What is Last Will and Testament?

A Last Will and Testament outlines how a person's assets are distributed after their death. These documents are vital for ensuring that wishes are honored. Explore state-specific templates for New Hampshire.

Last Will and Testament documents help clarify asset distribution after death. Attorney-drafted templates are quick and straightforward to complete.

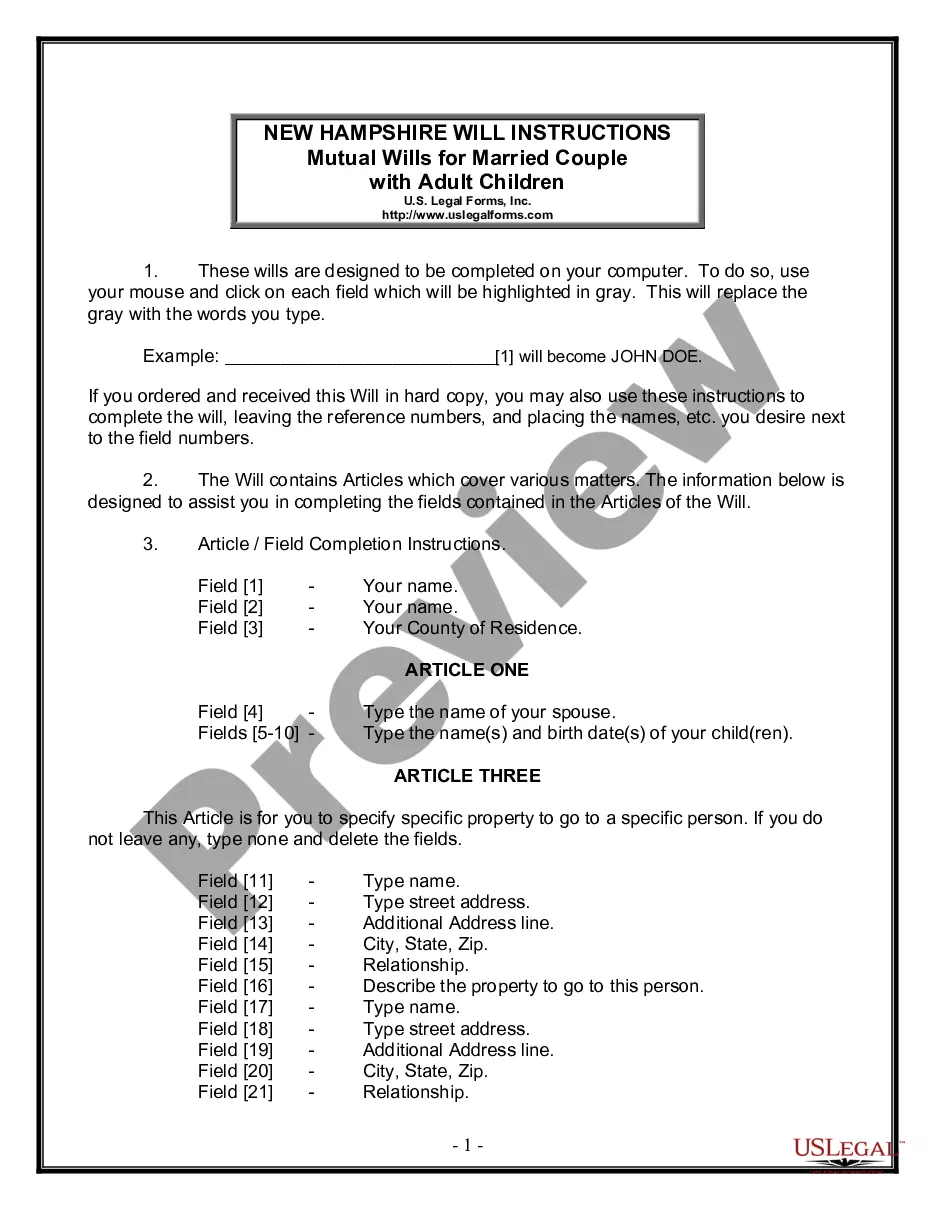

Create legally binding wills for married couples with adult children to ensure proper distribution of assets and titles upon death.

