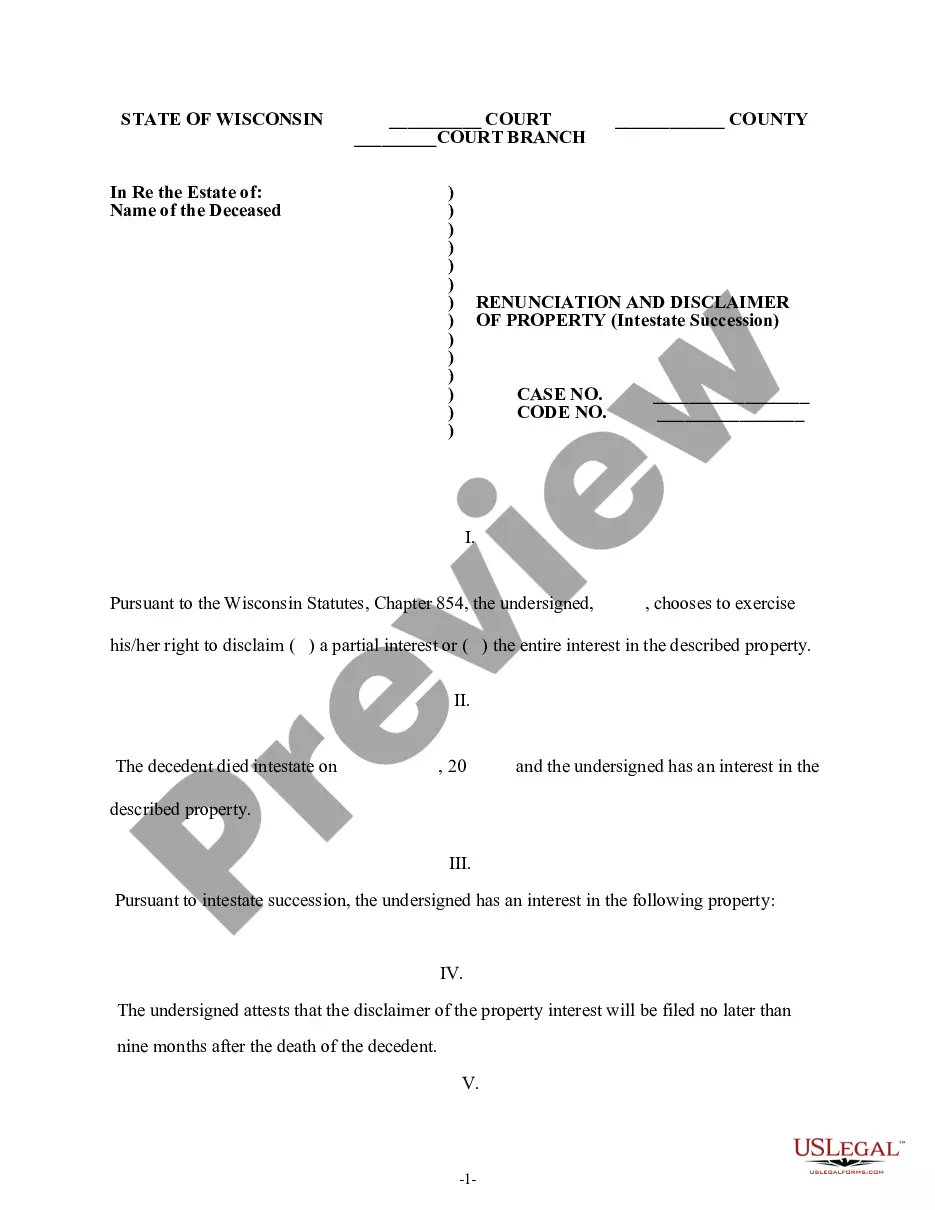

Wisconsin Renunciation And Disclaimer of Property received by Intestate Succession

About this form

The Renunciation and Disclaimer of Property received by Intestate Succession is a legal document that allows a beneficiary to formally refuse their interest in property inherited from a deceased person. This form ensures that the property will pass to other heirs as if the disclaiming beneficiary predeceased the decedent. It is particularly important for those looking to manage their inheritance and minimize potential tax implications, distinguishing it from other forms of estate management and property transfer documents.

