What is Probate?

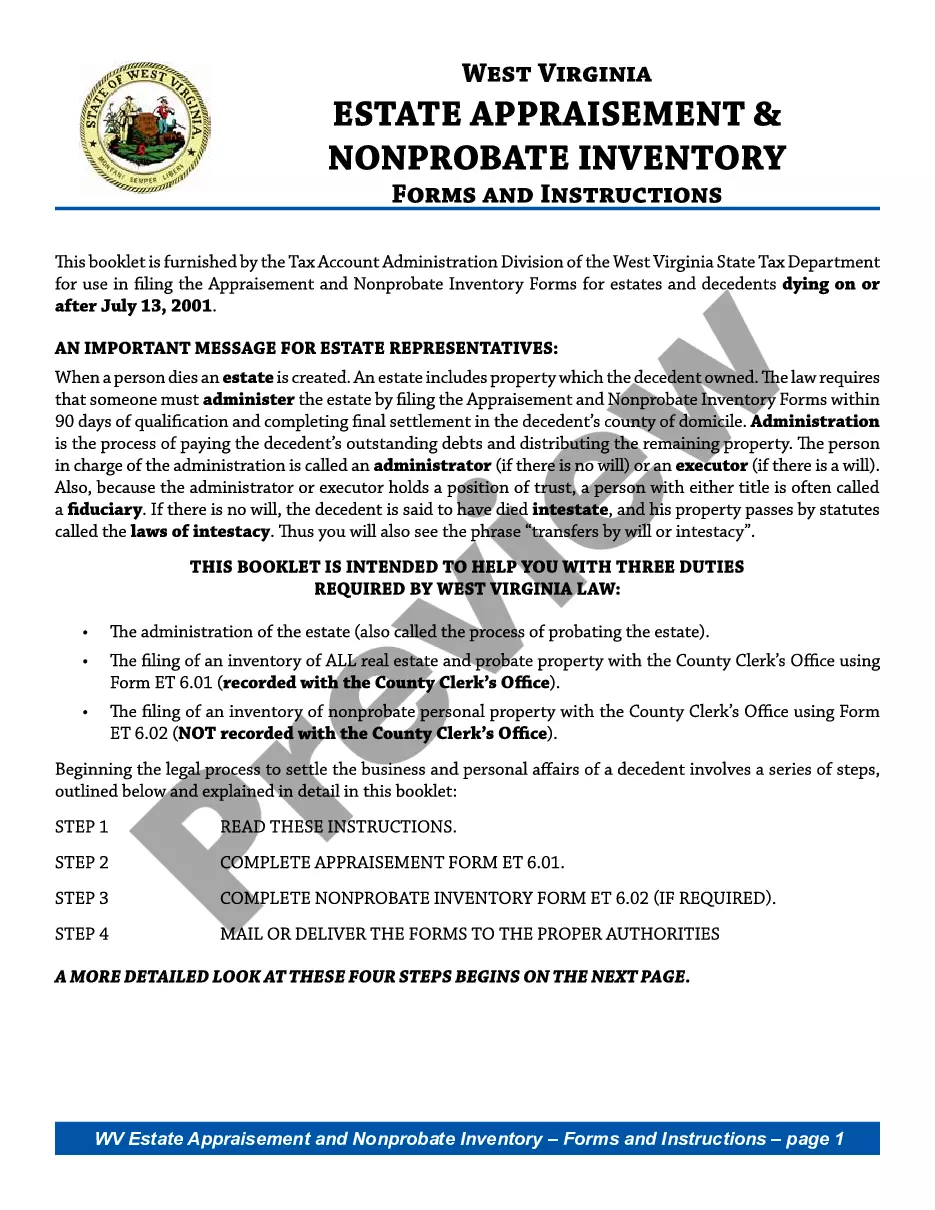

Probate is the legal process of settling a deceased person's estate. It involves validating wills, distributing assets, and settling debts. Explore state-specific templates to assist you.

Probate involves managing a deceased person's estate. Attorney-drafted templates are quick and easy to complete.