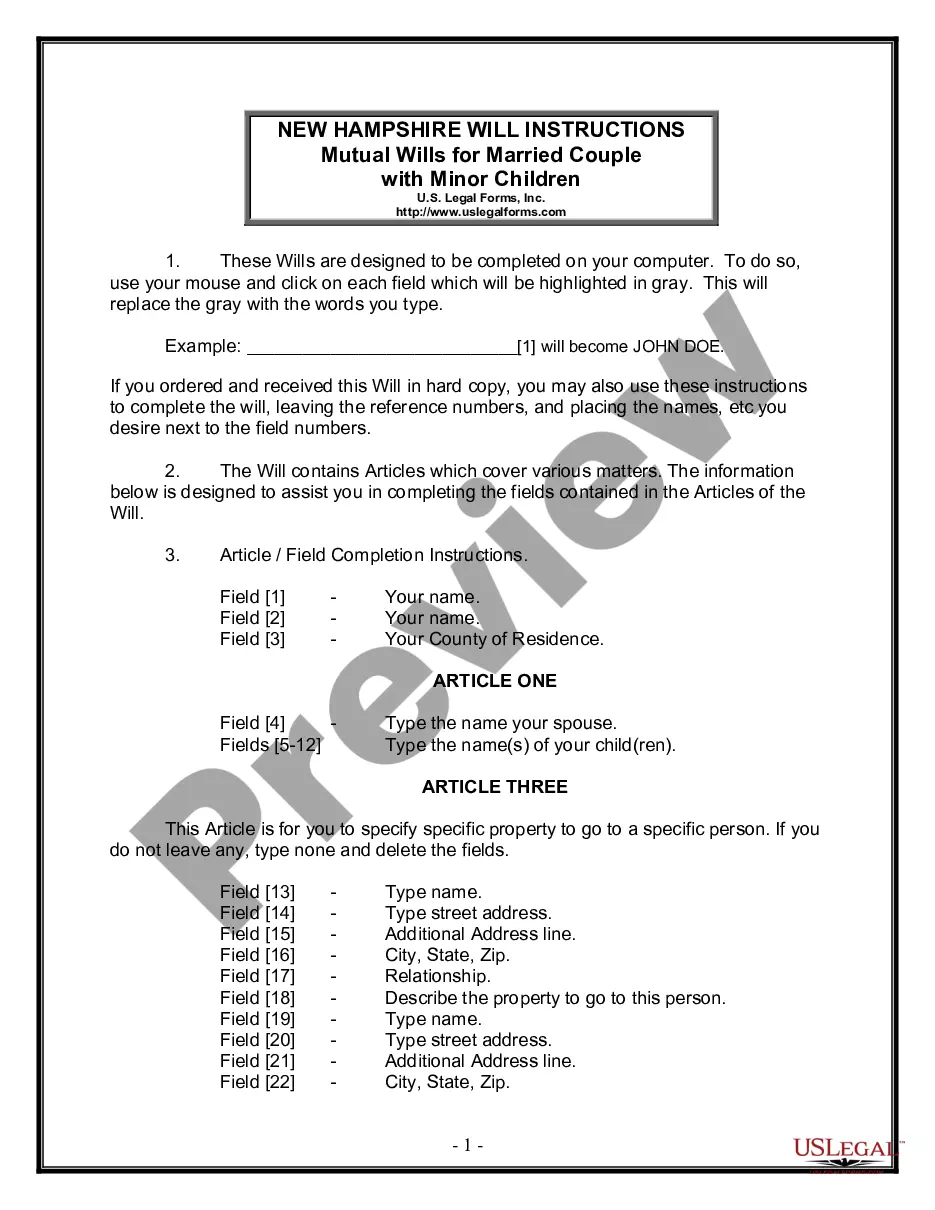

Create legally binding mutual wills that ensure your children are cared for when both partners pass away.

Get everything you need to prepare your estate and protect your loved ones in one convenient package.