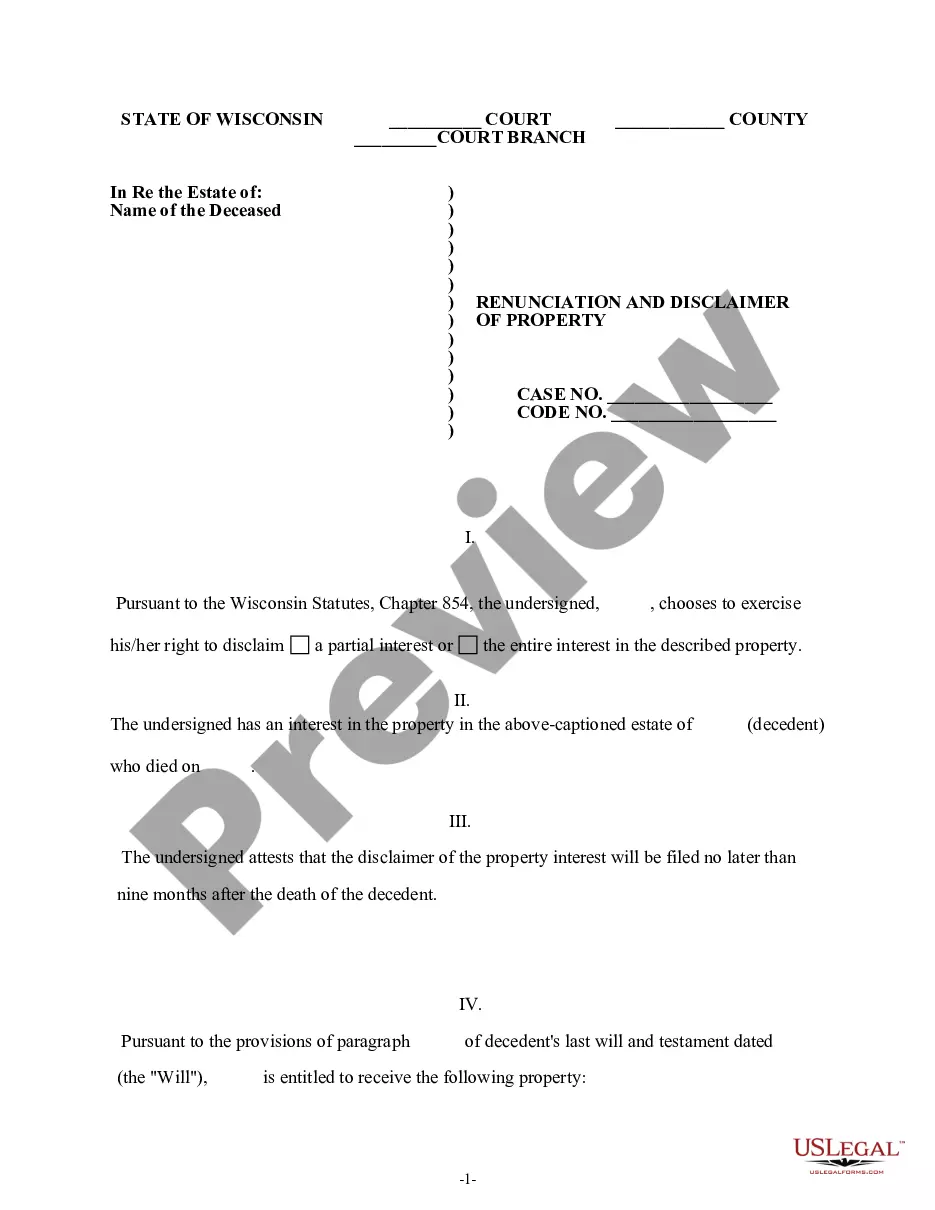

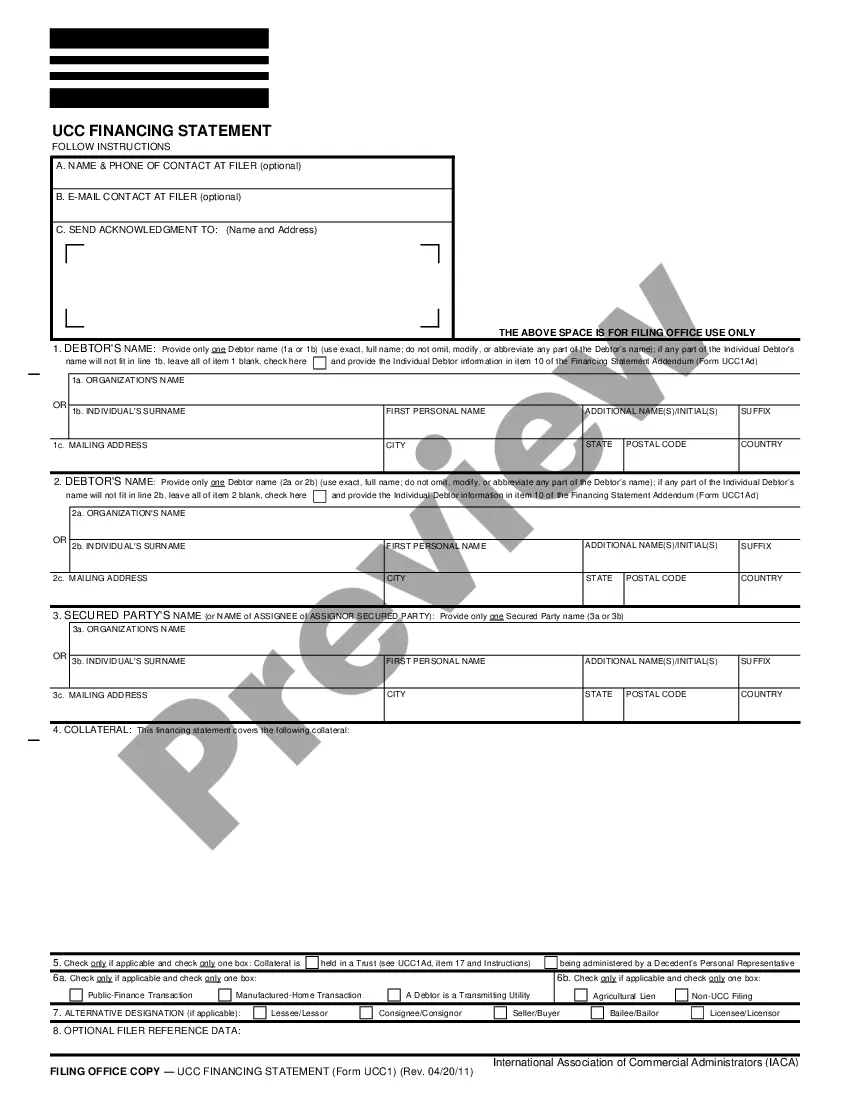

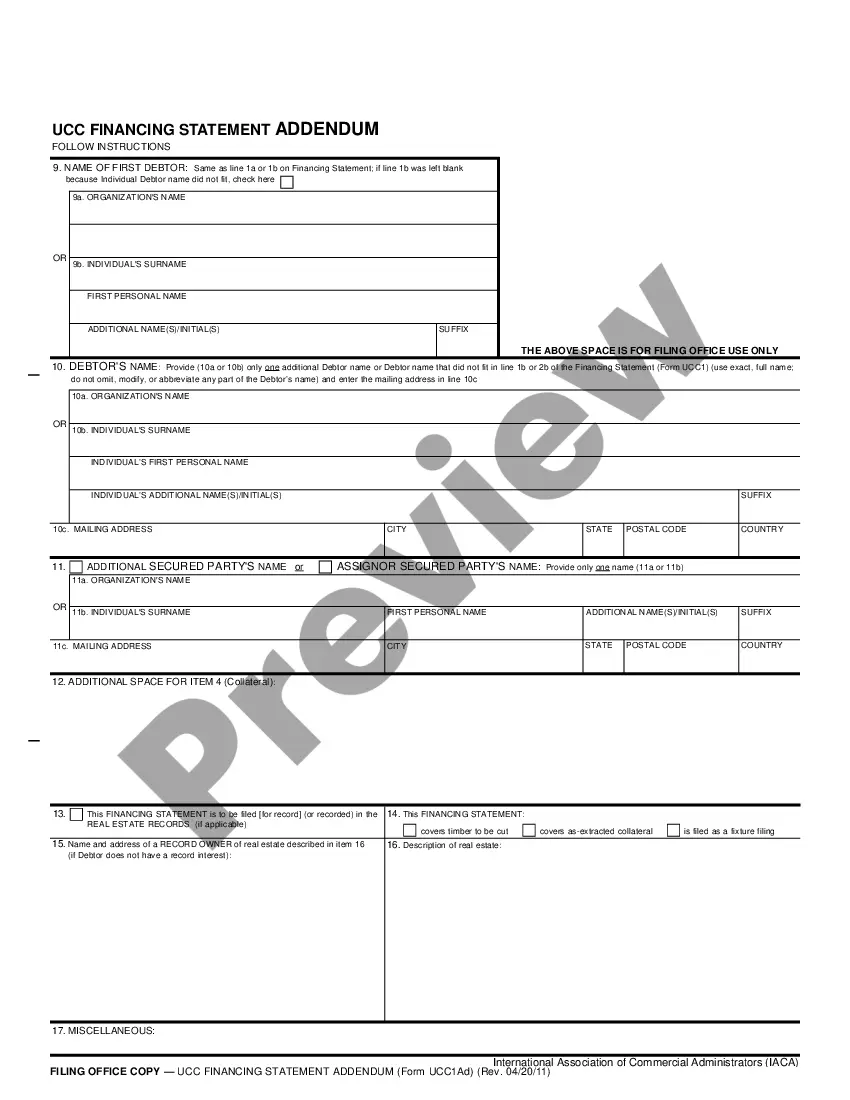

What’s included in this form

- Identification of the beneficiary who is renouncing the property interest.

