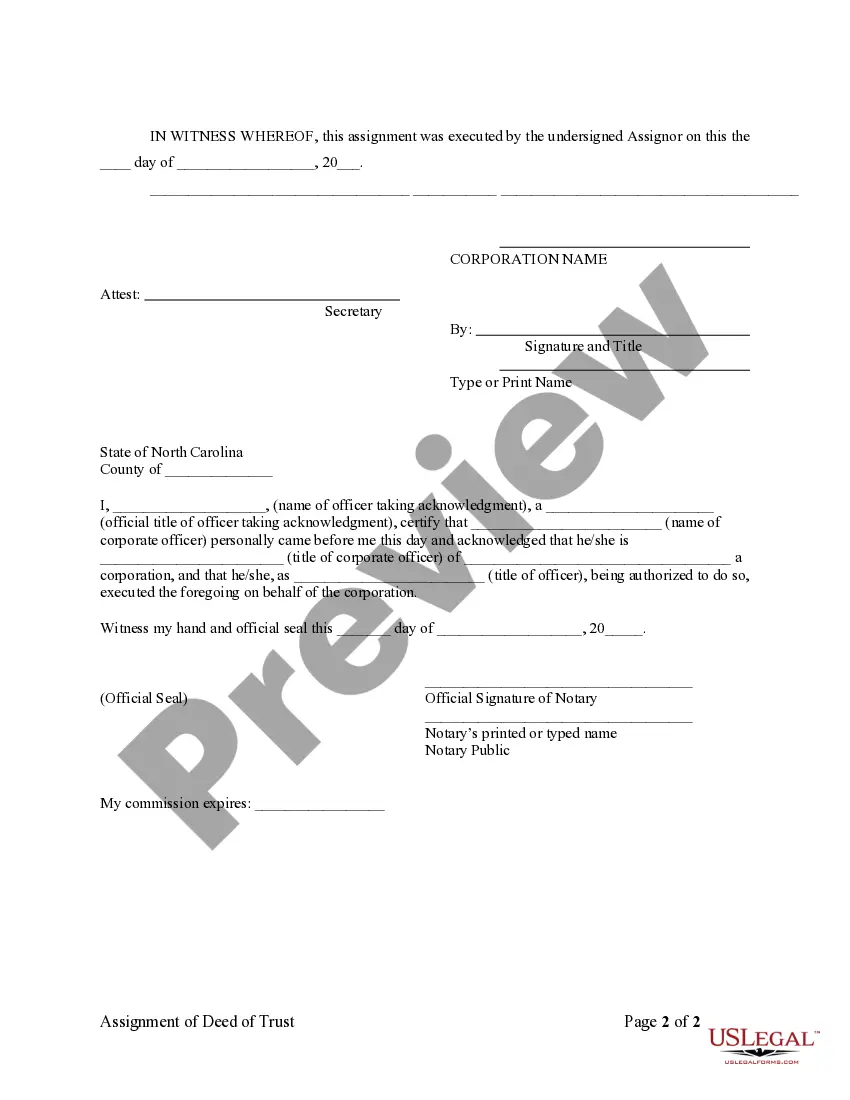

North Carolina Assignment of Deed of Trust by Corporate Mortgage...

Corporate Assignment Of Deed Of Trust

Description Assignment Deed Corporate

Assignment Trust Sample Related Forms

How to fill out What Is An Assignment Deed Of Trust?

Avoid pricey attorneys and find the North Carolina Assignment of Deed of Trust by Corporate Mortgage Holder you want at a affordable price on the US Legal Forms site. Use our simple categories function to search for and obtain legal and tax files. Go through their descriptions and preview them well before downloading. Additionally, US Legal Forms enables users with step-by-step instructions on how to obtain and complete every form.

US Legal Forms customers just need to log in and get the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to stick to the guidelines below:

- Make sure the North Carolina Assignment of Deed of Trust by Corporate Mortgage Holder is eligible for use in your state.

- If available, read the description and make use of the Preview option just before downloading the sample.

- If you are confident the document meets your needs, click Buy Now.

- In case the form is incorrect, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to your gadget or print it out.

After downloading, it is possible to fill out the North Carolina Assignment of Deed of Trust by Corporate Mortgage Holder by hand or with the help of an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Nc Deed Of Trust Form Form Rating

Deeds Of Trust Form popularity

North Carolina Deed Of Trust Other Form Names

Trust Holder FAQ

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

A Deed of Trust is a type of secured real-estate transaction that some states use instead of mortgages.A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

In the case of Deed of Trust, the lender can by pass the judicial process and utilize the power of sale to sell the property if the borrower defaults.The following states use Deed of Trusts: Alaska, Arizona, California, District of Columbia, Georgia, Mississippi, Missouri, Nevada, North Carolina, and Virginia.

In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate.Under a deed of trust, the borrower (called the "grantor") conveys legal title to the real estate to a third party (called the "trustee") to hold for the benefit of the lender (called the "beneficiary") until the loan is repaid.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

A deed conveys ownership; a deed of trust secures a loan.