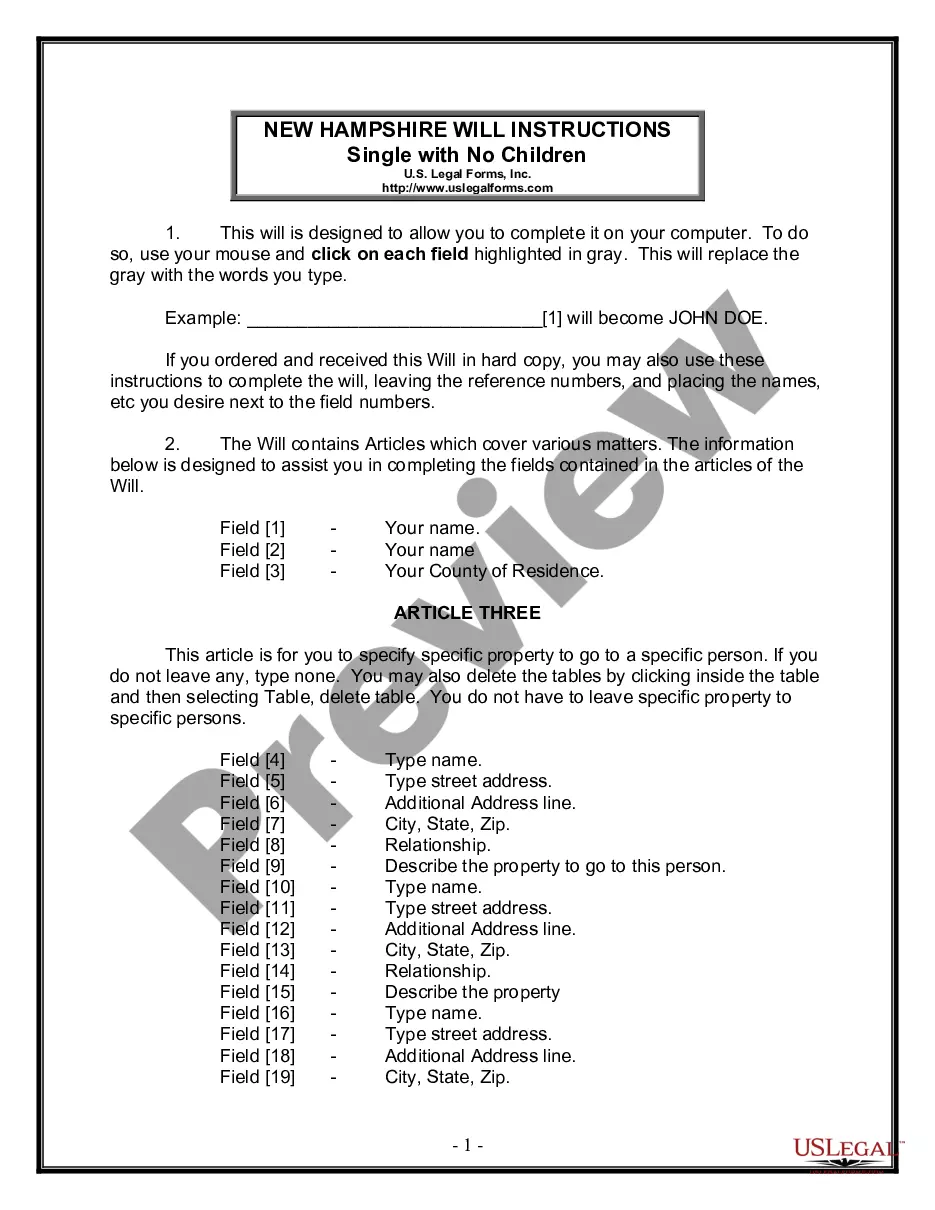

Create a simple will tailored for individuals without children, ensuring your assets go where you want them to after your passing.