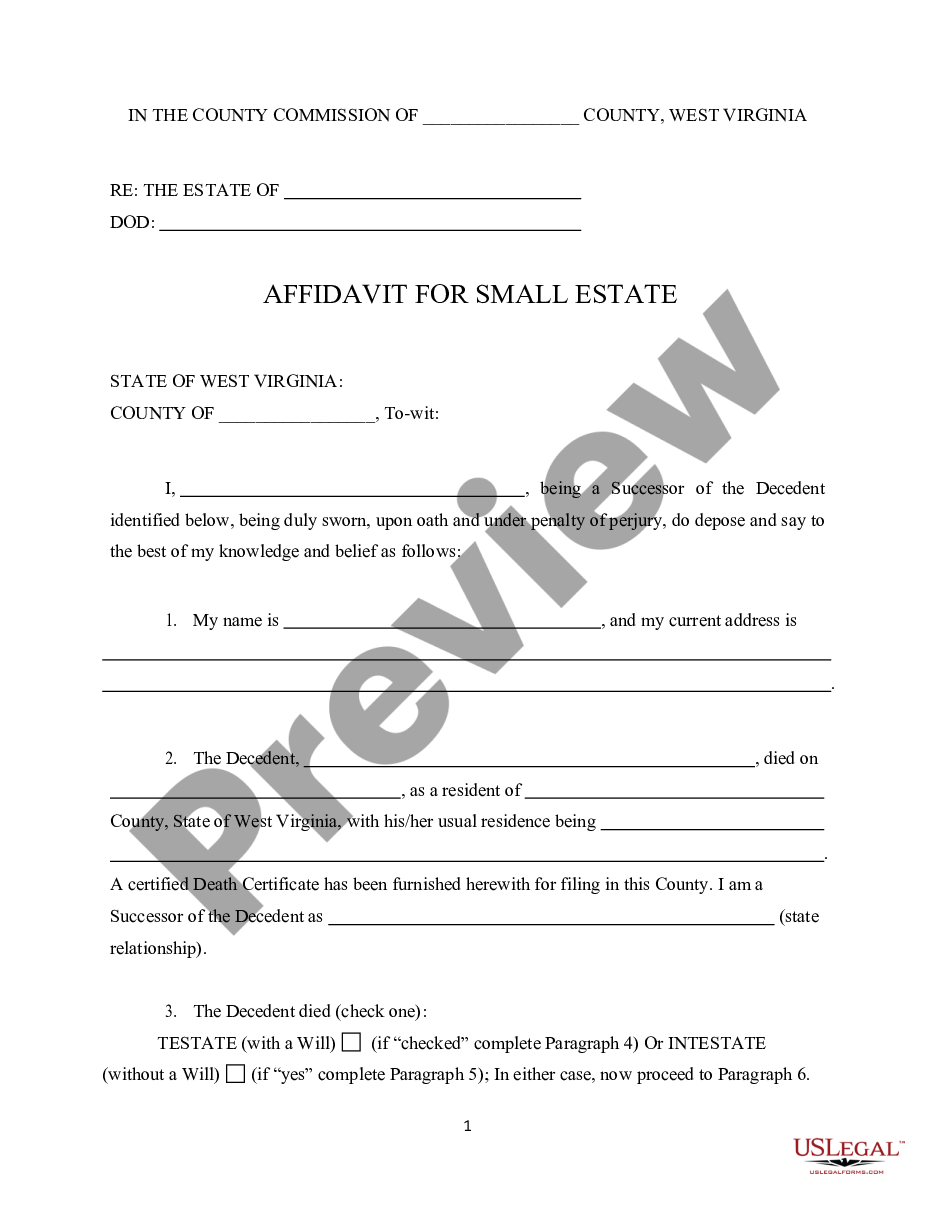

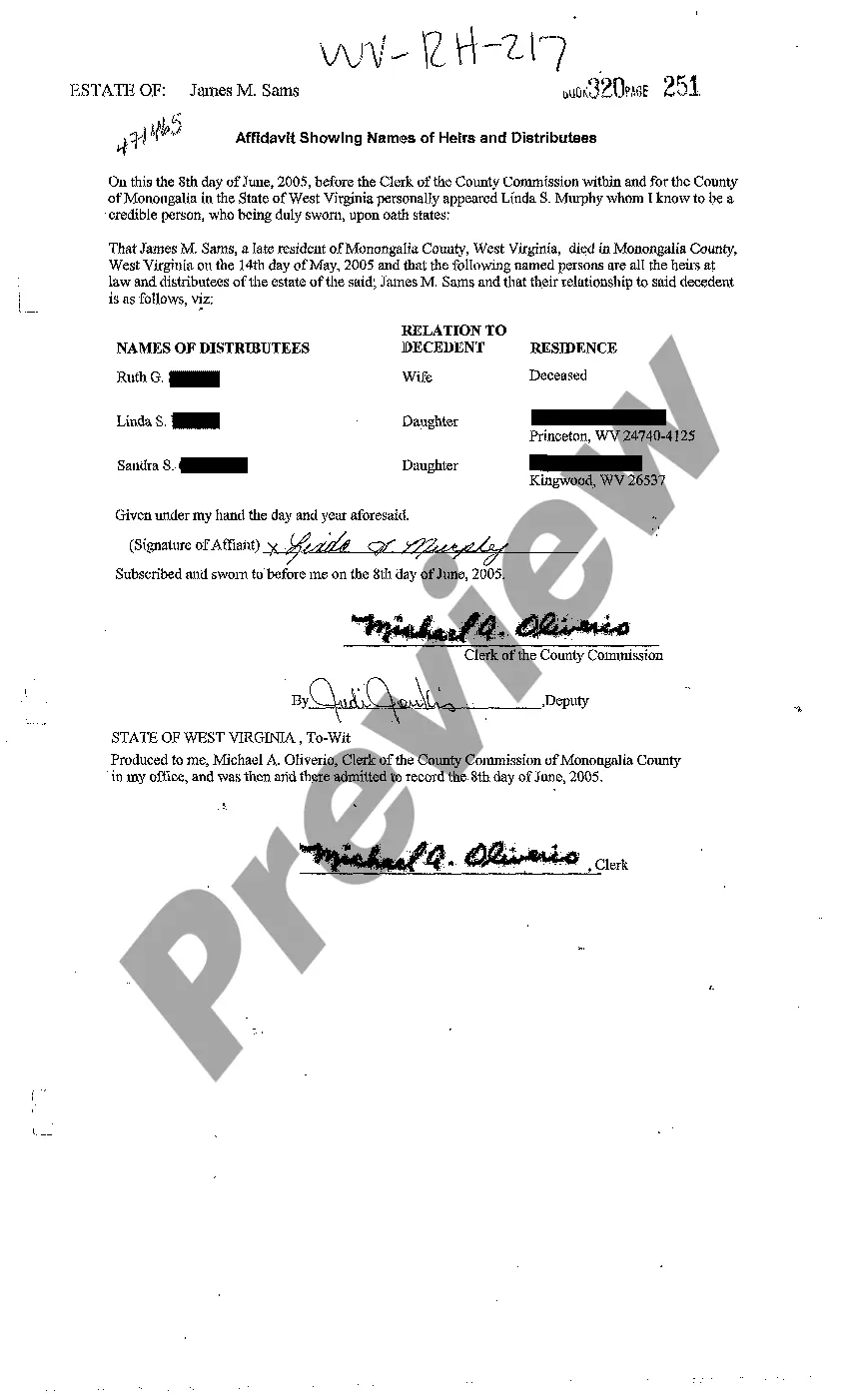

Use this affidavit to settle an estate with total assets below the statutory limit, streamlining the probate process for eligible estates.