What Is A Deed Of Trust In Nc Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

North Carolina

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rule is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

North Carolina Law

Assignment:

An assignment must be in writing and recorded.

Demand to Satisfy:

A petitioner may recover damages under this section only if he has given the mortgagee, obligee, beneficiary or other responsible party written notice of his intention to bring an action pursuant to this section. Upon receipt of this notice, the mortgagee, obligee, beneficiary or other responsible party shall have 30 days, in addition to the initial 60-day period, to fulfill the requirements of this section. See code section 45-36.3(2)(b), below.

Recording Satisfaction:

Upon full payoff, within 60 days the lender must either forward the satisfaction document to the borrower, or have the satisfaction recorded of record. See, 45-36.3, below.

Marginal Satisfaction:

A marginal satisfaction may be done in addition to recording the satisfaction document. See 45-37, below.

Penalty:

Any person, institution or agent who fails to comply with this section may be required to pay a civil penalty of not more than one thousand dollars ($1,000) in addition to reasonable attorneys' fees and any other damages awarded by the court to the grantor, trustor or mortgagor, or to a subsequent purchaser of the property from the grantor, trustor or mortgagor. See code section 45-36.3(2)(b) below.

Acknowledgment:

An assignment or satisfaction must contain a proper North Carolina acknowledgment, or other acknowledgment approved by Statute.

North Carolina Statutes

§45-36.2. Register of deeds includes assistants and deputies.

The words "register of deeds" appearing in this Article shall be interpreted to mean "register of deeds, assistant register of deeds, or deputy register of deeds." (1953, c. 848.)

§ 45-36.3. Notification by mortgagee of satisfaction of provisions of deed of trust or mortgage, or other instrument; civil penalty.

(a) After the satisfaction of the provisions

of any deed of trust or mortgage, or other instrument intended to secure

with real property the payment of money or the performance of any other

obligation and registered as required by law, the holder of the evidence

of the indebtedness, if it is a single instrument, or a duly authorized

agent or attorney of such holder shall within 60 days:

(1)

Discharge and release of record such documents and forward the cancelled

documents to the grantor, trustor or mortgagor; or,

(2)

Alternatively, the holder of the evidence of the indebtedness or a duly

authorized agent or attorney of such holder, at the request of the grantor,

trustor or mortgagor, shall forward said instrument and the deed of trust

or mortgage instrument, with payment and satisfaction acknowledged in accordance

with the requirements of G.S. 45-37, to the grantor, trustor or mortgagor.

(b) Any person, institution or agent who

fails to comply with this section may be required to pay a civil penalty

of not more than one thousand dollars ($1,000) in addition to reasonable

attorneys' fees and any other damages awarded by the court to the grantor,

trustor or mortgagor, or to a subsequent purchaser of the property from

the grantor, trustor or mortgagor. A five hundred dollar ($500.00)

civil penalty may be recovered by the grantor, trustor or mortgagor,

and a five hundred dollar ($500.00) penalty may be recovered by the purchaser

of the property from the grantor, trustor or mortgagor. If that purchaser

of the property consists of more than a single grantee, then the civil

penalty will be divided equally among all of the grantees. A petitioner

may recover damages under this section only if he has given the mortgagee,

obligee, beneficiary or other responsible party written notice of

his intention to bring an action pursuant to this section. Upon receipt

of this notice, the mortgagee, obligee, beneficiary or other responsible

party shall have 30 days, in addition to the initial 60-day period, to

fulfill the requirements of this section.

(c) Should any person, institution or agent

who is not the present holder of the evidence of indebtedness be required

to pay a civil penalty, attorneys' fees, or other damages under this section,

they will have an action against the holder of the evidence of indebtedness

for all sums they were required to pay.

§ 45-37. Discharge of record of mortgages, deeds of trust and other instruments.

(a) Subject to the provisions of

G.S. 45-73 relating to secured instruments which secure future advances,

any deed of trust or mortgage or other instrument intended to secure the

payment of money or the performance of any other obligation registered

as required by law may be discharged and released of record in the following

manner:

(1)

By acknowledgment of the satisfaction of the provisions of such deed of

trust, mortgage or other instrument in the presence of the register of

deeds by:

a. The trustee,

b. The mortgagee,

c. The legal representative of a trustee or mortgagee,

or

d. A duly authorized agent or attorney of any of

the above.

The register of deeds is not required to verify or make inquiry concerning

the authority of the person acknowledging the satisfaction to do so. Upon

acknowledgment of satisfaction, the register of deeds shall record a record

of satisfaction as described in G.S. 45-37.2, and may forthwith make upon

the margin of the record of such deed of trust, mortgage or other instrument

an entry of such acknowledgment of satisfaction which shall be signed by

the trustee, mortgagee, legal representative, agent or attorney and witnessed

by the register of deeds, who shall also affix his name thereto.