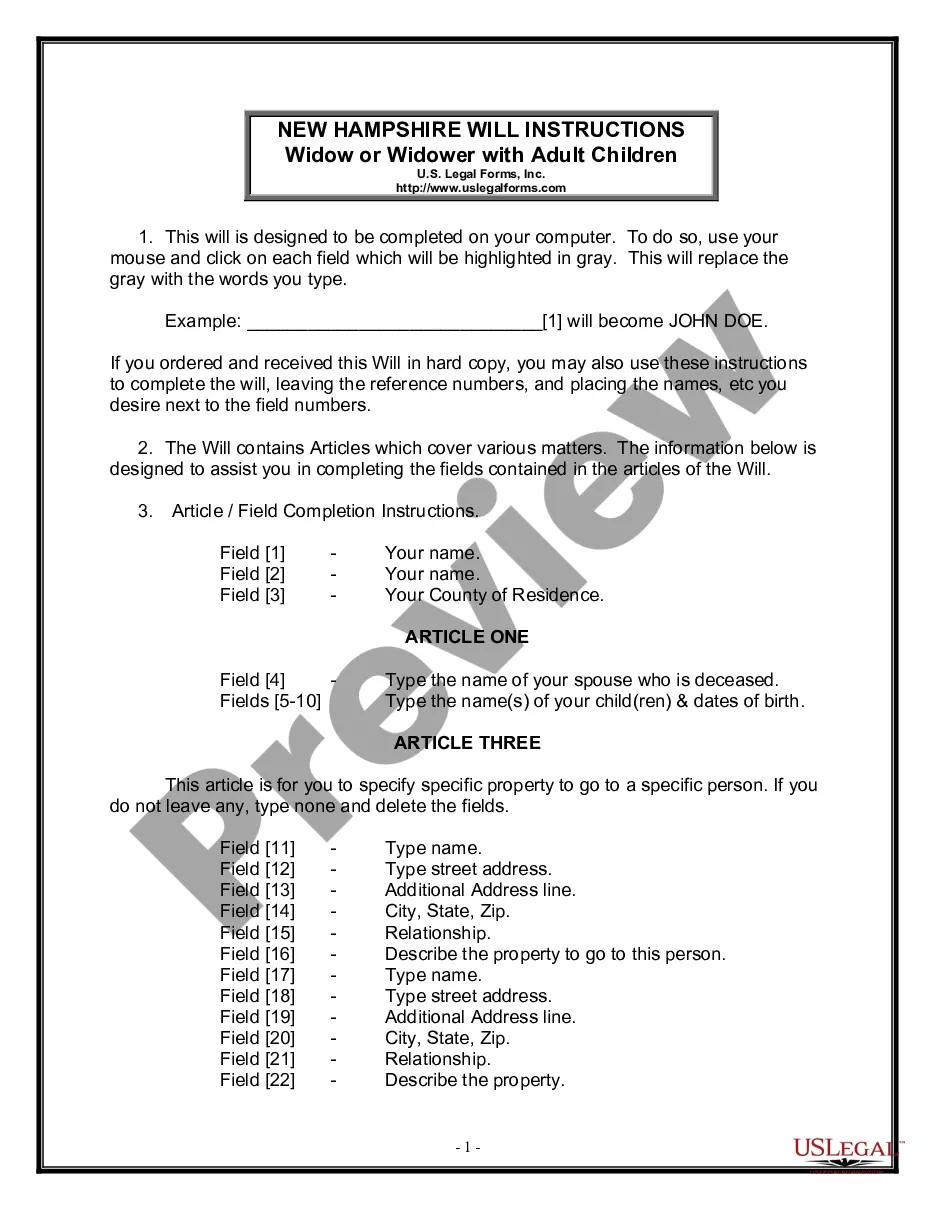

Create a tailored will for a widow or widower with adult children, ensuring your wishes for asset distribution are clearly stated.