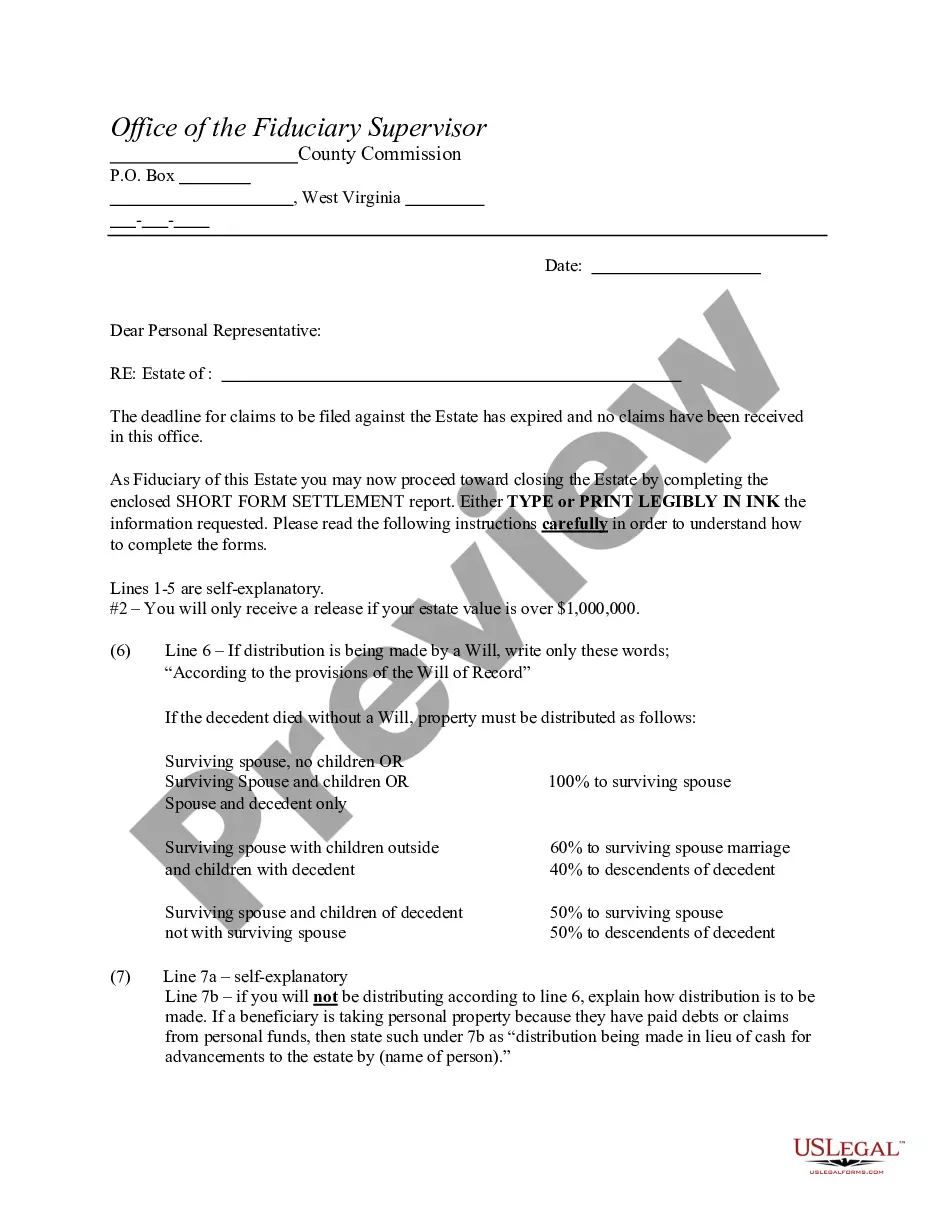

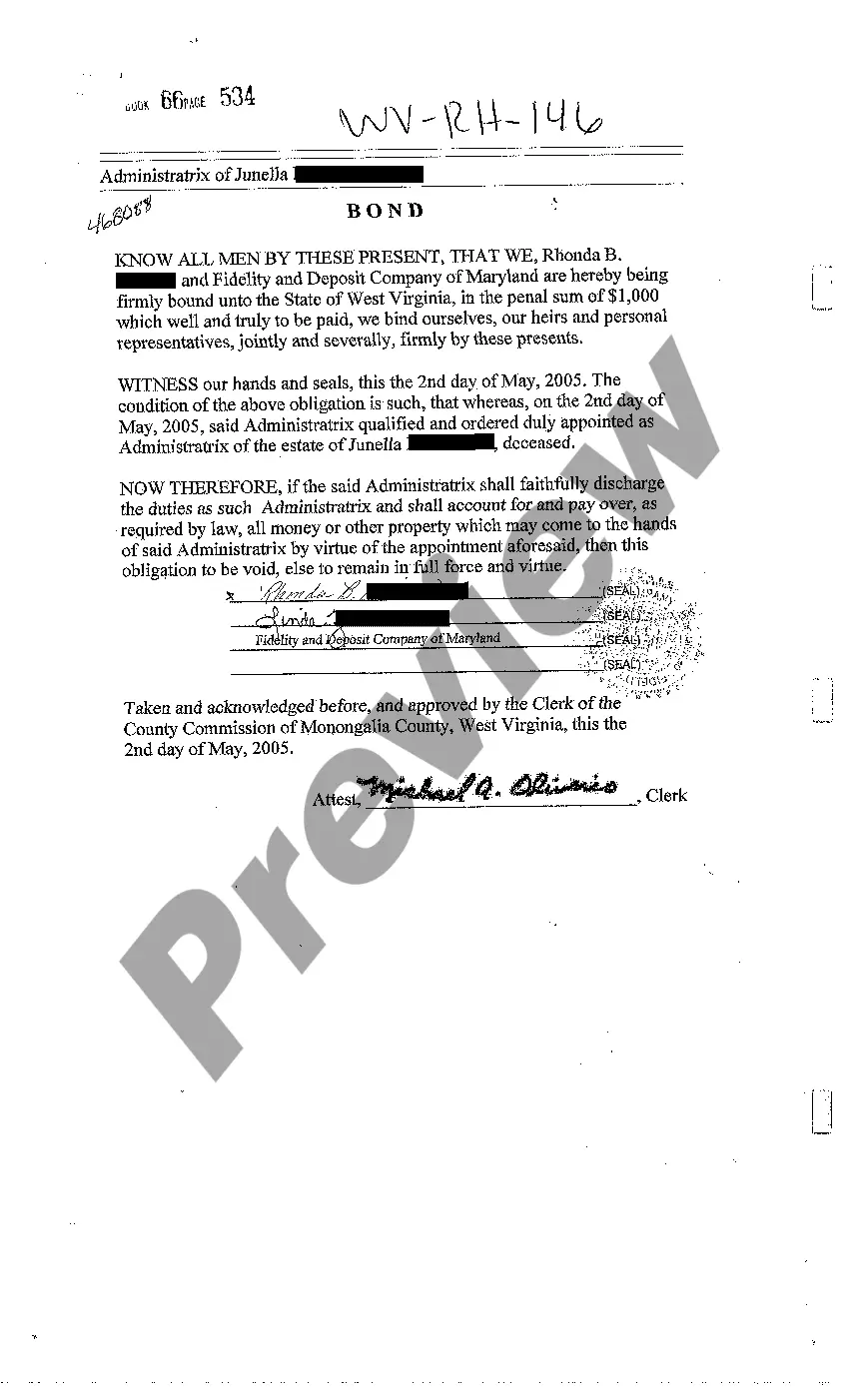

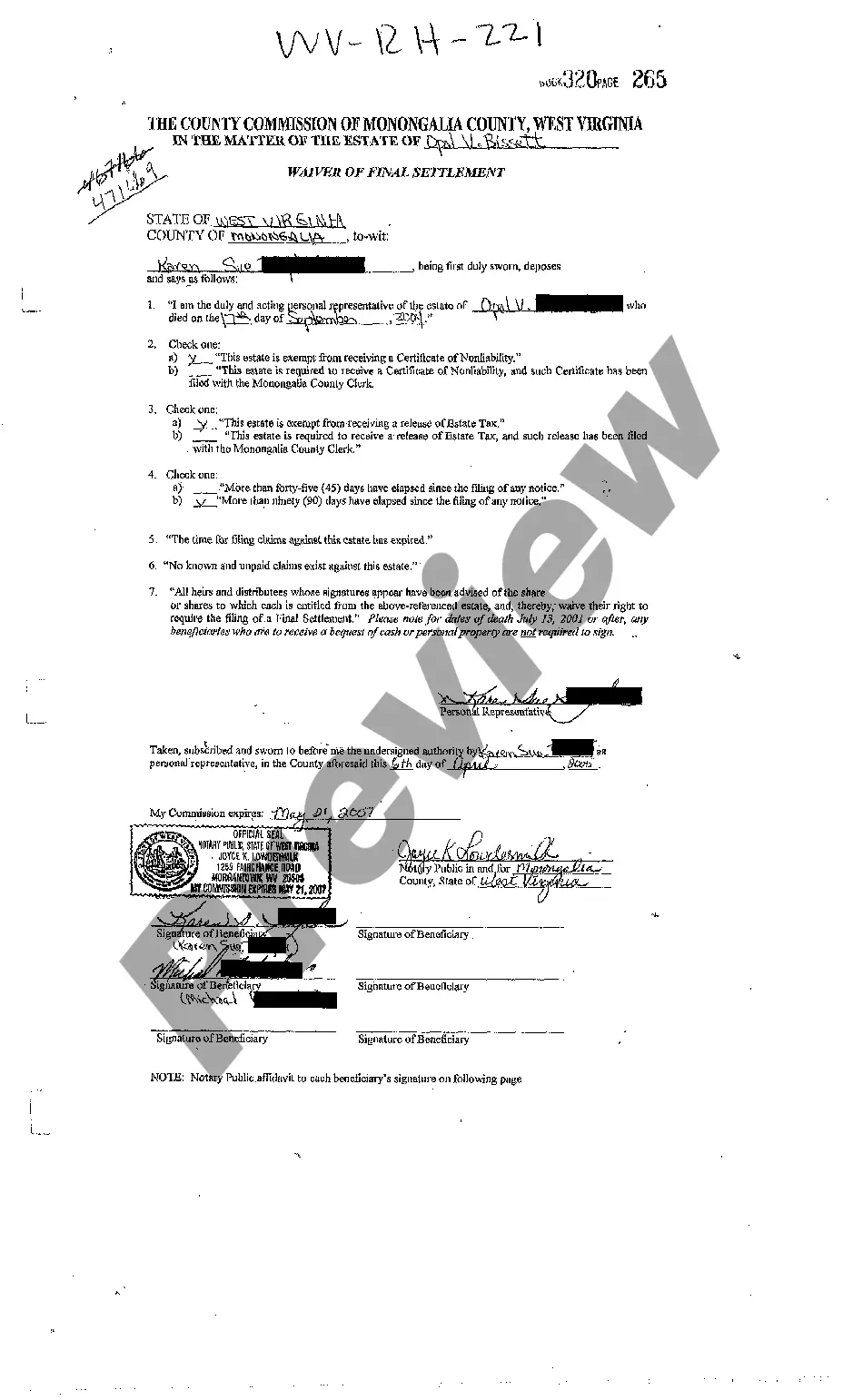

Use this settlement form to simplify the estate closing process when no claims have been filed against the estate.