- Description of the property or assets being disclaimed.

- A statement asserting the intent to renounce all rights to the property under Wisconsin law.

- A clause detailing how the property will pass to other beneficiaries.

- A state-specific acknowledgment and certificate for verifying the delivery of the form.

When to use this form

This form should be used when a beneficiary of an estate wishes to disclaim their interest in property received through intestate succession. Common scenarios include instances where the beneficiary prefers that the property pass to other heirs or wishes to avoid incurring taxes on the inheritance. It is also useful in resolving potential disputes among heirs or for those who may not have the financial means to manage the property.

Who needs this form

- Beneficiaries of an estate who have inherited property through intestacy.

- Individuals wanting to simplify the distribution of estate assets.

- Heirs looking to avoid potential tax liabilities associated with inherited property.

- Those involved in estate planning and management who require clear documentation of property disclaims.

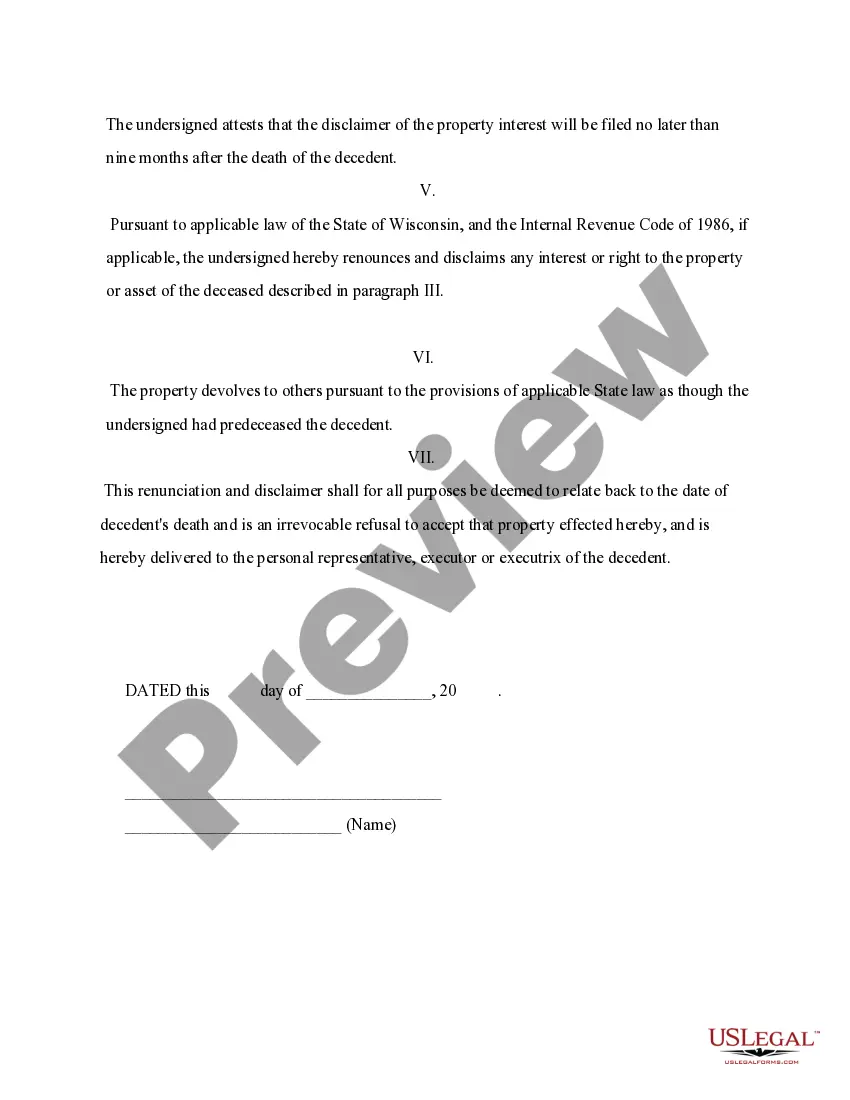

Instructions for completing this form

- Identify the beneficiary who will be renouncing their claim to the property.

- Clearly describe the property or asset that is being disclaimed.

