Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Two Individuals

What is this form?

The Transfer on Death Deed or TOD - Beneficiary Deed allows an individual (the Grantor) to designate two individuals (the Grantee Beneficiaries) to receive property upon the Grantor's death. This form is revocable at any time before the Grantor's passing, making it a flexible estate planning option. The deed becomes effective only after the Grantor's death and needs to be recorded to ensure legality. This differentiates it from traditional property transfer methods, as it ensures the property avoids probate and passes directly to the beneficiaries.

Form components explained

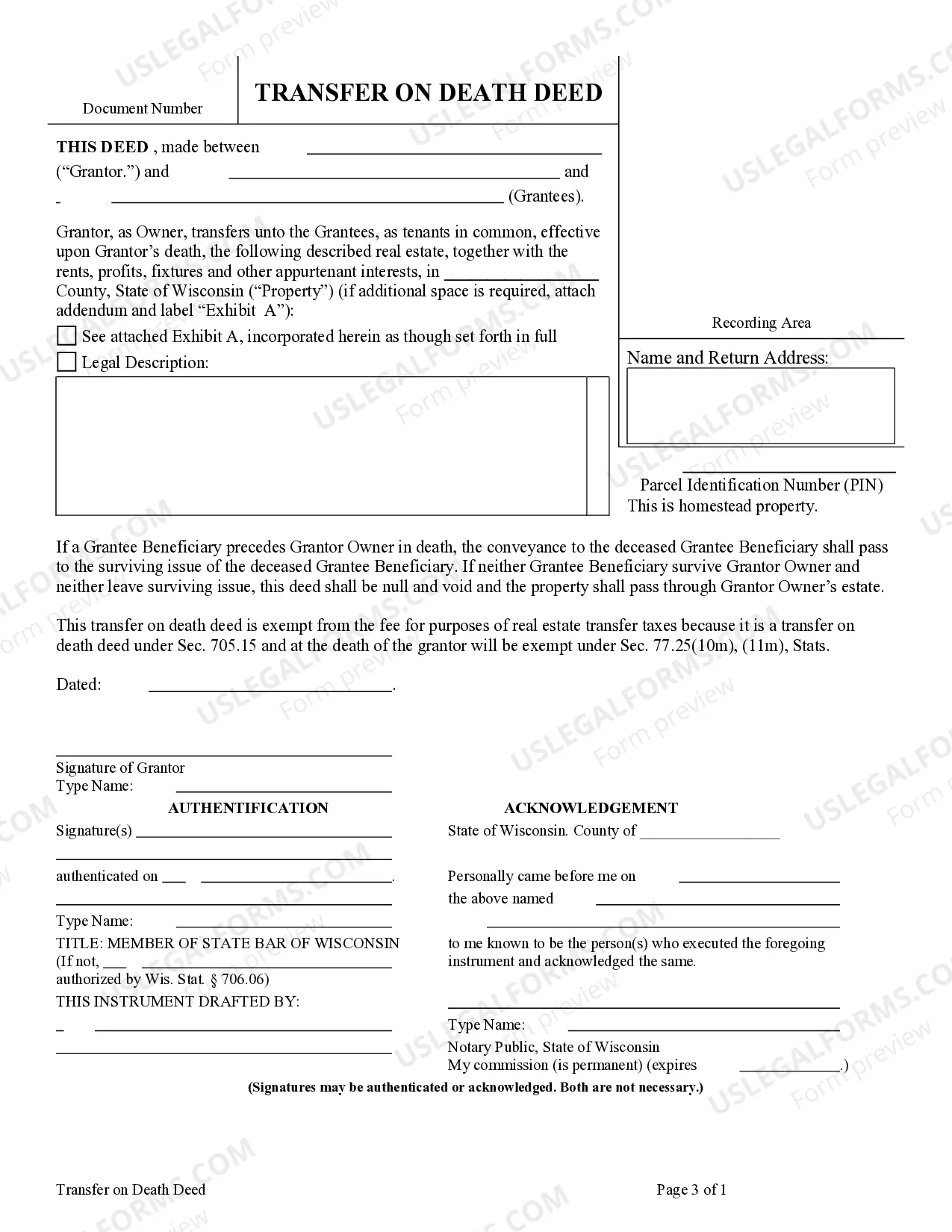

- Section for Grantor's details, including name and address.

- Identification of the property being transferred.

- Information on two Grantee Beneficiaries, including names and addresses.

- Revocation clause allowing the Grantor to change their mind prior to death.

- Signature lines for the Grantor and witnesses, if required.

When this form is needed

This form should be used when an individual wishes to transfer property to two persons after their death, ensuring a swift transfer without going through probate. It is particularly useful for individuals looking to manage their estate in a straightforward manner and who want to maintain control over their property while living.

Who should use this form

- Individuals who own property and want to designate beneficiaries for inheritance.

- People looking to avoid probate for their property after their death.

- Anyone needing to outline clear terms of property transfer upon death.

- Those seeking a revocable option for estate planning before passing.

Instructions for completing this form

- Identify the Grantor by entering their full name and address.

- Clearly specify the property to be transferred.

- Enter the names and addresses of the two Grantee Beneficiaries.

- Review the revocation clause to understand your rights as a Grantor.

- Sign the document in the presence of witnesses as required.

- Record the completed deed with the appropriate county office to ensure its validity.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Avoid these common issues

- Failing to record the deed before the Grantor's death, making it invalid.

- Leaving out details of the property to be transferred.

- Not including correct information for both Grantee Beneficiaries.

- Skipping the signing requirement or not having proper witnesses when needed.

- Not reviewing state-specific rules that might affect the form.

Why complete this form online

- Convenient access to legally drafted forms any time, anywhere.

- Edit and customize forms easily to fit your specific needs.

- Reliable templates created by licensed attorneys, ensuring compliance.

- Time-saving process compared to drafting a deed from scratch.

Form popularity

FAQ

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

States that allow TOD deeds are Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia,

Your deed won't be effective unless you recorded (filed) it in the local public records before your death. To get that done, take the signed deed to the land records office for the county in which the real estate is located. This office is commonly called the county recorder, land registry, or registrar of deeds.