(2)

By exhibition of any deed of trust, mortgage or other instrument accompanied

with the bond, note, or other instrument thereby secured to the register

of deeds, with the endorsement of payment and satisfaction appearing thereon

and made by:

a. The obligee,

b. The mortgagee,

c. The trustee,

d. An assignee of the obligee, mortgagee, or trustee,

or

e. Any chartered banking institution, or savings

and loan association, national or state, or credit union, qualified to

do business in and having an office in the State of North Carolina, when

so endorsed in the name of the institution by an officer thereof.

The register of deeds is not required to verify or make inquiry concerning

the authority of the person making the endorsement of payment and satisfaction

to do so. Upon exhibition of the instruments, the register of deeds shall

cancel the mortgage, deed of trust or other instrument by recording a record

of satisfaction as described in G.S. 45-37.2, and may make an entry of

satisfaction on the margin of the record. The person so claiming satisfaction,

performance or discharge of the debt or other obligation may retain possession

of all of the instruments exhibited. The exhibition of the mortgage, deed

of trust or other instrument alone to the register of deeds, with endorsement

of payment, satisfaction, performance or discharge, shall be sufficient

if the mortgage, deed of trust or other instrument itself sets forth the

obligation secured or the performance of any other obligation and does

not call for or recite any note, bond or other instrument secured by it.

(3)

By exhibiting to the register of deeds by:

a. The grantor,

b. The mortgagor, or

c. An agent, attorney or successor in title of

the grantor or mortgagor of any mortgage, deed of trust or other instrument

intended to secure the payment of money or the performance of any other

obligation, together with the bond, note or other instrument secured thereby,

or by exhibition of the mortgage, deed of trust or other instrument alone

if such instrument itself sets forth the obligation secured or other obligation

to be performed and does not call for or recite any note, bond or other

instrument secured by it, if at the time of exhibition, all such instruments

are more than 10 years old counting from the maturity date of the last

obligation secured. If the instrument or instruments so exhibited have

an endorsement of partial payment, satisfaction, performance or discharge

within the said period of 10 years, the period of 10 years shall be counted

from the date of the most recent endorsement.

The register of deeds shall

cancel the mortgage, deed of trust, or other instrument by recording a

record of satisfaction as described in G.S. 45-37.2, and may make proper

entry of cancellation and satisfaction of said instrument on the margin

of the record where the same is recorded, whether there be any such entries

on the original papers or not.

(4)

By exhibition to the register of deeds of any deed of trust given to secure

the bearer or holder of any negotiable instruments transferable by delivery,

together with all the evidences of indebtedness secured thereby, marked

paid and satisfied in full and signed by the bearer or holder thereof.

Upon exhibition of the deed of trust, and the evidences of indebtedness

properly marked, the register of deeds shall cancel such deed of trust

by recording a record of satisfaction as described in G.S. 45-37.2, and

may make an entry of satisfaction upon the margin of the record, which

record, or entry if made, shall be valid and binding upon all persons,

if no person rightfully entitled to the deed of trust or evidences of indebtedness

has previously notified the register of deeds in writing of the loss or

theft of the instrument or evidences of indebtedness and has caused the

register of deeds to record the notice or loss or theft in a separate document,

as required by G.S. 161-14.1.

Upon receipt of written notice of loss or theft of the deed of trust or

evidences of indebtedness the register of deeds shall record a record of

satisfaction, as described in G.S. 45-37.2, which in this case shall consist

of a rerecording of the record of the deed of trust containing the marginal

entry and may make on the record of the deed of trust concerned a marginal

entry in writing thereof, with the date of receipt of the notice. The deed

of trust shall not be canceled after such recording of a record of satisfaction

or marginal entry until the ownership of said instrument shall have been

lawfully determined. Nothing in this subdivision (4) shall be construed

to impair the negotiability of any instrument otherwise properly negotiable,

nor to impair the rights of any innocent purchaser for value thereof.

Every entry of acknowledgment of satisfaction or of satisfaction made or

witnessed by the register of deeds as provided in subdivision (a)(1) shall

operate and have the same effect to release and discharge all the interest

of such trustee, mortgagee or representative in such deed or mortgage as

if a deed of release or reconveyance thereof had been duly executed and

recorded.

(5)

By exhibition to the register of deeds of a notice of satisfaction of a

deed of trust, mortgage, or other instrument which has been acknowledged

by the trustee or the mortgagee before an officer authorized to take acknowledgments.

The notice of satisfaction shall be substantially in the form set out in

G.S. 47-46.1. The notice of satisfaction shall recite the names of all

parties to the original instrument, the amount of the obligation secured,

the date of satisfaction of the obligation, and a reference by book and

page number to the record of the instrument satisfied. The notice of satisfaction

shall be accompanied by the deed of trust, mortgage, or other instrument,

or a copy of the instrument, for verification and indexing purposes, which

shall not be recorded with the notice.