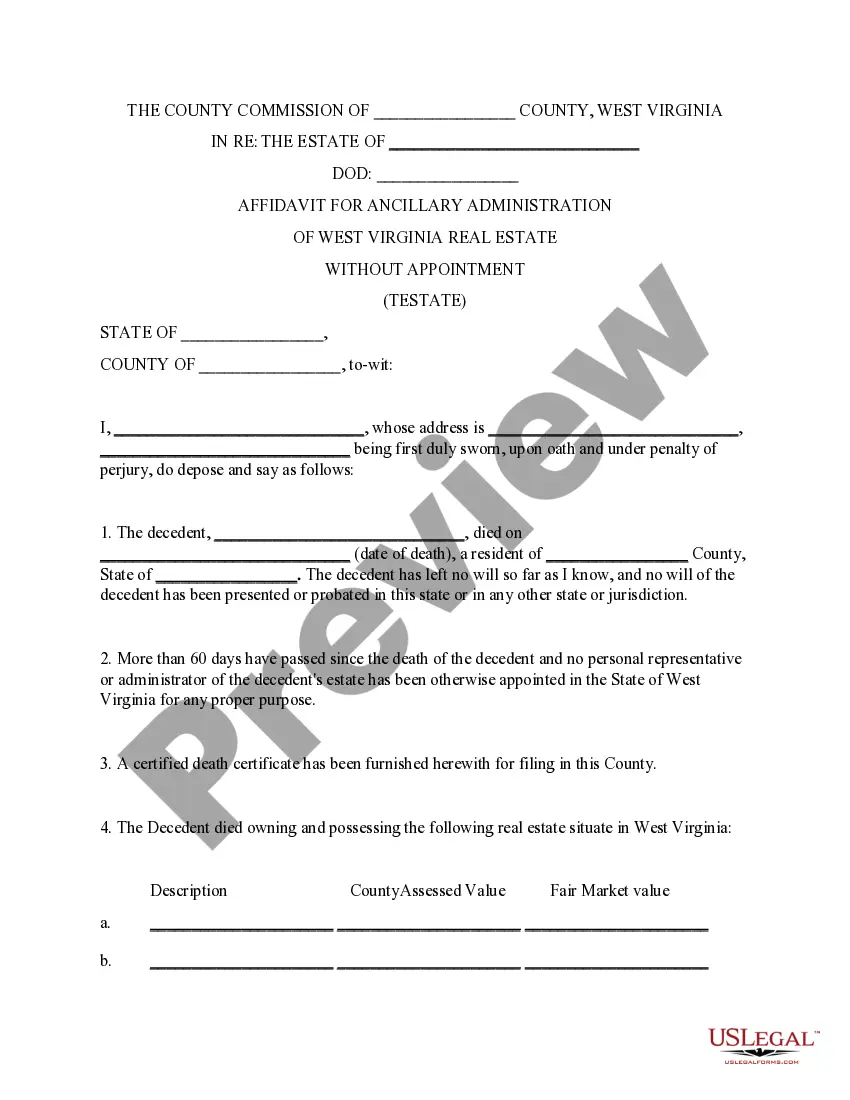

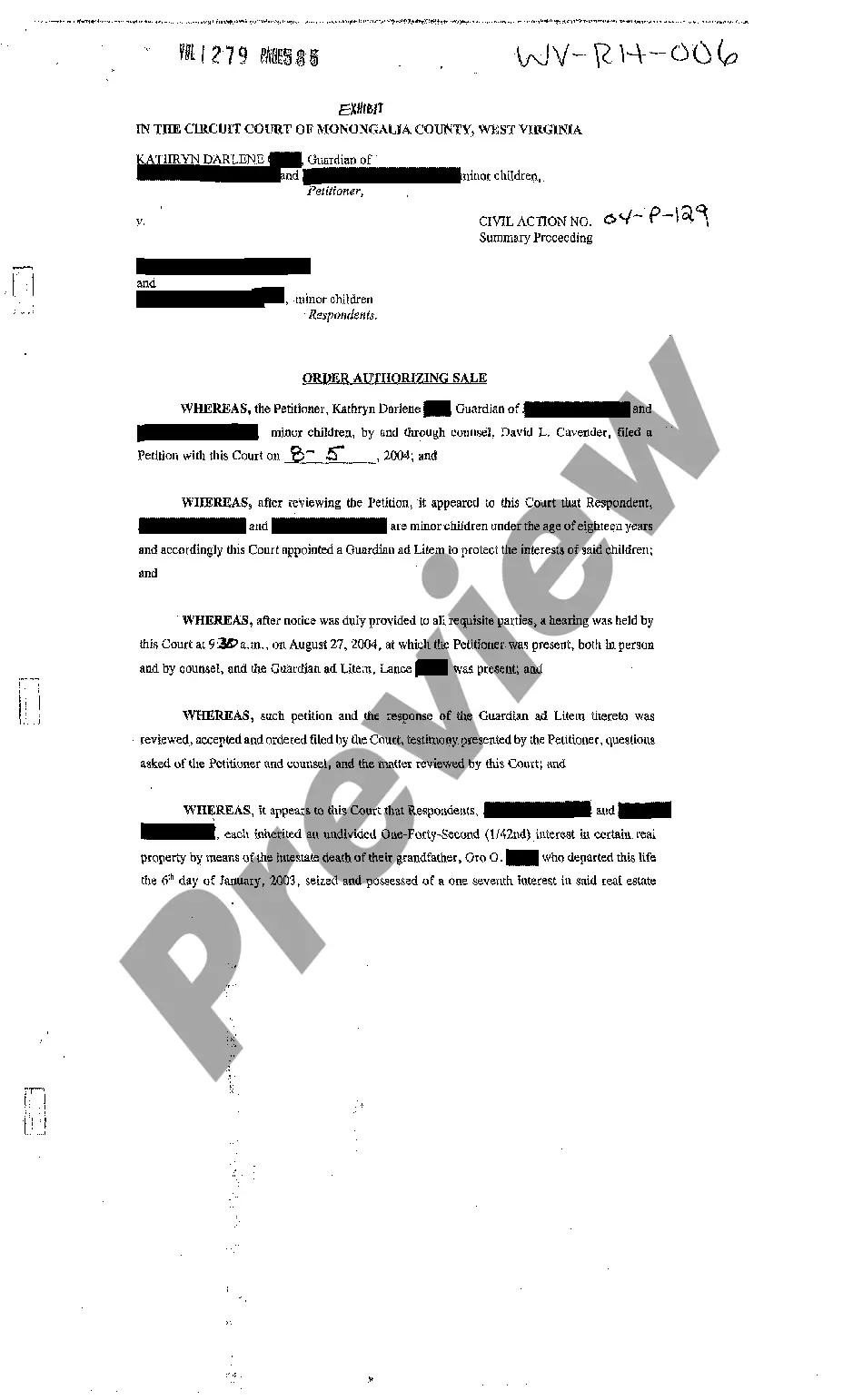

Use this affidavit when seeking to administer real estate from a decedent's estate without a personal representative in West Virginia.