- State the intention to renounce any rights or interests in the specified property.

- Include a statement on how the property will pass to other heirs as if the disclaiming beneficiary predeceased the decedent.

- Sign and date the form according to state legal requirements.

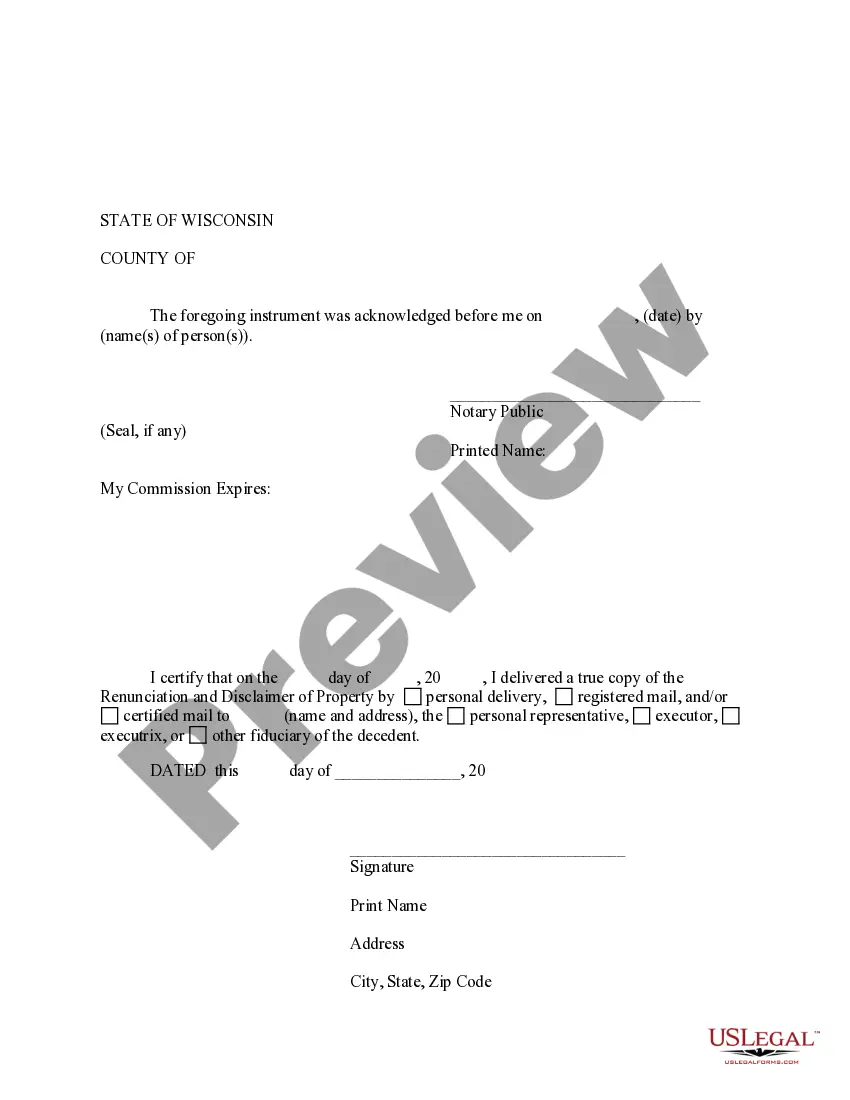

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Common mistakes to avoid

- Failing to clearly identify the property being disclaimed.

- Not including the required legal language specific to Wisconsin law.

- Signing the form without proper witnesses or acknowledgment when necessary.

- Neglecting to date the form, which may lead to complications later.

Advantages of online completion

- Convenient access to the form anytime and anywhere.

- Easy customization to suit individual circumstances and property details.

- Reliable templates that comply with Wisconsin legal requirements.

- Quick download and printing options for immediate use.

Form popularity

FAQ

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

Next of kin meaning In the event of someone's death, next of kin may also be used to describe the person or people who stand to inherit the most. This is usually the spouse or civil partner, but it could also be their children or parents in certain circumstances.

Dying Without a Will in Wisconsin If there isn't a will, the court will appoint someone, usually a relative, financial institution, or trust company to fill the role of executor or personal representative.

The term usually means your nearest blood relative. In the case of a married couple or a civil partnership it usually means their husband or wife. Next of kin is a title that can be given, by you, to anyone from your partner to blood relatives and even friends.

Your mother's next of kin is her eldest child. The term "next of kin" is most commonly used following a death. Legally, it refers to those individuals eligible to inherit from a person who dies without a will. Surviving spouses are at the top of the list, followed by those related by blood.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

In Wisconsin, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).