Upon exhibition of the notice of satisfaction, the register of deeds shall

record the notice of satisfaction and cancel the deed of trust, mortgage,

or other instrument as required by G.S. 45-37.2. No fee shall be charged

for recording any documents or certifying any acknowledgments pursuant

to this subdivision. The register of deeds shall not be required to verify

or make inquiry concerning the authority of the person executing the notice

of satisfaction to do so.

(6)

By exhibition to the register of deeds of a certificate of satisfaction

of a deed of trust, mortgage, or other instrument that has been acknowledged

before an officer authorized to take acknowledgments by the owner of the

note, bond, or other evidence of indebtedness secured by the deed of trust

or mortgage. The certificate of satisfaction shall be accompanied by the

note, bond, or other evidence of indebtedness, if available, with an endorsement

of payment and satisfaction by the owner of the note, bond, or other evidence

of indebtedness. If such evidence of indebtedness cannot be produced, an

affidavit, hereafter referred to as an "affidavit of lost note", signed

by the owner of the note, bond, or other evidence of indebtedness, shall

be delivered to the register of deeds in lieu of the evidence of indebtedness

certifying that the debt has been satisfied and stating: (i) the date of

satisfaction; (ii) that the note, bond, or other evidence of indebtedness

cannot be found; and (iii) that the person signing the affidavit is the

current owner of the note, bond, or other evidence of indebtedness. The

certificate of satisfaction shall be substantially in the form set out

in G.S. 47-46.2 and shall recite the names of all parties to the original

instrument, the amount of the obligation secured, the date of satisfaction

of the obligation, and a reference by book and page number to the record

of the instrument satisfied. The affidavit of lost note, if necessary,

shall be substantially in the form set out in G.S. 47- 46.3. The certificate

of satisfaction shall be accompanied by the deed of trust, mortgage, or

other instrument, or a copy of the instrument, for verification and indexing

purposes, which shall not be recorded with the certificate.

Upon exhibition of the certificate of satisfaction and accompanying evidence

of indebtedness endorsed paid and satisfied, or upon exhibition of an affidavit

of lost note, the register of deeds shall record the certificate of satisfaction

and either the accompanying evidence of indebtedness or the affidavit of

lost note, and shall cancel the deed of trust, mortgage, or other instrument

as required by G.S. 45-37.2. No fee shall be charged for recording any

documents or certifying any acknowledgments pursuant to this subdivision.

The register of deeds shall not be required to verify or make inquiry concerning

the authority of the person executing the certificate of satisfaction to

do so.

(b) It shall be conclusively presumed

that the conditions of any deed of trust, mortgage or other instrument

securing the payment of money or securing the performance of any other

obligation or obligations have been complied with or the debts secured

thereby paid or obligations performed, as against creditors or purchasers

for valuable consideration from the mortgagor or grantor, from and after

the expiration of 15 years from whichever of the following occurs last:

(1)

The date when the conditions of such instrument were required by its terms

to have been performed, or

(2)

The date of maturity of the last installment of debt or interest secured

thereby; provided that the holder of the indebtedness secured by such instrument

or party secured by any provision thereof may file an affidavit with the

register of deeds which affidavit shall specifically state:

(1)

The amount of debt unpaid, which is secured by said instrument; or

(2)

In what respect any other condition thereof shall not have been complied

with; or may record a separate instrument signed by the holder or party secured

and witnessed by the register of deeds stating:

(1)

Any payments that have been made on the indebtedness or other obligation

secured by such instrument including the date and amount of payments and

(2)

The amount still due or obligations not performed under the instrument.

Whenever practical, the register of deeds may also enter the information

contained in the separate instrument on the margin of the record of the

instrument. The effect of the filing of the affidavit or of the instrument

recorded made as herein provided shall be to postpone the effective date

of the conclusive presumption of satisfaction to a date 15 years from the

filing of the affidavit or from the recording of the instrument or the

making of the notation. There shall be only one postponement of the effective

date of the conclusive presumption provided for herein. The register of

deeds shall record the affidavit provided for herein and shall record a

separate instrument, as required by G.S. 161-14.1, making reference to

the filing of such affidavit and to the book and page where the affidavit

is recorded. Whenever practical, the register of deeds may also make such

a reference on the margin of the record of the deed of trust, mortgage,

or other instrument referred to. This subsection shall not apply to any

deed, mortgage, deed of trust or other instrument made or given by any

railroad company, or to any agreement of conditional sale, equipment trust

agreement, lease, chattel mortgage or other instrument relating to the

sale, purchase or lease of railroad equipment or rolling stock, or of other

personal property.

(c) Repealed by Session Laws 1991,

c. 114, s. 4.

(d) For the purposes of this section

"register of deeds" means the register of deeds, his deputies or assistants

of the county in which the mortgage, deed of trust, or other instrument

intended to secure the payment of money or performance of other obligation

is registered.

(e) Any transaction subject to the

provisions of the Uniform Commercial Code, Chapter 25 of the General Statutes,

is controlled by the provisions of that act and not by this section.