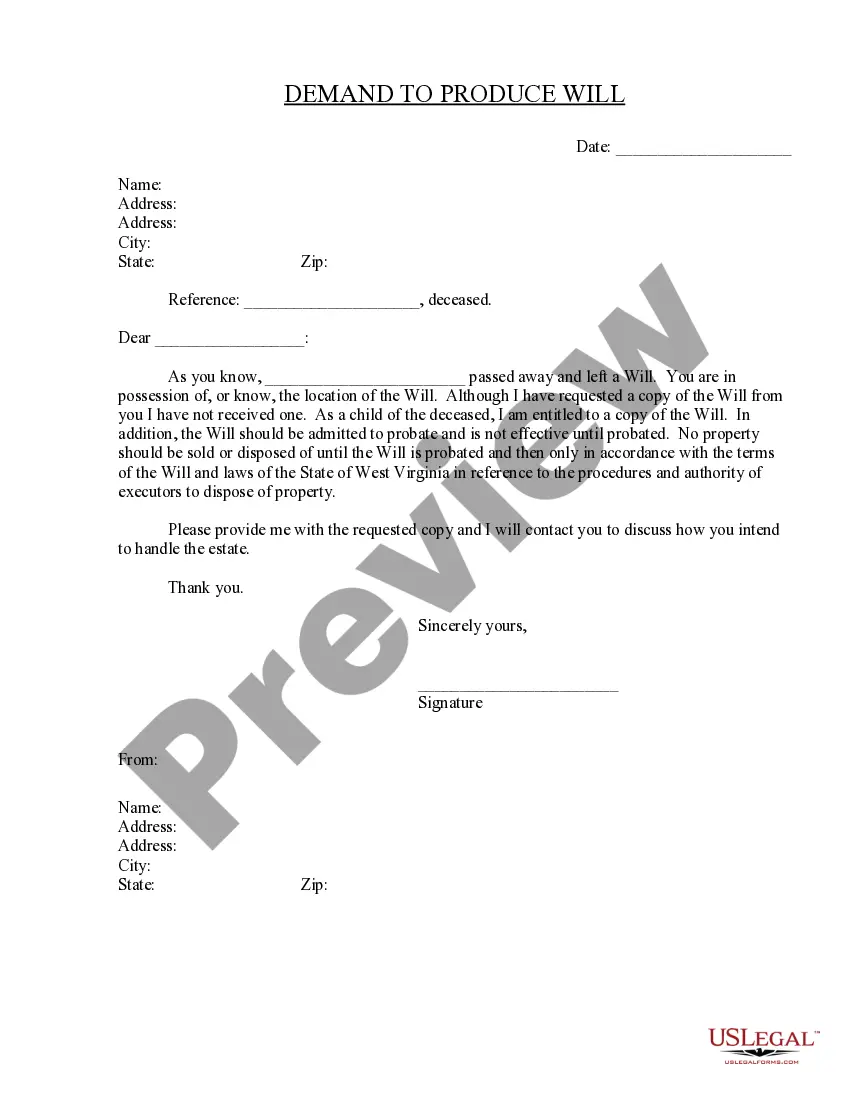

Request a copy of a deceased person's will to ensure you receive your rightful inheritance and understand estate management.

