Buy-Sell Agreement Between Co-Owners of Property: the Legal Regulations of Real Estate Co-Ownership

When there's a single property owner, putting real estate up for sale is relatively simple compared to when there are multiple owners. Real estate co-owners can be siblings who inherit a house, married partners, or other people who jointly acquire a property. No matter what ownership interest each party possesses, selling or renting such property requires signing a specific real estate buy sell agreement.

A legal instrument for buying out jointly owned property

The most common example of a real estate joint ownership is when siblings inherit a property according to a will execution. They may wish to keep the house, use it together, and jointly share the costs for its maintenance. However, when one beneficiary is not interested in the estate and the other wishes to purchase it on their own, they should prepare and sign an agreement stating the terms to buyout siblings' share of the house fairly.

This legal document defines all of the terms of the estate moving from one co-proprietor to another, in particular, the process of selling the property during the co-owners' lifetime and how the acquisition will take place in the case of one of the co-owner’s deaths. The document has a standard structure with no state-specific law requirements. Therefore, you can use a multi-state do-it-yourself buy out agreement template provided in the US Legal Forms online library. You can download the printable template in a Word format or prepare it electronically with the PDF editing tool available right from the platform for premium users.

Information to provide in a sibling buyout agreement form

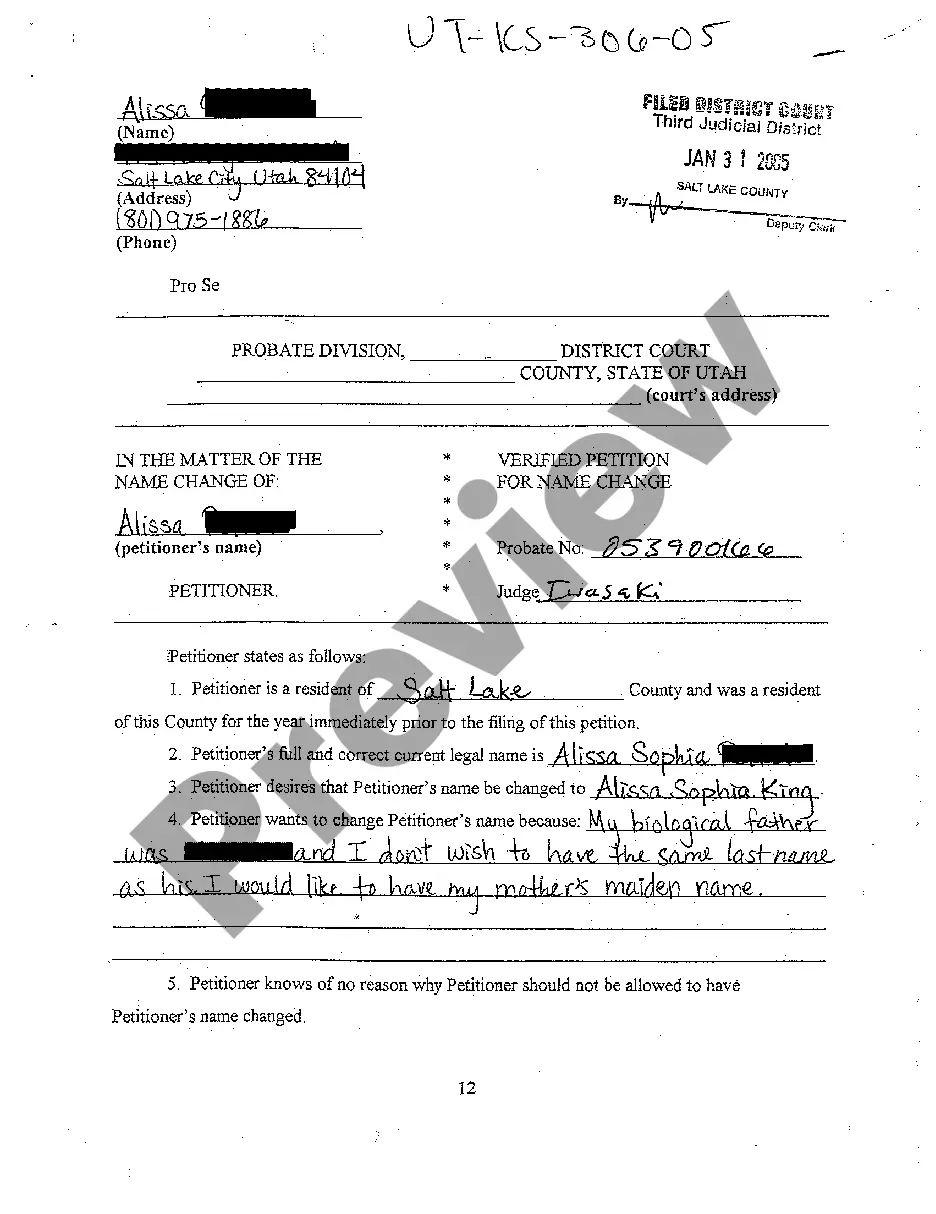

US Legal Forms offers a verified pre-drafted DIY template where you only need to fill out the blanks to prepare your agreement. Be ready to provide the following information:- Names of the co-owners, their addresses with city and state details

- Legal description of the real estate

- The fair market value of each co-owner’s interest in the estate

- Property insurance details