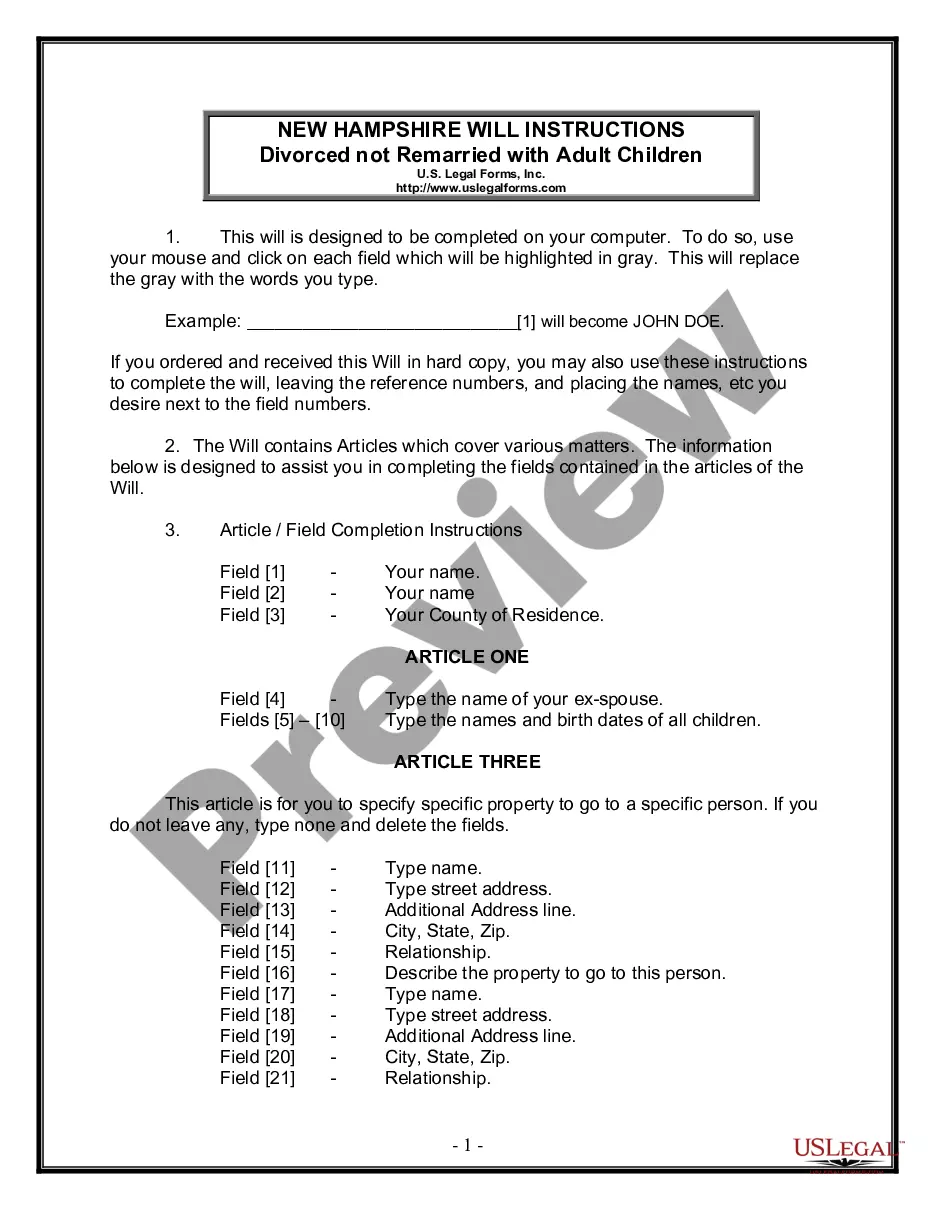

Ensure your property is distributed according to your wishes after passing, especially when you have adult children and have been divorced.