(f) Whenever this section requires

a signature or endorsement, that signature or endorsement shall be followed

by the name of the person signing or endorsing the document printed, stamped,

or typed so as to be clearly legible. The register of deeds may refuse

to accept any document when the provisions of this subsection have not

been met.

§ 45-37.2. Recording satisfactions of deeds of trusts and mortgages.

(a) When a notice of satisfaction is recorded pursuant to

G.S. 45-37(a)(5) or a certificate of satisfaction is recorded pursuant

to G.S. 45-37(a)(6), the register of deeds shall make an entry of satisfaction

on the notice or certificate and record and index the instrument.

(b) When a deed of trust, mortgage, or other instrument is

satisfied by a method other than by means of a notice of satisfaction or

certificate of satisfaction, the register of deeds shall record a record

of satisfaction consisting of either a separate instrument or all or a

portion of the original deed of trust or mortgage rerecorded, and shall

make the appropriate entry of satisfaction as provided in G.S. 45-37 on

each record of satisfaction. A separate instrument or original deed of

trust or mortgage rerecorded pursuant to this subsection shall contain

(i) names of all parties to the original instrument, (ii) the amount of

the obligation secured, (iii) the date of satisfaction of the obligation,

(iv) a reference by book and page number to the record of the instrument

satisfied, and (v) the date of recording the notice of satisfaction.

(c) Whenever it is practical to do so, the register of deeds

may make a marginal notation of satisfaction in addition to making the

recordation required by this section.

§45-41. Recorded deed of release of mortgagee's representative.

The personal representative of any mortgagee or trustee in any mortgage or deed of trust which has heretofore or which may hereafter be registered in the manner required by the laws of this State may discharge and release the same and all property thereby conveyed by deed of quitclaim, release or conveyance executed, acknowledged and recorded as is now prescribed by law for the execution, acknowledgment and registration of deeds and mortgages in this State.

§ 45-42. Satisfaction of corporate mortgages by corporate officers.

All mortgages and deeds in trust executed to a corporation may be satisfied and so marked of record as by law provided for the satisfaction of mortgages and deeds in trust, by any officer of the corporation indicating the office held. For the purposes of recordation and cancellation, such signature shall be deemed to be a certification by the signer that he is an officer and is authorized to execute the satisfaction on behalf of such corporation. Where mortgages or deeds in trust were marked "satisfied" on the records before the twenty-third day of February, 1909, by any president, secretary, treasurer or cashier of any corporation by such officer writing his own name and affixing thereto the title of his office in such corporation, such satisfaction is validated, and is as effective to all intents and purposes as if a deed of release duly executed by such corporation had been made, acknowledged and recorded.

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rule is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

North Carolina Law

Assignment:

An assignment must be in writing and recorded.

Demand to Satisfy:

A petitioner may recover damages under this section only if he has given the mortgagee, obligee, beneficiary or other responsible party written notice of his intention to bring an action pursuant to this section. Upon receipt of this notice, the mortgagee, obligee, beneficiary or other responsible party shall have 30 days, in addition to the initial 60-day period, to fulfill the requirements of this section. See code section 45-36.3(2)(b), below.

Recording Satisfaction:

Upon full payoff, within 60 days the lender must either forward the satisfaction document to the borrower, or have the satisfaction recorded of record. See, 45-36.3, below.

Marginal Satisfaction:

A marginal satisfaction may be done in addition to recording the satisfaction document. See 45-37, below.

Penalty:

Any person, institution or agent who fails to comply with this section may be required to pay a civil penalty of not more than one thousand dollars ($1,000) in addition to reasonable attorneys' fees and any other damages awarded by the court to the grantor, trustor or mortgagor, or to a subsequent purchaser of the property from the grantor, trustor or mortgagor. See code section 45-36.3(2)(b) below.

Acknowledgment:

An assignment or satisfaction must contain a proper North Carolina acknowledgment, or other acknowledgment approved by Statute.

North Carolina Statutes

§45-36.2. Register of deeds includes assistants and deputies.

The words "register of deeds" appearing in this Article shall be interpreted to mean "register of deeds, assistant register of deeds, or deputy register of deeds." (1953, c. 848.)

§ 45-36.3. Notification by mortgagee of satisfaction of provisions of deed of trust or mortgage, or other instrument; civil penalty.

(a) After the satisfaction of the provisions

of any deed of trust or mortgage, or other instrument intended to secure

with real property the payment of money or the performance of any other

obligation and registered as required by law, the holder of the evidence

of the indebtedness, if it is a single instrument, or a duly authorized

agent or attorney of such holder shall within 60 days:

(1)

Discharge and release of record such documents and forward the cancelled

documents to the grantor, trustor or mortgagor; or,

(2)

Alternatively, the holder of the evidence of the indebtedness or a duly

authorized agent or attorney of such holder, at the request of the grantor,

trustor or mortgagor, shall forward said instrument and the deed of trust

or mortgage instrument, with payment and satisfaction acknowledged in accordance

with the requirements of G.S. 45-37, to the grantor, trustor or mortgagor.

