Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

Aren't you tired of choosing from countless templates every time you need to create a Consumer Loan Application - Personal Loan Agreement? US Legal Forms eliminates the lost time an incredible number of Americans spend surfing around the internet for suitable tax and legal forms. Our expert crew of lawyers is constantly changing the state-specific Forms library, to ensure that it always provides the proper documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have an active subscription should complete easy steps before having the ability to download their Consumer Loan Application - Personal Loan Agreement:

- Utilize the Preview function and look at the form description (if available) to make certain that it’s the right document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right example for your state and situation.

- Use the Search field on top of the site if you want to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your sample in a convenient format to complete, print, and sign the document.

When you’ve followed the step-by-step recommendations above, you'll always be capable of log in and download whatever file you want for whatever state you require it in. With US Legal Forms, finishing Consumer Loan Application - Personal Loan Agreement templates or other legal files is not difficult. Begin now, and don't forget to double-check your examples with certified lawyers!

Form popularity

FAQ

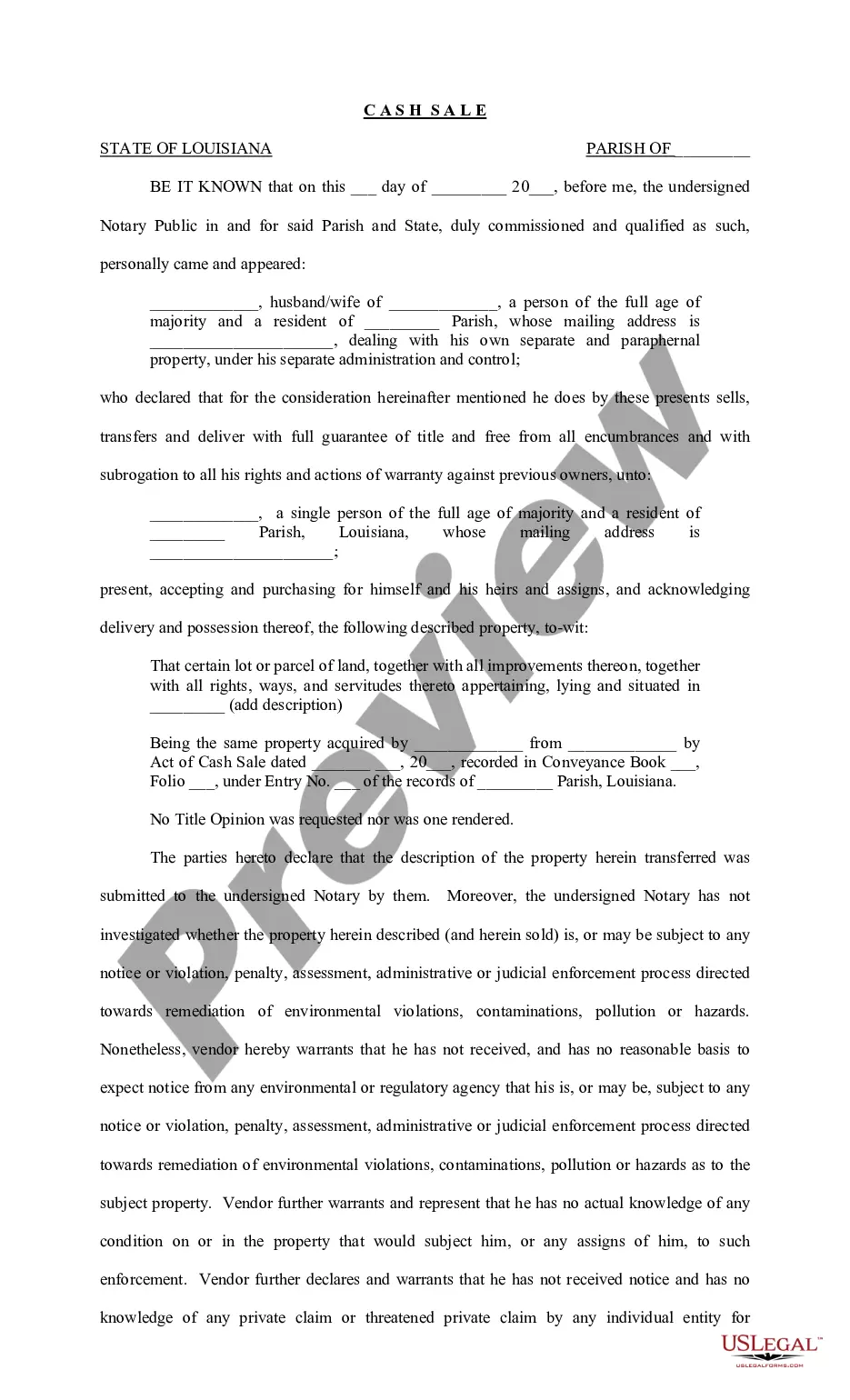

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

1. Debt consolidation. Debt consolidation is one of the most common reasons for taking out a personal loan. When you apply for a loan and use it to pay off multiple other loans or credit cards, you're combining all of those outstanding balances into one monthly payment.

Identity of the Parties. The names of the lender and borrower need to be stated. Date of the Agreement. Interest Rate. Repayment Terms. Default provisions. Signatures. Choice of Law. Severability.

Mention the relationship between the Lender and Borrower. Write the amount of loan that has been lent to the Borrower. Mention the purpose of the loan like conducting wedding, hospital charges, investing in a business or any other purposes. Give the duration or tenure of the loan and the termination date.

Visit the branch of the financial lender. Procure the personal loan application form and enter all the required details. Submit relevant documents that prove one's income, age, address and identity. The lender will then verify the documents and check the eligibility of the applicant.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to keep their own copy, ideally in a safe place.

Generally speaking, there is no requirement for a witness or notary public to witness the signing of the Loan Agreement.Even if it is not required, having an objective third party witness the signing of the loan agreement will be better evidence when you need to enforce the repayment of the loan.

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.