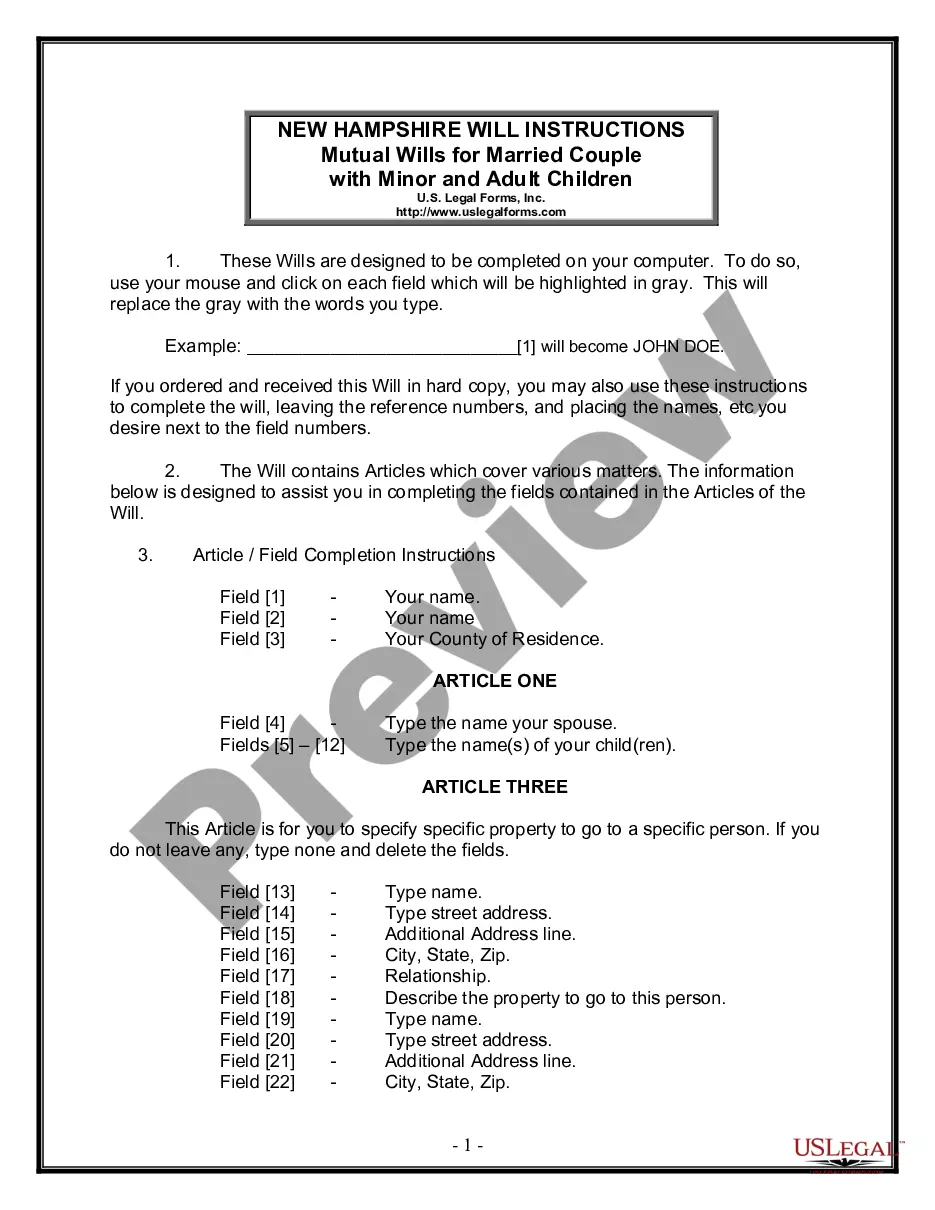

Create legally binding mutual wills for a married couple with children, ensuring clear distribution of assets and guardianship.

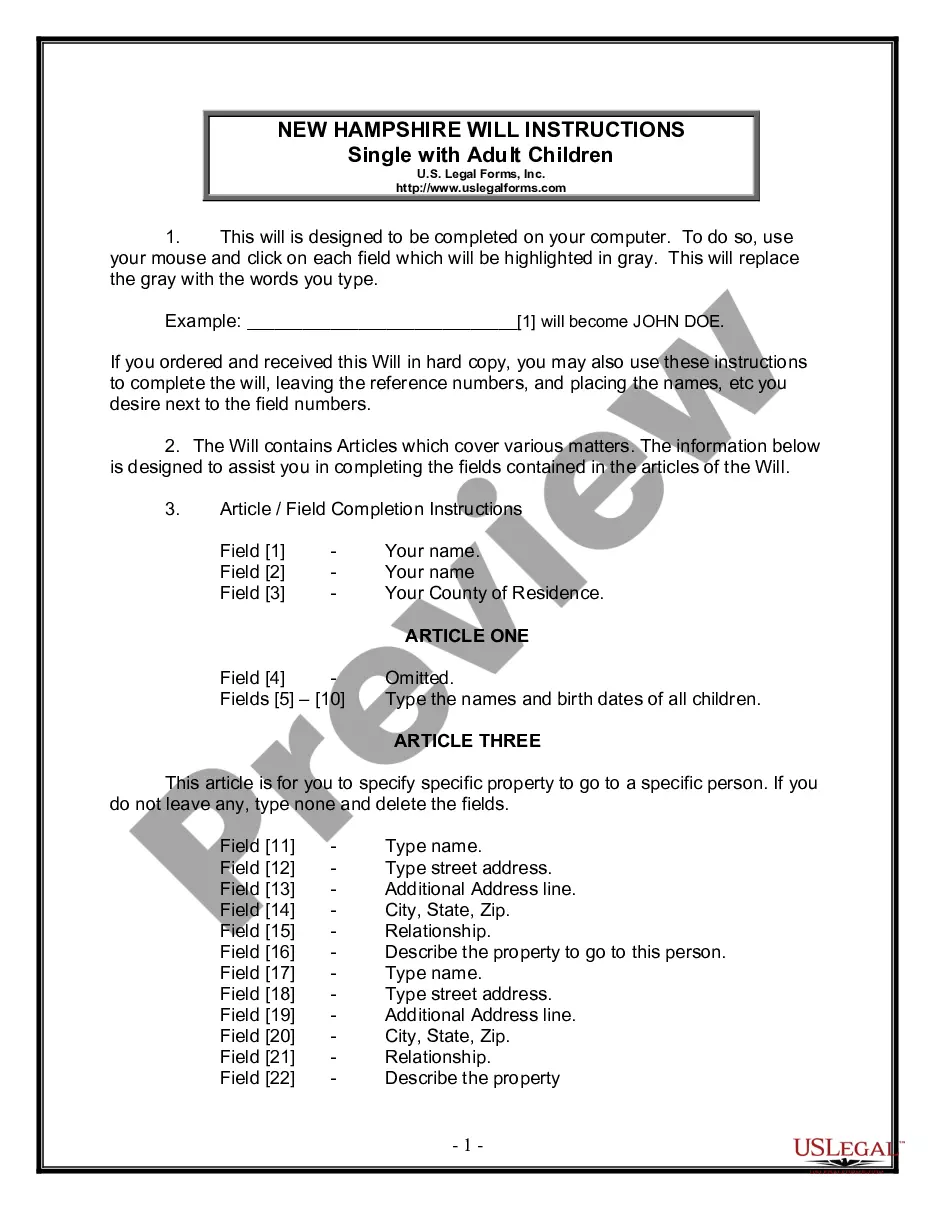

Secure your wishes for your estate and specify who will inherit your property after your passing.