(b) Any person, institution or agent who

fails to comply with this section may be required to pay a civil penalty

of not more than one thousand dollars ($1,000) in addition to reasonable

attorneys' fees and any other damages awarded by the court to the grantor,

trustor or mortgagor, or to a subsequent purchaser of the property from

the grantor, trustor or mortgagor. A five hundred dollar ($500.00)

civil penalty may be recovered by the grantor, trustor or mortgagor,

and a five hundred dollar ($500.00) penalty may be recovered by the purchaser

of the property from the grantor, trustor or mortgagor. If that purchaser

of the property consists of more than a single grantee, then the civil

penalty will be divided equally among all of the grantees. A petitioner

may recover damages under this section only if he has given the mortgagee,

obligee, beneficiary or other responsible party written notice of

his intention to bring an action pursuant to this section. Upon receipt

of this notice, the mortgagee, obligee, beneficiary or other responsible

party shall have 30 days, in addition to the initial 60-day period, to

fulfill the requirements of this section.

(c) Should any person, institution or agent

who is not the present holder of the evidence of indebtedness be required

to pay a civil penalty, attorneys' fees, or other damages under this section,

they will have an action against the holder of the evidence of indebtedness

for all sums they were required to pay.

§ 45-37. Discharge of record of mortgages, deeds of trust and other instruments.

(a) Subject to the provisions of

G.S. 45-73 relating to secured instruments which secure future advances,

any deed of trust or mortgage or other instrument intended to secure the

payment of money or the performance of any other obligation registered

as required by law may be discharged and released of record in the following

manner:

(1)

By acknowledgment of the satisfaction of the provisions of such deed of

trust, mortgage or other instrument in the presence of the register of

deeds by:

a. The trustee,

b. The mortgagee,

c. The legal representative of a trustee or mortgagee,

or

d. A duly authorized agent or attorney of any of

the above.

The register of deeds is not required to verify or make inquiry concerning

the authority of the person acknowledging the satisfaction to do so. Upon

acknowledgment of satisfaction, the register of deeds shall record a record

of satisfaction as described in G.S. 45-37.2, and may forthwith make upon

the margin of the record of such deed of trust, mortgage or other instrument

an entry of such acknowledgment of satisfaction which shall be signed by

the trustee, mortgagee, legal representative, agent or attorney and witnessed

by the register of deeds, who shall also affix his name thereto.

(2)

By exhibition of any deed of trust, mortgage or other instrument accompanied

with the bond, note, or other instrument thereby secured to the register

of deeds, with the endorsement of payment and satisfaction appearing thereon

and made by:

a. The obligee,

b. The mortgagee,

c. The trustee,

d. An assignee of the obligee, mortgagee, or trustee,

or

e. Any chartered banking institution, or savings

and loan association, national or state, or credit union, qualified to

do business in and having an office in the State of North Carolina, when

so endorsed in the name of the institution by an officer thereof.

The register of deeds is not required to verify or make inquiry concerning

the authority of the person making the endorsement of payment and satisfaction

to do so. Upon exhibition of the instruments, the register of deeds shall

cancel the mortgage, deed of trust or other instrument by recording a record

of satisfaction as described in G.S. 45-37.2, and may make an entry of

satisfaction on the margin of the record. The person so claiming satisfaction,

performance or discharge of the debt or other obligation may retain possession

of all of the instruments exhibited. The exhibition of the mortgage, deed

of trust or other instrument alone to the register of deeds, with endorsement

of payment, satisfaction, performance or discharge, shall be sufficient

if the mortgage, deed of trust or other instrument itself sets forth the

obligation secured or the performance of any other obligation and does

not call for or recite any note, bond or other instrument secured by it.

(3)

By exhibiting to the register of deeds by:

a. The grantor,

b. The mortgagor, or

c. An agent, attorney or successor in title of

the grantor or mortgagor of any mortgage, deed of trust or other instrument

intended to secure the payment of money or the performance of any other

obligation, together with the bond, note or other instrument secured thereby,

or by exhibition of the mortgage, deed of trust or other instrument alone

if such instrument itself sets forth the obligation secured or other obligation

to be performed and does not call for or recite any note, bond or other

instrument secured by it, if at the time of exhibition, all such instruments

are more than 10 years old counting from the maturity date of the last

obligation secured. If the instrument or instruments so exhibited have

an endorsement of partial payment, satisfaction, performance or discharge

within the said period of 10 years, the period of 10 years shall be counted

from the date of the most recent endorsement.

The register of deeds shall

cancel the mortgage, deed of trust, or other instrument by recording a

record of satisfaction as described in G.S. 45-37.2, and may make proper

entry of cancellation and satisfaction of said instrument on the margin

of the record where the same is recorded, whether there be any such entries

on the original papers or not.

(4)

By exhibition to the register of deeds of any deed of trust given to secure

the bearer or holder of any negotiable instruments transferable by delivery,

together with all the evidences of indebtedness secured thereby, marked

paid and satisfied in full and signed by the bearer or holder thereof.