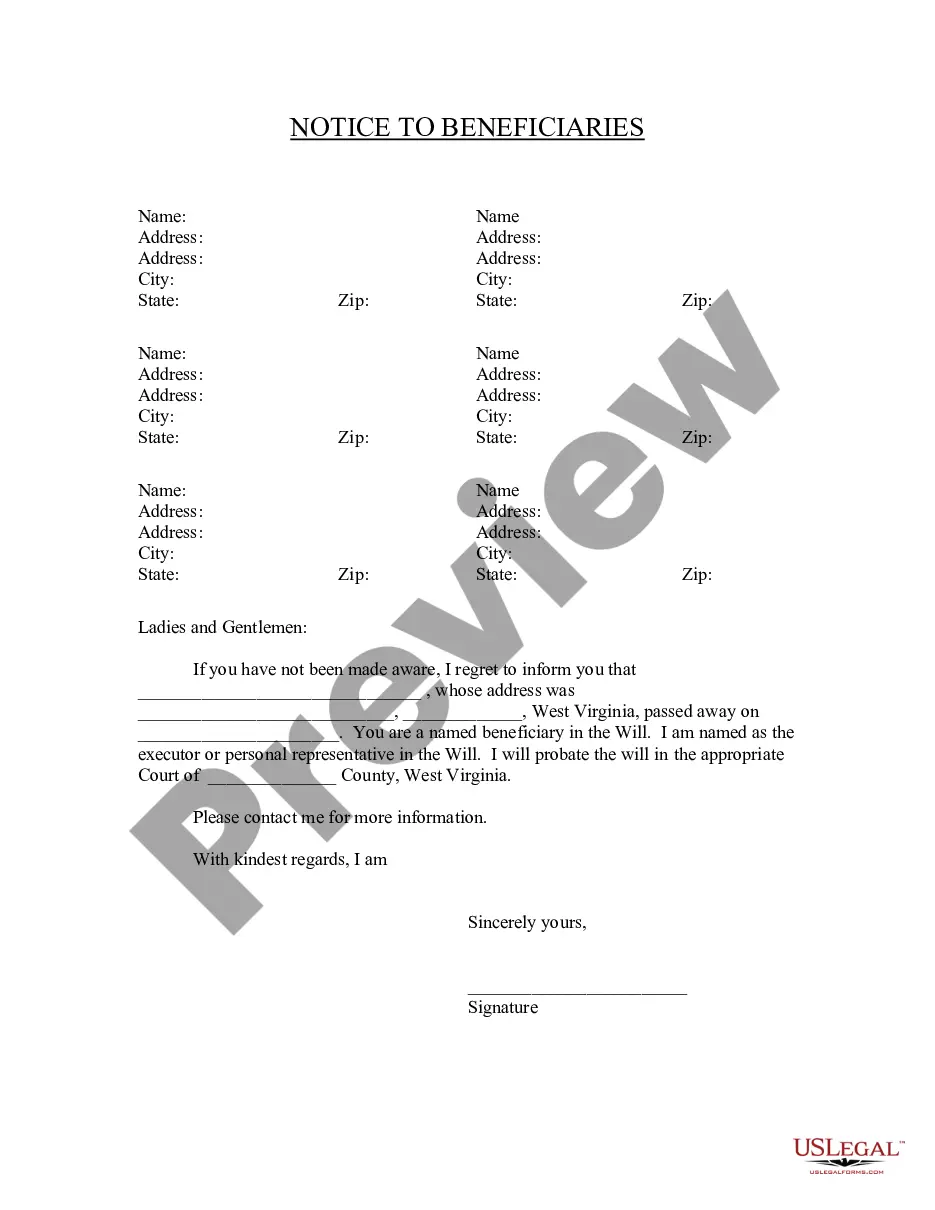

Notify beneficiaries of their status in a will and the probate process in West Virginia.

Probate ensures debts and taxes are paid before asset distribution.

Wills must be validated through the probate court for execution.

Probate can be contested by interested parties.

The process can vary based on whether a will exists.

Not all assets go through probate, such as joint accounts or trusts.

Begin easily with these steps.

A trust can provide additional benefits, such as avoiding probate.

If no estate plan exists, state laws determine asset distribution.

Review your plan regularly, especially after major life events.

Beneficiary designations typically override instructions in your will.

Yes, you can appoint separate agents for financial and health matters.