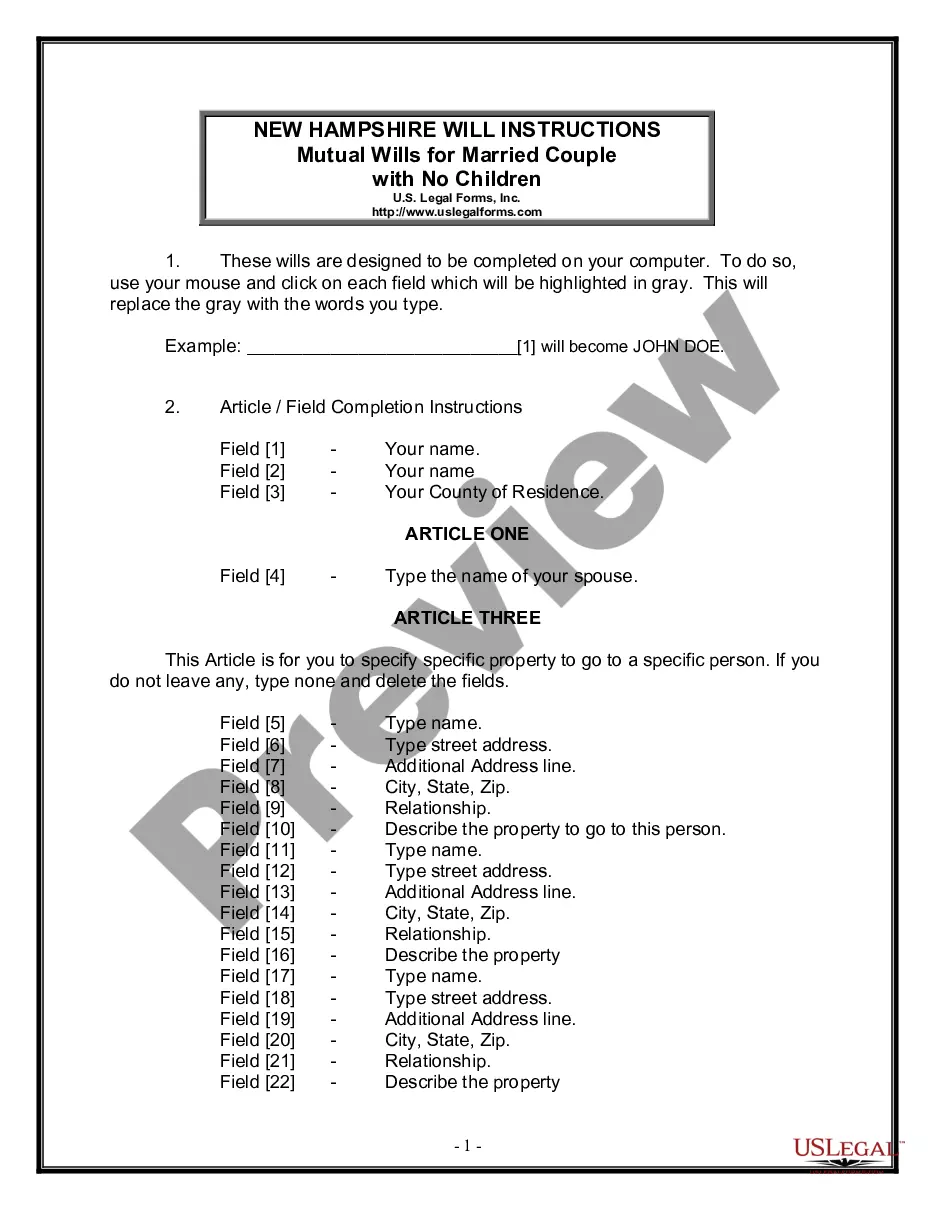

Create legally binding mutual wills to secure your estate planning as a couple without children, ensuring your wishes are honored.