Upon exhibition of the deed of trust, and the evidences of indebtedness

properly marked, the register of deeds shall cancel such deed of trust

by recording a record of satisfaction as described in G.S. 45-37.2, and

may make an entry of satisfaction upon the margin of the record, which

record, or entry if made, shall be valid and binding upon all persons,

if no person rightfully entitled to the deed of trust or evidences of indebtedness

has previously notified the register of deeds in writing of the loss or

theft of the instrument or evidences of indebtedness and has caused the

register of deeds to record the notice or loss or theft in a separate document,

as required by G.S. 161-14.1.

Upon receipt of written notice of loss or theft of the deed of trust or

evidences of indebtedness the register of deeds shall record a record of

satisfaction, as described in G.S. 45-37.2, which in this case shall consist

of a rerecording of the record of the deed of trust containing the marginal

entry and may make on the record of the deed of trust concerned a marginal

entry in writing thereof, with the date of receipt of the notice. The deed

of trust shall not be canceled after such recording of a record of satisfaction

or marginal entry until the ownership of said instrument shall have been

lawfully determined. Nothing in this subdivision (4) shall be construed

to impair the negotiability of any instrument otherwise properly negotiable,

nor to impair the rights of any innocent purchaser for value thereof.

Every entry of acknowledgment of satisfaction or of satisfaction made or

witnessed by the register of deeds as provided in subdivision (a)(1) shall

operate and have the same effect to release and discharge all the interest

of such trustee, mortgagee or representative in such deed or mortgage as

if a deed of release or reconveyance thereof had been duly executed and

recorded.

(5)

By exhibition to the register of deeds of a notice of satisfaction of a

deed of trust, mortgage, or other instrument which has been acknowledged

by the trustee or the mortgagee before an officer authorized to take acknowledgments.

The notice of satisfaction shall be substantially in the form set out in

G.S. 47-46.1. The notice of satisfaction shall recite the names of all

parties to the original instrument, the amount of the obligation secured,

the date of satisfaction of the obligation, and a reference by book and

page number to the record of the instrument satisfied. The notice of satisfaction

shall be accompanied by the deed of trust, mortgage, or other instrument,

or a copy of the instrument, for verification and indexing purposes, which

shall not be recorded with the notice.

Upon exhibition of the notice of satisfaction, the register of deeds shall

record the notice of satisfaction and cancel the deed of trust, mortgage,

or other instrument as required by G.S. 45-37.2. No fee shall be charged

for recording any documents or certifying any acknowledgments pursuant

to this subdivision. The register of deeds shall not be required to verify

or make inquiry concerning the authority of the person executing the notice

of satisfaction to do so.

(6)

By exhibition to the register of deeds of a certificate of satisfaction

of a deed of trust, mortgage, or other instrument that has been acknowledged

before an officer authorized to take acknowledgments by the owner of the

note, bond, or other evidence of indebtedness secured by the deed of trust

or mortgage. The certificate of satisfaction shall be accompanied by the

note, bond, or other evidence of indebtedness, if available, with an endorsement

of payment and satisfaction by the owner of the note, bond, or other evidence

of indebtedness. If such evidence of indebtedness cannot be produced, an

affidavit, hereafter referred to as an "affidavit of lost note", signed

by the owner of the note, bond, or other evidence of indebtedness, shall

be delivered to the register of deeds in lieu of the evidence of indebtedness

certifying that the debt has been satisfied and stating: (i) the date of

satisfaction; (ii) that the note, bond, or other evidence of indebtedness

cannot be found; and (iii) that the person signing the affidavit is the

current owner of the note, bond, or other evidence of indebtedness. The

certificate of satisfaction shall be substantially in the form set out

in G.S. 47-46.2 and shall recite the names of all parties to the original

instrument, the amount of the obligation secured, the date of satisfaction

of the obligation, and a reference by book and page number to the record

of the instrument satisfied. The affidavit of lost note, if necessary,

shall be substantially in the form set out in G.S. 47- 46.3. The certificate

of satisfaction shall be accompanied by the deed of trust, mortgage, or

other instrument, or a copy of the instrument, for verification and indexing

purposes, which shall not be recorded with the certificate.

Upon exhibition of the certificate of satisfaction and accompanying evidence

of indebtedness endorsed paid and satisfied, or upon exhibition of an affidavit

of lost note, the register of deeds shall record the certificate of satisfaction

and either the accompanying evidence of indebtedness or the affidavit of

lost note, and shall cancel the deed of trust, mortgage, or other instrument

as required by G.S. 45-37.2. No fee shall be charged for recording any

documents or certifying any acknowledgments pursuant to this subdivision.

The register of deeds shall not be required to verify or make inquiry concerning

the authority of the person executing the certificate of satisfaction to

do so.

