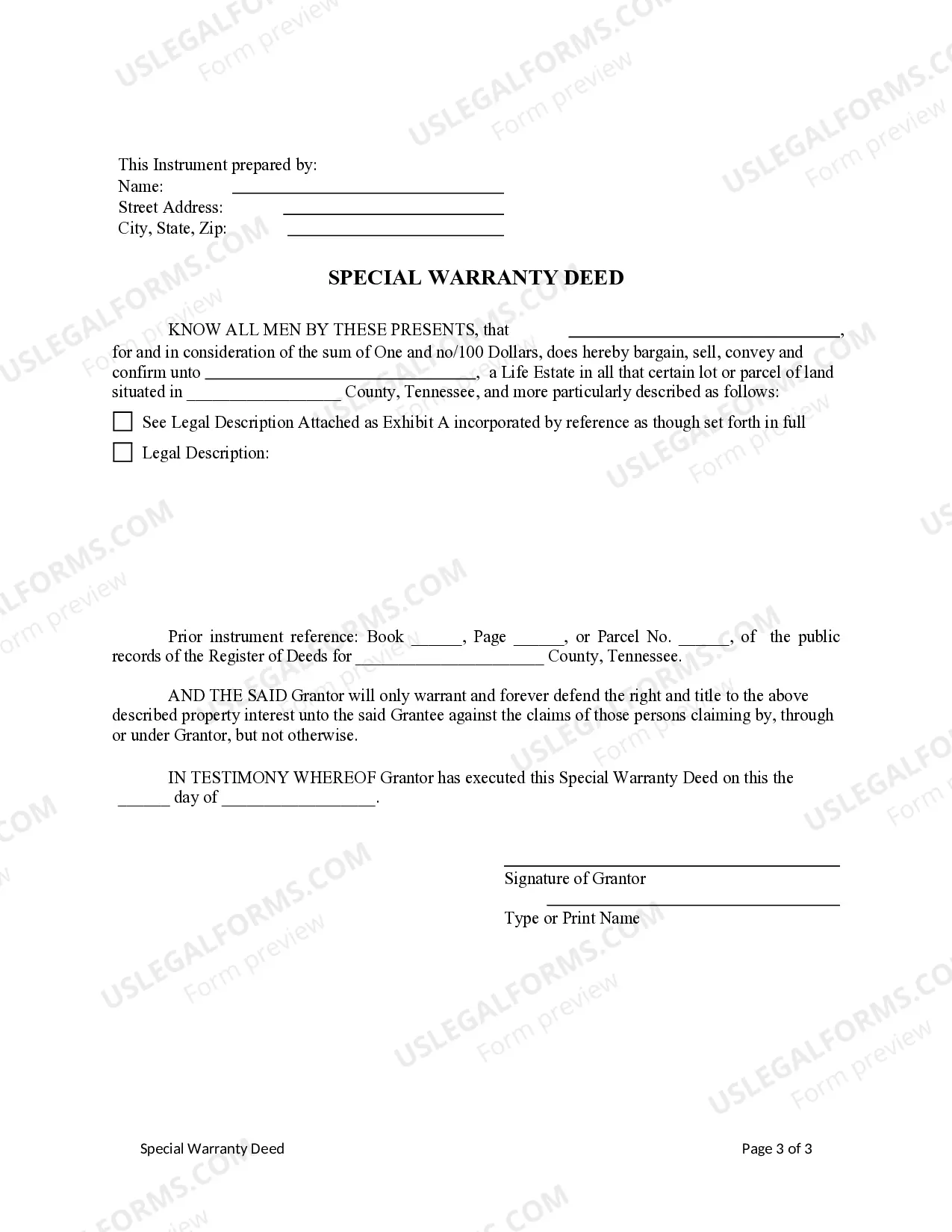

This form is a Special Warranty where the Grantor is an individual and the Grantee is an individual. Grantor conveys and confirms transfer of a life estate in the described property to Grantee. Grantor will warrant and defend the interest to Grantee against the claims of those claiming by, through, and under Grantor and not otherwise. This deed complies with all state statutory laws.

Tennessee Special Warranty Deed - Life Estate to Grantee with Remainder in Grantor

Description

How to fill out Tennessee Special Warranty Deed - Life Estate To Grantee With Remainder In Grantor?

Get access to quality Tennessee Special Warranty Deed - Life Estate to Grantee with Remainder in Grantor forms online with US Legal Forms. Steer clear of days of misused time browsing the internet and lost money on forms that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Get more than 85,000 state-specific authorized and tax templates you can save and complete in clicks within the Forms library.

To get the sample, log in to your account and then click Download. The file is going to be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

- Verify that the Tennessee Special Warranty Deed - Life Estate to Grantee with Remainder in Grantor you’re considering is suitable for your state.

- Look at the sample utilizing the Preview function and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay by credit card or PayPal to finish making an account.

- Pick a favored file format to download the document (.pdf or .docx).