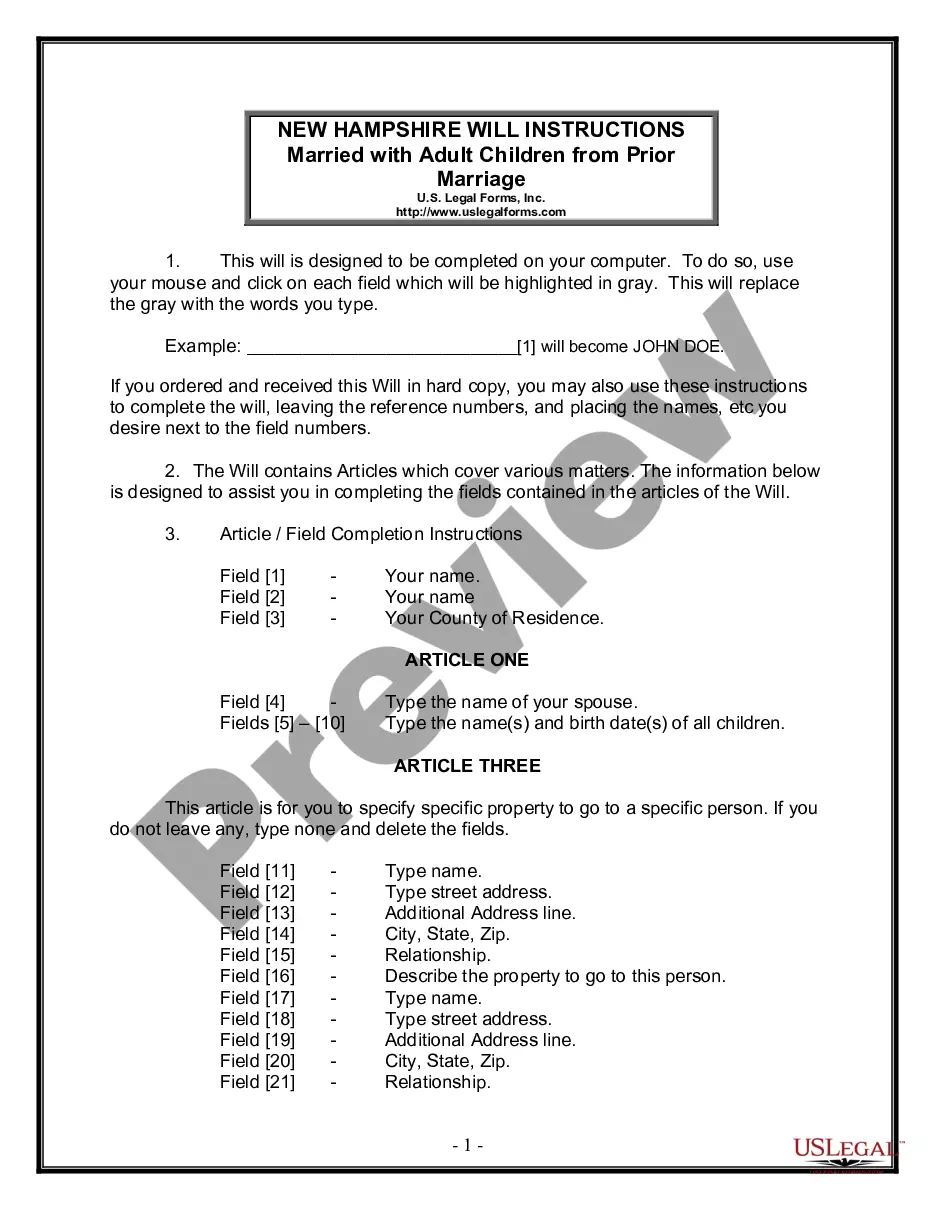

Plan your estate by designating beneficiaries and managing property distribution for a married person with adult children from a prior marriage.

A Last Will and Testament takes effect after a person dies.

Wills can be contested in court if there are disputes.

Witnesses are often required to validate a will.

Beneficiaries should be clearly named to avoid confusion.

Updating a will is important after major life events.

Begin the process easily with these five steps.

A trust can offer benefits not provided by a will, like privacy and asset management.

If no will exists, state laws determine asset distribution, potentially not aligning with your wishes.

It's advisable to review your will after major life changes, like marriage or the birth of a child.

Beneficiary designations on accounts may override your will’s directives.

Yes, you can appoint separate individuals for financial and healthcare decisions in your estate plan.