(b) It shall be conclusively presumed

that the conditions of any deed of trust, mortgage or other instrument

securing the payment of money or securing the performance of any other

obligation or obligations have been complied with or the debts secured

thereby paid or obligations performed, as against creditors or purchasers

for valuable consideration from the mortgagor or grantor, from and after

the expiration of 15 years from whichever of the following occurs last:

(1)

The date when the conditions of such instrument were required by its terms

to have been performed, or

(2)

The date of maturity of the last installment of debt or interest secured

thereby; provided that the holder of the indebtedness secured by such instrument

or party secured by any provision thereof may file an affidavit with the

register of deeds which affidavit shall specifically state:

(1)

The amount of debt unpaid, which is secured by said instrument; or

(2)

In what respect any other condition thereof shall not have been complied

with; or may record a separate instrument signed by the holder or party secured

and witnessed by the register of deeds stating:

(1)

Any payments that have been made on the indebtedness or other obligation

secured by such instrument including the date and amount of payments and

(2)

The amount still due or obligations not performed under the instrument.

Whenever practical, the register of deeds may also enter the information

contained in the separate instrument on the margin of the record of the

instrument. The effect of the filing of the affidavit or of the instrument

recorded made as herein provided shall be to postpone the effective date

of the conclusive presumption of satisfaction to a date 15 years from the

filing of the affidavit or from the recording of the instrument or the

making of the notation. There shall be only one postponement of the effective

date of the conclusive presumption provided for herein. The register of

deeds shall record the affidavit provided for herein and shall record a

separate instrument, as required by G.S. 161-14.1, making reference to

the filing of such affidavit and to the book and page where the affidavit

is recorded. Whenever practical, the register of deeds may also make such

a reference on the margin of the record of the deed of trust, mortgage,

or other instrument referred to. This subsection shall not apply to any

deed, mortgage, deed of trust or other instrument made or given by any

railroad company, or to any agreement of conditional sale, equipment trust

agreement, lease, chattel mortgage or other instrument relating to the

sale, purchase or lease of railroad equipment or rolling stock, or of other

personal property.

(c) Repealed by Session Laws 1991,

c. 114, s. 4.

(d) For the purposes of this section

"register of deeds" means the register of deeds, his deputies or assistants

of the county in which the mortgage, deed of trust, or other instrument

intended to secure the payment of money or performance of other obligation

is registered.

(e) Any transaction subject to the

provisions of the Uniform Commercial Code, Chapter 25 of the General Statutes,

is controlled by the provisions of that act and not by this section.

(f) Whenever this section requires

a signature or endorsement, that signature or endorsement shall be followed

by the name of the person signing or endorsing the document printed, stamped,

or typed so as to be clearly legible. The register of deeds may refuse

to accept any document when the provisions of this subsection have not

been met.

§ 45-37.2. Recording satisfactions of deeds of trusts and mortgages.

(a) When a notice of satisfaction is recorded pursuant to

G.S. 45-37(a)(5) or a certificate of satisfaction is recorded pursuant

to G.S. 45-37(a)(6), the register of deeds shall make an entry of satisfaction

on the notice or certificate and record and index the instrument.

(b) When a deed of trust, mortgage, or other instrument is

satisfied by a method other than by means of a notice of satisfaction or

certificate of satisfaction, the register of deeds shall record a record

of satisfaction consisting of either a separate instrument or all or a

portion of the original deed of trust or mortgage rerecorded, and shall

make the appropriate entry of satisfaction as provided in G.S. 45-37 on

each record of satisfaction. A separate instrument or original deed of

trust or mortgage rerecorded pursuant to this subsection shall contain

(i) names of all parties to the original instrument, (ii) the amount of

the obligation secured, (iii) the date of satisfaction of the obligation,

(iv) a reference by book and page number to the record of the instrument

satisfied, and (v) the date of recording the notice of satisfaction.

(c) Whenever it is practical to do so, the register of deeds

may make a marginal notation of satisfaction in addition to making the

recordation required by this section.

§45-41. Recorded deed of release of mortgagee's representative.

The personal representative of any mortgagee or trustee in any mortgage or deed of trust which has heretofore or which may hereafter be registered in the manner required by the laws of this State may discharge and release the same and all property thereby conveyed by deed of quitclaim, release or conveyance executed, acknowledged and recorded as is now prescribed by law for the execution, acknowledgment and registration of deeds and mortgages in this State.

§ 45-42. Satisfaction of corporate mortgages by corporate officers.

All mortgages and deeds in trust executed to a corporation may be satisfied and so marked of record as by law provided for the satisfaction of mortgages and deeds in trust, by any officer of the corporation indicating the office held. For the purposes of recordation and cancellation, such signature shall be deemed to be a certification by the signer that he is an officer and is authorized to execute the satisfaction on behalf of such corporation. Where mortgages or deeds in trust were marked "satisfied" on the records before the twenty-third day of February, 1909, by any president, secretary, treasurer or cashier of any corporation by such officer writing his own name and affixing thereto the title of his office in such corporation, such satisfaction is validated, and is as effective to all intents and purposes as if a deed of release duly executed by such corporation had been made, acknowledged and recorded.