Now you can open the Tennessee Special Warranty Deed - Life Estate to Grantee with Remainder in Grantor example and fill it out online or print it and do it yourself. Take into account giving the file to your legal counsel to be certain things are filled in appropriately. If you make a mistake, print and complete application once again (once you’ve created an account all documents you save is reusable). Make your US Legal Forms account now and get a lot more templates.

Form popularity

FAQ

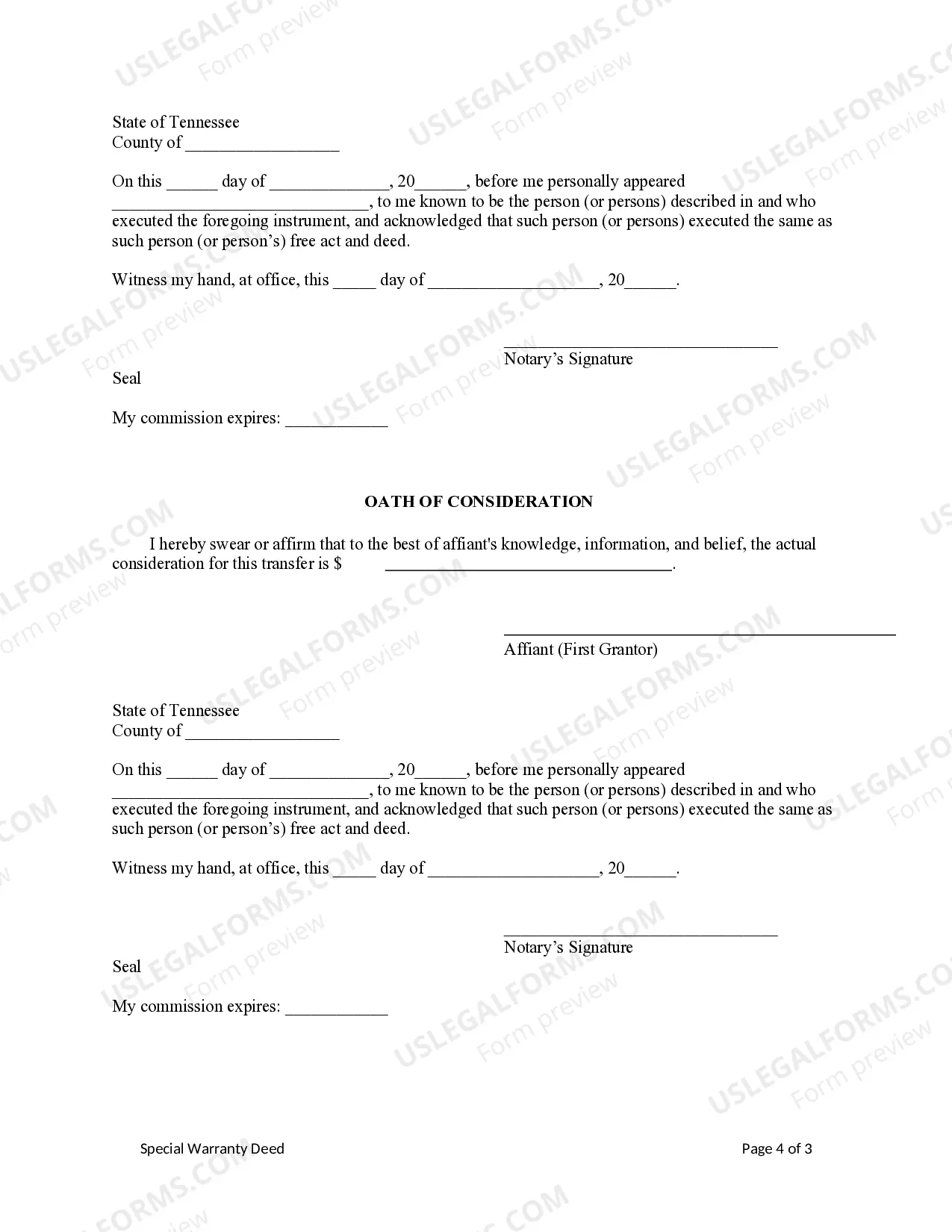

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

With a life estate deed, the remainderman's ownership interest vests when the deed is signed and delivered (or recorded in the public record). Accordingly, the children's ownership interest in the property vested upon their father signing the deed and recording it in the public records, or the year 2000.

The date the deed was made; The name of the party granting the life estate and their address; The name of the grantee and their address; The address and a legal description of the property that is subject to the life estate;

No, California does not require that the Grantee sign a warranty deed. However, some states and counties require that the deed be signed by the Grantee in addition to the Grantor.

Example of creation of a life estate: I grant to my mother, Molly McCree, the right to live in and/or receive rents from my real property, until her death, or I give my daughter, Sadie Hawkins, my real property, subject to a life estate to my mother, Molly McCree. This means a woman's mother, Molly, gets to live in

A remainder interest in property is the value or portion of the property inherited by an individual after the death of another heir. The remainder interest can be created by a will, a trust agreement, or a deed. In turn, a remainderman is a person who holds a remainder interest in property.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.